and the distribution of digital products.

Market Shockwave Ahead? Ethereum Could Crash Over 60%, Analyst Says

Like most digital assets, Ethereum witnessed a correction this week by losing over 5% in the last 24 hours while trading just above $2,500. While the increased on-chain activity could eventually make the bulls bet for the bounce back of Ether, a few experts differ with this perspective.

Crypto veteran analyst Peter Brandt predicts further downfall in Ether to the extent of loss of over 60% from its present price, with no indication of changing.

Currently, Ether is trading at a 42-month low. While Bitcoin re-tested the $70k mark early this week, Ether maintains a sluggish price action and is too far off from the experts’ target of $4k.

Ether’s Strong Bearish MovementEthereum trades at its 42-month low against the world’s top digital asset, which suggests a bearish momentum. Zooming out of the price chart, Ethereum is on a downward spiral and a painful market correction for holders and investors.

According to Brandt, Ethereum’s bearish sentiment will continue with no reassuring signs of reversal.

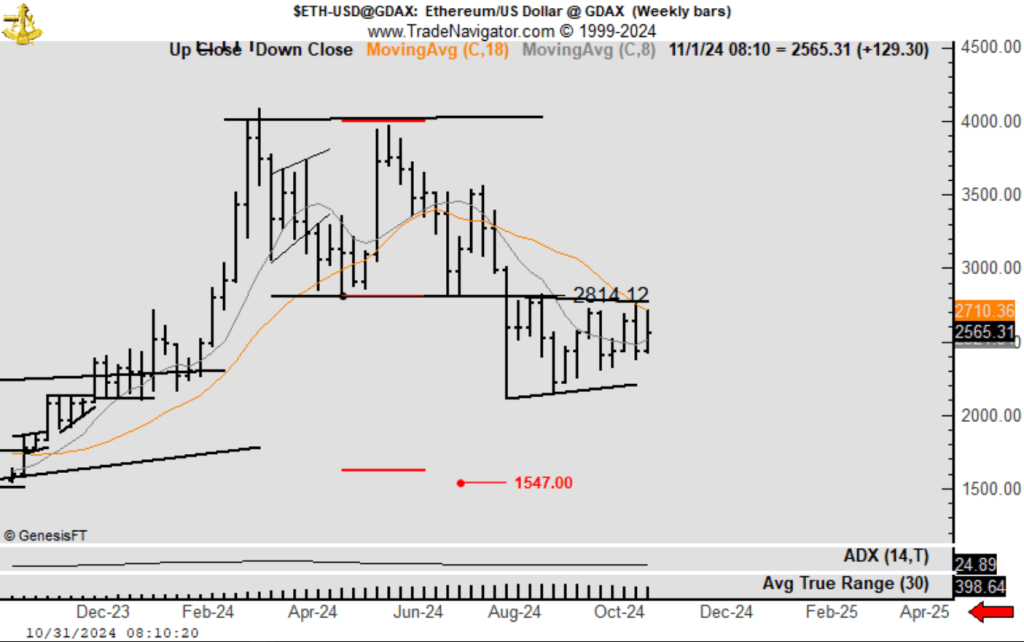

Interesting to note that there was not a buy signal in $ETH In fact, chart remains bearish with unmet target at 1551 pic.twitter.com/sjkXyTQXU2

— Peter Brandt (@PeterLBrandt) October 31, 2024

In a Twitter/X post, Brandt shared a graph saying there’s no but signal for Ether. He added that Ethereum’s chart is bearish, with the bulls making it difficult to hit the $1,551 target.

The 1-day-chart highlights the asset’s continued bearish moment momentum that started last August, characterized by a descending channel. Ethereum’s bearish flag is terrible news for traders and holders, suggesting a continued downtrend.

Aside from the bearish signals on the graph, Brandt also noted a few discouraging metrics for Ethereum. For example, Ether has dropped by over 5% over the last 24 hours, registering a sharper decline than Solana, at -4.91%, and Bitcoin, at -3.87%.

Also, Brandt noted that the ETH/BTC trading ratio dipped to 0.03613, a 42-month low, as BTC continues to lead the broader crypto market. Although Ethereum is currently priced at $2,507, Brandt sees the asset dipping even further to $1,551, reflecting a possible 62% decline from its current value.

$1,551 As Ethereum’s Unmet TargetBrandt sees $1,551 as the asset’s unmet target and a key milestone. In his analysis, this level serves as the holders’ point of capitulation. The recent dips in price have affected investors’ and holders’ confidence, with Ethereum struggling to sustain the $2,400 support.

As the second biggest crypto, Ethereum has displayed initial signs of a rally. Many observers have predicted a market rally, targeting a long-term price of $6,000. Short-term estimates put Ethereum’s price at $2,750.

However, Brandt offers a more bearish outlook for Ethereum, saying that the asset will go downhill unless a new set of technical indicators emerges.

Featured image from Tokpie, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.