and the distribution of digital products.

Different Types of Crypto Trading Bots

Just like in traditional markets populated with algorithms, in cryptocurrency markets, trading strategies can be automated using trading bots. Recently we have written a guide to cryptocurrency trading bots. In this article, we’ll take a closer look at different types of crypto trading bots.

These bots are built based on buy and sell strategies and are common in both traditional and cryptocurrency markets:

- Trend trading bots

- Arbitrage bots

- Coin lending bots

- Market making bots

In the world of automated cryptocurrency trading, several companies are competing for dominance in the market. There are cloud-based and downloadable bots which integrate with the most popular exchanges.

Crypto trading bots are built for both beginners and experts. You will most likely be blown away by the number of products with indicators, signals, and risk-management features fitting specific trading strategies. So how to choose the right trading bot for you?

Trend trading botsAs you can probably see from the name of the bot, it takes into account the momentum of a particular asset and, after analyzing it, executes buy or sell orders.

If the trend shows the upsurge in the price, the bot will enter a long position. And similarly, it will enter into a short position once the price drops.

In short, trend trading implies that an asset will continue to move in the same direction as it is currently moving, and the trend trading bots make this fact work in their favor.

In order to determine a trend, bots can use price action or other technical indicators, for example, moving averages, momentum indicators, trend lines, and chart patterns.

While setting up a new bot, you might want to add technical indicators that will be used by the bot.

This particular bot utilizes the concept of arbitrage. Arbitrage is a trade that exploits an imbalance in the price in different markets or different forms. In inefficient cryptocurrency markets, this is especially relevant. While simultaneously purchasing and selling an asset, you can profit from the existing imbalance.

Thus, arbitrage crypto bots are programmed to track the difference between the coin’s prices in different markets. To later buy the coin where the price is lower and sell where it is higher.

Arbitrage bots were particularly popular before 2017’s crypto hype, but these days they are harder to exploit because the spread between exchanges is much narrower than it used to be.

Coin lending botsOne of the exciting ways to earn on cryptocurrencies is to lend coins to margin traders who will later return you the loan with a percentage.

Some exchanges like Bitfinex and Poloniex have this margin funding option. Yet, it’s tedious to set the number of parameters manually every time a margin trader returns your money, and you need to arrange a new loan.

Coin lending bots help you automate the process, spend less time looking for the right interest rate, and take advantage of possible spikes in lending options.

While setting up such a bot, you can configure your strategy, withhold lending until the current interest rate reaches a certain threshold, choose a currency, and a date you want your coins back.

Some of those coin lending bots are free, some of them you can even find right on top of the exchanges that do margin funding.

Market maker botsOrderbook spread is something that the market maker bot utilizes to bring you profits.

The more actively an asset is traded, the wider the spread will be, and the more profits market-maker bots might return. The main principle here is to sell to investors at a higher value than a selling price and do it as often as possible.

The market maker bot places an order with a price that is different from the market price and, thus, making a market, earns money for the owner of the software.

It scans for markets with a wider spread and does it 24/7, giving a trader an advantage of time, volume, and price.

Best Crypto Trading Bots 3Commas3Commas is a Miami-based trading platform developed in 2017. As of now, they have around $22.5 billion in average monthly trading volume, and the platform is available worldwide.

Further, the platforms have a wide range of features, including DCA Bots, Smart Trade, TradingView, Options Bots, Crypto-Signals, Trading Terminal, etc.

One should note that the 3Commas Dollar Cost Averaging is one of the most preferred trading bots on this platform. Beginners can also practice trading at 3Commas using the paper-trading option.

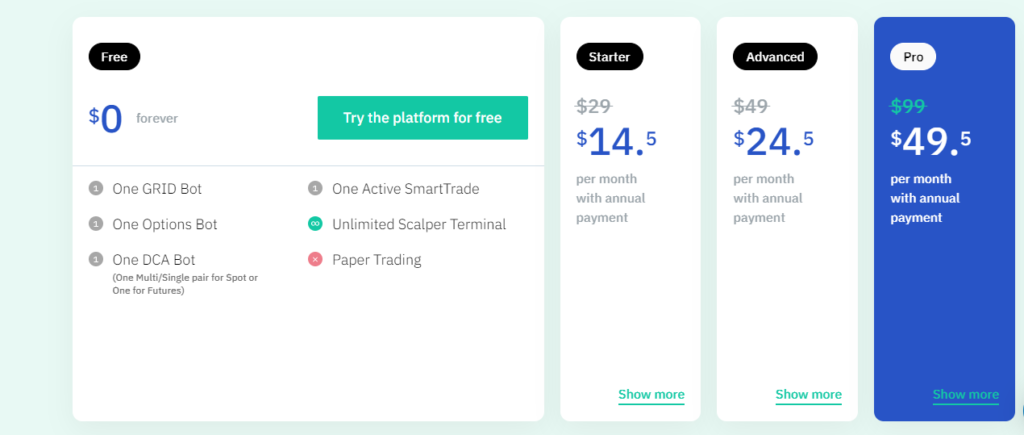

3Commas Pricing

CryptoHopper

3Commas Pricing

CryptoHopper

This platform was founded in 2017 by two brothers, one of which was a web developer and the other one a day trader. Currently, CryptoHopper is compatible with 16 exchanges.

The platform offers unique features, including asset managers, Miners & PSPs, CryptoTweeter, Strategy designers, and others. The CryptoHopper trading bots implement data and use strategies to buy and sell cryptocurrencies.

They have also introduced a feature called Artificial Intelligence Bots. In this, users have to feed strategies, which bots automatically will learn and adapt to the changes.

Further, it offers free services too, but users cant use the features to full. Cryptohopper users can also earn revenue on a monthly basis through the Cryptohopper affiliate program.

To learn more about it, you can read our CryptoHopper review article.

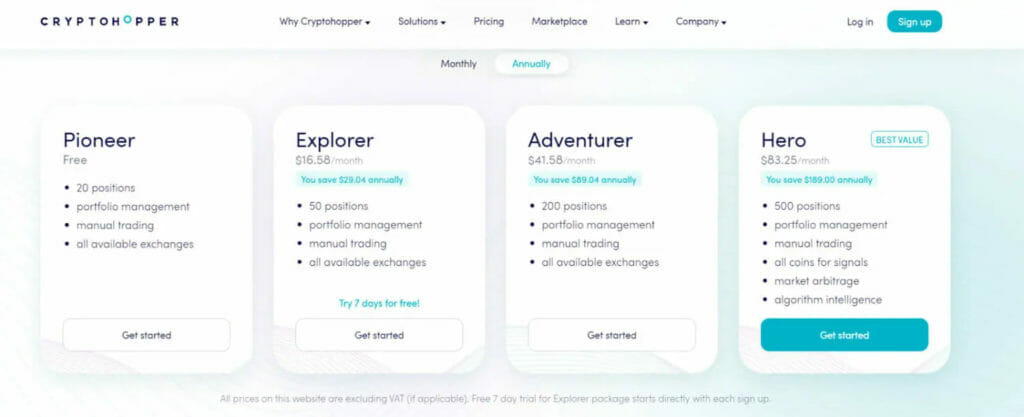

CryptoHopper Pricing

Wrapping Up

CryptoHopper Pricing

Wrapping Up

In conclusion, it is still possible to get ahead of other traders in the crypto market. While using automated software, as an individual, you have a better chance to fight against the whole world and even win.

The most popular tools in your crypto trading arsenal might be trend trading bots that await the momentum. Arbitrage bots to exploit the price imbalance in different markets. Coin lending bots to help you get rid of unnecessary manual work on top of crypto exchanges and market maker bots that utilize fluctuations in the spread.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.