and the distribution of digital products.

Metis Q4 2024 Brief

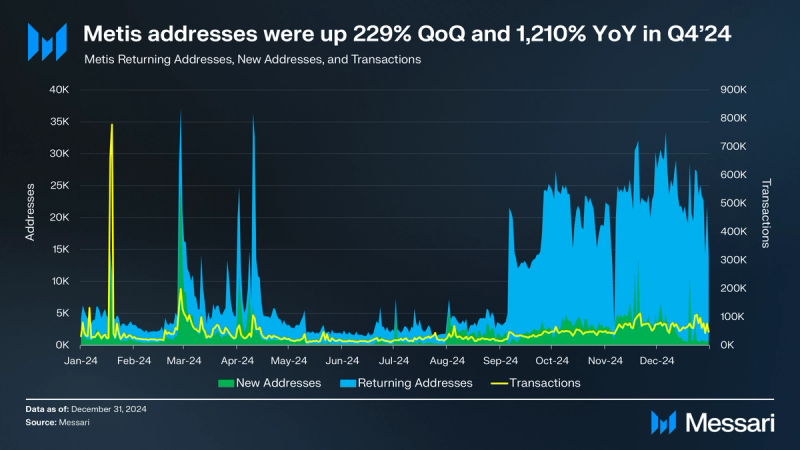

- In Q4 2024, network activity increased with active addresses up 229% QoQ and a 1,210% increase YoY. This surge in network activity was driven by gaming applications including DeFi Kingdoms, ScoreMilk, Growfitter, BUZZ, and Arena of Faith.

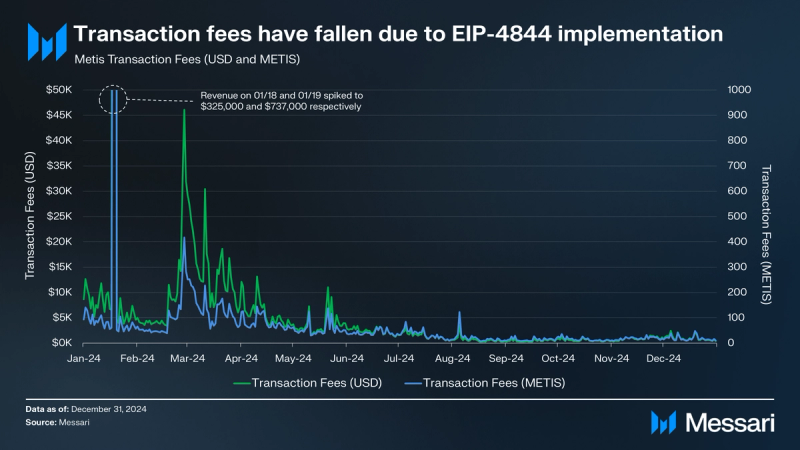

- The average transaction fee fell by 63% QoQ to $0.01 due to a fee scheduling improvement. Despite the drop in transaction fees, the network saw transactions rising by 123% QoQ to 62,000, representing a 265% increase YoY.

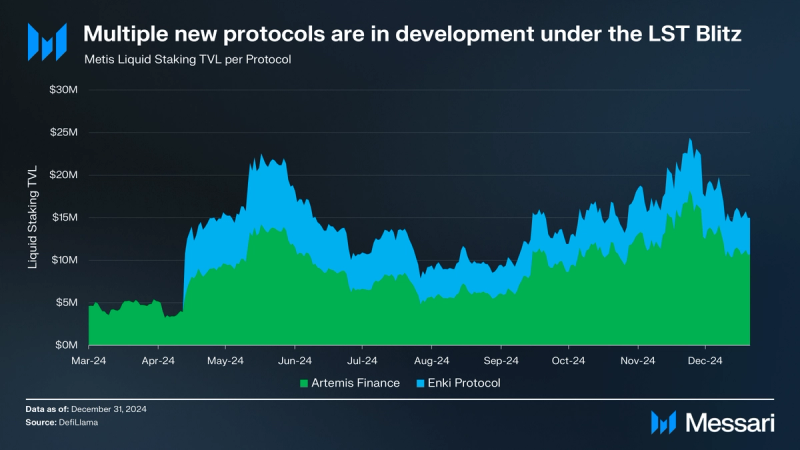

- The Metis Liquid Staking Blitz continued, with Artemis TVL reaching $10.6 million and Enki TVL hitting $4.3 million. There are at least two new LST protocols, including Stake.link from the Chainlink ecosystem, set to launch in the near future.

- The Metis Foundation continued strategic investments to foster ecosystem growth and development. These initiatives included an annualized incentive program, a Gitcoin partnership, the launch of Thrive Metis, and the GameFi Quantum Leap Accelerator, all aimed at long-term sustainability.

- Metis integrated independent decentralized sequencer nodes following a competitive selection process. OKX, Hashkey Cloud, and SNZ were the first to join as independent sequencer clients.

Metis (METIS) is an Ethereum Layer-2 Rollup that offers simple and fast smart contract deployment within the network. Metis offers many products to blockchain developers including the Oracles, Nodes, Data Indexers, and a SubGraph. The platform supports a wide range of decentralized applications and enterprise-level use cases like Aave for lending, Stargate for bridging, DeFi Kingdoms for gaming, and Artemis for TVL , facilitating a friendly experience for developers and end-users.

The native token of the Metis ecosystem is METIS, which serves multiple purposes within the network. It is used for paying transaction fees, staking for rewards to secure the network, and participating in governance processes.

A distinctive feature of Metis is its decentralized sequencer. This system employs dual sequencers operated by the Metis Foundation and select partners, ensuring increased reliability and reducing risks related to censorship and MEV. This architecture enables Metis to offer a robust solution for developers looking to build scalable decentralized applications while maintaining close alignment with Ethereum's secure infrastructure.

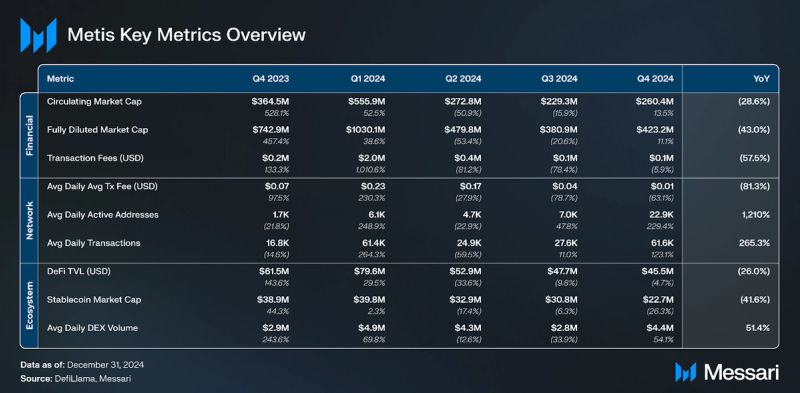

Key Metrics Analysis

Analysis

The last year has seen significant volatility in METIS’s valuation. Between Q3 2023 and Q1 2024, METIS’s circulating market capitalization increased tenfold before retracing in Q2 and Q3 alongside broader market declines. By the end of Q4 2024, the circulating market cap reached $260 million, reflecting a 14% QoQ increase but a 29% YoY decrease. Meanwhile, the fully diluted market cap rose 11% QoQ to $423 million, though it was down 43% YoY. Despite these improvements in absolute terms, METIS’s market cap ranking fell from 194 to 304 during the quarter, and it ranked as the thirteenth largest Ethereum rollup by market cap. Overall, most Ethereum rollups saw declines in market share.

METIS’s circulating supply increased by 2% QoQ, reaching 6.15 million tokens by the end of Q4 2024. With a total maximum supply of 10 million METIS, this represents 61.5% of the total supply now in circulation. Additionally, over 440,000 METS has been staked in the decentralized sequencer pool.

Transaction fees on the Metis network totaled $75,000 in Q4 2024, reflecting a 6% decrease QoQ and a 58% decrease YoY. This decline was entirely driven by a reduction in the average transaction fee, which fell by 63% QoQ to $0.01 due to an internal update. Despite the drop in transaction fees, the network saw a substantial increase in activity, with transactions rising by 123% QoQ to 62,000, representing a 265% increase YoY.

Metis network activity saw strong growth in Q4 2024. Daily active addresses reached 23,000, representing a 229% increase QoQ and a 1,210% increase YoY. Daily new addresses totaled 3,150 (+110% QoQ and +519% YoY), while daily returning addresses were 19,750 (+262% QoQ and +1,500% YoY). Daily transactions on the network climbed to 62,000, reflecting a 123% increase QoQ and a 265% increase YoY. This surge in network activity was driven by gaming applications including DeFi Kingdoms, ScoreMilk, Growfitter, BUZZ, and Arena of Faith. XX.

Over the last year, Metis has made serious investments into the growth and development of its ecosystem. Major initiatives during Q4 2024 included:

- The Metis Ecosystem Funding Round 1, in partnership with Gitcoin, allocated 3,000 METIS tokens to 34 community-selected projects, raising $37,744 from 883 unique donors.

- The launch of STARTathon, a 4-month program combining hackathons and accelerators, which offered over $200,000 in METIS prizes and milestone-based funding.

- The Metis GameFi Quantum Leap Accelerator Program introduced its inaugural batch of projects, including Score Milk, Buzz, and Arena of Faith, with a $10 million fund aimed at fostering gaming innovation.

- The Retroactive Grant Program launched with an initial $100,000 allocation to reward projects that have significantly contributed to the Metis ecosystem.

- BUZZ, a GameFi platform on Metis, introduced BEES, a meme token with utility, incentivizing participation and driving community engagement through farming, mining, and trading.

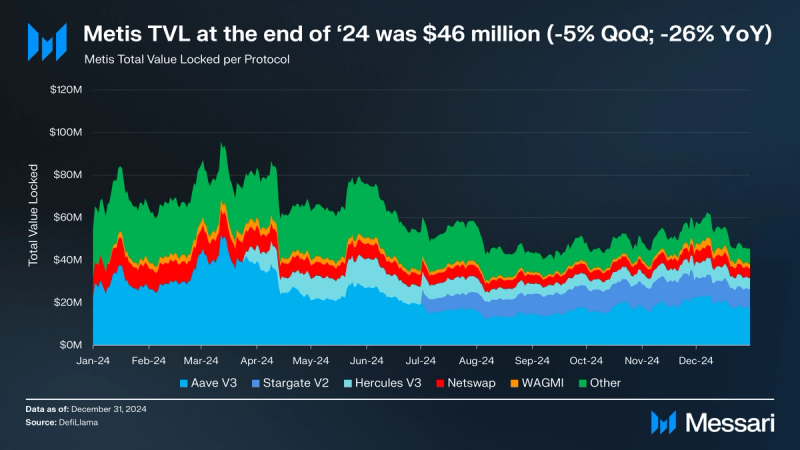

The DeFi Total Value Locked (TVL) on Metis at the end of Q4 2024 was $46 million, reflecting a 5% decrease QoQ and a 26% decrease YoY.

Aave remained the largest protocol by TVL, ending the quarter at $17.4 million (down 3% QoQ). Stargate followed with a TVL of $9 million (down 13% QoQ), while Hercules secured the third position with $5.3 million (down 2% QoQ). Netswap maintained a TVL of $4.6 million (down 1% QoQ), and WAGMI saw notable growth, with its TVL rising by 60% QoQ to $2 million. The rest of the protocols outside of the top five accounted for a combined TVL of $7.2 million.

Despite the decline in overall TVL, Metis continues to maintain a diverse mix of protocols, demonstrating a broad DeFi ecosystem.

At the end of Q4 2024, Artemis TVL was $10.6 million, reflecting a 4.5% decrease QoQ, while Enki TVL stood at $4.3 million, down 4% QoQ.

Metis’ liquid staking initiatives have been bolstered by community-approved programs aimed at accelerating the growth of LSTs on the network. Both Artemis Finance and Enki Protocol, the top-performing LST protocols, have been integrated with Metis Foundation sequencer nodes, enhancing staking options for users and improving network security.

Multiple new protocols are undergoing onboarding after governance approval as part of the Metis Liquid Staking Blitz, including Stake.link, and Velix.

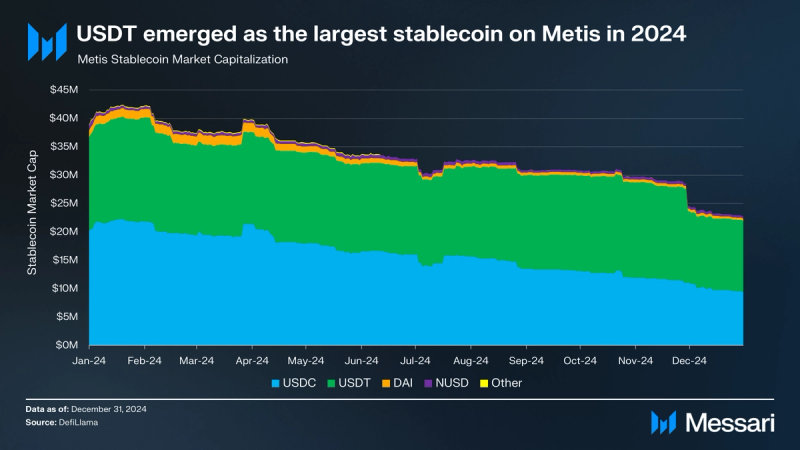

The total stablecoin supply on Metis declined by 26% QoQ in Q4 2024 to $23 million. USDC supply stood at $9.3 million, down 29% QoQ. USDT supply decreased to $12.6 million, representing a 25% QoQ decline. DAI supply was $429,000, down 15% QoQ, while NUSD supply reached $355,000, reflecting an 11% QoQ decrease. Metis ranked the 42nd largest chain by stablecoin market cap.

Decentralized SequencerThe Metis Decentralized Sequencer further advancements in Q4 2024. On October 4, 2024, Metis onboarded TEB/B-Harvest as the third external decentralized sequencer node operator. Since launch, the network has locked over 440,000 METIS.

In December 2024, Metis welcomed OKX as its fourth sequencer node provider. OKX committed 20,000 METIS tokens via its OKX Earn product. Additionally, Metis launched the Decentralized Sequencer Reboot initiative, introducing performance-based rewards of up to 15,000 METIS per month for node operators and LST protocols.

The second round of node selection and further incentives through the Metis DSEQ Reboot program are planned for early 2025.

Additional Developments- GM² deployed on Metis, the first Metis-native mobile wallet and SocialFi app, available on iOS and Android. This app enables users to manage Web3 assets, connect with influencers, and engage with the Web3 community while earning rewards through social interactions.

- DeFi Kingdoms' Colosseum launched on Metis, introducing a new Player vs. Player feature where users can pit their Heroes against opponents or participate as spectators and earn rewards.

- The partnership between API3 and Metis brought first-party oracles and decentralized price feeds to the Metis network, enabling protocols to access real-time data directly from the source, reducing latency and costs.

- Metis introduced BUZZ, a GameFi Telegram mini-app offering activities like farming, spinning, and treasure hunting while earning METIS tokens. BUZZ’s launch campaign allocated $50,000 in METIS rewards, attracting over 808,000 monthly users.

- The Metis Voyage AlphaDrop rewarded community pioneers through a tiered distribution of 5,000 METIS tokens, recognizing participation in categories such as learning, quests, onboarding, and timed challenges.

- Metis expanded its presence in South Korea by listing on Bithumb, one of the largest exchanges in the country.

- Metis perpetual futures are live on Kraken Pro.

- The integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) on Metis enabled secure cross-chain messaging and token transfers.

The Metis network has undergone significant growth and development throughout 2024, reflecting the resilience of its ecosystem amid volatile market conditions. While the overall market environment fluctuated, Metis demonstrated steady progress through increased activity, notable partnerships, and strategic expansions.

Key milestones, such as the continued enhancement of the Decentralized Sequencer, successful launches in liquid staking, and increased protocol adoption, underscore Metis's commitment to decentralization and ecosystem growth.

Looking ahead to 2025, Metis will continue to leverage its incentives alignment and ecosystem funds to grow the ecosystem, further build out the decentralized sequencer, and continue to compete in the hyper competitive L1 and L2 sectors.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.