and the distribution of digital products.

DM Television

CryptoView Review | All-in-one free crypto portfolio manager

With the growing number of crypto exchange providers, trading is no longer simple and time-efficient. Numerous trade interfaces, monitoring of separate portfolios, or keeping up to date with the market movements has proven to be troublesome, sluggish, and tedious for most traders.

In this article, we will review CryptoView, an all-in-one cryptocurrency portfolio management system, that mitigates the aforementioned issues by gathering all crypto-related data in a single user interface.

Crypto traders, who are registered in multiple exchanges, definitely know the issue of switching through tabs, managing trading with expiring sessions, and keeping track of the various arrays of trade interfaces.

Moreover, monitoring crypto funds over different trade accounts, wallet providers and cold wallets can be unpleasant and complicated. The problem persists particularly for active crypto traders and fund managers.

Summary- CryptoView enables users to synchronize exchange balances, trading history, currently opened orders, and external wallet balances into a single functional portfolio.

- The platform gives its users an all-in-one interface that helps for a smoother, faster, and more efficient trading and portfolio management.

- Simple registration and onboarding

- Encrypted API key connections

- Enhanced security with two-factor authentication, SSL, and DoS protection

CryptoView gives its users an all-in-one interface that provides a smoother, faster, and more efficient portfolio management. The platform is effectively the best cryptocurrency portfolio tracker available on the market, suitable both for beginners, as well as experienced crypto traders, and even seasoned fund managers.

The core mechanism of CryptoView consists of multi-exchange portfolio management tools, combined with a vast array of crypto trading tools.

For example, the platform supports different crypto exchange options, in-depth portfolio analytics, a multi-source news aggregator, a crypto event schedule, and a remarkable interface that allows full customization.

CryptoView isn’t just only a digital currency portfolio tracker – rather it is a completely customizable platform empowering trades on most of the leading crypto exchange platforms.

Seamless onboardingCryptoView’s signup process is extremely simplified and only requires a few clicks to register on the platform. Furthermore, users receive a fully-operational 30-day free trial. The trial is useful for getting accustomed to all of CryptoView’s functionalities and layouts, as well as exploring the vast range of tools available on the platform.

Features CryptoView Charting Review

CryptoView Charting Review

After completing the registration, users will have to connect their exchange and wallet accounts with the cryptocurrency portfolio management software.

Portfolio TrackingCryptoView operates by utilizing API connections with the world’s leading exchanges. The API mechanism allows instant data synchronization with third-party user accounts and crypto-wallets.

The platform enables users to synchronize exchange balances, trading history, currently opened orders and external wallet balances into a single functional portfolio.

If for some reason users have difficulties connecting the API to the exchange or wallet, CryptoView has developed a step-by-step tutorial for API key generation and integration for each of the supported exchanges. Once the connection is complete, the portfolio management platform will automatically begin to track and store the portfolio data.

Currently, CryptoView supports various crypto exchanges like Binance, Bitfinex, Bitstamp, Bittrex, BitMex, Coinbase, CoinbasePro, CoinEx, HitBtc, OKeX, Huobi, Kraken, KuCoin, Poloniex and Cex.io.

The core of CryptoView’s all-in-one solution is the cryptocurrency portfolio tracker. The tracker provides a detailed list of the crypto assets from all API-connected crypto exchanges and wallets. Furthermore, the software provides additional information about current prices, price changes for various time periods (12h, 24h, 7 days, and 30 days), as well as a 7-day trendline for each asset.

You might also be interested in:

- Crypto APIs Review 2020 | 30% Discount Coupon Code

- 2020 Investor’s Guide to Crypto

- Shrimpy Review – Crypto Trading Bots for Social Portfolio Management

- Best crypto tax tools for my money $$

- Cryptohopper vs 3Commas vs Shrimpy – Are you confused?

Another feature of CryptoView is the Portfolio analytics tab. The software creates a detailed daily “snapshot” of crypto asset amounts and exchange rates for a 24-hour period. The raw data is then translated into a customizable histogram, which tracks the overall performance of a given portfolio.

Users also have the ability to stack multiple portfolios and compare their performance, all within a single tab. The platform supports several pie charting options, which show the distribution of assets in a portfolio, or the weight of each portfolio in the managed mix.

One of the best features of CryptoView is the integration of TradingView’s real-time multi-charting options. The integration gives users over 85 technical indicators, as well as more than 75 drawing tools and charting options, which enhance user experience.

The multi-charting is suitable for novice and seasoned traders, as well as fund managers, as it gives them the flexibility to plan and execute trades while relying on one of the leaders in trading visualization.

Users are able to switch between 27 multi-chart layouts, as well as monitor up to nine simultaneous charts, all on one screen.

CryptoView also supports up to five screen templates, which can be stored for a quick and easy switch between configurations with multiple screens or different screen ratios. If a trader works on two or three screens, for example, he can store his layout and recall it just with a single click. Also, the platform combines side-widgets, foldable trading panels, and a high degree of customization, allowing CryptoView to be among the best crypto portfolio trackers for traders, fund managers, and crypto analysts.

Advanced Trading and Alterting ToolsTraders can use CryptoView’s order book, as well as market depth indicators, latest trades, and full trading history. Advanced trading orders like “stop-limit” and “stop-loss” are supported as well, which minimizes the chance of losing funds due to sudden price volatility.

To complement the trading, CryptoView also enables the “fill indicator” which shows how much of the order can be executed instantly, based on the given exchange’s order book.

The platform also supports advanced alerting features, which traders can use as indicators for price change, percentage change, or other events in any trading pair. Users would be notified via an SMS or an email.

Fund managers, on the other hand, can benefit from CryptoView’s powerful fund management features, tailored for individuals or companies managing more than one portfolio.

Users can create, monitor, and manage up to five portfolios simultaneously, switching between them with just one click. Each individual portfolio can be individually shared via a special “view-only” link for client reviews and monitoring purposes. The link includes a detailed list of all asset balances and performance histograms.

CryptoView Trading Tools Review

Trade safely and secure

CryptoView Trading Tools Review

Trade safely and secure

CryptoView does not manage the transfer and withdrawal of user funds. To mitigate the risks, such operations can be done only on the exchange interface. Furthermore, CryptoView requires API key permissions in order to access personal data like balance and trading history. The platform uses enterprise-grade security, including SSL-encrypted connections, API key encryption, two-factor authentication, and DoS protection. CryptoView also has the ability to freeze accounts if any illicit activities are detected.

Pricing CryptoView Pricing Review

CryptoView Pricing Review

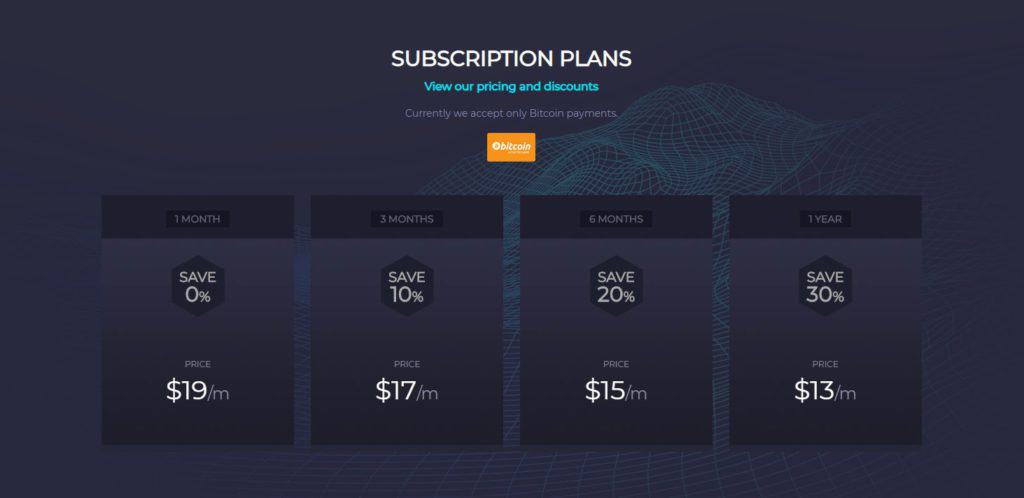

In order to take full control over the vast functionalities, CryptoView has developed a subscription-based model, with prices ranging between $13 and $19 per month, depending on the period chosen by the user. If users opt for an annual subscription, CryptoView offers a 30% price discount. The cryptocurrency tool does not impose any trading volume limits or other limitations for a seamless crypto journey.

CryptoView also gives users two reward mechanisms for earning – an affiliate program and a referral program. The affiliate program grants users $20 in Bitcoin for every user that goes through the 30-day trial period and purchases any of the subscription plans. The referral program grants users with two free months for every customer who successfully joins CryptoView after the trial period has ended.

Pros and Cons Pros:- Seamless integration of various exchange data into a single portfolio

- All information is visible in a single browser tab

- Over 85 technical indicators and 75 drawing tools

- API support for all major exchanges

- Enhanced security

- Fully customizable layout

- No deposits/withdrawals directly through CryptoView

With the crypto world constantly evolving, all-in-one solutions like CryptoView are increasingly needed by novice crypto traders and seasoned trading professionals who need to simplify their trading experience across multiple exchanges. Fund managers can also benefit from using CryptoView, as the platform possesses all the needed tools for monitoring and managing their clients’ crypto portfolios.

Let us know what you think about our CryptoView review in the comment section below.

Frequently Asked Questions What is API trading?API is an acronym for “application programming interface”. API enables communication and interaction between different software products. In simple terms, an API is a messenger that makes request processing and tells a system what users want to do — and then returns the system’s response back to them.

A trading API enables users to interact remotely with various crypto exchange accounts and manage them from the CryptoView account. More specifically, it allows users to synchronize data and execute trading orders.

CryptoView’s API connections are useful for both novice traders and traders with multiple exchange accounts since all operations and data are done in the same system and interface.

All major crypto exchanges nowadays offer trading APIs to their customer base.

Does CryptoView charge any fees?CryptoView does not charge any additional transaction fees and/or commissions, apart from the monthly subscription fee.

Does CryptoView store users’ funds?CryptoView never stores users’ funds. All funds remain safely stored in users’ exchange accounts and wallets. The platform does not provide functional support for funds withdrawal, transfer, or deposit.

What is included in the Free Trial?CryptoView provides a 30 days Free Trial to all users who wish to try the service, including all features of the paid version with no limitations.

CryptoView Alternatives- Shrimpy – Shrimpy is a social portfolio management and crypto trading platform for your personal crypto investments. The application focuses on long-term strategy automation, portfolio tracking, and copying strategies from other traders in the social program. Also, read our Shrimpy review.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.