and the distribution of digital products.

DM Television

A Guide to Understanding Liquid Staking for Noobs

\ \ Who says you can’t eat your cake and have it too? Not so in Web3! [Blockchain technology makes this easily possible as pie]

\ Imagine you have to put money in a fixed deposit (FD) at a bank to earn interest. Traditionally, you wouldn’t be able to access that money until the fixed deposit matures. But this time, you are issued a receipt representing your ownership of the fixed deposit and the accrued interest. While you can’t withdraw the original money from the fixed deposit before maturity, you can trade the receipt with others or use it to access a loan service from other banks.

\ While this may not be feasible with traditional banks, this is how liquid staking works. Thanks to decentralized finance (DeFi) for making this possible through blockchain technology.

\ In this article, we’ll explore:

\

What is staking?

What is Liquid Staking?

How Does Liquid Staking Work?

Benefits of Liquid Staking

Risk and Limitations of Liquid Staking

Factors to Consider Before Choosing a Liquid Staking Provider

What is Staking?

Image Credit: Reddit

\n

Before diving into liquid staking, let’s have a clear understanding of what staking is.

\ Staking involves the process of locking up some amount of cryptocurrency tokens in a Proof of Stake (PoS) blockchain network to support the network operations and security.

\ Think of staking as similar to a fixed deposit where you put your money in a high-yield savings account with a traditional bank. The bank takes your money and lends it to others. In return for locking your money with the bank, you receive a certain percentage interest.

\ Decentralized finance works similarly to traditional finance. Everything you can think of in traditional finance, savings, borrowing, lending, etc has been offered on chain through defi.

\ Like your fixed deposit, you commit your tokens to a staking protocol when you stake. In return for staking, you get rewards in the form of additional tokens. Staking works on a proof of stake consensus mechanism, which is one of the ways used to validate transactions on the blockchain network.

\ The problem of staking is that the staked token becomes illiquid just like your locked funds in a fixed deposit. You only receive a reward during or after your staking period.

\ Liquid staking however solves this problem by unlocking the value of the staked asset and can be used as collateral on other defi protocols.

Staking Providers (Staking as a Service)Staking service providers act as a bridge between users and the complexities of Proof-of-Stake (PoS) blockchains. They handle the following key tasks:

\

Infrastructure Management: Providers run the validator nodes required for staking on PoS blockchains. This eliminates the need for users to set up and maintain their nodes, which can be a technical challenge.

Streamlined Staking Process: Providers simplify the staking process for users. They handle tasks like depositing tokens, managing validator selection, and claiming rewards. This allows users to participate in staking without getting bogged down in technical details.

Accessibility for Everyone: By removing the technical barriers, staking providers enable a wider range of users to participate in staking. This includes individuals who may not have the technical expertise to manage their validator nodes.

\

Overall, staking service providers act as facilitators, making staking on PoS blockchains more accessible and user-friendly for everyone.

What is Liquid Staking?Liquid staking takes traditional staking a step further by enabling users to stake their tokens and receive a separate token called Liquid Staking Token (LST), in return. This new token represents the ownership of the staked token which can be ETH, MATIC, etc.

\ With liquid staking, you do not only earn staking rewards but you can also utilize your LST by trading it or using it as collateral in other DeFi protocols.

How Does Liquid Staking Work?Liquid staking involves a three-step process: Staking, issuing liquid staking tokens, and unstaking.

\ Staking involves the process of locking your token in a designated smart contract on a liquid staking platform. Based on the value of the staked token, the platform issues a liquidity staked token as a receipt for the staked token.

\ The LST is a tokenized representation of the original token and can be used in various DeFi protocols for trading or any other financial activity.

Unstaking your token involves burning the corresponding LST which usually incurs a fee while the platform verifies the burn transaction on-chain before returning the unstaked tokens to the user.

\ Let’s break it down a bit.

\ So you have a token (A) to be used for staking.

\ You stake the token (A) with a liquidity staking provider to receive staking rewards (B) and a token (C) that represents your ownership of/and unlocks the value of A.

\ While you earn rewards (B) from A for being staked, you can earn extra bucks for yourself by trading your LST ( C) or using it as collateral to earn rewards (D) from another Defi protocol.

\ At the end of the Staking period, you have for yourself, your staked token(A) plus the staking reward (B) and rewards from your LST (D) while you burn C to claim back A.

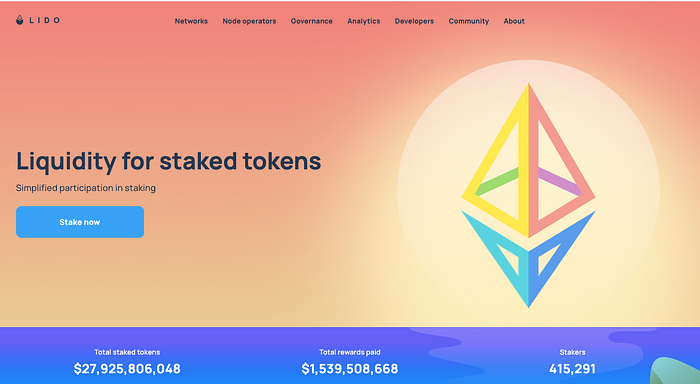

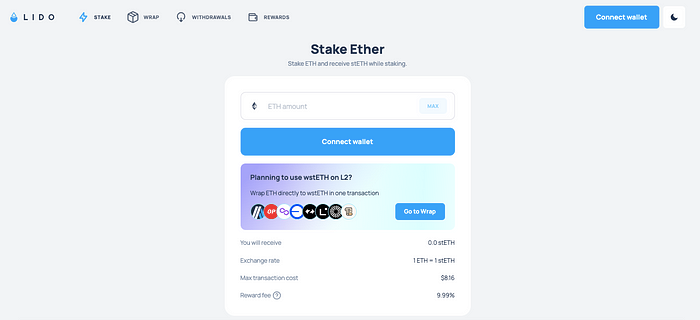

A Case Study With LidoUsing Lido as a case study will help us understand better how liquid staking works.

\

\ Lido is a liquid staking solution for Ethereum (ETH), Solana (SOL), and Polygon (MATIC). It allows users to stake fractions of the minimum threshold (32 ETH for the Ethereum network) to earn block rewards.

\

\ Let’s say you have 0.5 ETH on your Metamask wallet you want to use for liquid staking on Lido, you first connect your wallet to the platform. Upon depositing the funds into Lido’s staking pool smart contract, you’ll receive Lido Staked ETH (stETH), an ERC-20 compatible token, which is minted upon deposit and will be burned upon withdrawal.

\ Now you have a liquidity staked token, stETH, you can use across DeFi to get more reward opportunities to your daily staked rewards. So when you finally unstake your base token, the stETH is burnt with a fee while you receive your staked token plus your staking rewards.

Benefits of Liquid StakingUnlocked Liquidity: Liquid staking unlocks the inherent value of the staked token which enables it to be utilized for trading or as collateral in defi protocols.

\ Reward Opportunities: Liquid staking enables users to not only earn from traditional staking on a POS protocol but also opens the door for other earning opportunities through engaging with one’s LST.

\ Outsource Infrastructure Requirements: Without having to maintain the complex staking infrastructure as a solo validator on a Proof of stake network, like having the required 32 ETH, liquid staking enables you to still earn from block rewards.

Risk and Limitations of Liquid StakingSmart Contract Risk: One significant possible risk is the vulnerability of smart contracts. Liquid staking involves interacting with smart contracts. There is a chance of exploitation if a flaw or bug exists in the contract code. Choosing reputable and audited liquid staking platforms to mitigate this risk is crucial.

\ High Fees: Liquid staking may involve higher fees compared to traditional staking. The platforms often charge fees for the issuance and burning of LSTs, as well as network transaction fees.

\ Slashing: If the liquid staking service providers act maliciously, their funds could be slashed to keep the network secured thereby affecting their pool of liquid staking users.

\ Market Volatility: The crypto market is very volatile and can affect both the prices of the staked token and the liquid staking token. Since the price of the liquid staking token is not pegged to the staked tokens they represent, they may trade at the same price or at a very slight discount most of the time. They can drop below the price of the underlying asset during market-high volatility.

Factors to Consider Before Choosing a Liquid Staking ProviderEvaluate the Liquid Staking Provider and Security: Don’t rush into staking your token on any platform. It’s crucial to select a provider that supports the specific cryptocurrency networks you’re interested in. Security should be a top priority. Look for a provider with a strong track record of security practices. This should include independent audits of their smart contracts by reputable firms and the existence of bug bounty programs. These measures help mitigate the risks associated with potential vulnerabilities in their software.

\ Understand the Tokenomics and Rewards: If you don’t know the source of the yield, you’re probably the yield. Learn how the liquid staking token works and how you earn rewards with it. Different providers have different ways of giving out rewards, which can affect how much you earn and how easily you can trade the staking token itself.

\ Conclusion

Liquid staking offers a compelling solution for cryptocurrency holders seeking to earn rewards on their assets while maintaining liquidity. It removes the limitations of traditional staking by providing tradable tokens that represent staked assets. This innovation opens doors for wider participation in Proof-of-Stake (PoS) blockchains, potentially increasing security and network stability.

\ While there are inherent risks to consider, such as smart contract vulnerabilities and market volatility, choosing a reputable liquid staking provider with strong security practices can help mitigate these concerns. As liquid staking technology matures and integrates with DeFi applications, it has the potential to revolutionize the way users interact with and earn returns on their cryptocurrency holdings.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.