and the distribution of digital products.

DM Television

Everything You Need to Know to Launch Your Crypto Startup in 2025

In recent years, the crypto industry has become one of the most developed sectors. Despite regulatory challenges and volatility, it continues to attract entrepreneurs and venture capitalists. Why? Because the opportunities outweigh the risks, and examples of successful companies prove that a well-built strategy can turn a startup into an international brand.

\ So, if you are planning to launch your crypto business in 2025, today's article will help you understand why now is the perfect time to start, what trends are shaping the market, and what has made market leaders successful companies.

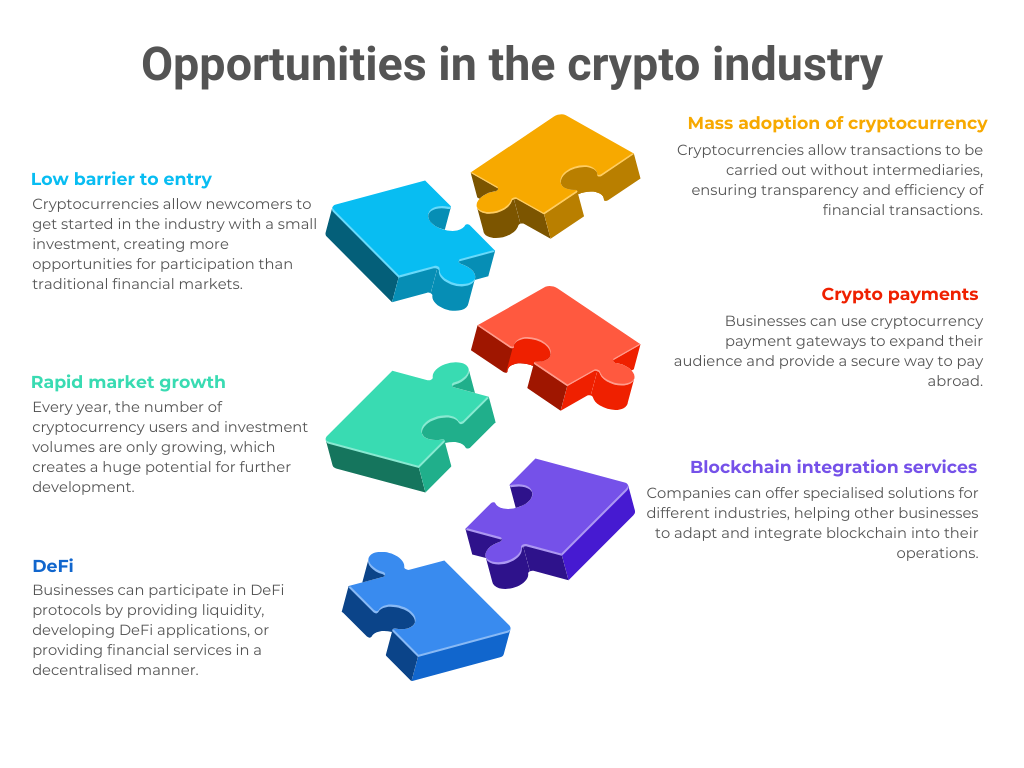

Current Market Trends and Opportunities: Is There Still Room for New Players?One of the main reasons why cryptocurrencies have become popular among entrepreneurs is their ability to change outdated business models. They create new business opportunities by reducing dependence on intermediaries and enabling transparent, distributed and automated models. In addition, the industry opens up a wide range of opportunities for the successful launch of crypto businesses.

\ However, with opportunities always come risks, which should be kept in mind before entering the volatile cryptocurrency market. During a recent webinar titled ‘Building a crypto-currency strategy’ by Investing, expert Adam Harris outlined 4 key risks that entrepreneurs and investors should consider before building their strategy.

\

- Regulatory uncertainty - the cryptocurrency market still faces ambiguous regulation in many countries, which may affect its development and stability.

- Market volatility - significant price fluctuations can both bring huge profits and lead to large losses.

- Security vulnerability - the growing number of hacker attacks, exploits and hacked projects indicates the need for a thorough approach to asset security.

- Emergence of meme coins - such assets pose additional risks due to their speculative nature and vulnerability to manipulation. Harris also noted that in the wake of the hype, some influencers are using the popularity of meme coins to their advantage by launching dubious tokens that often have no real value. He urged investors to analyse assets carefully and not to be swayed by momentary trends without in-depth research.

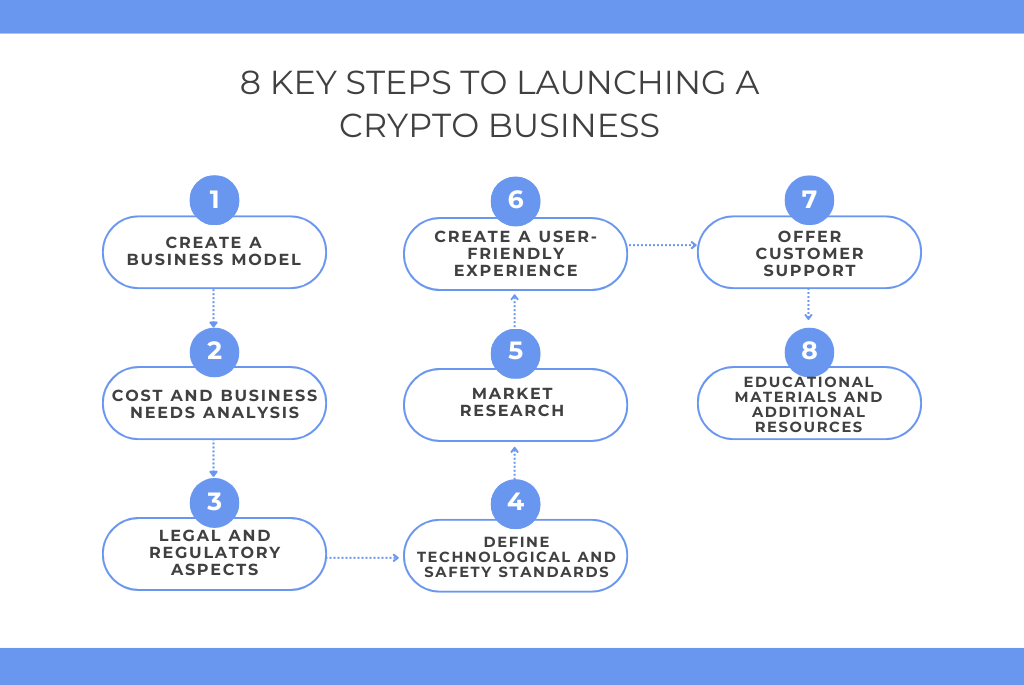

Launching a crypto business is not only a matter of having an idea but also of the right approach to the main stages. Therefore, to create a successful crypto business, there are several important steps that will help you get started.

- Create a business model. Any business begins with a clear understanding of its mechanics: what value it will bring to customers, what resources and processes are required for operation, the profit formula, etc. To simplify the start, you can use ready-made white-label solutions that allow you to focus on the business model rather than on application development, regulatory compliance, or security factors.

- Cost and business needs analysis. To keep your business running smoothly, you also need to understand its financial aspects. For example, the costs of infrastructure (servers, hosting), technical support (development, security), and operating expenses (licences, marketing). A clear understanding of these aspects helps to avoid financial risks.

- Legal and regulatory aspects. The crypto market is regulated differently in each country, so you need to have a clear understanding of local and international rules before launching. In particular, consulting with lawyers will help to avoid potential problems and ensure compliance with local and international laws.

- Define technological and safety standards. Access to advanced technologies is key to the successful development of a crypto business. The technologies you need depend on your business model and the type of project. For example, developing a crypto wallet may require stricter security than a crypto lending platform.

- Market research. Understanding the market is the key to identifying your target audience. Therefore, the first thing you need to do is research: general trends in the crypto industry, current supply and demand, competitors and their strategies. Analysing these key points will help you to predict demand and create a product that meets the requirements of users.

- Create a user experience. A simple and user-friendly interface helps to retain customers and improves the interaction with the platform. If the platform is difficult to use, potential customers can quickly lose interest in it.

- Offer a customer support. Customer support is an essential component of the success of any business. Quick resolution of user problems increases the trust in your product. Therefore, it is necessary to provide 24/7 support, various communication channels (chat, email, Telegram), and service in several languages.

- Educational materials and additional resources. The crypto industry is constantly changing, and many users are just starting to get acquainted with it. Therefore, educational materials, analytics, and guides help customers improve their cryptocurrency awareness and increase your brand's expertise.

\ The crypto industry has repeatedly seen examples of companies that have successfully gone from idea to scale. Coinbase, WhiteBIT, Andreessen Horowitz, etc. - every crypto enthusiast has heard the names of these companies many times, but what exactly helped them become successful? Industry leaders often share their many years of experience when giving advice to young startups.

\ For example, Brian Armstrong, CEO of Coinbase, speaking about the company's founding, emphasised:

\ ‘You have to put something out there, and then grind it out for two or three years. Talk to your customers, improve the product, talk to your customers, improve the product… If you look at almost every successful startup, it feels like it was an overnight success, but really that’s just how history gets written in hindsight. If you talk to most of those founders in the early days, there was a period where any reasonable person would have quit. Nothing was working… And all of them somehow persevered and pushed through and finally found something that started to work.’

\ At the same time, WhiteBIT founder and president Volodymyr Nosov reminds us that a manager's soft skills play no less important role in the company's development than professional skills:

\ ‘I think the ability to communicate is the main point for everything. You can be a great specialist, you can be an amazing artist, you can be anything, but if you don't know how to communicate, you can be left with all these benefits.’

\ In addition, the entrepreneur has repeatedly stressed the importance of security and reliability of crypto platforms, which is the key to user trust.

\ In particular, Marc Andreessen, General partner of Andreessen Horowitz, emphasises that great achievements in business are usually not accidental, but the result of many years of work and a deep understanding of the problem that the company's founder was working on.

\ ‘There’s a mythology that these ideas arrive like magic or people stumble into them… The reality usually with the big successes is that the founder has been chewing on the problem for 5-10 years before they start the company… So they’re a true domain expert.’

\ He continues:

\ ‘We call it the idea maze because for any idea there’s all these different permutations. Who should the customer be? What shape should the product have? How should we take it to market?… The really smart founders have thought through all these scenarios by the time they go out to raise money. And they have detailed answers on every one of those fronts because they put so much thought into it. The more haphazard founders haven’t thought about any of that. And it’s the detailed ones who tend to do much better.’

To sum up,As Adam Harris noted in his webinar: ‘Unlike stock and forex markets, crypto is still in its "Wild West" phase.’ Nevertheless, the market offers huge opportunities - especially for those who choose the right strategy, are able to analyse trends and are ready to adapt to changes.

\n

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.