and the distribution of digital products.

DM Television

NFTs May Be Entering Their Financial Renaissance

Non-fungible tokens (NFTs) are unique digital assets on a blockchain. These digital assets can represent anything. The first experiments in tokenization via NFTs began with the most obvious applications, such as works of art.

\ The unique nature of NFTs allows for new forms of NFT ownership, monetization, and trading. Over time, the technology became more deeply embedded in the minds of developers and ways of NFT began to emerge. This opened up a new phase of the industry, which I call NFT2.0 of which Defi NFT (Decentralized Finance) is a part.

\ However, this phase remained invisible to the mass market amid the waning interest in utility-free collections. Still in the minds of most people NFT is strictly linked to collections and profile pictures (PFP), while statistics tell us about the huge growth of Defi NFT.

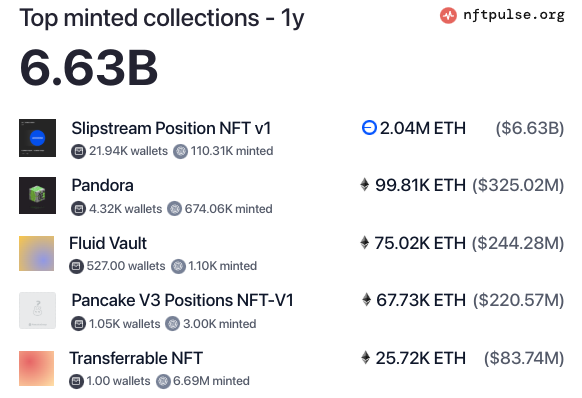

\ According to nftpulse the most expensive mints for 2024 belonged to the DeFi NFT category.

\

\ There are over 6 billion reasons to take a closer look at the industry.

\ I categorize the entire DeFi NFT market into two areas:

- Financialization of NFT collections.

- Tokenization of financial instruments through NFTs.

By financialization I mean improving market variables such as liquidity, trading volume, etc. by adding new financial instruments (protocols).

\ The massive user interest in the NFT market immediately exposed several problems:

- The problem of fair distribution and price curve formation

- The problem of liquidity of collections, the essence of which is rarity, and users are reluctant to part with rare items.

- The problem of capital efficiency, especially for expensive collections. Increasing liquidity and access to capital.

\ The first generation of projects in 2021 reached at a model of dynamic pricing, i.e. increasing mint price over a limited time. After the end of the mint, the total supply of assets in the collection is fixed. In 2024, the idea of initial allocation was reinvented by the Blastr with the release of refundable NFTs.

\

Minting involves locking ETH into an NFT contract for a certain amount of time. When the lock-time is over,your NFTs are effectively free as you can get a full refund. Simply request a refund, the NFT will be burned and your ETH returned.

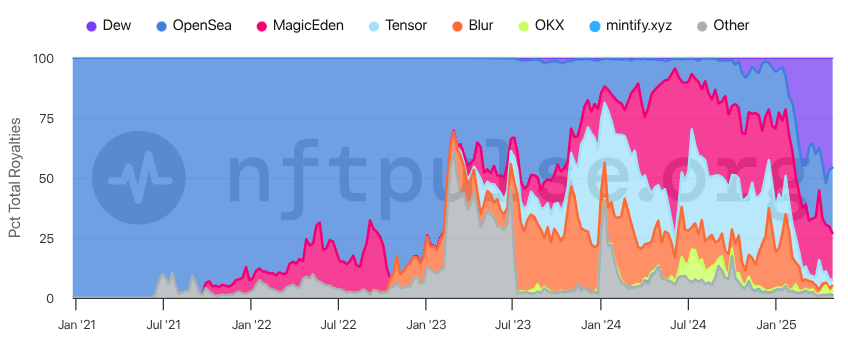

\ Setting a fair mint price can foster a healthy secondary market that benefits creators in the form of royalties. With the advent of marketplaces, Royalties became mainstream and even led to a tough confrontation between Blur and Opensea, but challenged the community with another problem - Liquidity.

\

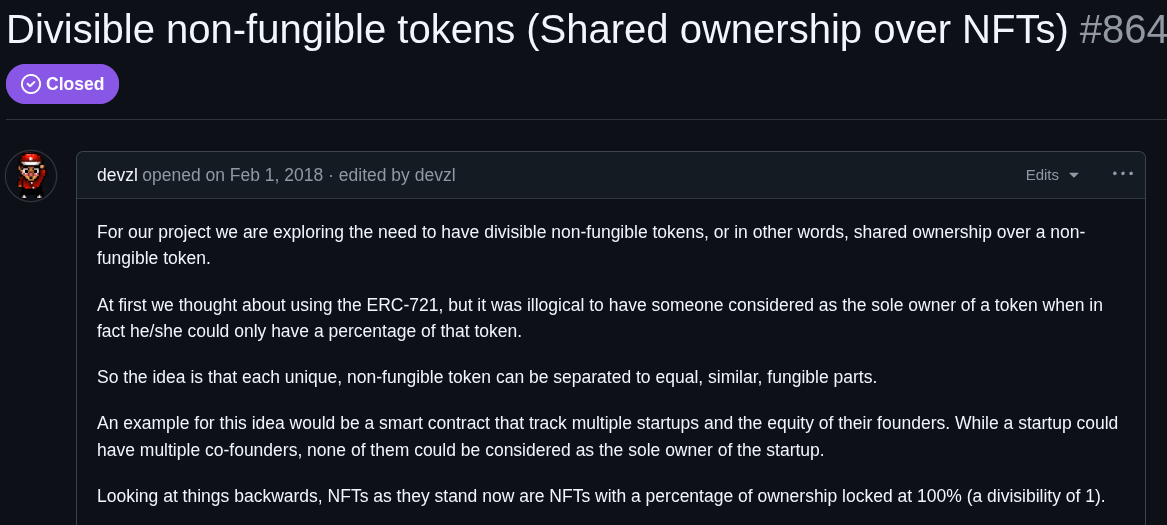

\ And that's where technology came to the rescue once again. In February 2018, devzl proposed an idea that was later called fractionalization.

\

\ This paved the way for a new type of exchange where not the NFTs themselves, but their fractions (“split parts”) were traded. These fractions were ordinary fungible tokens of the ERC-20 standard. The first exchange of fractionalized NFTs was introduced in March 2021 with Fractional.art.

\

\ As interest in collections has waned, many authors have begun experimenting with increasing the utility of NFTs.

\ The integration of technological innovation has led to the birth of dynamic NFTs, with metadata changing depending on the algorithms or events embedded in the code. Ahead of their time, the first to do so were CryptoKitties. The blockchain game launched in late 2017 and used NFTs representing digital cats whose attributes (genes, character, appearance) could change as a result of breeding and other in-game actions. This made CryptoKitties NFTs dynamic in terms of metadata updates and attribute evolution.

\ Non-fungible tokens, primarily game-based ones began to be rented out. There were many protocols, but now only Lootrush can be highlighted.

\

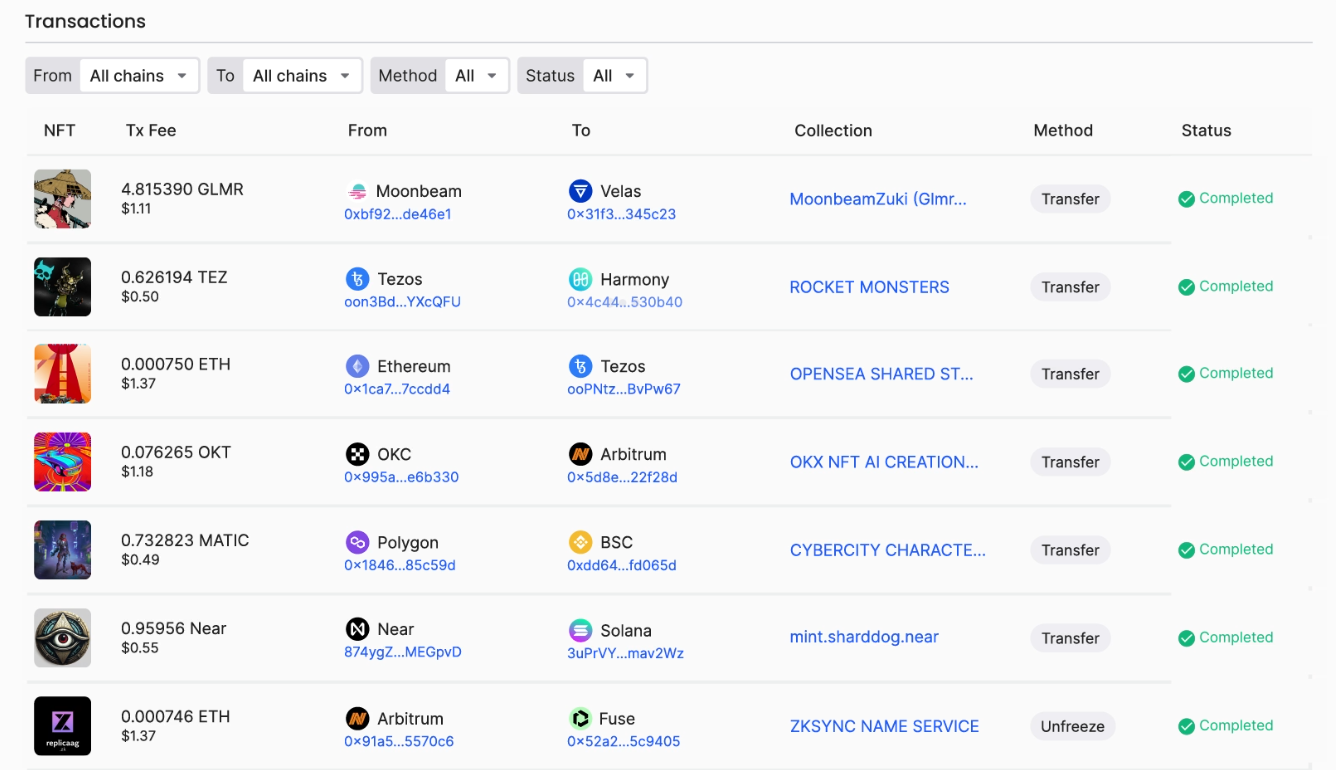

\ \ Cross-platform utility led first to the emergence of NFT bridges and then to omnichain collections. The leader in this category is XP.NETWORK.

\

\ NFTs powered by blockchain technology can represent real world assets (RWAs) such as real estate, artwork, or even stocks. This tokenization makes it easier to trade, transfer or even split these assets.

\

| Project | Asset Type | NFT Use Case | |----|----|----| | Centrifuge | Invoices, Real Estate, Receivables | Each asset as a unique NFT | | RealT | Real Estate | Property ownership tracked via NFTs | | Boson Protocol | Physical Goods | Redeemable NFTs for real-world items |

\ Community management rights have created the sectors of transactional reputation, social NFTs, and ve-tokenomics.

\

veNFT (voting escrow NFT) - User locks their ERC-20 protocol utility token receiving an ERC-721 governance token. The lock period (also known as vote-escrowed period) can be up to 4 years, following a linear relationship. The longer the vesting period, the higher the voting power (vote weight).

\ The use of veNFT has effectively become the standard in reward distribution by DeFi protocols, including the largest ones such as Aerodrome.

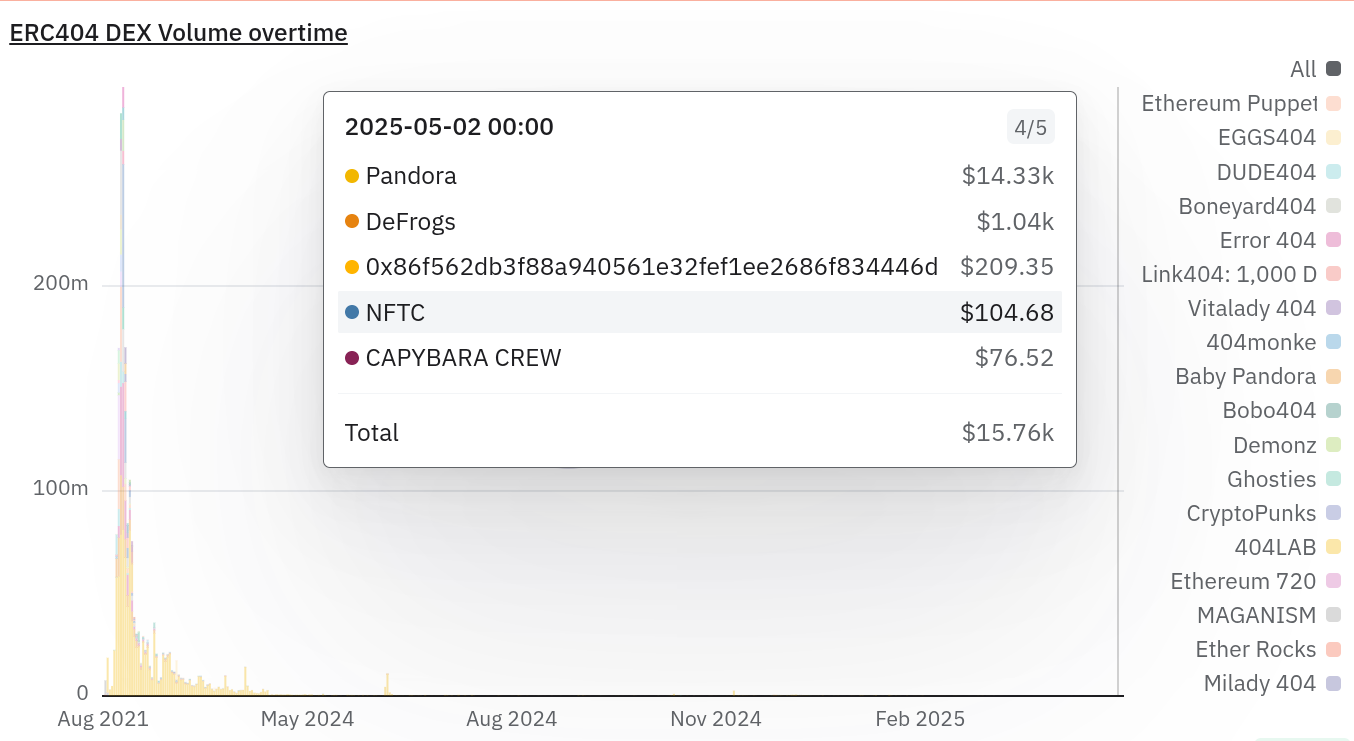

\ The Pandora team offered another solution to the liquidity issue of illiquid assets in 2023 by issuing the first ERC-404 token, $PANDORA.

\ ERC-404 tokens consist of linked ERC-20 (“fungible”) and ERC-721 (“non- fungible”) tokens that function independently but are linked together during transactions. Ownership of ERC-721 NFTs implies ownership of the corresponding ERC-20 fractional tokens.

\ Unlike previous fractional methods based on external platforms, ERC-404 allows fractional tokens to be owned through the minting and burning mechanisms built into the token standard. Selling fractions burns an NFT, and merging fractions mints a new NFT.

\ ERC-404 tokens integrate liquidity mechanisms that allow fractional NFTs to be traded on both decentralized exchanges (DEX) and NFT marketplaces, improving market efficiency and accessibility.

\ ERC-404 enables the creation of “semi-fungible” tokens that combine fungibility and uniqueness to enable new use cases in the DeFi and NFT ecosystems.

\

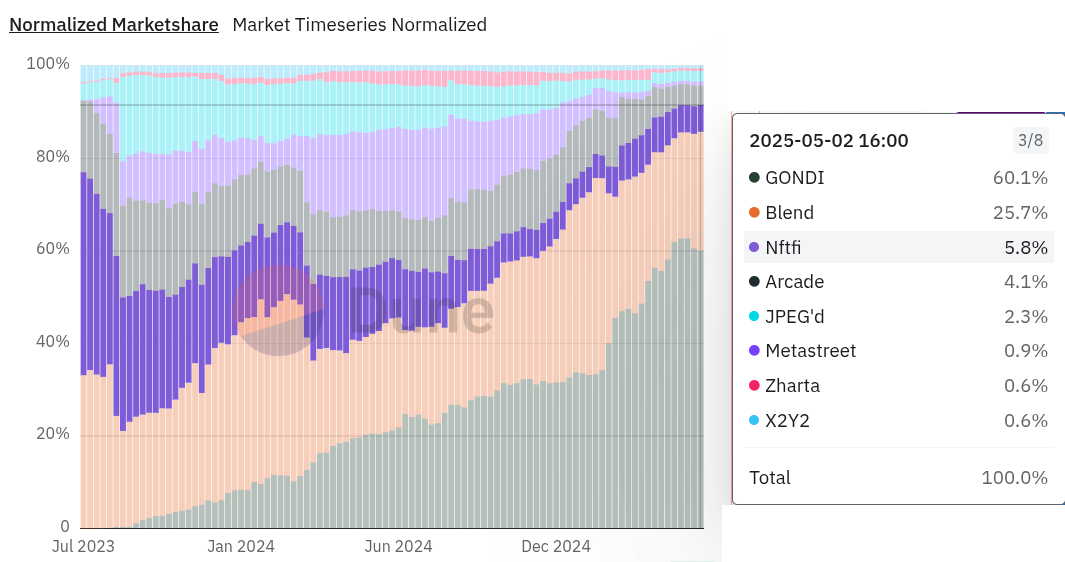

\ NFT- backed lending protocols were established to improve capital efficiency. NFTfi was one of the first such protocols.

\

NFTfi, allow you to borrow cryptocurrencies by pledging your NFTs. If you can't pay back the loan, the lender can claim your assets. This system provides liquidity to NFT holders without having to sell their assets.

\ NFTfi has lost its lead, but the category continues to evolve.

\

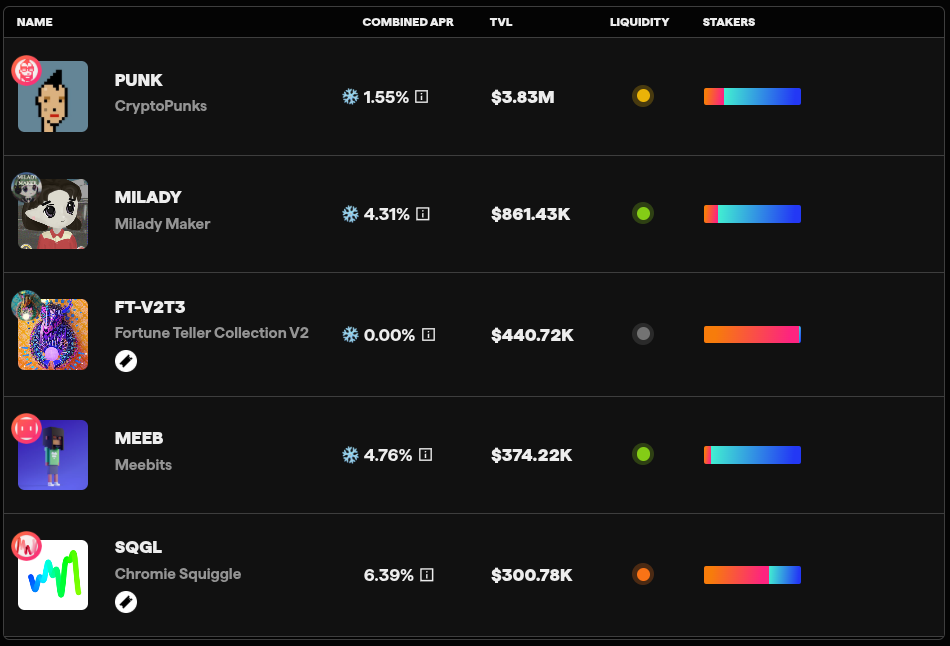

\ Many top collections have rallied a strong diamond-hands community around them. They have begun to partner with other projects interested in a solid community in exchange for rewards. This is how NFT staking was born.

\ You can stake your NFTs to earn rewards in the form of cryptocurrencies or other NFTs. This method allows you to put your unused NFTs to work and generate passive income through innovative NFT and DeFi integrations. NFTx Yield is one of the first examples of DeFi NFTs used to generate stake rewards.

\

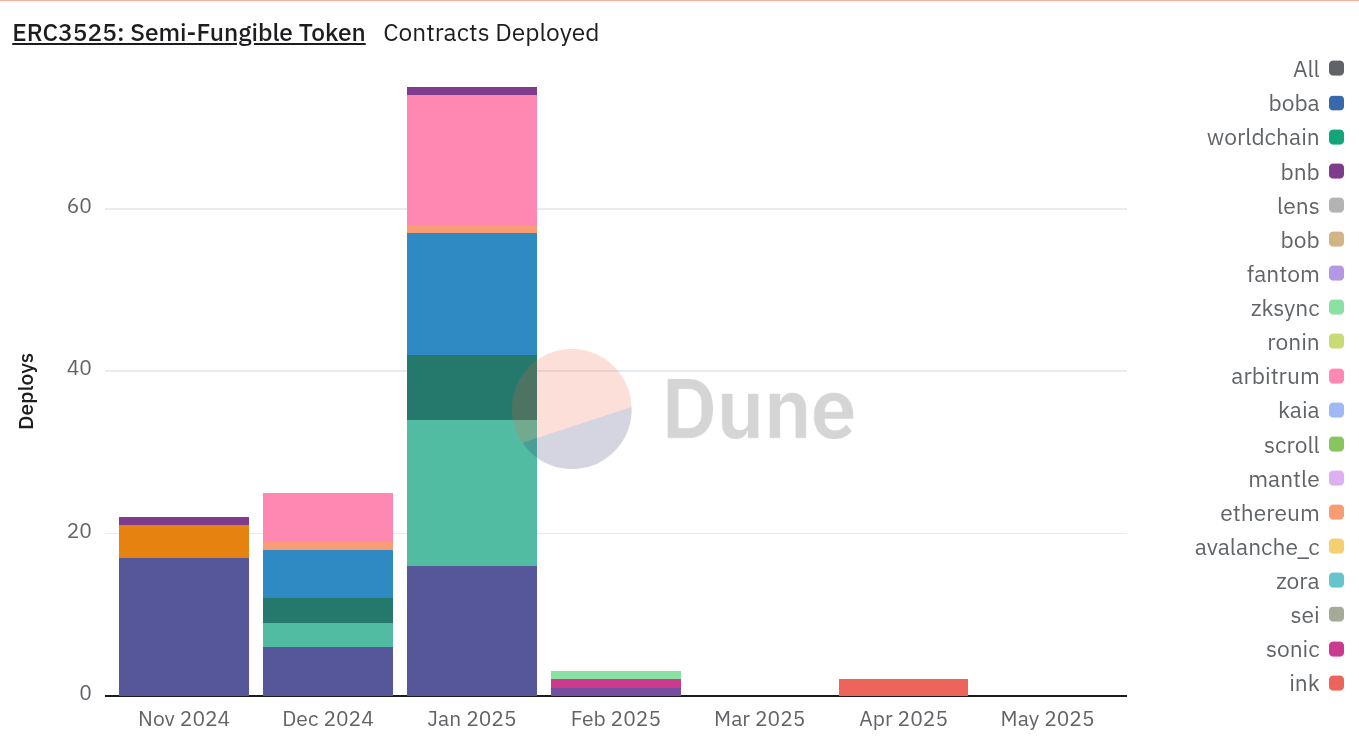

\ NFT as a method of tokenization, no less flexible than ERC-20 tokens. Assets an ERC-3525 semi-fungible token (SFT) could represent range from simple instruments like a gift card, loyalty card, check, or a store voucher, to heavy-duty things like a bond, future or option contract, ETF, ABS, or a land title.

\

SFTs combine elements of fungible and non-fungible tokens. Each token is unique, but tokens within the same class or category can be exchanged on a one-to-one basis. Semi-fungible tokens allow for dividing and merging tokens within a specific category without affecting their overall value.

\

\ There are other SFT standards that have not yet found widespread use:

\

- ERC1400: security token standard that emphasizes regulatory compliance, flexibility and transparency in the representation of asset ownership on the blockchain. Tokens can denote different asset classes or rights, each with unique characteristics and value. ERC1400 also enhances transparency and compliance by allowing relevant documents (direct access to ownership documents or valuation reports) to be attached directly to token transfers. ERC1400 gives issuers the ability to impose detailed restrictions on transfers, a critical aspect under global securities regulation. This allows regulation of who can own or transfer tokens, preventing unauthorized or non-compliant transactions. It enables compliance with regulatory requirements such as anti-money laundering (AML) and know-your-customer (KYC) protocols, building investor confidence in the legitimacy of their investments.

- ERC3475: Abstract Storage Bonds allows for the issuance and trading of decentralized bonds with multiple maturity data, enabling a more complex data structure that can store important information such as rate of return, maturity and interest rates on the chain, thereby simplifying the management of liquidity pools and significantly reducing fees, as well as paving the way for a secondary market where these debt securities can be traded without the intervention of traditional financial intermediaries. The standard supports the divisibility of the bonds, allowing them to be split or combined for trading purposes, increasing the flexibility of RWA portfolio management. In addition, these tokens can serve as collateral for derivatives such as futures and options.

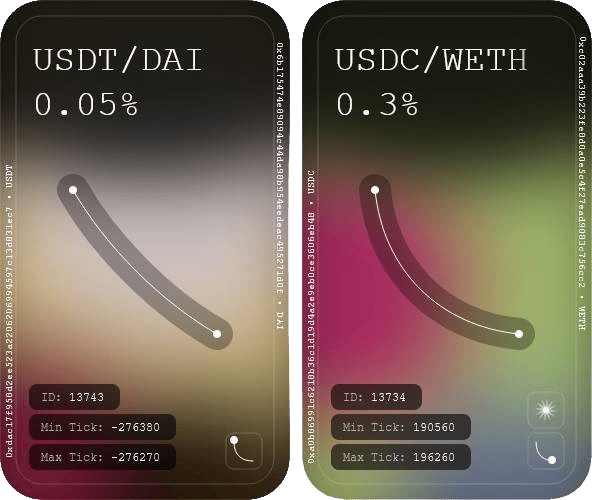

\ Another approach was demonstrated by one of the pioneers of DeFi - AMM DEX Uniswap. In its protocol v3, it tokenized user liquidity positions via the EPC-721 standard.

\

\ Many other positions have begun to be tokenized through NFTs, including

- vaults for algorithmic stablecoins, like Open Dollar.

- leveraged positions or options contracts, like DeriProtocol. An NFT could encode a trader's collateral, leverage ratio, and expiration date, enabling decentralized counterparties to assess risk programmatically.

- SAFT contracts to distribute tokens post-TGE with autopay royalties for bidding on the secondary market.

\ At the top of the technological pyramid are programmable, or smart NFTs, which allow the user to activate the required functions in a few clicks during a mint. The first versions of this approach were realized in 2021 by Charged Particles and Envelop.

\ Independently of each other, later projects came to create non-custodial crypto-indexes or collateralized derivatives.

\ Later, independently of each other, the projects came up with the idea of non-custodial cryptoindexes or collateralized derivatives.

\ It is worth mentioning another important area of industry development - specially designed blockchains that unify many of the above technologies into one unified stack. A prime example here is the Mint blockchain.

cryptoindexes

DeFi NFT challenges- Regulatory uncertainty

- Interoperability and compatibility between different blockchain networks, protocols and marketplaces

- Security and risk management requires increased attention due to possible new attack vectors and risk factors.

- User experience and and intuitive interfaces remain a major challenge.

It is already possible to borrow against LP NFT (Revert) or governance veNFT (40acres), and the interaction and compatibility of these categories will increase further.

\ Big money coming into the categories is only possible with unification of standards and regulatory transparency, but the capture and division of the market by protocols is already happening now.

\ It’s likely that interoperability will evolve in the direction of abstraction of accounts and chains. Development will be widespread, but the ecosystem with the greatest economic security and decentralization will be the leader.

\ It’s possible to mint NFT and refund the tokens paid for it or keep it and pledge USDC tokens. Put them into Uniswap liquidity v3 pool , and the resulting LP-NFT position can be pledged in another lending and take USDT, etc. It turns out to be such a financial ouroborus.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.