and the distribution of digital products.

DM Television

Interdax Review | An Ultimate Crypto Exchange

Estimated reading time: 15 minutes

In this article, we will review Interdax, a crypto derivatives exchange that launched its mainnet in November 2019 and is incorporated in Seychelles. The platform offers spot trading and derivatives with competitive fees, continuous settlement, and up to 100x leverage.

Table of contents- Trading Products

- Order Types

- Sub-accounts

- Interdax Security

- User Experience

- Interdax Review: Deposit and Withdrawals

- Interdax Fee

- Supported Countries

- Interdax Referral Program

- Interdax Margin Bonus Program

- Customer Support

- Interdax API

- Interdax Testnet

- Interdax review: Pros and Cons

- Interdax Review: Conclusion

- Frequently Asked Questions (FAQs)

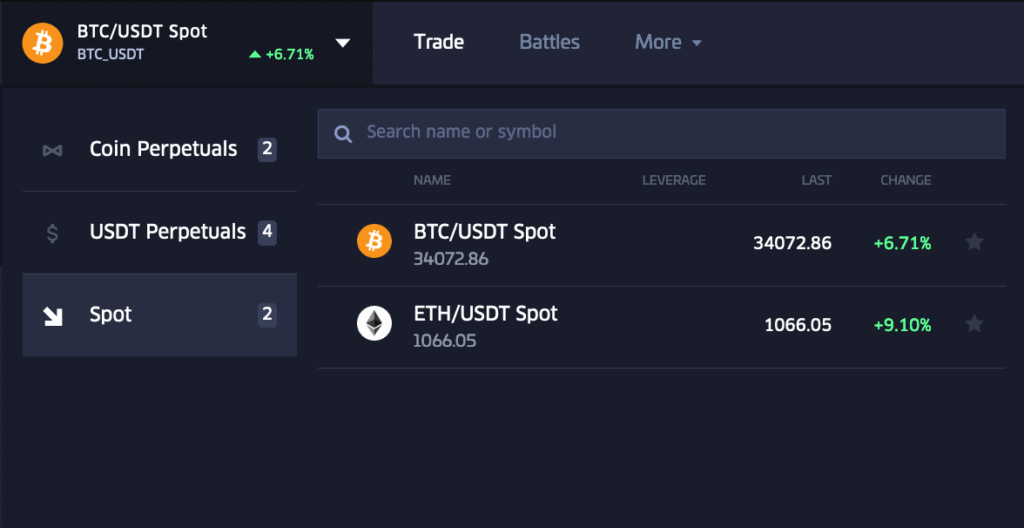

There are currently two spot trading pairs available on Interdax: BTC-USDT and ETH-USDT.

Interdax Review: Spot Trading

Perpetuals

Interdax Review: Spot Trading

Perpetuals

The Interdax exchange offers two types of perpetual contracts:

- Coin Perpetuals, such as BTC-PERP,

- Stablecoin Perpetuals (or USDT perpetuals), such as LINK-USDT-PERP.

Perpetual contracts do not have an expiry date, unlike futures contracts. Investors can buy or sell perpetual contracts and hold these positions for as long as they want. Profit and loss is updated continuously so that traders do not have to exit a trade to realise their profits. Any earnings from a trade can be used immediately to enter a new position in the underlying asset, make a transfer, or can be withdrawn.

A robust methodology is used to construct an index price by aggregating the top five order books from constituent exchanges, resulting in an index that is resistant to manipulation and outliers. It gives exchanges with thicker books more weight, and the index draws bid-ask prices from multiple exchanges based on API availability. Exchanges are removed from index calculations if they have been offline for more than 30 seconds.

The contract specifications for all perpetuals can be found here.

Coin PerpetualsCoin perpetuals are inverse derivatives where trades are settled and margined in the underlying coin, i.e., BTC for BTC-PERP and ETH for ETH-PERP. These contracts allow traders to use BTC or ETH as collateral to enter positions with up to 100x leverage. The contract size is 1 USD.

The balances of different assets are isolated from each other, meaning that ETH balances will not affect positions or orders for BTC-PERP, and vice versa.

Stablecoin PerpetualsStablecoin perpetuals are linear derivatives where trades are settled and margined in the stablecoin TetherUSD (USDT). The balances and positions of BTC and ETH are isolated from stablecoin perpetuals; only USDT can be used as collateral.

Interdax currently offers four stablecoin perpetuals, allowing users to trade Chainlink’s native LINK asset, Uniswap‘s UNI governance token, Avalanche’s AVAX token, and Filecoin (FIL) with the continuous settlement and up to 100x leverage:

- LINK-USDT-PERP,

- UNI-USDT-PERP,

- AVAX-USDT-PERP, and

- FIL-USDT-PERP.

USD is the quote currency for stablecoin perpetuals and the contract size is 1 unit of the base currency, e.g., 1 LINK for LINK-USDT-PERP or 1 UNI for UNI-USDT-PERP.

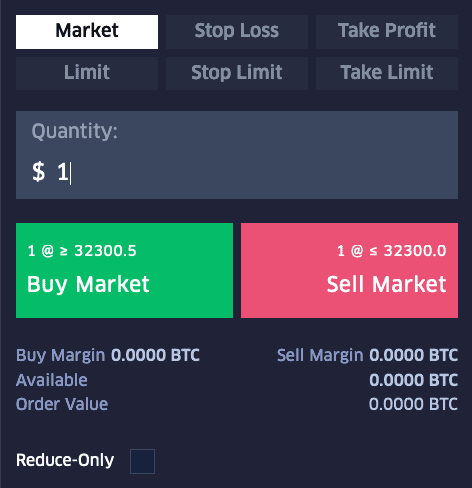

Order TypesThere are six order types which can be grouped into two categories: market orders and limit orders.

Market OrdersMarket orders are executed immediately at the best available price and must pay the taker fee. To enter a trade quickly, you can use market orders.

Stop Loss and Take Profit are also types of market orders which are executed based on a pre-defined trigger price. For instance, a Stop Loss order allows you to set a market order to sell below the current market price once the index price moves below your specified level. A Take Profit order can be used to sell above the current market price once the index price moves above a specified level.

Interdax review: Market orders

Interdax review: Market orders

The top of the order panel shows the different types of orders you can use. Once you’ve chosen the order type, enter the quantity and buy or sell for market orders.

The top row (Market, Stop Loss and Take Profit) are all types of market orders. For Stop Loss and Take Profit orders, you also have to set a trigger price. When a trigger price is reached, a market order is submitted.

The Reduce-only order flag is available for market orders, which ensures that an order only acts to reduce the size of an existing position. The Reduce-only option can be used when submitting a stop loss order and a take profit order to ensure that neither of the orders are triggered unintentionally once an open position is closed.

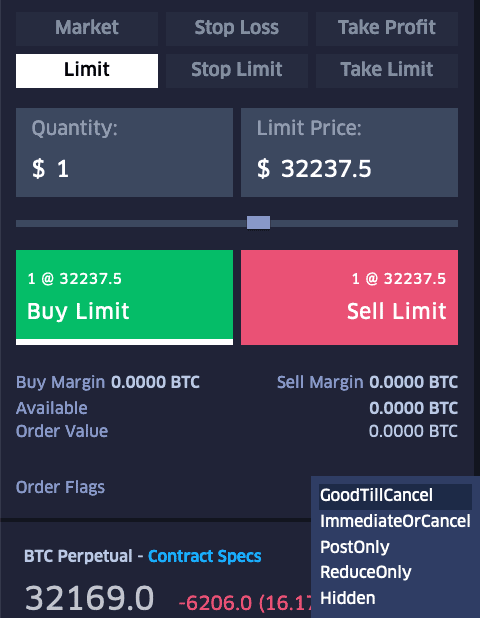

Limit OrdersLimit orders can be used to buy or sell at a particular price without having to pay the taker fee. In this case, the maker fee applies, which is 0% since these traders are providing liquidity to the order book. Once you’ve selected a limit order, enter the quantity and limit price, then click buy limit or sell limit.

The order panel shows the limit orders beneath the market orders: Limit, Stop Limit and Take Limit. Stop Limit and Take Limit are orders that can be used like the Stop Loss and Take Profit orders, but in this case, the trader does pay any fees since the maker fee is 0%. Also, users must set a limit price as well as a trigger price for these limit orders. The limit price and trigger price can be equal.

Interdax review: Limit orders

Interdax review: Limit orders

There are several order flags that can be used in conjunction with limit orders:

- GoodTillCancel: Limit orders are valid until you decide to cancel them,

- ImmediateOrCancel: Fills the order immediately at the best available price and the unfilled portions are cancelled. This order flag allows partial order execution, but comes with the risk that the order may not be executed at all.

- PostOnly: Ensures that the limit order is placed into the order book and is charged the maker fee instead of the taker fee.

- ReduceOnly: Order can only reduce the size of (or close) an open position.

- Hidden: Ensures that the limit order is not visible on the order book. Used by traders who do not want to reveal their intentions to the market.

The order panel also shows the buy/sell margin (which is the amount of collateral that is required to maintain an open position), the order value and the available balance for the selected sub-account.

Sub-accountsSub-accounts can be used to manage risk, hedge against positions, and set up highly sophisticated trading strategies. Funds can be transferred between sub-accounts seamlessly, and liquidations in one sub-account will not affect the balances of other sub-accounts.

The account menu on the top right hand side shows the balances of all assets in a sub-account. You can click on ‘Manage’ to transfer funds, rename or delete sub-accounts, or click on ‘New’ to add a sub-account:

Interdax review: Sub-accounts

Interdax review: Sub-accounts

You could use sub-accounts for different trading strategies, e.g., one for scalping, one for swing trading, and so on. Or you can use the sub-account feature to hedge a position. For instance, you could go long using the funds in one sub-account and enter a short position with a smaller size in another sub-account. In the event the long trade doesn’t work out, the losses will be partially offset by the profits from the short position in the other sub-account.

Sub-accounts can also specify the amount of leverage used. Suppose you have 2 BTC in sub-account 1 and 0.50 BTC in sub-account 2. To open a position of 4 BTC with 5x leverage, transfer 1.2 BTC from sub-account 1 to sub-account 2, leaving 0.8 BTC in sub-account 1. With a position size of 4 BTC and a balance of 0.80 BTC in sub-account 1, the leverage used will be around 5x.

To decrease the leverage, you can add more funds to sub-account 1. If you want to increase the leverage, you can transfer a portion of the funds out of sub-account 1 to sub-account 2. Transfers between sub-accounts are free and instant.

Interdax SecurityAccording to Mozilla’s observatory test, Interdax received a C+ rating. The web application runs on the latest version of TLS 1.3.

Interdax uses a novel shielded multi-signature scheme to protect user funds, which you can read more about here. In summary, user funds are stored in cold wallets with a 3-of-5 multi-signature scheme. Even if the servers are compromised, any coins held by Interdax on behalf of customers are safe.

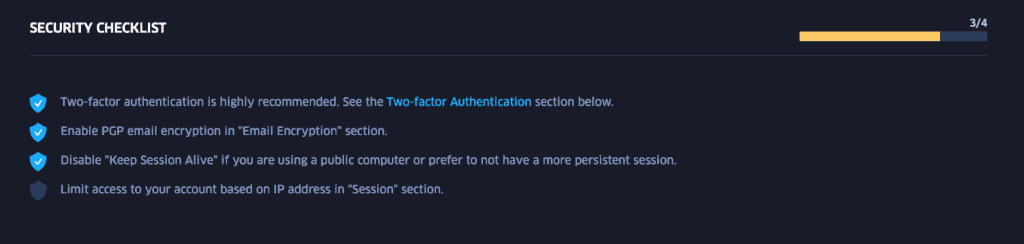

The security features to protect users include two-factor authentication (2FA) using Google Authenticator, Captchas, PGP encryption for emails, and whitelisting based on IP addresses (so that your account can only be accessed from IP addresses that are on your whitelist). Users can also disable ‘Keep Session Alive’ if they are using a shared computer or if they want to disconnect from the platform after an hour of inactivity.

The security settings page displays a checklist to show the security level of your account. These features are not activated by default, so you’ll have to activate them once you register:

Interdax review: Security

Interdax review: Security

There’s no possibility of Interdax leaking any personal information whatsoever, since there is currently no KYC. Only an email address and a password are required to set up an account. To complete registration, a strong password is mandatory.

User ExperienceInterdax offers a customisable interface where different panels can be resized or removed completely. The application operates in dark mode by default and uses TradingView charts, offering drawing tools and technical indicators within the platform so traders can analyse their setups.

Orders and positions are displayed on the trading chart, and can be edited or cancelled from this panel. If you want to change the limit price/trigger price of an order, you can drag it on the chart to your desired limit price/trigger price:

Interdax review: User experience

Interdax review: User experience

The order quantity can also be amended from the chart:

Interdax review: trading chart orders

Interdax review: trading chart orders

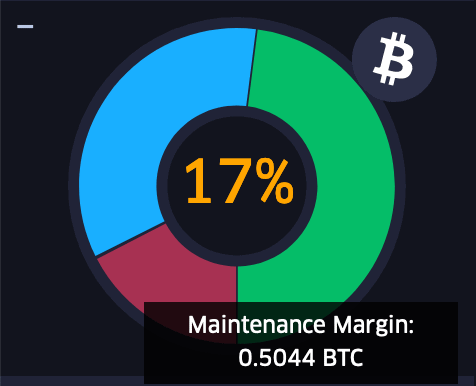

The margin wheel, which is located above the order panel, clearly shows the riskiness of any open positions.

The available balance is represented by the green portion of the wheel, the initial margin required for active orders is shown in orange, the maintenance margin needed for any open positions is displayed by the red portion, while the hold for spot orders is shown in blue. You can hover over any of the portions to show the corresponding amounts.

The percentage in the middle of the wheel shows the maintenance margin as a percentage of your available balance. Once it rises above 65%, it flashes to show the high risk associated with your position(s).

Interdax’s Help Centre offers trading resources, FAQs/ information about cryptocurrencies, and details about the exchange.

Customers also benefit from 24/7 support via Telegram, Twitter, the Help Centre, and email.

Interdax Review: Deposit and WithdrawalsInterdax accepts BTC, ETH and USDT deposits. Deposits can be made by entering your account’s address into your wallet or by scanning a QR code.

Bitcoin deposits will be credited after two confirmations from the network, while ETH/USDT deposits will be made available for trading after 12 confirmations. As soon as a transaction is broadcast to the network, incoming transfers will be shown as ‘pending’ on the deposits page. Interdax does not charge any fees for deposits.

Withdrawals are processed once per day. For convenience, Interdax also facilitates smaller withdrawals instantly (pending network confirmations) using funds stored in a hot wallet. If the hot wallet has enough funds, then you can withdraw smaller amounts at any time.

There are no fees associated with withdrawals, and funds can be taken from any sub-account. However, there are minimum withdrawal amounts, which are:

- 0.0001 BTC,

- 0.001 ETH, and

- 0.001 USDT.

Interdax uses a maker-taker model. For all trading instruments (spot and perpetuals), the taker fees are 0.05% and the maker fees are 0%. Market orders are always executed as takers, whilst limit orders can be makers or takers. A resting limit order (i.e., it rests on the order book) is a maker, while if a limit order does not hit the order book and is filled immediately, it is a taker.

The funding rates for perpetuals are calculated multiple times per second, and the 8-hour average is shown by the interface. If the funding rate is negative, those in long positions pay those in short positions. If the funding rate is positive, those in short positions pay those in long positions.

Accumulated payments are credited to (or deducted from) the user’s balance continuously. Funding payments will appear on the transaction history page as soon as the accumulated payments reach at least 1 satoshi (0.00000001 BTC) for BTC-PERP. The funding payments work similarly for ETH-PERP and stablecoin perpetuals.

Supported CountriesInterdax is supported in all countries except if you are located in or a resident of one of the following jurisdictions: Cuba, Iran, North Korea, Québec (Canada), Sudan, Syria, the United States of America and Venezuela.

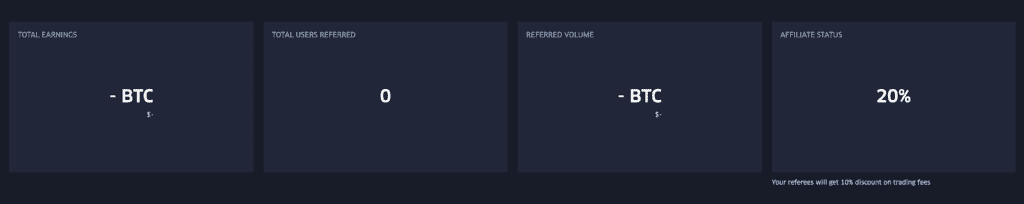

Interdax Referral ProgramInterdax’s referral program allows users to earn 20% of the trading fees of the users they’ve signed up, while also providing their referrals with a 10% discount. You can also customise your referral code/link.

Use this referral link to get 10% discount on your fee.

The customized referral links can be shared on social media channels. In addition, you can check the number of users referred, the amount they have traded, and your total earnings in BTC.

Interdax review: referral program

Interdax review: referral program

More details about the referral program can be found here.

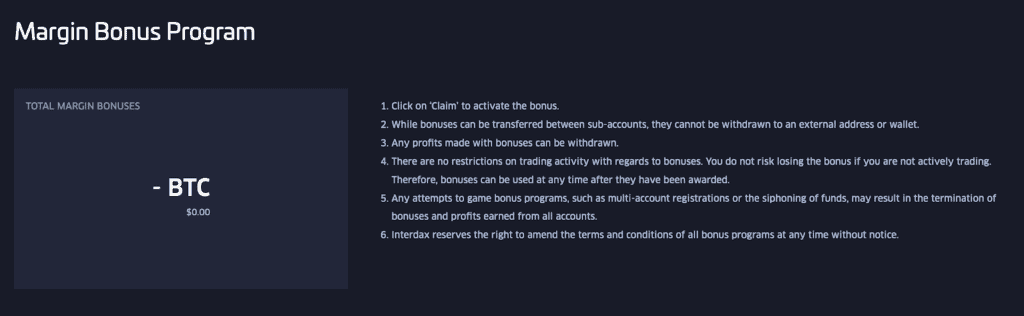

Interdax Margin Bonus ProgramThe margin bonus program gives traders extra capital on top of their first deposit. The bonus offered by this program is 5%.

For example, if you deposit 1 BTC, an additional 0.05 BTC will be credited as a bonus to use as margin. The total balance of 1.05 BTC cannot be withdrawn without forfeiting the margin bonus. However, any profits made using the margin bonus can be withdrawn.

Interdax Margin bonus

Interdax Margin bonus

More details about the margin bonus program can be found here.

Customer SupportCustomer support is available 24/7 through Interdax’s Help Centre and via email. Support is also offered through the Telegram channel and via Twitter.

Interdax APIYou can automate your trading on the Interdax platform using the public API. REST and Websocket APIs are available along with code examples.

Interdax TestnetInterdax’s testnet gives traders the opportunity to practice and try out the platform before registering and depositing any capital. Testnet accounts are funded with demo BTC, ETH and USDT once signing up so you can get a feel for the platform.

Interdax review: Pros and Cons Pros:- Low fees (0.05% taker and 0% maker),

- Offers high leverage of up to 100x,

- Robust index methodology,

- Intuitive and user-friendly interface,

- No KYC,

- 24/7 customer support.

- Relatively new platform,

- No fiat support,

- Not regulated.

In conclusion, Interdax is a relatively new but unregulated platform with several attractive features including sub-accounts to manage risk and execute sophisticated trading strategies, a robust index methodology, derivatives with up to 100x leverage, and a novel shielded multi-signature scheme to protect customer’s funds. The platform’s interface is intuitive and user friendly, along with a smooth registration process that does not require any sensitive, personal details since there is no support for fiat currencies.

Frequently Asked Questions (FAQs) Does Interdax accept fiat deposits?No, Interdax only accepts BTC, ETH, and USDT deposits.

How long do withdrawals take?If there’s enough in the hot wallet and it is a small amount, it will be processed instantly. If there is not enough in the hot wallet to cover the withdrawal, larger withdrawals are processed daily. Interdax covers the network fees for withdrawals.

What are perpetual contracts?Perpetual contracts are similar to futures derivative contracts that use cryptocurrency as collateral and do not have an expiry date. Users can place leveraged trades with position sizes larger than the available balance and are required to hold collateral to cover the maintenance margin. Funding payments are also used to keep the price of the contract in line with the price of the underlying asset. The 8-hour average funding rate is shown in the interface.

How do I specify my leverage?You can specify the leverage used, but unlike other exchanges this cannot be done directly. You will have to use a sub-account, transfer some of the balance and size your position accordingly.

Can I use Interdax in the United States?No, users from the United States are restricted.

Is Interdax regulated?No, Interdax is not yet fully regulated.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.