and the distribution of digital products.

Java vs. Scala: Comparative Analysis for Backend Development in Fintech

Choosing the right backend technology for fintech development involves a detailed look at Java and Scala. Both languages bring distinct advantages to the table, and for professionals working in the fintech industry, understanding these nuances is crucial.

\ There is no arguing Java is a true cornerstone in software development — stable, boasting comprehensive libraries and a vast ecosystem. Many of us — me included! — relied on it for years, and today Java is the backbone of countless financial systems. Scala, in many respects a more modern language, suggests an interesting blend of object-oriented and functional programming, proud of a syntax that reduces boilerplate code and boosts developer productivity. For teams searching to introduce functional programming concepts without stepping away from the JVM ecosystem Scala is an intriguing option.

\ Our discussion will cover the essential aspects that matter most in fintech backend development: ecosystem and libraries, concurrency, real-time processing, maintainability, and JVM interoperability. Let's analyse, side by side, how Java and Scala perform in the fast-paced, demanding world of fintech backend development, focusing on the concrete benefits and limitations each language presents.

Ecosystem and Libraries for FintechWhen deciding between Java and Scala for your fintech backend, your major concern will be the richness of their ecosystems and the availability of domain-specific libraries.

\ Java accumulated an impressive array of libraries and frameworks that have become go-to resources for fintech projects. One example is Spring Boot – a real workhorse for setting up microservices, packed with features covering everything from securing transactions to managing data. There’s also Apache Kafka, pretty much the gold standard for managing event streams effectively. But what stands out about Java's ecosystem isn't just the sheer volume of tools but also the community backing them. A vast network of experienced Java developers means you’re never far from finding a solution or best practice advice, honed through years of real-world application. This kind of support network is simply invaluable.

\ Scala, while newer on the scene, brings forward-thinking libraries and tools that are particularly well-suited to the challenges of modern fintech development. Akka, with its toolkit for crafting highly concurrent and resilient message-driven apps, fits perfectly with the needs of high-load financial systems. Alpakka, part of the Reactive Streams ecosystem, further extends Scala's capabilities, facilitating integration with a wide range of messaging systems and data stores. The language’ functional programming capabilities, combined with its interoperability with Java, allow teams to gradually adopt new paradigms without a complete overhaul.

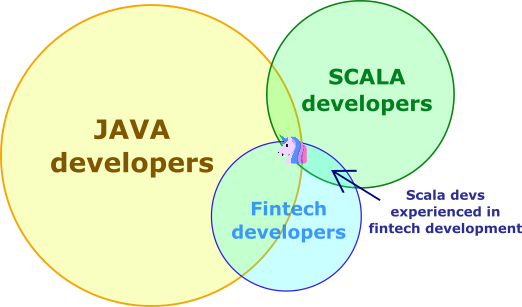

\ On the other hand, one significant challenge that fintech companies might face when adopting Scala is the relative scarcity of experienced Scala developers compared to Java developers. The smaller community size can make it difficult to find developers with deep experience in Scala, especially those who are adept at leveraging its advanced features in a fintech context. This scarcity can lead to higher recruitment costs and potentially longer project timelines, one of the factors to consider when deciding between Java and Scala.

\

\ While Scala presents compelling advantages to fintech companies interested in building scalable, distributed systems, Java is still a strong contender. The choice between these languages will require you to carefully assess your project's needs, weighing specific pros and cons of the two paradigms. With this in mind, let’s compare some fundamental aspects of these two remarkable languages.

Concurrency and Real-time ProcessingIn fintech, where handling multiple transactions swiftly and safely is the daily bread, a language’s concurrency models are of particular interest. Let’s see what Java and Scala offer us in this regard.

Java and Concurrency in FintechInitially, Java offered threads and locks – a straightforward but sometimes cumbersome way to manage concurrency. However, Java 8 introduced CompletableFuture, which marked a dramatic leap to straightforward asynchronous programming.

\ CompletableFuture provides developers with a promise-like mechanism that can be completed at a later stage, making it ideal for fintech applications that require high throughput and low latency. Let’s consider a scenario where you need to fetch exchange rates from different services concurrently and then combine them to execute a transaction:

\

CompletableFuture\ In this snippet, supplyAsync initiates asynchronous tasks to fetch exchange rates. thenCombine waits for both rates before executing a transaction, ensuring that operations dependent on multiple external services can proceed smoothly. The exceptionally method provides a way to handle any errors that occur during execution, a crucial feature for maintaining robustness in financial operations.

\n Scala and Concurrency with Akka

Transitioning from Java to Scala’s actor model via Akka provides a stark contrast in handling concurrency. Akka actors, elegant yet efficient, are especially well-suited for the demands of fintech applications; they were designed to be lightweight and can be instantiated in the millions. They also bring fault tolerance through supervision strategies, ensuring the system remains responsive even when parts of it fail.

\ Consider the previous example of fetching exchange rates and processing a transaction. Here’s how you can apply the actor model in Scala:

\

import akka.actor.Actor import akka.actor.ActorSystem import akka.actor.Props import akka.pattern.ask import akka.util.Timeout import scala.concurrent.duration._ import scala.concurrent.Future case class FetchRate(currency: String) case class RateResponse(rate: Double) case class ProcessTransaction(rate1: Double, rate2: Double) class ExchangeServiceActor extends Actor { def receive = { case FetchRate(currency) => sender() ! RateResponse(exchangeService.getRate(currency)) } } class TransactionActor extends Actor { implicit val timeout: Timeout = Timeout(5 seconds) def receive = { case ProcessTransaction(rate1, rate2) => val result = processTransaction(rate1, rate2) println(s"Transaction Result: $result") } } val system = ActorSystem("FintechSystem") val exchangeServiceActor = system.actorOf(Props[ExchangeServiceActor], "exchangeService") val transactionActor = system.actorOf(Props[TransactionActor], "transactionProcessor") implicit val timeout: Timeout = Timeout(5 seconds) import system.dispatcher // for the implicit ExecutionContext val usdRateFuture = (exchangeServiceActor ? FetchRate("USD")).mapTo[RateResponse] val eurRateFuture = (exchangeServiceActor ? FetchRate("EUR")).mapTo[RateResponse] val transactionResult = for { usdRate <- usdRateFuture eurRate <- eurRateFuture } yield transactionActor ! ProcessTransaction(usdRate.rate, eurRate.rate)\n Here, ExchangeServiceActor fetches currency rates asynchronously, while TransactionActor processes the transaction. The use of the ask pattern (?) allows us to send messages and receive futures in response, which we can then compose or combine as needed. This pattern elegantly handles the concurrency and asynchronicity inherent in fetching rates and processing transactions, without the direct management of threads.

\ The actor model, by design, encapsulates state and behaviour, making the codebase cleaner and easier to maintain. Fintech applications, with their demand for fault tolerance and quick scalability, are one of the major beneficiaries of Scala’s Akka framework.

Code Readability and Maintainability in FintechJava's syntax is known for its verbosity, which, applied to fintech, translates to clarity. Each line of code, while longer, is self-explanatory, making it easier for new team members to understand the business logic and the flow of the application. This characteristic is beneficial in environments where maintaining and auditing code is as crucial as writing it, given the regulatory scrutiny fintech applications often face.

\ On the other hand, while Scala's more concise syntax reduces boilerplate and can lead to a tighter, more elegant codebase, it also introduces a significant challenge. The flexibility and variety of Scala can often result in different developers solving the same problem in multiple ways, creating what can be described as a 'Babylon' within the project. This variability, while showcasing Scala's expressive power, can make it more difficult to maintain consistent coding standards and ensure code quality and understandability, especially in the highly regulated environment of fintech.

\ This steepens the learning curve, especially for developers not familiar with functional programming paradigms. Consider a simple operation in a fintech application, such as validating a transaction against a set of rules. In Java, this might involve several explicit steps, each clearly laid out:

\

public boolean validateTransaction(Transaction transaction) { if (transaction.getAmount() <= 0) { return false; } if (!knownCurrencies.contains(transaction.getCurrency())) { return false; } // Additional validation rules here return true; }\ The challenger, Scala, boasts a more concise syntax by virtue of its functional programming capabilities. This conciseness helps dramatically reduce the boilerplate code, making the codebase tighter and easier to maintain. Despite the challenge of maintaining a uniform standard across a team I mentioned above, the brevity of Scala code can be a significant asset, though it requires a steeper learning curve, especially for developers not familiar with functional programming paradigms.

\ The same transaction validation in Scala might look significantly shorter, leveraging pattern matching and list comprehensions:

\

def validateTransaction(transaction: Transaction): Boolean = transaction match { case Transaction(amount, currency, _) if amount > 0 && knownCurrencies.contains(currency) => true case _ => false }\ **JVM Interoperability and Legacy Integration \ A critical factor in choosing a backend technology for fintech applications is how well it integrates with existing systems. Many financial institutions rely on extensive legacy systems that are critical to their operations. Java’s and Scala’s paths to interoperability and integration within the JVM ecosystem have their unique advantages here.

\ Java's long history and widespread use in the financial industry mean that most legacy systems in fintech are built using Java or compatible with Java. This compatibility facilitates seamless integration of new developments with existing systems. Java's stability and backward compatibility are key assets when updating or extending legacy systems, minimising disruptions and ensuring continuous operation.

\ For instance, integrating a new Java-based service into an existing system can be as straightforward as:

\

// Java service to be integrated with a legacy system public class NewJavaService { public String processData(String input) { // Process data return "Processed: " + input; } }\ This simplicity in integration is a significant advantage for Java, reducing the time and effort required to enhance or expand legacy systems with new functionalities.

\ Scala's interoperability with Java is one of its standout features, allowing Scala to use Java libraries directly and vice versa. This interoperability means that financial institutions can adopt Scala for new projects or modules without abandoning their existing Java codebase. Scala can act as a bridge to more modern, functional programming paradigms while maintaining compatibility with the JVM ecosystem.

\ For example, calling a Scala object from Java might look like this:

\

// Scala object object ScalaService { def processData(input: String): String = { // Process data s"Processed: $input" } } // Java class calling Scala object public class JavaCaller { public static void main(String[] args) { String result = ScalaService.processData("Sample input"); System.out.println(result); } }\ This cross-language interoperability is particularly beneficial in fintech, where leveraging existing investments while adopting new technologies is often a strategic priority. Scala offers a path to modernise applications with functional programming concepts without a complete system overhaul.

ConclusionIt certainly is no revelation that the two languages have their strengths and difficulties. Java stands out for its robust ecosystem and libraries, offering a tried-and-tested path for developing fintech applications. Its traditional concurrency models and frameworks provide a solid foundation for building reliable and scalable systems. Moreover, Java's verbose syntax promotes clarity and maintainability, essential in the highly regulated fintech sector. Finally, Java's widespread adoption makes integration with existing systems and legacy code seamless

\ Scala, on the other hand, will be your weapon of choice if you want to streamline your development process with a more expressive syntax and a robust concurrency management model. It’s particularly appealing for projects aiming for high scalability and resilience, without stepping completely away from the Java universe. This makes Scala a strategic choice for evolving your tech stack, introducing functional programming benefits while keeping the door open to Java's realm.

\ So — no, there is no and probably never will be a definitive, final answer to this question. You will always have to balance the immediate needs of your project with long-term tech strategy. Do you build on the solid, familiar ground that Java offers, or do you step into Scala's territory, with its promise of modernised approaches and efficiency gains?

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.