and the distribution of digital products.

How Inscriptions Work on EVM Chains

1.1 Research Questions and Contributions

\

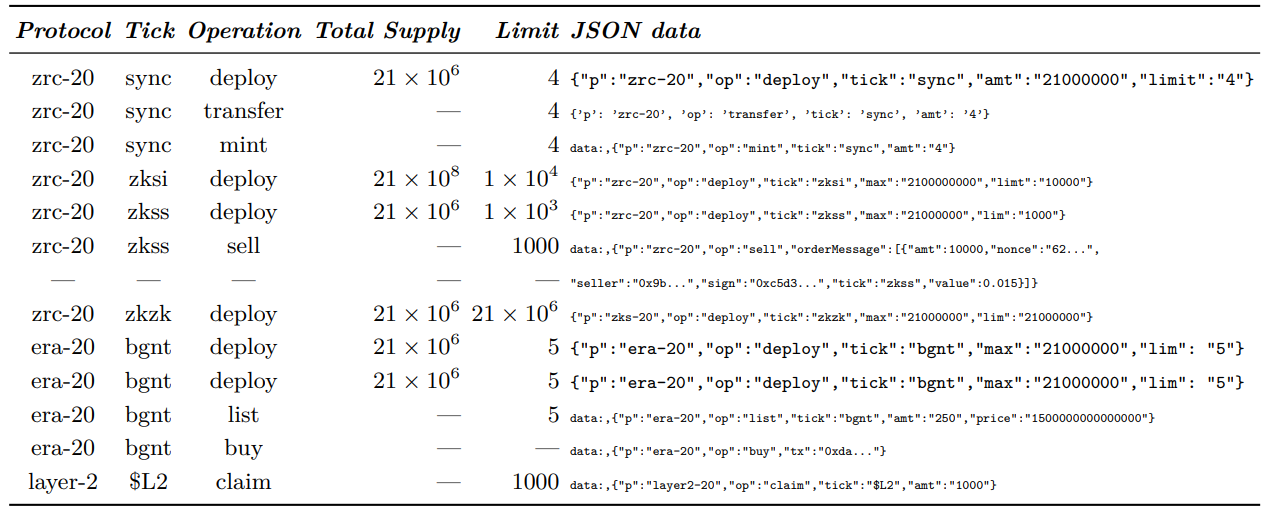

4 Inscriptions and ordinalsInscriptions and ordinals involve the recording of arbitrary data on the blockchain. On EVM-compatible chains, users encode hex data into the transaction input call data (refer to columns JSON in Table 1), usually also setting the transaction’s from and to attributes with the same user’s addresses. This structure constitutes a self-transfer made from a user to their own address.

\

\

\ \

4.1 Operation TypesThere are various protocol standards that define the structure of the inscription. BRC-20 was the first standard proposed for Bitcoin, and it includes three main types of operations: deploy, mint, and transfer, each encoded into a single transaction [36]. The protocol standards on EVM-compatible chains extend the set of operations, e.g., claim, list, buy, and sell.

\ Deploy. The deploy action specifies the protocol name, token tick, total supply, and the maximum amount of tokens a user can mint (or claim) per transaction. Table 1 shows examples of inscriptions’ data recorded on-chain. For instance, to deploy an inscription, a transaction containing a deploy action should be recorded on-chain, marking the initiation of an inscription event. In the case of a zrc-20 sync inscription (see first row in Table 1), the protocol specifies a total supply of 21 million inscriptions and a limit of 4 tokens per transaction.

\ Mint. After the transaction deploying the inscription is persisted to the chain, users can issue a mint action to actually mint (or in this case, claim ownership) of the tokens. To initiate this, users need to issue a transaction with an input call data encoded to HEX code, specifying the protocol and tick that jointly identify the inscription-based token. In the same transaction, users provide the number of tokens they want to claim (refer to column Limit in Table 1) that must be not higher than the maximum limit specified in deploy operation for the given protocol-tick pair. The off-chain indexer is responsible for assuring the integrity of inscription-based tokens.

\ Claim. Similarly to mint, it allows users to mint and claim ownership of a new inscription token. This operation is used, for example, within the layer2-20 standard to mint a new inscription token, $L2. The $L2 token is a multi-layer2 inscription token that its inscription creator allows to be minted on multiple blockchains. However, there is just one deploy operation that defines the token’s maximum supply. The off-chain indexer maintained by the creator is responsible for ensuring the integrity of data in these circumstances.

\ Transfer. Once users successfully mint the inscriptions, they can transfer ownership of their inscription tokens to another address. To do so, they typically issue a transaction to another address and add the data formatting standard of a transfer to the input call data. The receiving address will then possess ownership of these inscriptions. The inscription token is also identified by a protocol standard and a token name (tick). Tokens with the same names (ticks) can be deployed multiple times using various protocol standards.

\ List. It enables users to list their inscriptions on marketplaces [9, 16, 44, 8]. Users specify the quantity of tokens and their price (in Ether) that they are willing to receive in exchange for their inscriptions from interested buyers.

\ Buy. This operation is used to purchase inscription tokens from marketplaces. It references the transaction that listed the inscription on the marketplace. The buy operation specifies only protocol standards, as the token name (tick), amount, and price are declared in the list operation.

\ Sell. It is used for selling inscriptions, this operation specifies the protocols and the order message containing seller and signer details, as well as the amount of tokens being sold and their prices.

\

4.2 Comparison with NFTs and ERC-20sIn this section, we discuss the distinctions between inscriptions and established Ethereum Request for Comment (ERC) standards such as ERC-20 [10] and ERC-721 [11] concerning tokens and NFTs, respectively.

\ Comparison with NFTs. In the Ethereum blockchain, non-fungible tokens (NFTs) [35] are created through smart contracts. Each user receives a unique token ID, affirming their ownership of a specific asset. These assets, which can be JPEG files or CryptoPunk images, are stored off-chain on a server or on the InterPlanetary File System (IPFS) [17].

\ In contrast to NFTs, inscription-based tokens do not rely on any smart-contract and, thus, do not allow upgrades. The link to the asset file is inscribed into the transaction data. In a blockchain with a maximal native token supply, such as Bitcoin, the amount of inscription is bound by the blockchain network limits. In contrast, NFTs based on smart-contracts lack such limitations, theoretically allowing for unlimited minting. Also, each inscription is allocated a position in the blockchain, which creates the opportunity to derive the additional value of the inscription from the location within the block.

\ ***Comparison with ERC-20. ***The other application of inscriptions is to create ERC-20- style tokens. As inscription-based tokens are not reliant on smart-contracts, they are not susceptible to the risk of smart-contract upgrades, and their maximal circulating supply is declared once in the deploy operation. The minting and transfer of each new inscription-based token can be tracked directly on the blockchain and cannot be altered.

\ However, due to their lack of smart-contract support, inscription-based tokens offer limited functionality. They are primarily utilized for speculative purposes and fall into the category of meme-coins [36]. Based on the inscription technology, it is possible to mint a single NFT-style token or a group of tokens with a predefined token supply in circulation. Nevertheless, it is the off-chain indexer, managed by the token’s creator, responsible for ensuring the data integrity of minted tokens. Trading of inscription-based tokens predominantly occurs within inscriptions marketplaces since they are not compatible with the ERC-20 standard required by decentralized exchanges [40].

\

:::info Authors:

(1) Johnnatan Messias, Matter Labs;

(2) Krzysztof Gogol, Matter Labs, University of Zurich;

(3) Maria Inês, Silva Matter Labs;

(4) Benjamin Livshits, Matter Labs, Imperial College London.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.