and the distribution of digital products.

DM Television

Inscriptions Trading and Gas Fee Analysis of the zkSync Era

1.1 Research Questions and Contributions

6.3 Inscription Trading.In this study, we analyze the trading behavior of two inscription tokens within the zkSync Era: zrc-20 sync, the predominant token, and era-20 bgnt, a token of smaller stature but notable for its completed minting process. Our analysis, presented in Figures 4 and 5, shows their respective trading activities. Notably, era-20 bgnt demonstrates a higher level of trading activity compared to zrc-20 sync. Specifically, we observed 477 transfer transactions for zrc-20 sync, alongside corresponding token median prices as shown in Figure 4, and 1148 buy transactions for era-20 bgnt, with corresponding median prices depicted in Figure 5

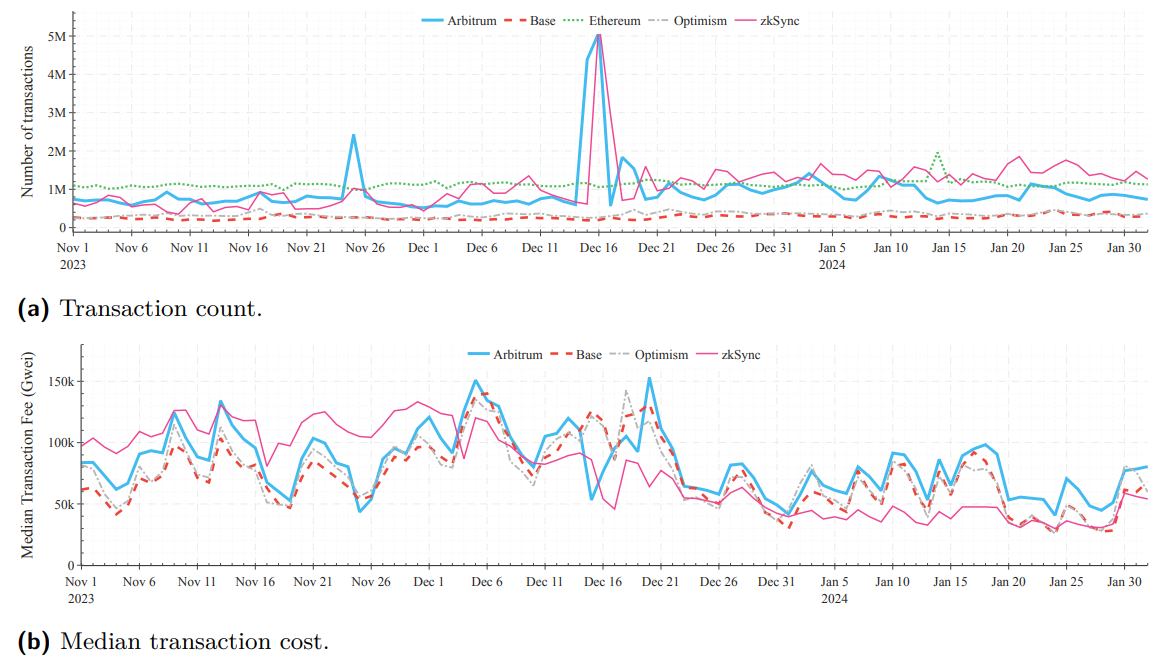

\ During the studied period, the price of zrc-20 sync oscillated between $0.10 and $0.4, while era-20 bgnt ranged from $0.10 to $0.8. Trading of the era-20 bgnt token continued from its minting throughout the entire studied period. As the trades occur in batches of 4 or 5 tokens, they provide minimal compensation to the seller to cover the gas fees necessary to mint and list the inscriptions. The trading of inscriptions at such low prices is feasible due to the low gas fees on rollups, which ranged at zkSync Era from $0.05 to $0.25 during the period (see Figure 6). Next, we examine how spikes in inscription transactions influence gas fees across the network.

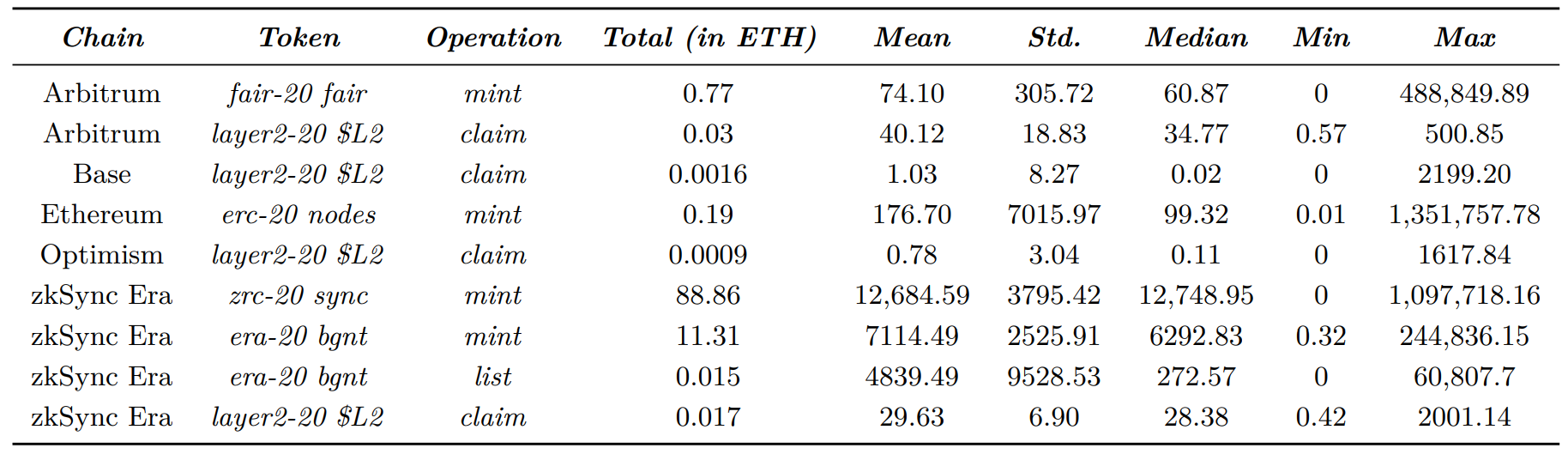

\ Table 4 presents a breakdown of fees incurred during operations on inscriptions. In the first transaction, deploy, the maximum number of tokens that can be minted or claimed in a single blockchain transaction is specified. Therefore, mint and claim operations generally deal with this maximum amount specified in deploy, typically 4 or 5 tokens for mint while sometimes even 1000 for claim, as depicted in Table 1. We calculate the average fee per single token for each operation. We found that the mint operation is more efficient than claim, although both have a similar meaning. Minting was specified in the original BRC-20

\

\

\ specification. The interesting comparison provides claim operation for layer2-20 $L2 token, as it is operating across all rollups. Its mining (claiming) operation had a lower median fee on Optimism and Base, followed by zkSync Era and Arbitrum.

\

:::info Authors:

(1) Johnnatan Messias, Matter Labs;

(2) Krzysztof Gogol, Matter Labs, University of Zurich;

(3) Maria Inês, Silva Matter Labs;

(4) Benjamin Livshits, Matter Labs, Imperial College London.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.