and the distribution of digital products.

Moonbeam Q4 2024 Brief

- Moonbeam Routed Liquidity (MRL) had $30.5 million volume across 2,300 transactions in 2024. MRL simplifies onboarding for parachains and boosts liquidity flow without lengthy governance or development processes.

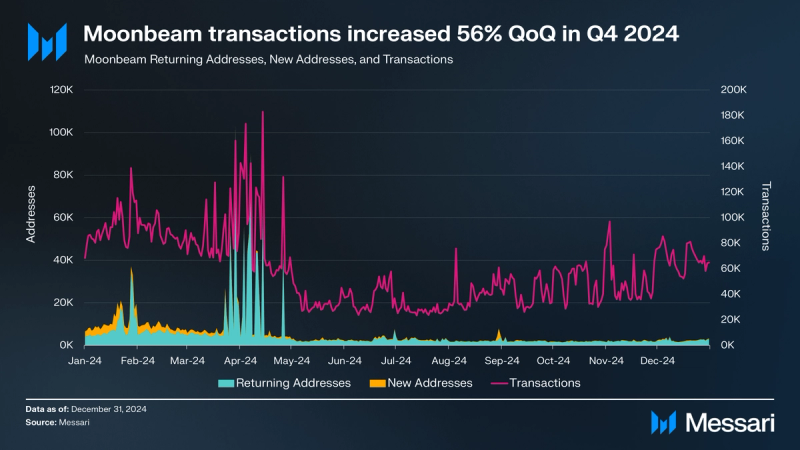

- Transactions increased by 56% QoQ to 57,000 daily transactions. Additionally, Moonbeam had $122 million in inflows during Q4 2024.

- Developer activity continued to increase, with 222 total developers, 74 full-time, and 115 others according to Electric Capital as of November 2024.

- StellaSwap became the largest protocol by TVL at $12.5 million, up 5% QoQ and over 120% in six months. Stellaswap surpassed Moonwell which has been the leading DeFi protocol by TVL for most of Moonbeam’s existence.

- Moonbeam introduced plans for a strategic expansion into the Ethereum ecosystem. This initiative aims to launch an expansion chain in the re-staking ecosystem that leverages Ethereum validators and restaking for security while preserving Moonbeam's EVM and crosschain capabilities built on the substrate framework.

Moonbeam (GLMR) is a Layer-1 parachain on the Polkadot Network, serving as an EVM-compatible smart contract platform. It provides an Ethereum Virtual Machine (EVM) implementation and a Web3 API, enabling straightforward deployment of Solidity contracts and protocol interfaces with minimal modifications. Moonbeam enables crosschain integrations, leveraging its Moonbeam Routed Liquidity functionality and bridge networks. Its primary features include cross-chain integration, staking, and on-chain governance.

The network includes multiple deployments: Moonbeam on Polkadot (December 2021), Moonriver on Kusama (June 2021), and Moonbase Alpha on TestNet (September 2020). This structure ensures safe and rapid updates to Moonbeam's mainnet.

Moonbeam's technology stack, built with Rust and Substrate, provides a robust development environment. It boasts Ethereum compatibility, offering a full EVM implementation and Web3 RPC API, which integrates existing Ethereum tools and applications. As a key player in the Polkadot ecosystem, Moonbeam provides developers with an accessible route to leverage Polkadot's network effects while utilizing Ethereum tooling and compatibility.

Website / X (Twitter) / Telegram

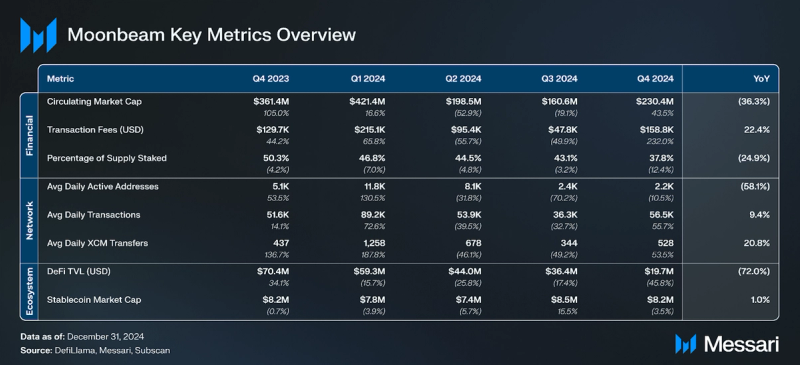

Key Metrics Analysis

Analysis

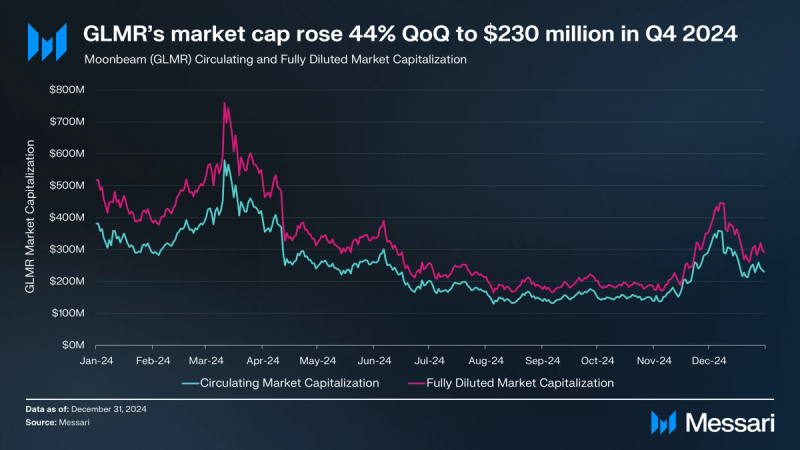

During Q4 2024, GLMR’s circulating market capitalization rose to $230 million, reflecting a 44% quarter-over-quarter (QoQ) increase but a 36% decline year-over-year (YoY). The fully diluted market capitalization similarly increased by 44% QoQ, reaching $291 million, though it was down 44% YoY. Despite the quarterly increase in market capitalization, GLMR’s market cap ranking dropped from 276 to 325.

GLMR is the native token of the Moonbeam network, with functions including incentivizing block producers to ensure network security, enabling onchain governance, and facilitating transaction fees. The token has an annual inflation rate of 5%, with no capped maximum supply.

At the end of Q4 2024, GLMR’s circulating supply stood at 938.8 million tokens, an increase from the previous quarter’s 904 million. The percentage of GLMR staked decreased to 38%, down by 12% QoQ from 43% in Q3 2024.

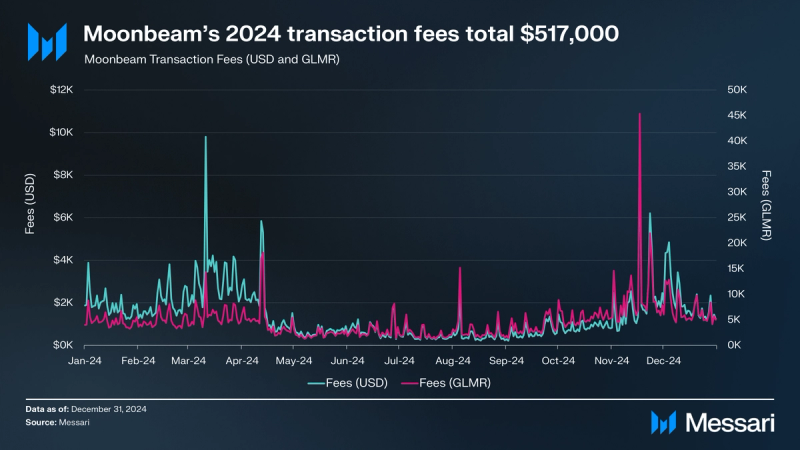

GLMR transaction fees (USD) increased by 232% QoQ in Q4 2024, totaling $159,000. This increase was driven by a surge in network activity, with daily transactions rising 56% QoQ to 57,000.

The rise in transaction volume and fees reflects higher user engagement and network utilization. The total transaction fees generated by the network throughout 2024 amounted to $517,000.

Of the transaction fees generated, 80% were burned, while the remaining 20% were directed to the network's Treasury.

Addresses were flat QoQ in Q4 2024 with 2,200 daily active addresses, while transactions increased by 56% QoQ to 57,000 daily transactions. The increase in transactions was driven by heightened activity across key protocols, including Stellaswap, EvrLoot, Tokeniza, and N3mus, which collectively saw transaction growth due to new launches, feature expansions, and tournaments. As a result of the increased activity, Moonbeam became the leading parachain by active addresses and ranked as the third parachain by transactions.

Developer activity continued to increase, with 222 total developers, 74 full-time, and 115 others according to Electric Capital as of November 2024.

Moonbeam has implemented several technical upgrades over the previous six months:

- 6-Second Block Times: An upgrade that successfully reduced block times from 12 to 6 seconds, improving throughput capacity.

- Optimizing Data Access on Moonbeam: Chain Integration Process with The Graph Now Live: Integration with The Graph Network to enhance decentralized indexing and data querying capabilities.

- RT3100 Unlocking Passkeys and Other New Use Cases: Introduces Passkeys, enhanced crosschain compatibility through Snowbridge, and a new runtime API for optimized transaction costs.

- Glacis Integration: Integration of Glacis, providing universal cross-chain messaging and tools for developers.

- Gas limit per block at 60 million: By setting the gas limit to 60 million per block, Moonbeam significantly boosts the number of transactions that can be processed in each block. The 60M block gas limit plus cutting block times in half yields an 8x throughput increase.

- No-delay block time: Improving the responsiveness of wallet interactions.

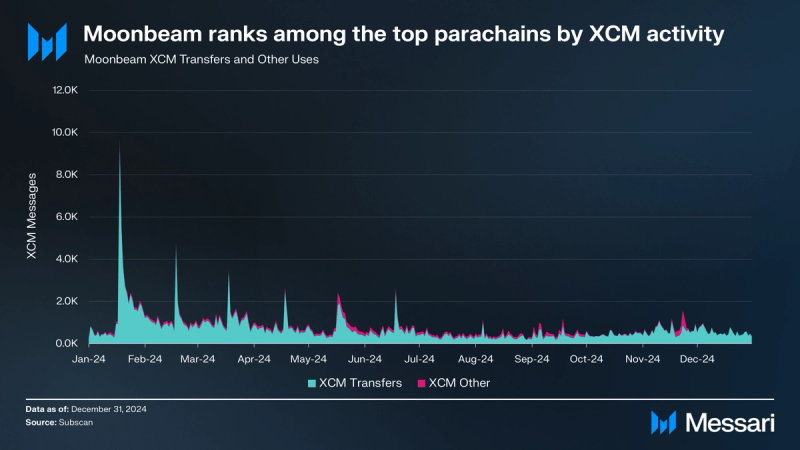

Daily XCM transfers averaged 528, which represented a 54% increase QoQ. Other XCM use cases averaged 50 per day, which decreased by 60% QoQ. The total XCM messages per day reached 578, reflecting a 23% increase QoQ. Moonbeam continues to rank among the top parachains in XCM activity.

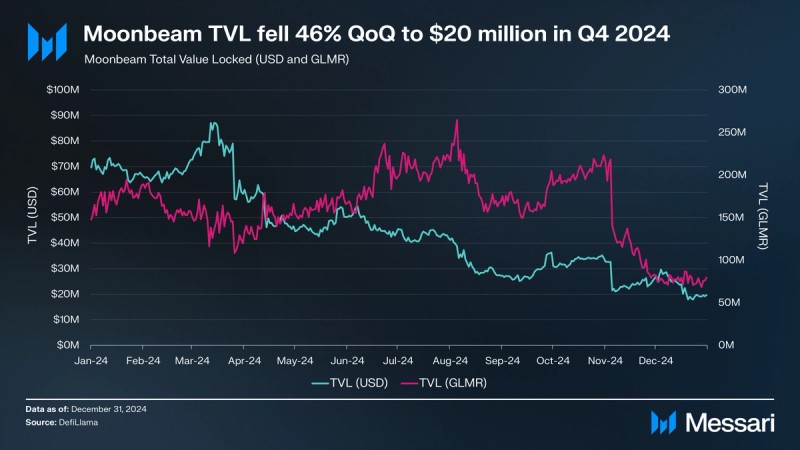

DeFi TVL (USD) on Moonbeam was $20 million, down 46% QoQ and 72% YoY. The decrease in TVL was primarily driven by Moonwell, which saw its TVL fall by 76% QoQ from $18.7 million to $4.4 million. The decrease in Moonwell’s TVL was primarily due to Coinbase discontinuing support for wBTC. StellaSwap became the largest protocol by TVL at $12.5 million, up 5% QoQ and over 120% in six months. Prime Protocol followed with $1.1 million in TVL, while FraxSwap recorded $715,000.

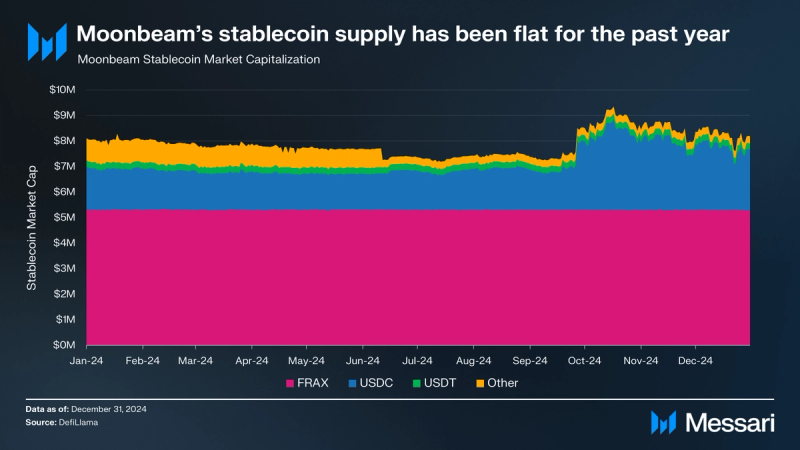

The stablecoin supply on Moonbeam decreased by 4% QoQ to $8.2 million and remained essentially flat over the past year. FRAX was the leading stablecoin at $5.3 million, followed by USDC at $2.4 million. The remaining stablecoins collectively accounted for $500,000 in supply.

Additional DevelopmentsGaming was a major focus for Moonbeam in 2024. Key initiatives included the Polkadot Games Bounty funded with 100,000 DOT, the Lunar Gaming Festival, and support for games like Age of Chronos and Voidge. Moonbeam also invested in N3MUS through its $10 million Innovation Fund to support their gaming infrastructure, including a wallet and tournament system, which launched in December and registered 8,600 users within the first six weeks.

Moonbeam advanced its focus on real-world asset tokenization through a partnership with Colb Finance as part of the Moonbeam × Colb Finance collaboration to introduce Swiss-compliant stablecoins and Tokenized Structured Products for professional investors. Other RWA protocols include Tokeniza, Zuka, DREX, and Tamarin Health.

The DePIN Diode expanded to Moonbeam, offering secure communication tools such as encrypted chat, file sharing, and a Zero Trust Network VPN. Since June, DePIN Diode added 900 new users and aims to reach 1,500 nodes by 2025, incentivizing contributors with tokens.

Other notable events included:

- Moonrise Points Campaign Recap: Concluded with 9,056 participants collectively completing 333,042 quests. Participants minted 368 NFTs through Rarible, while $100,000 in rewards was distributed separately from the Rarible activity, with top performers receiving a commemorative NFT.

- Governance Guild Launch: Established a governance guild with 5 million GLMR and 50,000 MOVR tokens delegated to 10 community delegates, fostering a more decentralized governance model.

- Partnership with Drex: Collaborated with Drex to support renewable energy projects in Ecuador, empowering over 300 small businesses with solar power through blockchain-based micro-investment.

- Christmas Tournament: Hosted a holiday-themed tournament with over 530 participants, awarding prizes in two competitions: Pinkmas Magic Drop and Jingle in the Jungle.

The Moonbeam team also released a primer on Moonbeam Routed Liquidity in Q4 2024. MRL uses Wormhole and XCM to seamlessly bridge assets between Moonbeam and Polkadot parachains, enabling instant routing without direct bridge integration for parachains. By leveraging Moonbeam’s existing Wormhole connection, MRL simplifies onboarding for parachains and boosts liquidity flow without lengthy governance or development processes. This bidirectional system supports efficient asset transfers, such as routing USDC from Ethereum to a parachain, enhancing accessibility and scalability across Polkadot’s 51 parachains. MRL had $30.5 million volume across 2,300 transactions in 2024.

RoadmapMoonbeam's roadmap for 2025 and beyond includes efforts to enhance crosschain interoperability, expand gaming initiatives, support real-world asset tokenization and DeFi, and explore new regional markets. This will be achieved by following the developments in the Polkadot and Ethereum ecosystems. The Moonrise initiative has made progress, with key developments such as reducing block times to six seconds, establishing an ecosystem fund, and incorporating Ethereum's Dencun compatibility.

In September 2024, Moonbeam introduced a proposal to expand into the Ethereum ecosystem by launching an expansion chain secured by Ethereum restaking. This deployment, referred to as Moonbeam V2, would leverage Ethereum validators and introduce new restaking options. The proposal is in the research phase, with several deployment architectures under consideration.

Potential opportunities include:

- Creating a DeFi hub for AVS project tokens, liquidity aggregation, and xERC20 adoption.

- Developing decentralized storage solutions within the EVM environment.

- Bridging XCM assets into the Ethereum restaking ecosystem.

- Implementing enhanced operator transparency and monitoring tools.

Moonbeam continues to engage with the community and partners to refine its strategic direction and deliver on these roadmap goals.

Closing SummaryMoonbeam's performance in 2024 illustrates steady progress across key metrics, including network activity, developer engagement, and DeFi participation. Despite a challenging market environment, Moonbeam maintained its focus on core objectives such as crosschain interoperability, real-world asset tokenization, and ecosystem growth.

Key upgrades, including reduced block times and enhanced developer tools, have positioned Moonbeam as a leading player in the Polkadot ecosystem. The introduction and success of Moonbeam Routed Liquidity further reinforces its growing adoption.

Looking forward to 2025, Moonbeam’s roadmap highlights continued expansion and strategic development, including potential integration with the Ethereum ecosystem. The proposal is still being worked on, but it is nonetheless an exciting time for the Moonbeam community.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.