and the distribution of digital products.

DM Television

Educational Byte: Cryptocurrency Mining and Centralization Issues

\ As you may know, anything and everything in the digital realm can be replicated —copied and pasted. For a while, it happened the same with non-institutional-backed attempts at digital cash: the risk of double spending (replicating the same coins to spend them twice) was there. The first-ever cryptocurrency, Bitcoin (BTC), solved the double-spending problem by employing a process metaphorically called ‘mining’.

\ If we looked at ‘mining’ in a dictionary, we’d find something like “removing minerals from the ground.” So, in our case, is mining removing bitcoins from the Internet or something like that? Well, not really. As we mentioned earlier, the term is purely metaphorical. In reality, crypto mining is a cryptographic (mathematical) process in which numerous machines (computers or specialized devices) solve very complex calculations that allow for the creation of new blocks and the release of new tokens inside a distributed network.

\ Actually, those machines compete against the others to solve it first and get the prize in the form of new coins. You can imagine it as a massive digital puzzle-solving competition where thousands of people (computers) race to solve incredibly complex riddles. This mechanism is called Proof-of-Work (PoW).

\ Think of PoW as the competition rules: only those who put in the effort to solve puzzles can claim the prize. Bitcoin is the most famous example, but other cryptocurrencies, like Monero and Dogecoin, also use Proof-of-Work. It’s an effective way to avoid double spending and create non-government-backed money, but it also uses a lot of electrical energy since all those computers work very hard to solve the puzzles.

\

Who are crypto miners?In theory, anyone, anywhere, could be a crypto miner and join any PoW network without any formal requisite. It’s even encouraged because that’s the point of a decentralized network: the more people, the better. However, practice could be trickier, especially if we’re talking about big networks like Bitcoin, in which the mining difficulty has increased to very incredible levels with every miner that has joined over the years. In the early days, anyone could mine bitcoins with only a common CPU. That’s changed, a lot.

\

Mining difficulty on the Bitcoin network has increased to such a point that now it’s only possible to mine with specialized machines. ASIC mining machines are specialized computers built specifically for mining cryptocurrencies like Bitcoin. Unlike regular computers, they’re designed to solve Bitcoin’s PoW puzzles much faster, but they can only mine specific cryptocurrencies. These machines can be pricey, ranging from a few hundred dollars for older models to over $16,000 for the latest, most powerful ones.

\ There are also mining farms. These are large facilities filled with hundreds or even thousands of ASIC machines, all working together to mine Bitcoin. Big companies own many of these farms, making Bitcoin mining a professional, large-scale industry. For smaller miners, joining mining pools—groups of miners sharing resources and splitting rewards—has become the only viable way to compete.

\ Today, institutional or group mining is the way to go with Bitcoin, making solo mining almost impossible. Bitcoin mining requires technical skills and a significant budget to make any real profit, therefore, miners are often private companies or private-owned mining pools. This could be slightly different with other coins like Monero or Dogecoin, but mining pools are very common platforms, not only available for the Bitcoin network.

\

Centralization in crypto miningCentralization in crypto mining occurs when a few entities control most of a cryptocurrency network’s mining power. This consolidation is a growing concern because it undermines the original purpose of cryptocurrencies: a decentralized, censorship-resistant financial system. When only a handful of mining pools or corporations dominate, they gain significant influence over the network, enabling them to prioritize transactions, exclude certain users, or even enforce governmental or corporate policies.

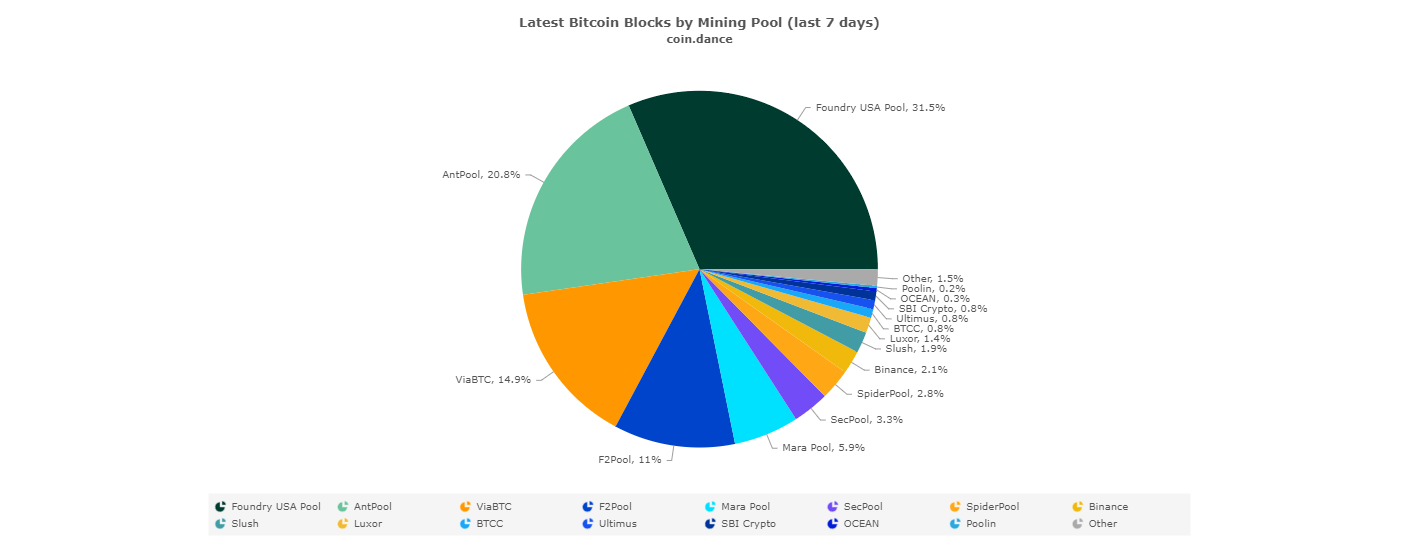

\ This centralization also opens the door to surveillance and manipulation. Mining operators can censor or block specific transactions if pressured by authorities. It’s already happened in other networks, beyond Bitcoin. In extreme cases, a few entities controlling the majority of the hashrate could collude, launching a 51% attack to rewrite the blockchain or, more likely, just censor certain users. As of Decemer 2024, for instance, over 78% of the Bitcoin hashrate is controlled by only four mining pools [CoinDance].

\

\ Obyte provides a solution to these risks with its Directed Acyclic Graph (DAG) architecture, which requires no miners or ‘validators’. This eliminates centralized control, creating a network free from potential censorship and manipulation. By making participation accessible to all without heavy investments in hardware, Obyte ensures a genuinely decentralized environment that fulfills the original promise of cryptocurrency.

:::info Featured Vector Image by Freepik

:::

\n

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.