and the distribution of digital products.

DM Television

Empirical Analysis of Inscriptions on Ethereum and EVM-Compatible Rollups

1.1 Research Questions and Contributions

6 Empirical AnalysisThis section presents the empirical analysis of the inscriptions recorded on Ethereum and its major EVM-compatible rollups: Arbitrum, Base, Optimism, and zkSync Era. We characterize the inscription protocols, operations, tokens, and their trading dynamics. Subsequently, we investigate the impact of sudden surges in inscription transactions on the blockchains’ performance.

6.1 Overall TransactionsMultiple spikes in inscription transaction counts occurred on Arbitrum (November 25th , December 15th, 16th, and 18th) and zkSync Era (November 17th, 16th, 17th, and December 21st) as shown in Figure 2a. During peak periods, inscriptions dominated daily transactions, comprising nearly 90% on zkSync Era and Arbitrum (December 16th, 2023), over 50% on Ethereum (January 14th, 2023), and almost 35% on Optimism and Base (January 24th, 2024). Figure 2b illustrates those peaks. Due to this high activity of inscriptions on-chain, some rollups were not prepared to handle the surge in transactions, leading to downtimes and delays in processing transactions [33, 15]. Next, we delve into the protocols and operations contributing to these observed spikes.

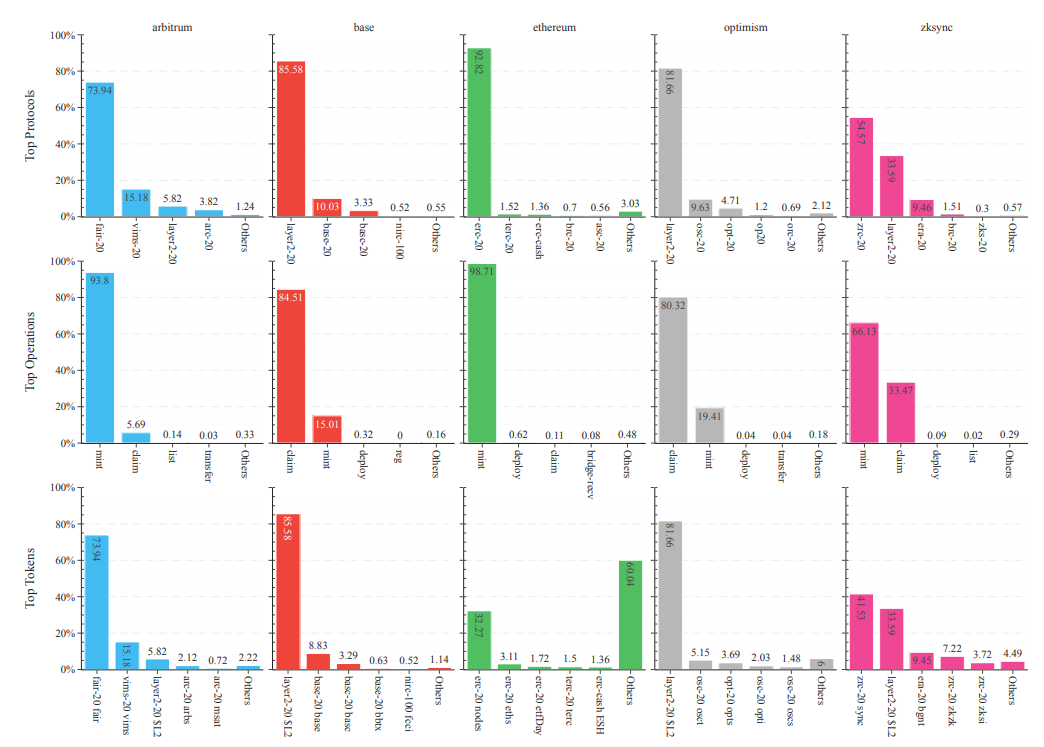

6.2 Inscriptions CharacterizationOur research indicates that inscription tokens are uniquely unified by a protocol-tick pair. Therefore, we aggregate data using this pair to identify the top tokens. Figure 3 illustrates the breakdown of inscription transactions based on protocol, operation, and the leading token. Below, we provide our observations for each of these categories.

\ Protocols. Our initial observation reveals that each blockchain contains a particular leading inscription protocol, similar to BRC-20 on Bitcoin, constituting between 54% and

\

\ 93% of transactions. Moreover, blockchain-specific standards such as FAIR-20 for Arbitrum, ERC-20 for Ethereum, and ZRC-20 for zkSync Era exhibit prominence. The LAYER2-20 protocol facilitates minting and trading of the inscription token across multiple rollups. It is present across all studied L2s, emerging as the dominant inscription protocol on Base and Optimism, and the second largest on zkSync Era.

\ Operations. The new inscription standards resemble the original BRC-20 standard but introduce additional operation types such as claim, list, buy, and sell, which were absent in the original BRC-20 implementation on Bitcoin. Notably, the claim operation works similarly to mint, generating new tokens. Hence, we aggregate mint and claim operations, constituting approximately 99% of all transactions related to inscriptions across all studied chains. Understandably, a small number of transactions are attributed to the list operation, used for listing inscriptions for sale in an inscription marketplace, and the deploy operation, which declares the token on the chain along with its token supply. The low percentage of transfer, sell, and buy transactions suggests that inscription tokens are not yet actively traded on EVM chains.

\ Tokens. Based on our observations, various protocols deploy and mint tokens with the same ticks. Therefore, we identify each inscription token by a protocol-tick pair. We found that Arbitrum, Base, and Optimism each have one dominant token, representing between 73% and 85% of inscription transactions. The distribution of tokens is most diverse on Ethereum, with ERC-20 NODES token contributing 32% of transactions, and each other tokens less than 3.5%. The four largest tokens on zkSync Era account for over 90% of

\

\

\ inscription transactions and zkSync Era has more powerful leading tokens than in other chains. The token LAYER2-20 $L2 is present on all rollups, being also the dominant token on Base and Optimism.

\

:::info Authors:

(1) Johnnatan Messias, Matter Labs;

(2) Krzysztof Gogol, Matter Labs, University of Zurich;

(3) Maria Inês, Silva Matter Labs;

(4) Benjamin Livshits, Matter Labs, Imperial College London.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.