and the distribution of digital products.

How to Trade on Perpetual Protocol?

Futures trading is very popular in the crypto space. Although it was initially offered by well-known centralized exchanges such as Bitmex, Binance, and Bybit.

Decentralized futures trading has been getting more attention recently. So today, we will discuss Perpetual protocol, a DeFi protocol that offers decentralized futures trading.

Summary (TL;DR)- Perpetual Protocol is a DeFi project to create the world’s best, most accessible, and most secure decentralized derivatives trading platform.

- Perpetual Protocol provides two options to its users to bridge assets to Optimism, i.e., Optifaucet and PerpUI.

- PERP is the native utility token used for Governance and Staking.

- The total supply of PERP tokens is hard capped to 150 million, and the current circulating supply is around 88.7 million.

- Perpetual Protocol has been audited four times since its inception by HasHCloak, Dedaub, and Trail of Bits.

- Perpetual Protocol is built on top of Uniswap v3, where all operations with Uniswap v3 pools holding perpetual tokens must be performed via the protocol’s clearinghouse smart contract.

- Perpetual Protocol uses a new approach known as a vAMM or virtual AMM.

- Taiwanese entrepreneurs launched the project. (Shao-Kang Lee and Yenwen Feng)

Note: You get a discount on trading fees by using the code “FREE“

What is Perpetual Protocol?Perpetual Protocol is a DeFi project to create the world’s best, most accessible, and most secure decentralized derivatives trading platform.

Its core product is a perpetual futures DEX. It was founded in 2019 by a small team of startup founders & software engineers and was called Strike, and the team changed the name to Perpetual Protocol in the summer of 2020.

Its first mainnet version was launched on the xDai network in December 2020, and version 2 of the protocol known as Curie (named after Marie Curie) was launched on Optimism in November 2021.

How Does Perpetual Protocol Work?Perpetual Protocol is built on top of Uniswap v3, where all operations with Uniswap v3 pools holding perpetual tokens must be performed via the protocol’s clearinghouse smart contract.

Users cannot add or remove liquidity or swap tokens directly via Uniswap smart contracts.

Liquidity on Perpetual Protocol does not depend on Uniswap liquidity. This means there can be a small amount of liquidity on Uniswap v3’s regular pools but a huge amount of liquidity for the same asset in the perpetual token pool.

In the traditional AMM, users deposit crypto assets into liquidity pools representing trading pairs. Then, users who trade pay a small fee to all liquidity providers based on their contribution to the pool.

Here, the DeFi protocol providers and traders determine the price for each pair and facilitate the actual exchange of assets.

Perpetual Protocol uses a new approach known as a vAMM or virtual AMM. It uses the same x*y=k constant product formula as Uniswap.

Here virtual implies that there is no real asset pool k stored inside the vAMM. Instead, the real asset is stored in a smart contract vault that manages all the collateral backing of vAMM. It is designed only for price discovery, not for spot exchange.

Note: You get a discount on trading fees by using the code “FREE“

How to Connect Wallet to Perpetual Protocol?In this section, we will learn how to connect a wallet to Perpetual Protocol.

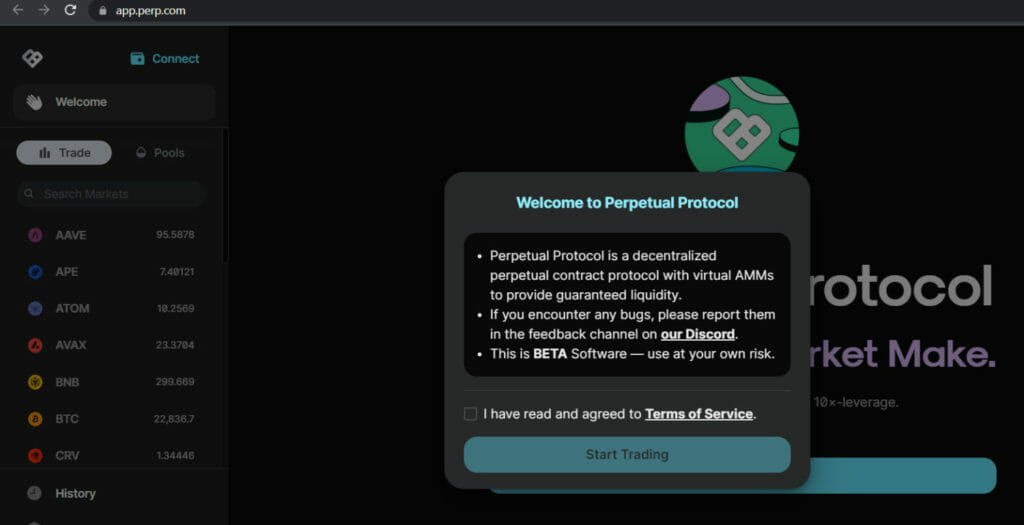

- Step 1: Go to https://app.perp.com/. We will see a Welcome to Perpetual Protocol. Then, click on I have read and agreed to Terms & Service.

Welcome

Welcome

- Step 2: Click on the Connect Wallet button.

Connect Wallet

Connect Wallet

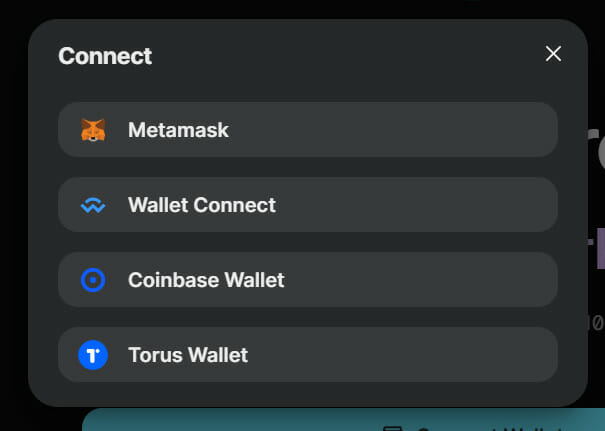

- Step 3: We will see four wallet options, i.e., MetaMask, Wallet Connect, Coinbase Wallet, and Torus Wallet.

- In this article, we will be selecting and using MetaMask Wallet as it is the most widely used and one of the most popular wallets.

- The team is also working on future support for other Web3 wallets.

Select Wallet

Select Wallet

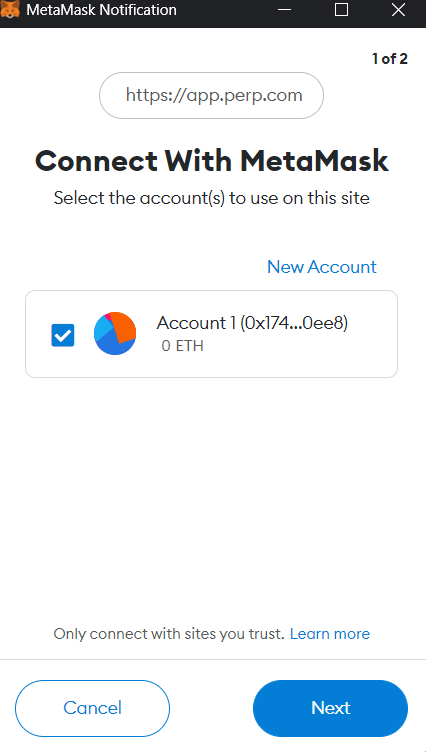

- Step 4: Click on MetaMask. It will ask us to select the account we want to use on Perpetual Protocol. Then, click on the Next button.

Click on Next

Click on Next

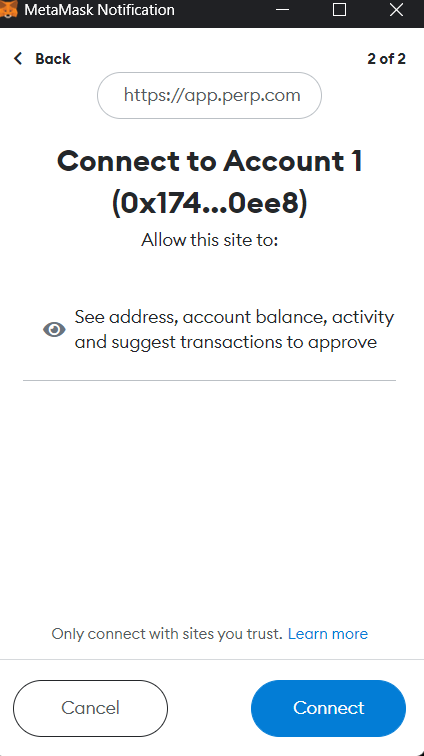

- Step 5: Now, we will see that Perpetual Protocol is connecting to our Account 1 with address 0x17...0ee8, and Perpetual Protocol can know the address, account balance, and activity and suggest transactions to approve.

- Click on the Connect button.

Click on Connect

Click on Connect

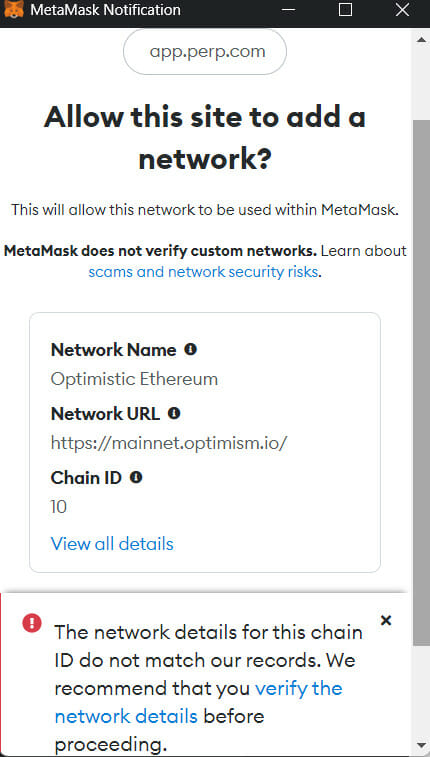

- Step 6: As we know, the Perpetual Protocol is built on Optimism Network, i.e., an Ethereum Layer 2 Solution.

- So, If our wallet is not on the Optimism Network, then Perpetual Protocol will ask us to switch our network to Optimism in MetaMask Wallet.

Switch Network

Switch Network

- Step 7: Click on the Approve button.

Click on Approve

Click on Approve

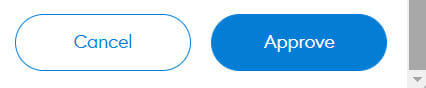

- Step 8: Click on the Switch Network button. This command will switch the network from the existing mainnet/test network to Optimism Network.

Click on Switch

Click on Switch

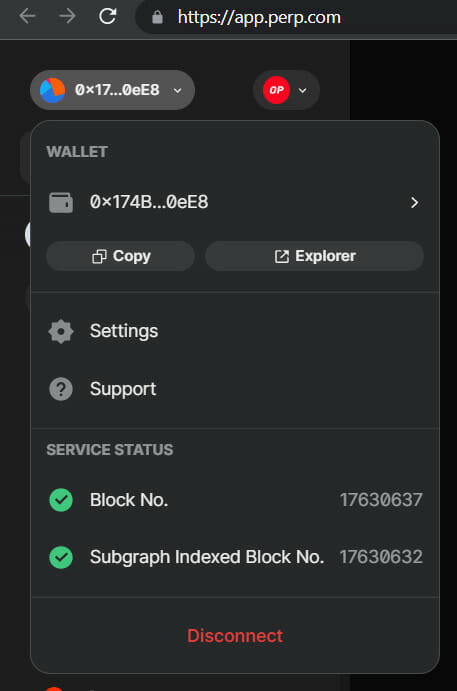

- To disconnect an existing wallet to connect to another wallet, Go to the address on the top left-hand side and then Click on the Disconnect button.

Disconnect

How to Bridge Assets to Optimism using Optifaucet?

Disconnect

How to Bridge Assets to Optimism using Optifaucet?

Perpetual Protocol provides two options to its users to bridge assets to Optimism, i.e., Optifaucet and PerpUI. This section will teach us how to Bridge Assets to Optimism via Optifaucet.

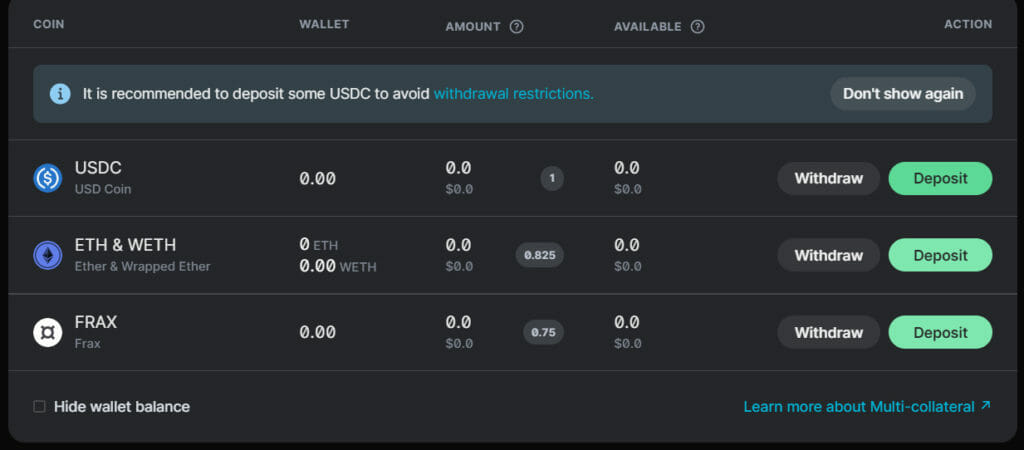

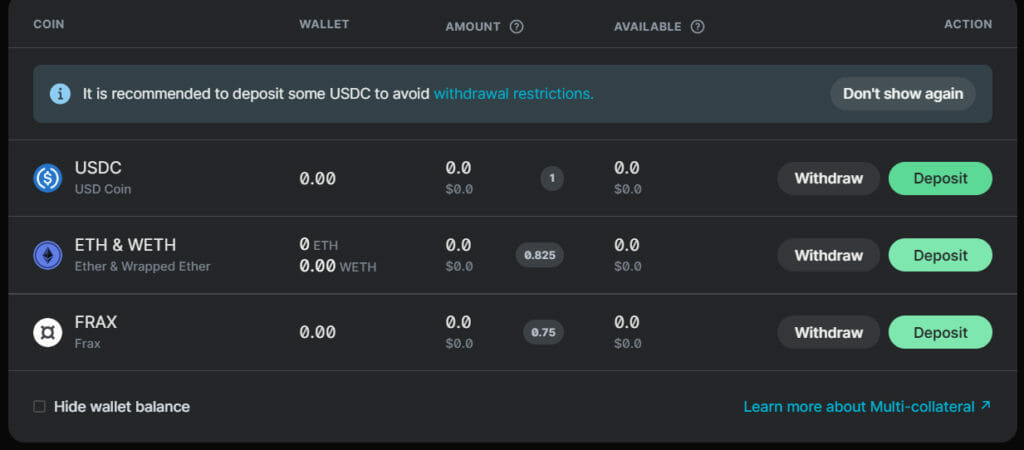

- Step 1: Go to https://app.perp.com/. Then, Click on the Deposit button.

Deposit

Deposit

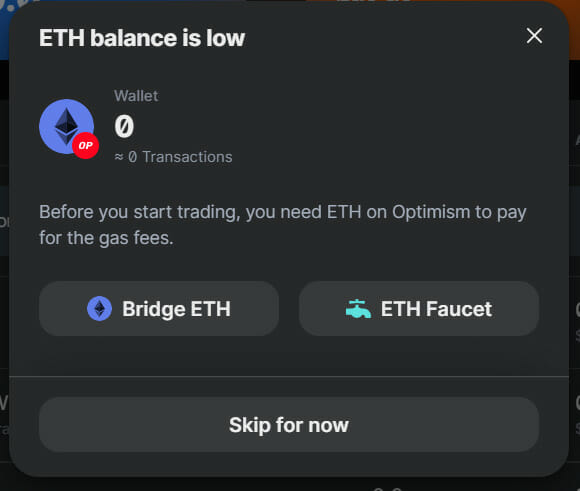

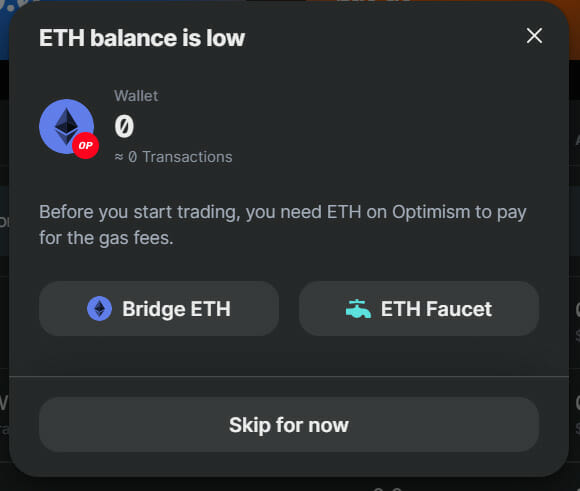

- Step 2: We will see two wallet options, i.e., Bridge ETH and ETH Faucet. Here, we will use ETH Faucet.

Options

Options

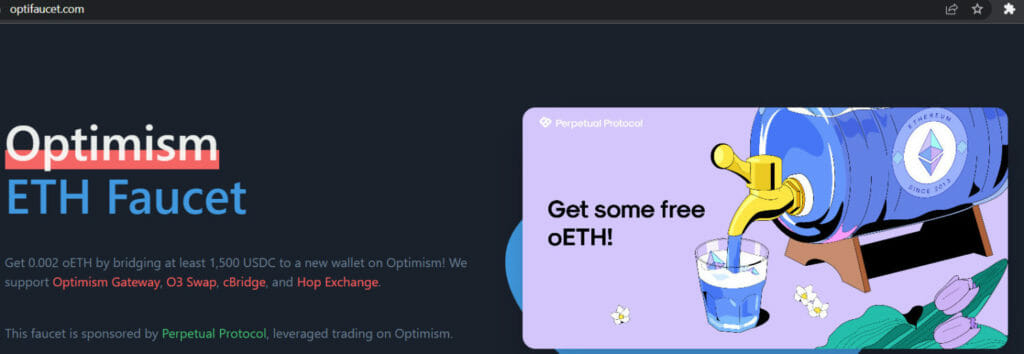

- Step 3: Now, Click on the ETH Faucet button, and we will be directed to Optifaucet.

- Users can get 0.002 oETH by bridging at least 1,500 USDC to a new wallet on Optimism.

- Perpetual Protocol sponsors this faucet. Here, four bridging options are available to transfer USDC, i.e., Optimism Gateway, O3 Swap, cBridge, and Hop Exchange.

- Here, we will be using Optimism Gateway.

Optifaucet

Optifaucet

- Step 4: Click on Optimism Gateway. The link provided in the Optifaucet is an older link.

- So, users will see a pop-up at the top of the older link, i.e., This is the legacy bridge. Optimism’s v2 bridge is live at app.optimism.io.

- So, click on the new link. Now, Click on Connect Wallet.

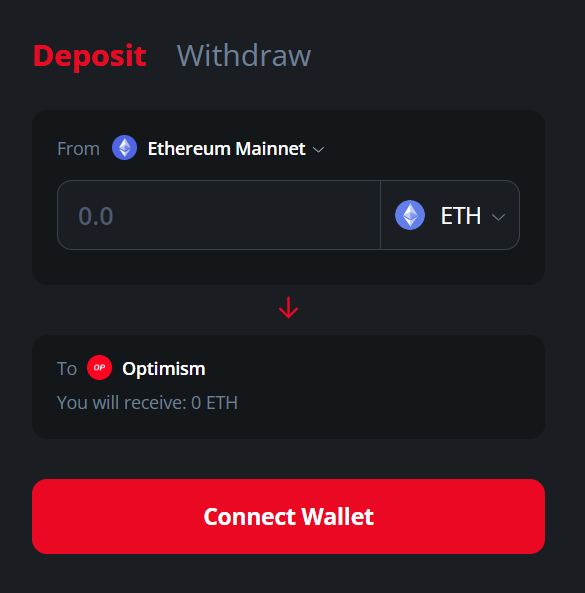

Bridge

Bridge

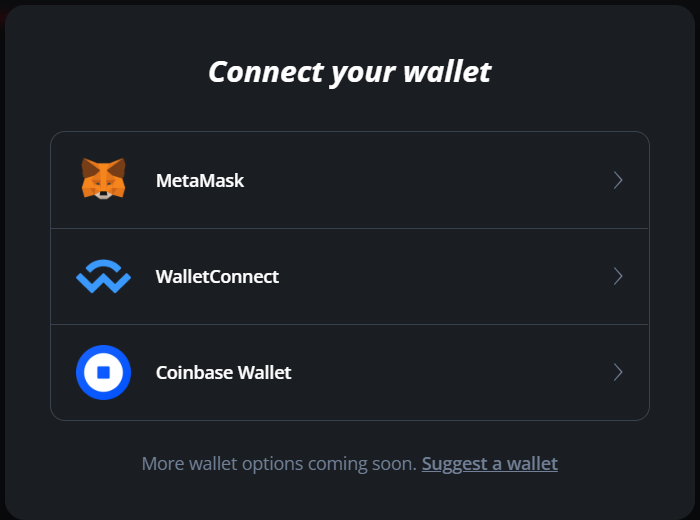

- Step 5: We will see three wallet options, i.e., MetaMask, Wallet Connect, and Coinbase Wallet.

- In this article, we will be selecting and using MetaMask Wallet as it is the most widely used and one of the most popular wallets.

- The team is also working on adding support for other Web3 wallets in the future.

Select a Wallet

Select a Wallet

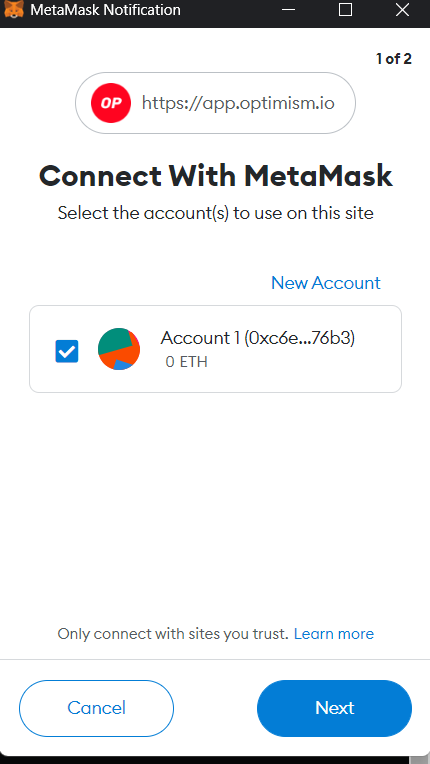

- Step 6: Click on MetaMask. It will ask us to select the account we want to use on Optimism Bridge.

- Then, click on the Next button.

Click on Next

Click on Next

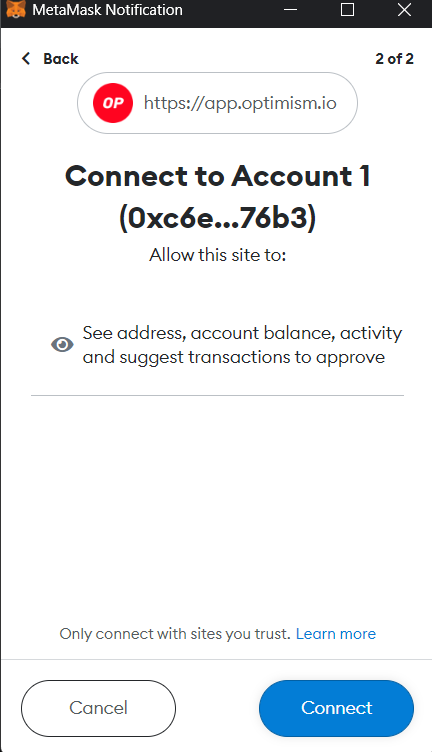

- Step 7: Now, we will see that Optimism Bridge is connecting to our Account 1 with address 0x17...0ee8, and Optimism Bridge can know the address, account balance, activity, and suggest transactions to approve. Click on the Connect button.

Click on Connect

Click on Connect

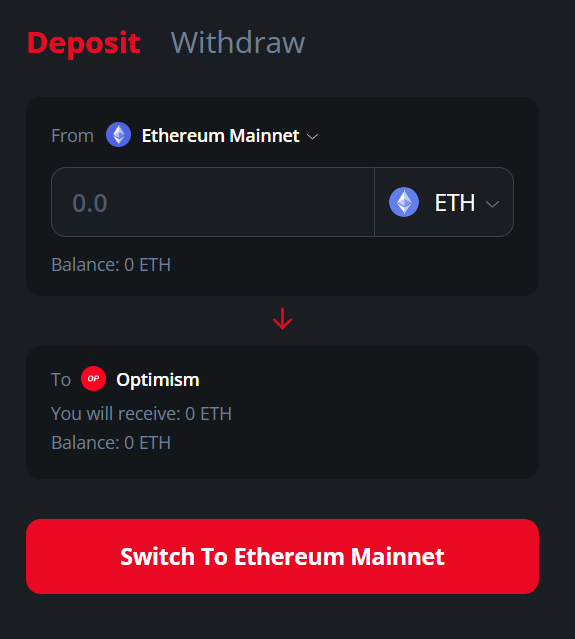

- Step 8: Now, the Connect Wallet the button will be changed to the Switch to Ethereum Mainnet button.

- Because we will be transferring ETH from the Ethereum Mainnet, click on the Switch to Ethereum Mainnet button.

Switch to Ethereum Mainnet

Switch to Ethereum Mainnet

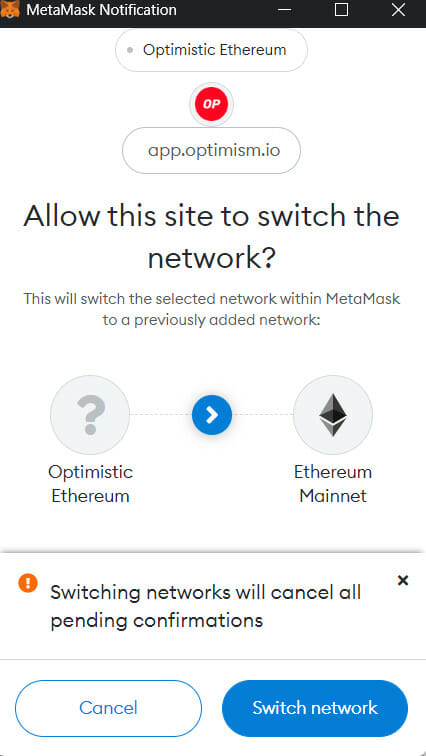

- Step 9: We will see a MetaMask notification pop-up. Click on the Switch Network button.

Switch Network

Switch Network

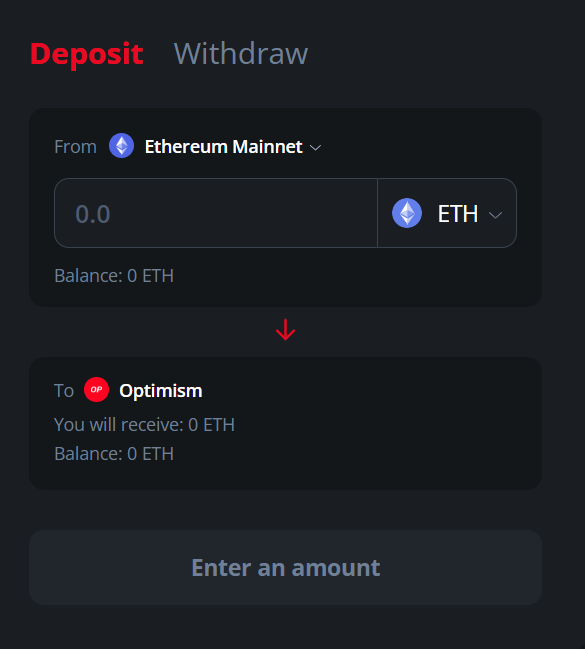

- Step 10: Now, it’s time to deposit some USDC.

Deposit USDC

Deposit USDC

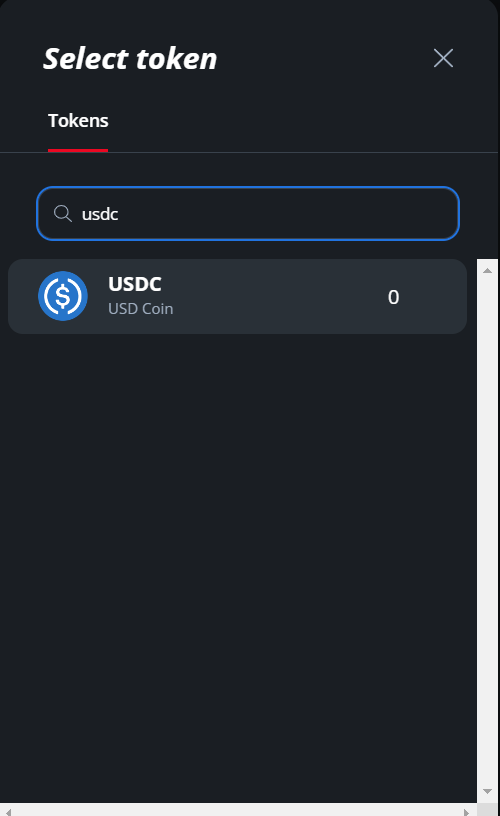

- Step 11: We have to change the asset from ETH to USDC by clicking on the ETH icon and selecting the USDC.

Select Token

Select Token

- Step 12: After selecting USDC, we have to click on Approve to allow the bridge to use USDC in our wallet.

- We have to check the gas fees and Click on Confirm. Once approved, we have to enter the amount of USDC we want to bridge.

- To become eligible to get 0.002 oETH, we must bridge at least 1,500 USDC to a new wallet on Optimism.

- Lastly, we have to click on Deposit and Confirm the transaction in our MetaMask Wallet. It will take around 20 minutes for our funds to be bridged on Optimism.

- After the deposit completion, we can go back to the Optifaucet page and Paste our Ethereum Address to receive 0.002 oETH after verifying the captcha.

Note: You get a discount on trading fees by using the code “FREE“

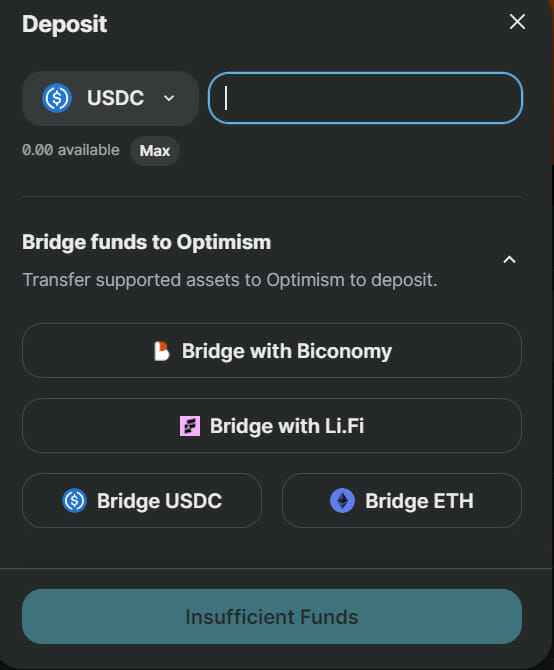

How to Bridge Assets to Optimism using PerpUI?Previously, we have learned how to bridge assets to Optimism via Optifaucet. In this section, we will learn how to Bridge Assets to Optimism via PerpUI.

- Step 1: Go to https://app.perp.com/. Then, Click on the Deposit button.

Click on Deposit

Click on Deposit

- Step 2: We will see two wallet options, i.e., Bridge ETH and ETH Faucet. Click on Skip for now.

Wallet Options

Wallet Options

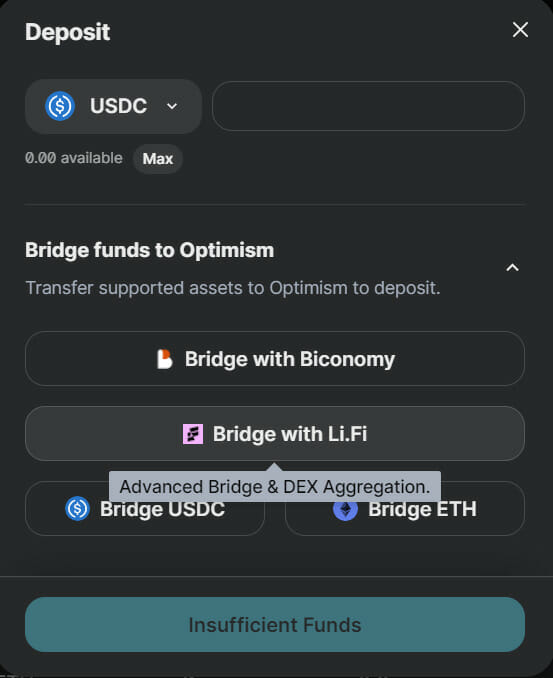

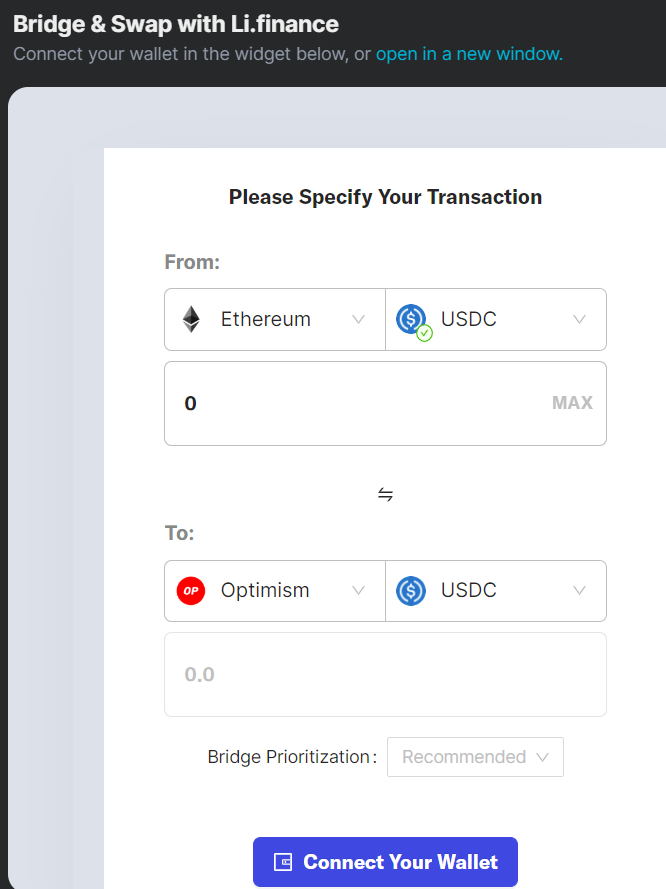

- Step 3: Now, Click on the Bridge with LiFi button. A widget powered by Bridge Aggregator LiFi will appear.

- It helps in finding the cheapest and fastest to bridge our assets.

Click on Bridge with LiFi

Click on Bridge with LiFi

- Step 4: All steps are now the same as we have seen in the Optimism Bridge in the Optifaucet.

Bridge

Bridge

- In this case, we have some advanced options, where we can select the price slippage, routes, and much more.

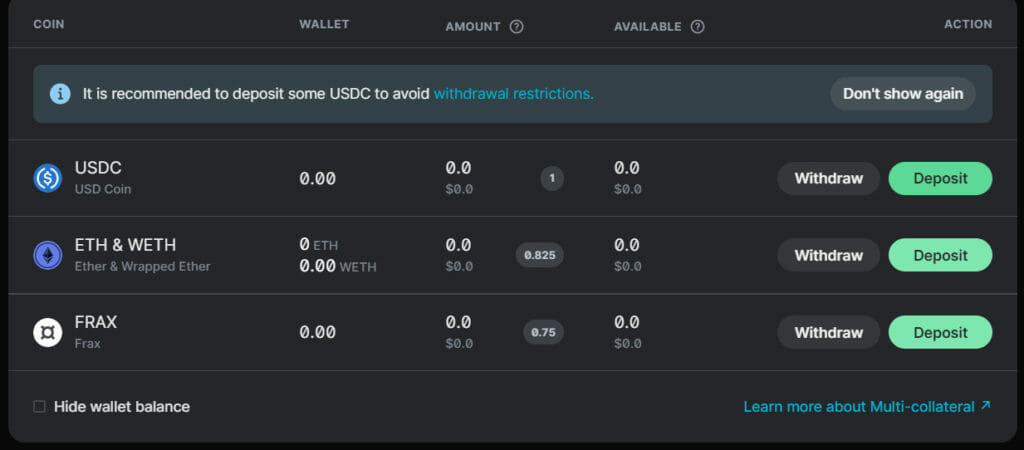

In this section, we will learn how to deposit funds on Perpetual Protocol. Before transferring funds to Perpetual Protocol, users should have some ETH and USDC on Optimism.

If readers have doubts, they can read the upper portions of this article, where we have explained how to transfer ETH and USDC on Optimism via Optifaucet and PerpUI.

- Step 1: Also, before, go to https://app.perp.com/.

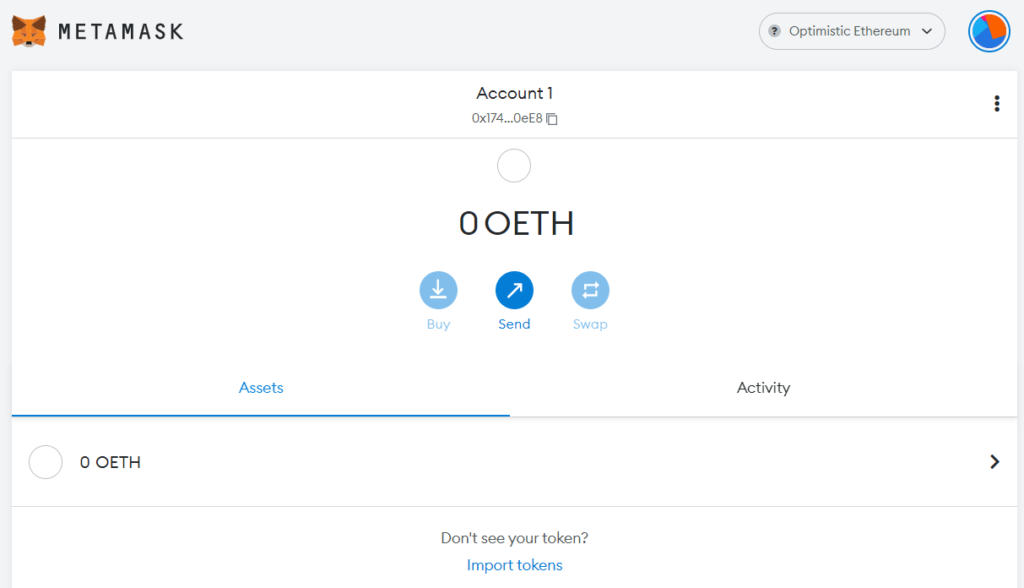

- We will have to import the USDC token on Optimistic Ethereum in our MetaMask Wallet.

- Firstly, Open the MetaMask wallet. Click on Import Tokens.

Open MetaMask

Open MetaMask

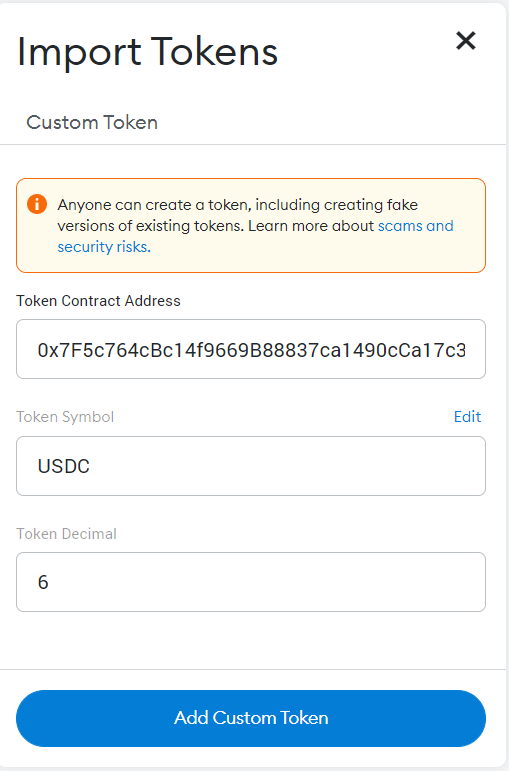

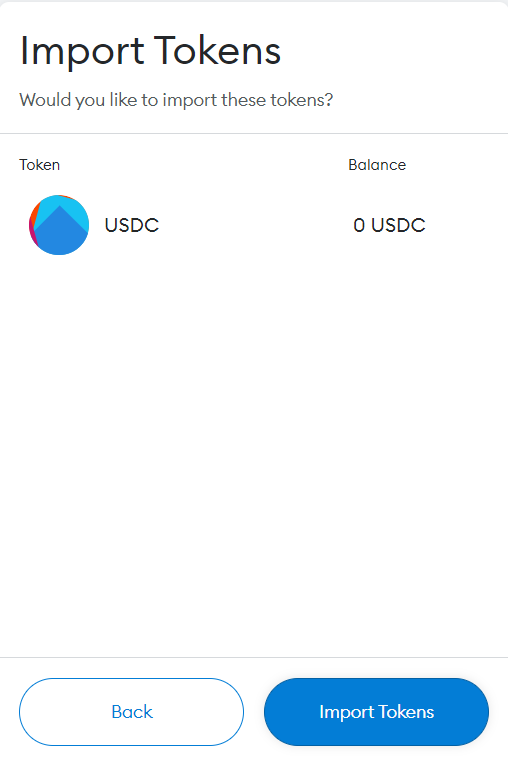

- Step 2: Now, we will go to optimistic.etherscan.io to add the respective USDC token contract address on Optimistic Ethereum, i.e., 0x7F5c764cBc14f9669B88837ca1490cCa17c31607.

USDC token

USDC token

- Step 3: Finally, we will click on Import Tokens and USDC is added in our wallet.

Import Tokens

Import Tokens

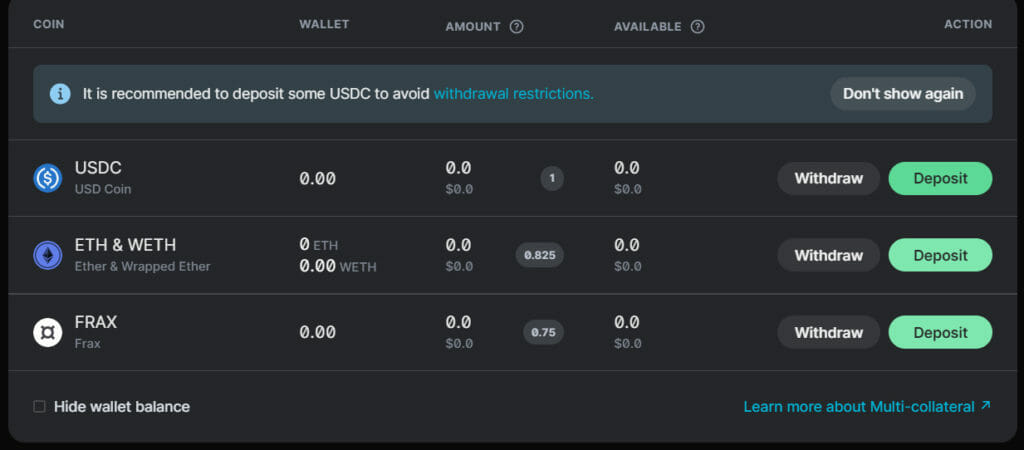

- Step 4: Now, we will go to https://app.perp.com/. Then, Click on the Deposit button.

Deposit

Deposit

- Step 5: Enter the amount of USDC and Click on Approve. We will see a notification pop-up.

- Click on Confirm to give clearinghouse smart contract access to our USDC. Now, we can easily deposit our USDC by clicking the same Deposit button once more and entering the amount of USDC.

- Lastly, Click on Confirm to confirm the transaction in our wallet and our USDC will be deposited.

Confirm Transaction

Confirm Transaction

Users can visit History Page to check all their previous deposits.

Note: You get a discount on trading fees by using the code “FREE“

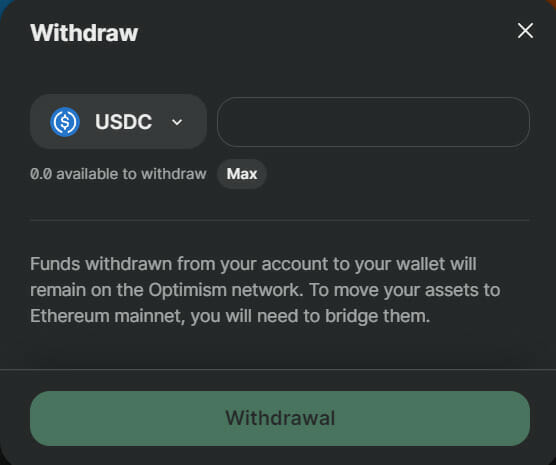

How to Withdraw from Perpetual Protocol?In this section, we will learn how to withdraw funds on Perpetual Protocol.

- Step 1: Go to https://app.perp.com/. Then, Click on the Withdraw button.

Click on Withdraw

Click on Withdraw

- Step 2: Write the amount to withdraw and Click on the Withdrawal button. After that, our balance is updated, and funds will be transferred to the wallet.

Confirm Transaction

Confirm Transaction

Users can visit History Page to check all their previous withdrawals.

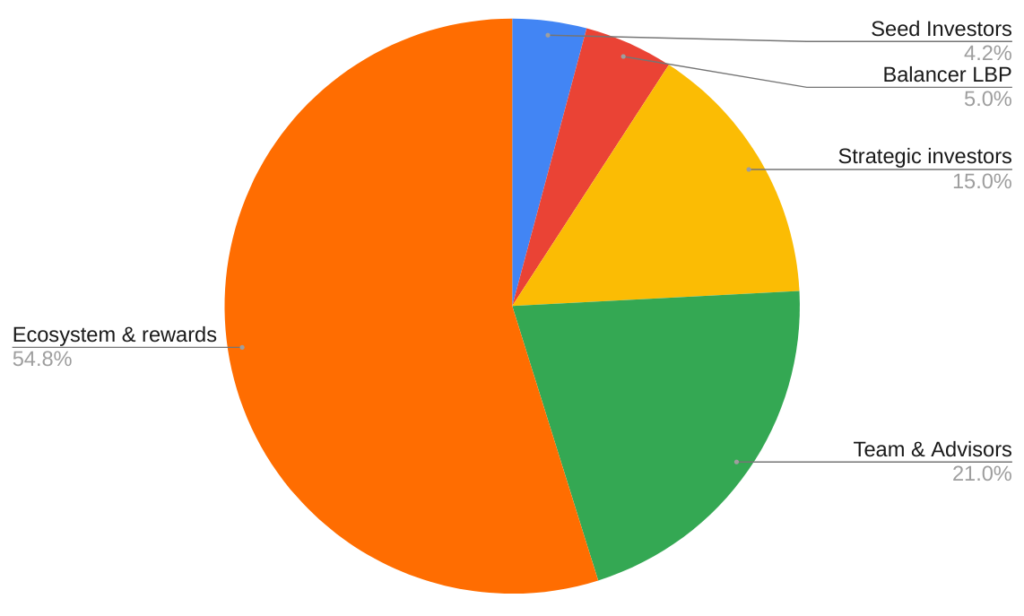

Perpetual Protocol: Token DistributionPERP is the native utility token used for Governance and Staking.

The total supply of PERP tokens is hard capped to 150 million, and the current circulating supply is around 88.7 million. Here is a quick overview of token distribution:

Token Distribution

Perpetual Protocol: Security

Token Distribution

Perpetual Protocol: Security

Perpetual Protocol has been audited four times since its inception. Perpetual Protocol was audited for the first time on November 2nd, 2021, by HashCloak team.

Later, it was edited in the same year, i.e., on December 21st, 2021, by Dedaub team. In 2022, It has been audited two times.

- Firstly, it was audited by Dedaub Team on March 4th, 2022.

- Secondly, it was audited by the Trail of Bits Team on March 22nd, 2022.

Perpetual Protocol Team has also created a bug bounty on Immunefi that has been live since January 2021. Rewards are distributed to white hat hackers based on the severity of the vulnerability.

Here is a quick table for reference:

How to Buy PERP token on a Crypto Exchange like Binance?Binance is the world’s leading centralized cryptocurrency exchange. This section will learn how to buy PERP tokens on a Centralized Exchange like Binance.

- Step 1: Go to the official Binance website and Create an account with an email id and phone number. Complete the verification process to log into the account successfully.

Login/Signup

Login/Signup

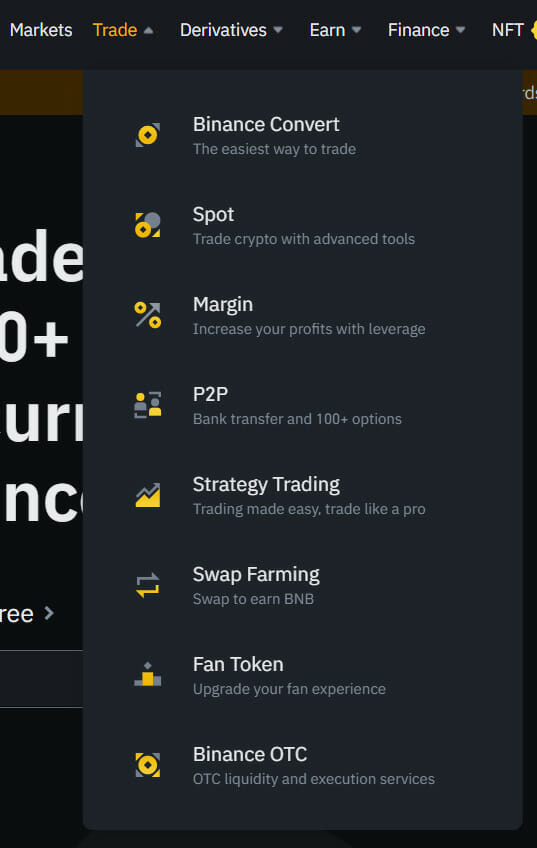

- Step 2: Now, Click on Trade and then, Click on Spot.

Click on Spot

Click on Spot

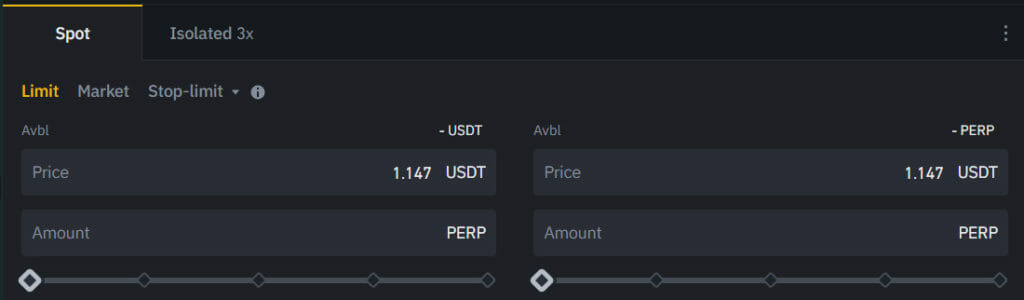

- Step 3: We will be directed to the Trade BTC/USDT page. So before buying PERP, we should have USDT, BUSD, or BTC in our wallet.

- Now, Search PERP with a search option on the right-hand side of the screen.

Search PERP

Search PERP

- Step 4: The trading pair will be changed to Trade PERP/USDT. So now, we can easily buy or sell PERP with USDT, BUSD, or ETH.

Buy/Sell PERP

How to Buy PERP token on a Decentralized Exchange Like Uniswap?

Buy/Sell PERP

How to Buy PERP token on a Decentralized Exchange Like Uniswap?

Uniswap is one of the most popular Decentralized exchanges. In this section, we will learn how to buy PERP tokens on a Decentralized Exchange like Uniswap.

- Step 1: We need an Ethereum Wallet like MetaMask, Trust Wallet, etc., and some ETH.

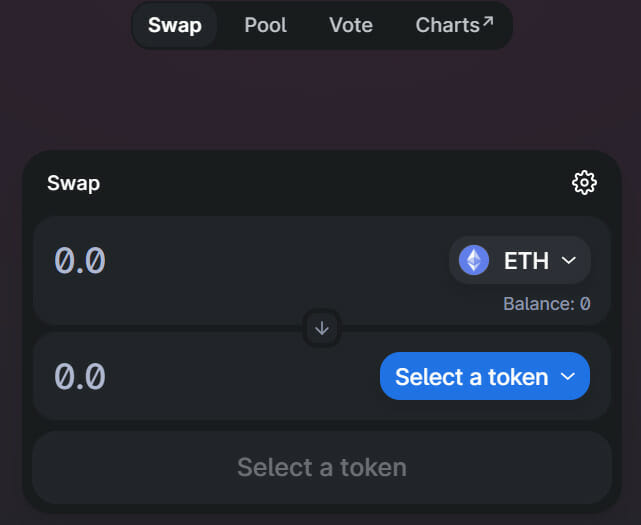

- Go to the Uniswap interface.

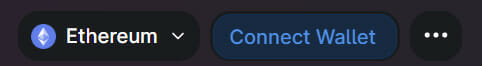

- Then, click the Connect Wallet option in the upper right corner and log in with the wallet.

Connect Wallet

Connect Wallet

- Step 2: We will see four wallet options, i.e., MetaMask, WalletConnect, Fortmatic, and Coinbase Wallet.

- This article will use MetaMask Wallet, one of the most widely used crypto wallets.

- Now, Click on Select a token.

Select a token

Select a token

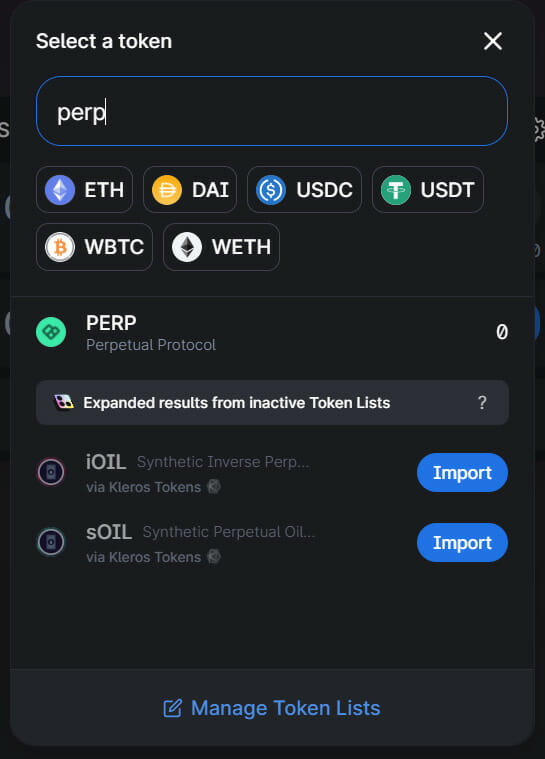

- Step 3: Now, Search the PERP token.

Search PERP

Search PERP

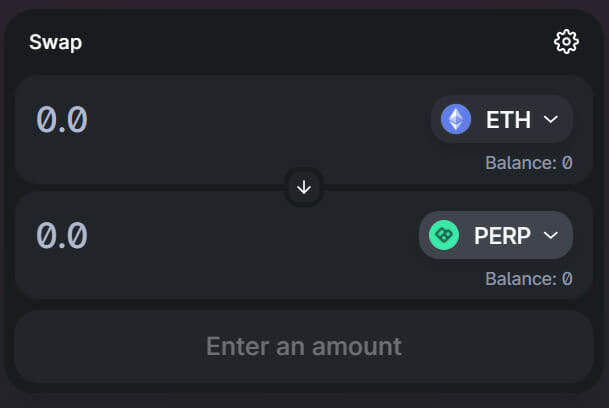

- Step 4: Enter the amount and press the swap button. A transaction preview window will open, and we need to confirm the transaction on our MetaMask wallet.

- Our tokens will then appear in our MetaMask wallet. We can track its progress by copying and entering the transaction ID into Etherscan.

Confirm Transaction

Perpetual Protocol: Conclusion

Confirm Transaction

Perpetual Protocol: Conclusion

Perpetual Protocol is an on-chain perpetual futures DEX, i.e., recently deployed on Optimism. As we have seen in the recent bull market, many centralized exchanges have halted their deposit and withdrawals.

As a result, the need for decentralization is increasing. Also, people are now looking for many different types of crypto trading, like margin trading, futures trading, etc., to increase their portfolios. Perpetual Protocol is one of the best DEX options for futures trading.

Note: You get a discount on trading fees by using the code “FREE“

Frequently Asked Questions (FAQs) What are Perpetual Contracts?Perpetual Contracts are a type of futures contract which allow traders to speculate on the future price of a given asset by buying, i.e., going long, or selling, i.e., going short perpetual futures contracts. They do not expire, unlike futures, and remain effective until the trader closes their position.

Who is behind Perpetual Protocol?Perpetual Protocol project was launched by Taiwanese entrepreneurs, i.e., Yenfen Weng and Shao-Kang Lee who earlier launched payroll & accounting companies for crypto startups.

What is Perpetual Protocol’s Perpvangelist Program?Users who can contribute their time and skills to help grow the Perpetual Protocol ecosystem can apply for Perpvangelist Program.

Also, read

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.