and the distribution of digital products.

DM Television

How to Short Bitcoin using Leveraged Tokens

Estimated reading time: 7 minutes

What is shorting a cryptocurrency?Shorting allows you to borrow cryptocurrencies and sell them at their current price. Later, You have to repay the same number of cryptocurrencies. If the price is lower, you will get paid the price difference; else, you have to pay your exchange/Broker. It allows you to make profits by selling high and buying low.

Let’s take an example. You borrowed ten BTC at 10,000 USD each and sold them. Later, you bought BTC at 9,000 USD each. When you return them ten BTC, you will make a profit of 1000 USD each on one BTC, giving you a total profit of 10,000 USD.

But if the BTC price increases to 11,000 USD and it’s time to repay the BTC’s, you have to pay the additional 10,000 USD.

Therefore, it entirely depends on whether you predict the direction of the market correctly or now.

How to short Bitcoin using Leveraged tokens?There are several ways to short Bitcoin, however, the easiest way to short Bitcoin is Leveraged tokens.

Leveraged Tokens offer leveraged exposure without taking care of the requirements, margin, liquidation risk, and management. The tokens have fixed or variable leverage. The rebalancing technique varies according to the exchange. Let’s discuss the top three exchanges that offer leveraged tokens – Pionex, and Binance.

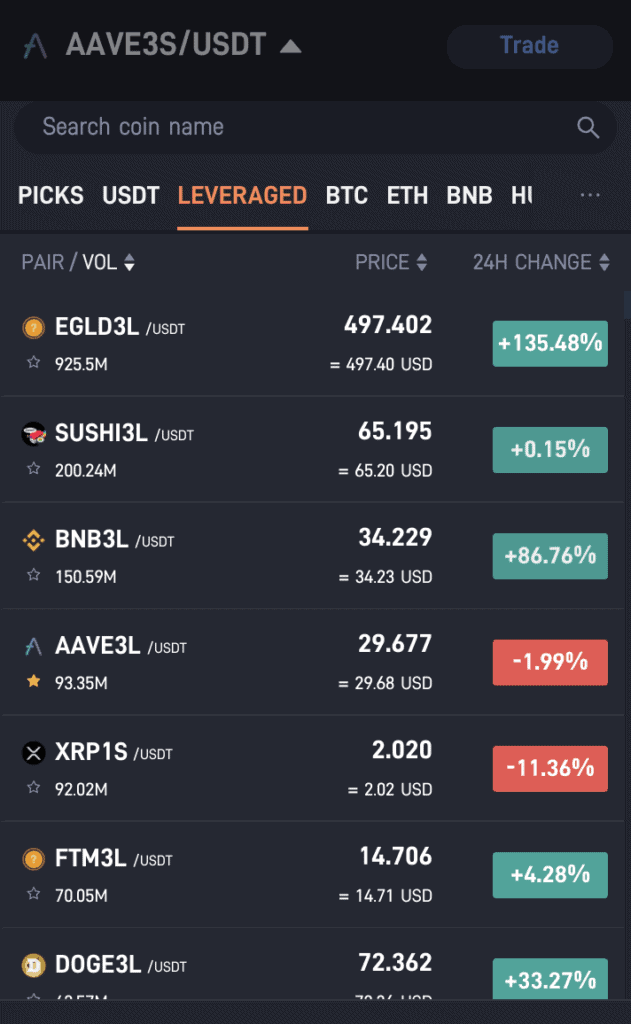

PionexPionex Leveraged Tokens provide high leveraged exposure with variable target leverage. They use an optimized rebalancing mechanism that is triggered if the leverage exceeds a particular range.

The tokens are named using “Coin + Leverage + Long/Short.” For example, ETH3S indicates ETH 3x Short.

To short Bitcoin, you can use the following tokens –

- 3x Short Pionex Leveraged Tokens: The leverage varies within 1.8x-4.8x.If it exceeds this range, Pionex will rebalance it to 3x.

- 1x Short Pionex Leveraged Tokens: The leverage varies within 0.75x-1.5x.If it exceeds this range, Pionex will rebalance it to 3x.

Additionally, you can also use in-built trading bots with leveraged tokens. You can choose to use the Trailing Take Profit bot, Grid Trading Bot, or Infinity Grid Bots, depending upon the situation.

Pionex Leveraged Tokens

Pionex Leveraged Tokens

The funding fee is 0.03% per day. The price of pionex leveraged token depends upon the spot price, funding fee, and rebalancing.

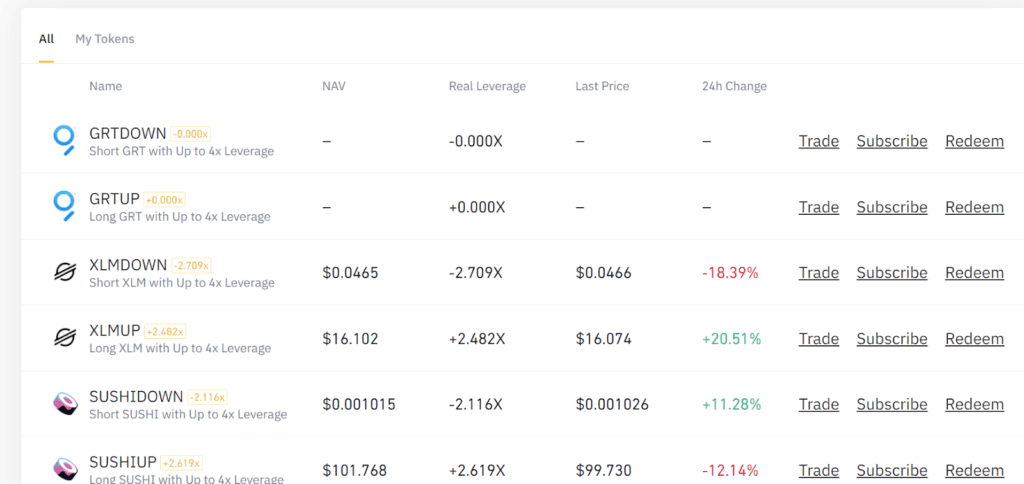

BinanceBinance provides Binance Leveraged Tokens (BLVT) that provide variable leverage between 1.25x and 1.5x. They are listed only on Binance and can be stored only in your Binance account.

The exact leverage is not publicly visible to prevent traders from anticipating rebalancing events.

The tokens rebalance only when the market conditions are necessary.

You can exit the market either by selling the tokens on the spot market or redeem their value in USDT. The latter option is expensive and is used only in extraordinary situations.

Binance Leveraged Tokens

Risk of using Leveraged Token

Binance Leveraged Tokens

Risk of using Leveraged Token

- Leveraged Tokens are high-risk products that can lead to losses if you don’t have proper knowledge about the market. Hence, it is not advised for beginners.

- The transparency offered by each token varies according to the crypto exchange.

Here, you don’t have to go through the hassle of buying bitcoins and sell them again. You open and close your position. The difference will be calculated, and if you have made a profit, you will get paid, or else you have to pay the difference. However, you do have to pay a small initial deposit.

2. Bitcoin ExchangesCryptocurrency exchanges allow you to short bitcoin. Additionally, you can also use leveraged shorting. Leveraged shorting is very risky because it can magnify your gains as well as losses. The profits will be high if you guess correctly. Some of the popular exchanges to short bitcoin are Kraken, Bitfinex, Poloniex, and more.

3. Bitcoin OptionsBitcoin options trading allows you to buy or sell bitcoins within a defined date range and price. These contracts are complex and often use leverage and hence are recommended to users having trading experience.

4. Bitcoin FuturesBitcoin futures allow you to buy and sell bitcoins at a specific date and price. They are legal contracts where you commit to buy a particular number of shares at an agreed price. If the bitcoin price increases on the specified date according to your prediction, you will be in profit.

5. Prediction MarketPrediction Market is a platform that allows you to place bets on the outcome of future events. If your prediction is correct within a specific range, you will profit; else, you will lose the wagered amount. It is a form of betting. Some well-known prediction platforms are –

Shorting Bitcoin: Pros and ConsIf you are a simple investor, never try to short Bitcoin.

Pros- It helps you to earn profits in less time.

- You should follow the changes in the industry to predict the changes in the cryptocurrency price.

- Bitcoin shorting is highly risky, and if you predict the market direction wrong, you may end up making losses.

Shorting Bitcoin allows you to make profits by buying low and selling high. You should know the bitcoin market to speculate its direction. The timing is crucial. If you are right, you make profits; else, you have to cover the losses. Bitcoin can be shorted using Bitcoin Exchanges, Options, Futures, CFD, Spread-betting, prediction markets, and leveraged tokens. They are high-risk trades and are recommended only for advanced traders.

Frequently Asked Questions (FAQ) Where to short Bitcoin?You can short Bitcoin using leveraged tokens, Options, Futures, CFD, Spread-betting, and prediction markets.

Can you short BTC on Coinbase?It is not possible to short BTC on Coinbase.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.