and the distribution of digital products.

Money vs Currency

Your true wealth is your time and freedom.

\ Money is just a tool for trading and acts as a container to store your economic energy unit when you are ready to deploy it

\ BUT, the whole world has been turned away from real money and has been fooled into using currency, a deceitful imposter that is silently stealing your two most valuable assets, time and freedom.

\ We’re entering in the greatest financial crisis the world will ever know. This will be the greatest wealth transfer in history, as wealth is never destroyed; it is merely transferred. Opposite side of every crisis is an Opportunity

\ I believe the best investment that you can make in your lifetime is your own financial education.

Education on history of money, global economics, scams.

\

Currency VS Money| ==Currency== | ==Money== | |----|----| | Medium of Exchange | Medium of Exchange | | Unit of Account | Unit of Account | | Portable | Portable | | Durable | Durable | | Divisible | Divisible | | Fungible | Fungible | | | STORE OF VALUE |

\ Fiat currency exists at the dictate or from a government.

:::warning Question: Are there any historical examples of a fiat currency—a paper currency not backed by any physical asset—successfully enduring over time?

Answer: NO

:::

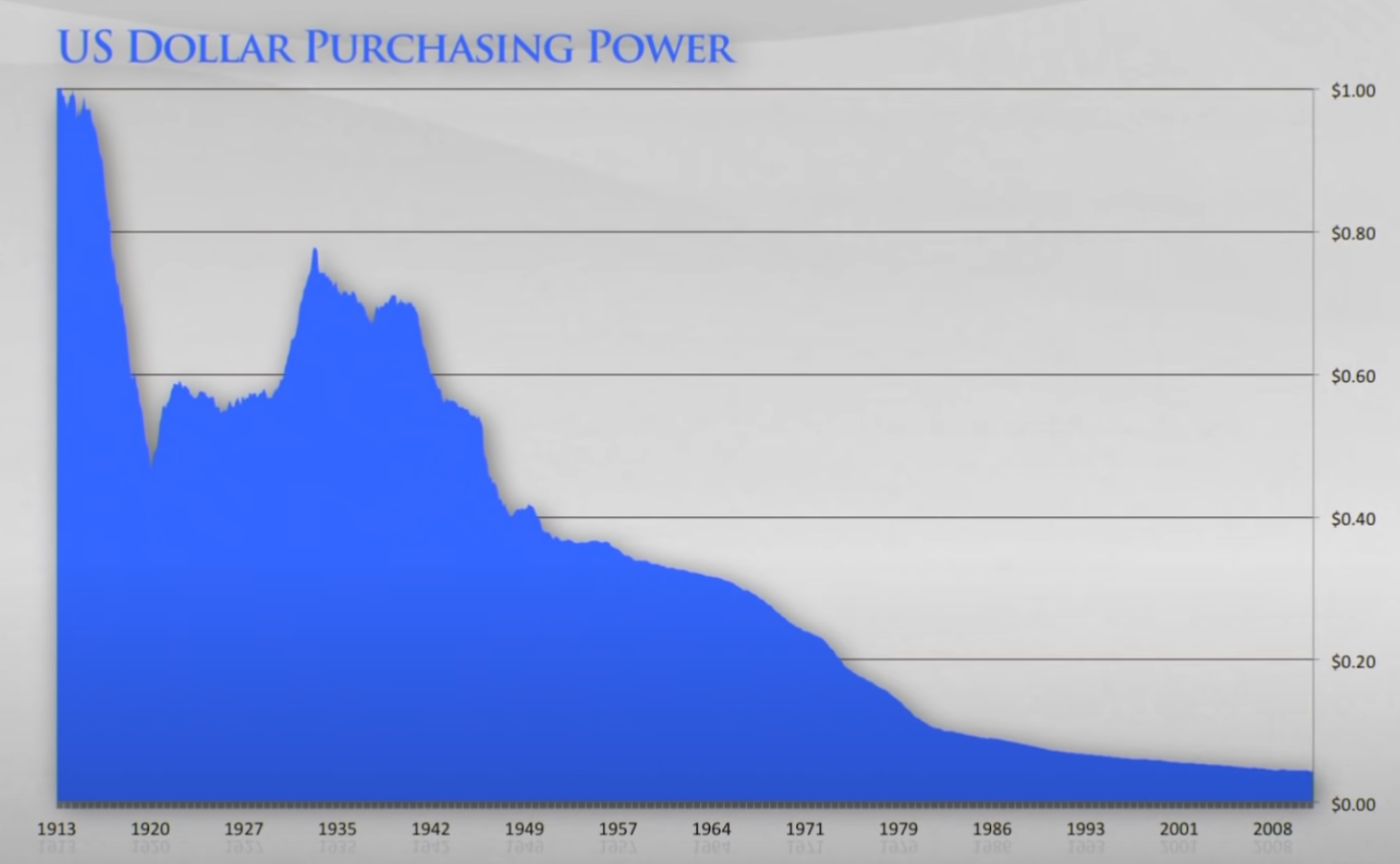

\ US Dollar has lost more than 95% of its purchasing power since the creation of Federal Reserve in 1913.

\ National currencies are really a tool by the government and the financial sector to leach away your time and freedom by stealing your purchasing power.

\ So rather than storing your economic energy, currencies leak.

\ Whereas, Money must be a store of value and maintain its purchasing power over long periods of time.

\ Gold is only formed when a star explodes, a supernova, and it stays around forever!

\ This is one of the properties that make it limited in supply and an ultimate money.

\ NOBODY CAN PRINT GOLD and SILVER.

\

\

InflationInflation: Expansion of currency supply

Deflation: Contraction of currency supply

\ As the supply of currency increases, the prices of goods and services rise, reducing the purchasing power of that currency.

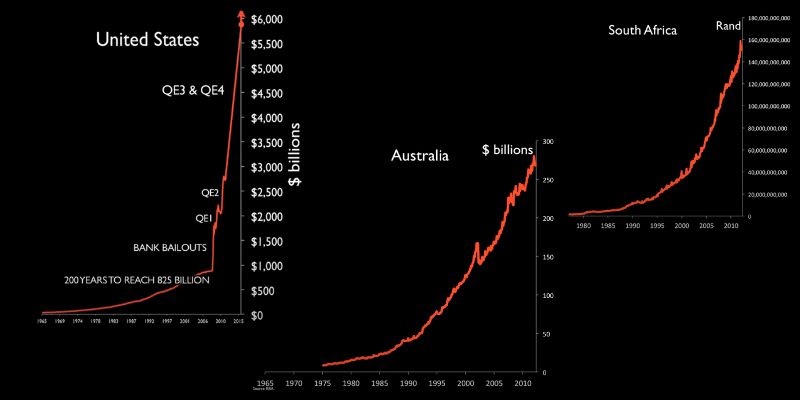

\ QE (Quantitative Easing) fancy way of saying “currency creation”.

QE started with banking bailouts in 2009, when the currency was created out of thin air and then given to the banks who paid themselves record bonuses in reward for crashing the world economy.

Global CrisisAfter World War II, US Dollar became the global base currency and was pegged by Gold.

Every other country trades with the exchange rates calculated in US Dollar.

\ It was simply an IOU note backing every dollar in existence with equivalent amount of gold, until it wasn’t in 1970 when US Dollar was no longer pegged to Gold, and the paper notes now not backed by Gold.

\

\ The currency printing accelerated especially after the 2008 financial crisis, when we the problem got too big to be ignored.

\ Given the premise of poor class, inflation affects them disproportionately in the percentage of their income that goes to food.

\ For example, in Egypt, once the ratio got to 40% of income going to food, and the price of food rising due to inflation, historcally a point where people actually stage a revolution. At this point the risk-reward was favourable for a revolution.

\ When you have a runaway inflation, its punishing people who are most productive in society.

\ In other words people that produce more than they consume and save the difference, and these people save in their national currency.

The Great OpportunityThis all seems pretty scary!

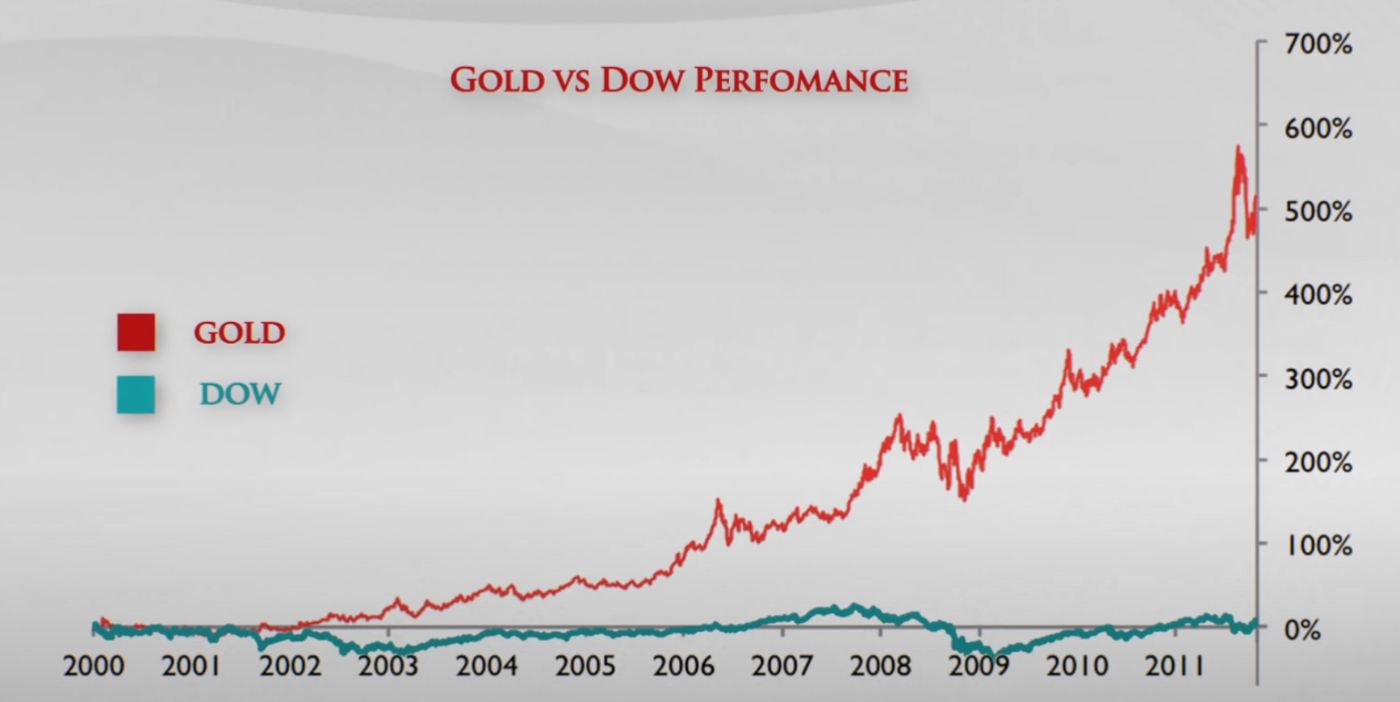

\ However, the great news is that Gold and Silver always end up doing accounting of the expansion of these currency supplies.

\ When governments do this kind of stuff to their currency supply, they debase it, eventually it comes back in inflation. People sense the loss of their purchasing power, and they rush back to gold and silver, bidding its value higher until it meets or exceed the value of all currency in circulation.

\ This is a process that’s been going on over and over again throughout history, except this time it’s happening on a Global Scale.

\ That means, its the greatest wealth transfer in history.

\ Therefore, it’s the greatest opportunity in history and it’s not gonna happen again in your lifetime.

Lessons- Your true wealth is your time and freedom.

- Money is a trading tool that stores the economic energy that is your time and freedom, whereas currencies leak them away.

- Gold and Silver are the ultimate money, simply because of their properties.

- Fiat currencies are based solely on confidence, and always return to their intrinsic value of ZERO.

- Rising prices are a symptom of an expanding currency supply.

- Gold and Silver always account for this expanding currency supply.

\ Reference for this article: Hidden Secrets of Money Episode 1 - Mike Maloney

\ \

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.