and the distribution of digital products.

Messari’s Ryan Selkis Accuses Ripple of Using Tax Sheltering Scheme

RippleWorks is a 501(c)(3) nonprofit organization registered in the U.S. co-founded by Chris Larsen, the current Executive Chairman of Ripple.

The charitable organization is unique in that it does not provide material help. Instead, it provides “charitable consultancy” delivered by experts affiliated with the foundation. For example, the ALU school in Africa was supported by “Rippleworks Expert” Brett Browman, who provided growth marketing expertise.

Messari’s co-founder criticized the foundation for delivering zero charitable donations to others, according to its public balance sheet for 2018. The foundation seems to have incurred only two million dollars in non-tax expenses, out of a revenue of almost $300 million and $1.2 billion in Assets Under Management.

Selkis then concludes that “[Ripple is] using that vehicle as a corporate and executive tax shelter.” He then compared these figures with the Ripple Foundation’s other payments: a $665,000 salary for the CEO and a $30 million investment in Michael Arrington’s XRP Capital. “Arrington, of course, is a personal friend of Ripple CEO Brad Garlinghouse,” he added.

Claims Require NuanceMessari previously covered XRP, claiming that its market capitalization is vastly overstated due to various sales limitations.

But while there is certainly some merit to Selkis’s argument, it is normal that Rippleworks did not donate to other charities. As explained above, it focuses on providing a consultancy service to the selected projects. Its charitable activities would thus fall entirely within the administrative costs portion of the balance sheet.

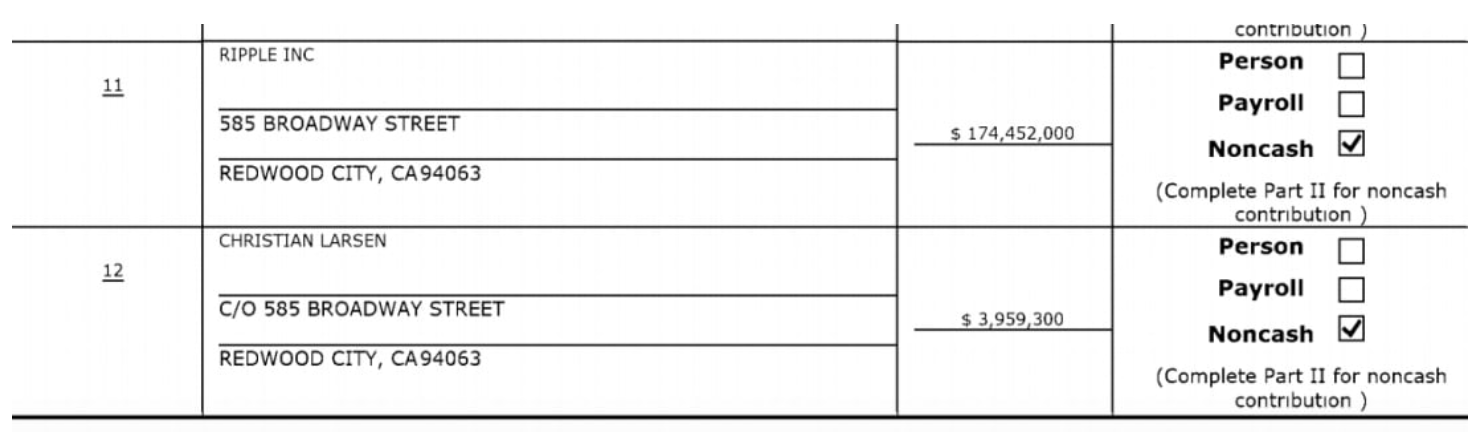

Nevertheless, the foundation’s material expenses amounted to less than one percent of its revenue — and only part of it was devoted to charity. The money ultimately remained in control of Ripple-affiliated persons, while Ripple Foundation was able to write off $174 million through a “non-cash” donation i.e. XRP tokens that it “created out of thin air,” notes Selkis.

Source: foundationcenter.org via Messari

While these strategies may be legal, using tokens that can be theoretically created ad-hoc for sheltering could elicit undue interest from tax agents.The post Messari’s Ryan Selkis Accuses Ripple of Using Tax Sheltering Scheme appeared first on Crypto Briefing.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.