and the distribution of digital products.

DM Television

Cycle Network: Building a “VisaNet” for Crypto

- Cycle Network’s three-layer design eliminates the need for traditional bridges by anchoring security in Ethereum, extending connectivity across source networks, and consolidating activity through a zkEVM rollup.

- Cycle’s infrastructure already powers practical applications like all-chain stablecoin settlement and chain-abstracted GameFi. Projects such as Golden Goose demonstrate how Cycle abstracts operational complexity while delivering yield strategies.

- Since the launch of its Alpha Mainnet, Cycle has secured over $400 million in value and processed more than 2.7 million transactions.

- The CYC token launch is designed to reward early users, drive ecosystem growth, and secure the network. With 20% allocated to community airdrops and 10% to staking-based security, Cycle’s tokenomics align long-term participation with decentralization.

Introduction

Cycle Network is building a crosschain settlement layer that abstracts the complexity of multichain environments without relying on bridges. Its infrastructure has already secured over $400 million in value, processed more than 3 million mainnet transactions, and integrated over 20 networks, including Monad, Berachain, Sonic Labs, BSC, and Base.

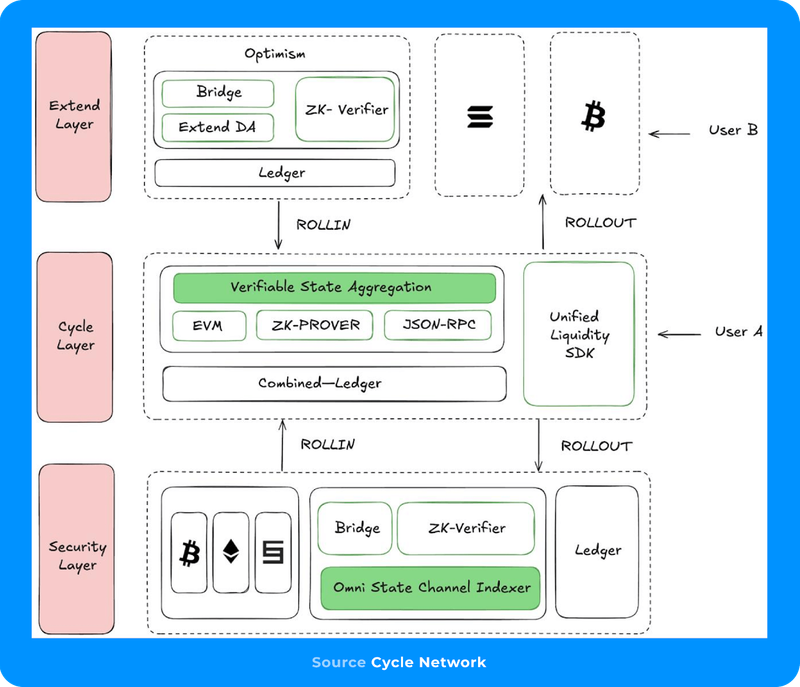

Cycle’s architecture consists of three layers. First, the Security Layer anchors state integrity using Ethereum and zero-knowledge proofs (ZKPs). Second, the Extended Layers span all source and destination networks, connected via decentralized endpoints and Extended Data Availability (EDA). Third, the Cycle Layer functions as a zkEVM rollup that aggregates activity across networks. These layers work together to maintain a synchronized global state and allow applications and users to interact across networks as though operating on a single network.

Cycle’s infrastructure powers real-world use cases such as all-chain stablecoin settlement and simplified multichain interfaces. This enables bilateral reconciliation with traditional banks of RWAs and stablecoins, enhancing the verifiability and transparency of transactions.

Cycle Network OverviewCycle Network’s technical architecture is designed to abstract multiple networks into a unified, bridgeless settlement layer. It achieves this through three primary components: the Security Layer, the Extended Layers, and the Cycle Layer.

The Security Layer forms the foundation for Cycle Network's integrity and safety. Leveraging Ethereum's decentralized and programmable infrastructure, Cycle anchors its global state on Ethereum to benefit from its robust security guarantees. By integrating Ethereum endpoints with zero-knowledge proofs (ZKPs), Cycle enables trustless, onchain verification of network activity. These ZKPs, posted on Ethereum, allow anyone to independently validate Cycle’s state updates, thereby inheriting the security of Ethereum’s consensus.

The Extended Layers include all source and destination networks where transaction data resides, such as Layer-1s, Layer-2s, and application-specific chains. Cycle establishes Endpoints on each Extended Layer to validate and ensure complete message retrieval through Extended Data Availability (EDA). These Endpoints synchronize states across all connected networks via decentralized indexing.

At its core, the Cycle Layer acts as a sophisticated rollup layer, aggregating transactions from both the Security Layer and Extended Layers. It employs a decentralized sequencer and zero-knowledge Ethereum Virtual Machine (zk-EVM) prover to maintain a coherent global state across many networks. This structure enables users to interact securely across networks without the complexity of manual bridging or chain-specific interfaces.

Stablecoin Liquidity & Crosschain SettlementCycle Network improves stablecoin liquidity and crosschain settlement by allowing stablecoins to move across networks as if on a single, unified system. Its all-chain settlement capability transforms how stablecoin transactions are reconciled, validated, and confirmed across networks. Users benefit from unified liquidity access without the need for complex bridging or fragmented liquidity management.

For stablecoin issuers, Cycle provides verifiable proof that onchain token activity matches offchain bank reserves or other real-world assets. By aggregating transactions into a single, auditable ledger, every token movement across integrated networks can be transparently recorded and reconciled. This structure supports compliance requirements and builds trust with regulators and the market by ensuring that each stablecoin is backed by tangible assets.

Cycle also simplifies multi-network deployment for developers. Traditionally, deploying stablecoins required separate contracts on each network. Cycle’s SDK removes this friction by enabling simultaneous deployment across all supported networks in a single action. This approach reduces development time and accelerates market entry, similar to how cloud infrastructure virtualizes the deployment environment.

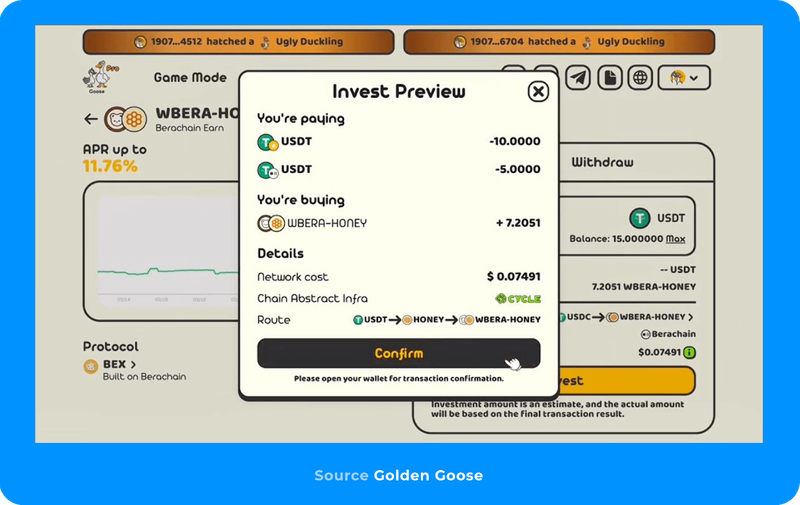

Golden Goose: Chain‑Abstracted GameFi in ActionGolden Goose is a gamified DeFi platform built on Cycle Network that simplifies crosschain strategies into game-like experiences. Users stake assets like USDT to “hatch” virtual geese that generate yield, complete quests for reward boosts, and earn VEGOOSE tokens and airdrops, including allocations of Cycle’s CYC token. Under the hood, Cycle automates bridging, swapping, gas payments, liquidity provision, and staking. Instead of navigating multiple applications and networks, users interact with a single dashboard: they choose a strategy and click “stake,” while Cycle routes assets across networks using its Rollin/Rollout infrastructure and unified liquidity system, which move assets into or out of Cycle’s layer.

Golden Goose lowers sign-up friction for both crypto-native and mainstream users. Players can onboard with a social login and begin earning without setting up a wallet. The application’s campaign attracted over 800,000 addresses, including over 100,000 from TikTok, and by August 2025, its mainnet had onboarded 20,000 paying addresses with $15 million in TVL. Adoption has been especially strong in Latin America, Brazil, Japan, and Turkey.

Cycle Network Token LaunchCycle Network’s Alpha Mainnet went live on February 10, 2025, an event that inaugurated the pre-TGE phase. At alpha launch, Cycle also rolled out incentive programs, including testnet rewards, developer bounties, and early user contests, to stimulate network activity.

A major milestone in the pre-TGE timeline was the release of the Cycle Liquidity Hub in mid-June 2025. Announced as a cornerstone of the lead-up to TGE, the Liquidity Hub is essentially Cycle’s crosschain clearinghouse for stablecoins and other assets. Deposits into the Cycle Liquidity Hub contribute to a pooled liquidity reserve used by Cycle’s Rollin/Rollout processes across different networks. In return, depositors earn a yield (from fees or incentives) and position themselves for token rewards. The launch of the Liquidity Hub kicked off a series of pre-TGE airdrop programs to reward those who support the network at this stage.

Airdrop Structure and ParticipationCycle Network has reserved an allocation of tokens for community airdrops. In fact, 20% of the total CYC token supply at TGE is set aside for early supporters (such as liquidity providers and active users) as a reward pool. The airdrop program is designed with retail-first, fair-play mechanics in mind. Notably, there is a cap on how much any individual can contribute to airdrop credit: roughly $1,000 per address is the maximum that counts toward the airdrop scoring. By capping contributions, Cycle prevents whales from dominating the airdrop allocation. Simply overfilling or using multiple wallets won’t meaningfully boost one’s allocation, as oversubscription doesn’t boost users’ points on the leaderboard.

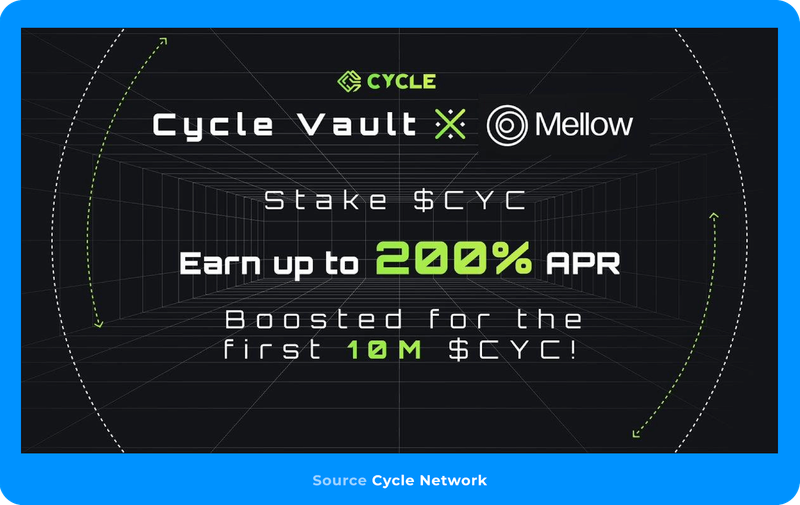

To further reward participants, Cycle is introducing the Mellow CYC Staking Boost, where users can stake CYC on Mellow for up to 200% APR. This boost offers an additional incentive for community members to actively engage with the ecosystem while awaiting their airdrop rewards.

Tokenomics

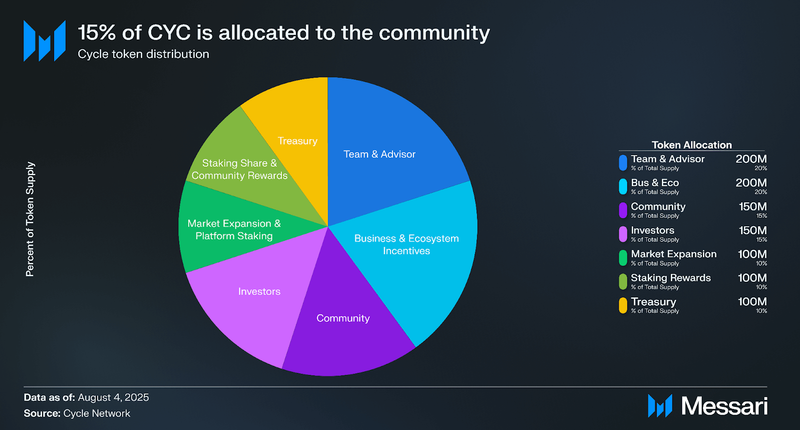

TokenomicsCycle Network’s tokenomic model is built around a fixed-supply token, CYC, which will serve as the utility and governance token of the network. The total supply is 1 billion CYC, and the protocol has committed that no further tokens will ever be minted. CYC’s supply is allocated across several categories to ensure both the development of the project and the incentivization of its community and participants:

- Team and Advisors (20%): This allocation is locked with a 12-month cliff after TGE (no team tokens released in the first year), then vested linearly over 48 months.

- Business and Ecosystem Incentives (20%): Business and Ecosystem Incentives (20%): These tokens are essentially a fund dedicated to growing the Cycle ecosystem. For example, they can be used as rewards for projects that drive volume through Cycle or as grants for teams building important infrastructure or applications on the network. Initially, distribution of this pool is based on measurable contributions. Once Cycle’s on-chain governance is live, the community will vote on how to allocate these ecosystem incentive tokens.

- Community (15%): This chunk is designated for community-oriented programs (many of which are the airdrops and user incentives we described in the pre-TGE phase, and likely continued rewards post-TGE). Rewards are distributed every six months and fully unlocked after three years.

- Investors (15%): Early investors and backers of Cycle (including strategic partners and incubation funds) are allocated 15% of the supply. This portion also has a 1-year cliff post-TGE and vests over 24 to 36 months thereafter, depending on specific agreements.

- Treasury (10%): Initially locked for 6 months after TGE. After the cliff, the treasury tokens unlock gradually over 48 months.

- Market Expansion and Platform Staking ( 10%): Another 10% is set aside for activities around market expansion, ecosystem growth, and platform staking incentives. A portion of this allocation may be utilized at TGE (for initial liquidity or exchange listings), with the rest deployed over time as needed for growth campaigns and reinforcing Cycle’s liquidity.

- Staking and Shared Security Rewards (10%): Finally, 10% is allocated to incentivize network security via staking (in particular, Symbiotic restaking and potentially Cycle’s native validator staking if applicable). These tokens will be paid out as rewards to those who stake or restake CYC to secure the Cycle Network and its crosschain transactions. The release of this portion is planned over a long term (linearly over 60 months, i.e. 5 years). This slow emission ensures that security providers have a steady income for maintaining the network, and it encourages them to keep their stake for many years. It also aligns with Symbiotic’s model where restakers lock value to secure multiple networks (Cycle being one of them), earning rewards over time.

CYC has multiple functions within Cycle Network’s design. The token’s demand is intended to be driven by usage of the network. Key utilities and incentive roles for CYC include:

- SDK Usage Fees: Developers building on Cycle will need to pay in CYC when they utilize Cycle’s APIs for crosschain operations. For example, calling the Rollin/Rollout functions incurs a fee payable in CYC.

- Gas Fees for Cycle Network: CYC will be the native gas token for all transactions and smart contract executions that occur within the Cycle Network environment.

- Staking for Security (Symbiotic Restaking): Cycle is part of the Symbiotic shared security protocol, where holders of various tokens can “restake” them to secure multiple networks. CYC itself can be staked to participate in the validation and security of Cycle’s aggregate sequencer or other nodes. Users who stake CYC to help secure the network are rewarded for doing so (from the 10% staking rewards pool, as described). Additionally, new networks or appchains that want to join Cycle’s unified liquidity network are required to stake CYC as well. That implies, for example, if a new Layer-1 wishes to plug into Cycle’s liquidity layer, they must acquire and lock some amount of CYC. Staking yields rewards and also grants participants a voice in governance (once enabled).

- Liquidity Mining Incentives: To bootstrap liquidity in Cycle’s crosschain pools, the network will use CYC as a reward for liquidity providers. As noted, users who deposit major assets like ETH into Cycle’s Liquidity Hub or related all-chain liquidity pools will earn CYC tokens as an incentive. This is a classic liquidity mining model but applied to Cycle’s unique context: instead of providing liquidity to a single AMM or single network, LPs are contributing to crosschain liquidity that benefits the whole ecosystem. The incentive in CYC compensates them for impermanent loss or opportunity cost, and encourages more liquidity to flow in.

Beyond these core utilities, CYC is also intended to function as the governance token for Cycle Network. While governance features may roll out in the near future, token holders will eventually be able to vote on proposals such as protocol upgrades, parameter changes, and how to allocate certain token pools (like the ecosystem incentives or treasury). This gives CYC holders a say in the network’s evolution and aligns with the project’s decentralized ethos.

ConclusionCycle Network has laid the foundation for crosschain infrastructure that unifies liquidity and supports real-world applications such as stablecoin settlement. Cycle Network’s architecture already secures over $400 million in value and has facilitated millions of transactions. Platforms like Golden Goose show how Cycle’s infrastructure can power consumer-friendly, crosschain applications while abstracting away complexity for both users and developers.

After TGE, Cycle is transitioning from infrastructure buildout to ecosystem expansion. Pre-TGE initiatives such as the Liquidity Hub and airdrop programs are designed to distribute ownership and bootstrap participation. The CYC token will serve as a utility asset across the network, and be used for transaction fees, liquidity rewards, security staking, and governance. Cycle’s structured tokenomics, coupled with a clear distribution and incentive strategy, position the project for success beyond launch as it aims to become a foundational layer for crosschain settlement and unified liquidity.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.