and the distribution of digital products.

Crypto Rally Expected In Q4 2024 With ‘Exceptionally High’ Chances: Analyst

Bitcoin’s (BTC) breakout above $65,000 could lead to ‘exceptionally high’ chances for a wider crypto rally in Q4 2024, according to Markus Thielen, head of research at 10x Research.

Sustained Bitcoin Rally Could Spark FOMO In AltcoinsIn a recent report, Thielen outlined several factors that could set the stage for a crypto rally in the last quarter of 2024. According to the report, further upside for the crypto markets could be on the cards due to two key factors.

First, the acceleration in stablecoin minting signals rising interest among investors and traders in re-entering the crypto market.

In the weeks following the July 31 Federal Open Market Committee (FOMC) meeting, nearly $10 billion worth of stablecoins were issued, boosting market liquidity and even eclipsing Bitcoin exchange-traded fund (ETF) inflows.

The report states:

Circle, which typically caters to more regulated institutions, has accounted for a disproportionate 40% of recent stablecoin inflows, signaling increased allocation from larger market players. Unlike USDT minting on Tron, typically associated with capital preservation, USDC minting may indicate a rise in DeFi activity. Year-to-date, stablecoin inflows have reached $35 billion, pushing the total value of outstanding stablecoins to $160 billion.

Thielen emphasizes Bitcoin’s recent breakout above $65,000, stating that it could rapidly move toward the psychologically important $70,000 price level before it attempts to print a new all-time-high (ATH) value.

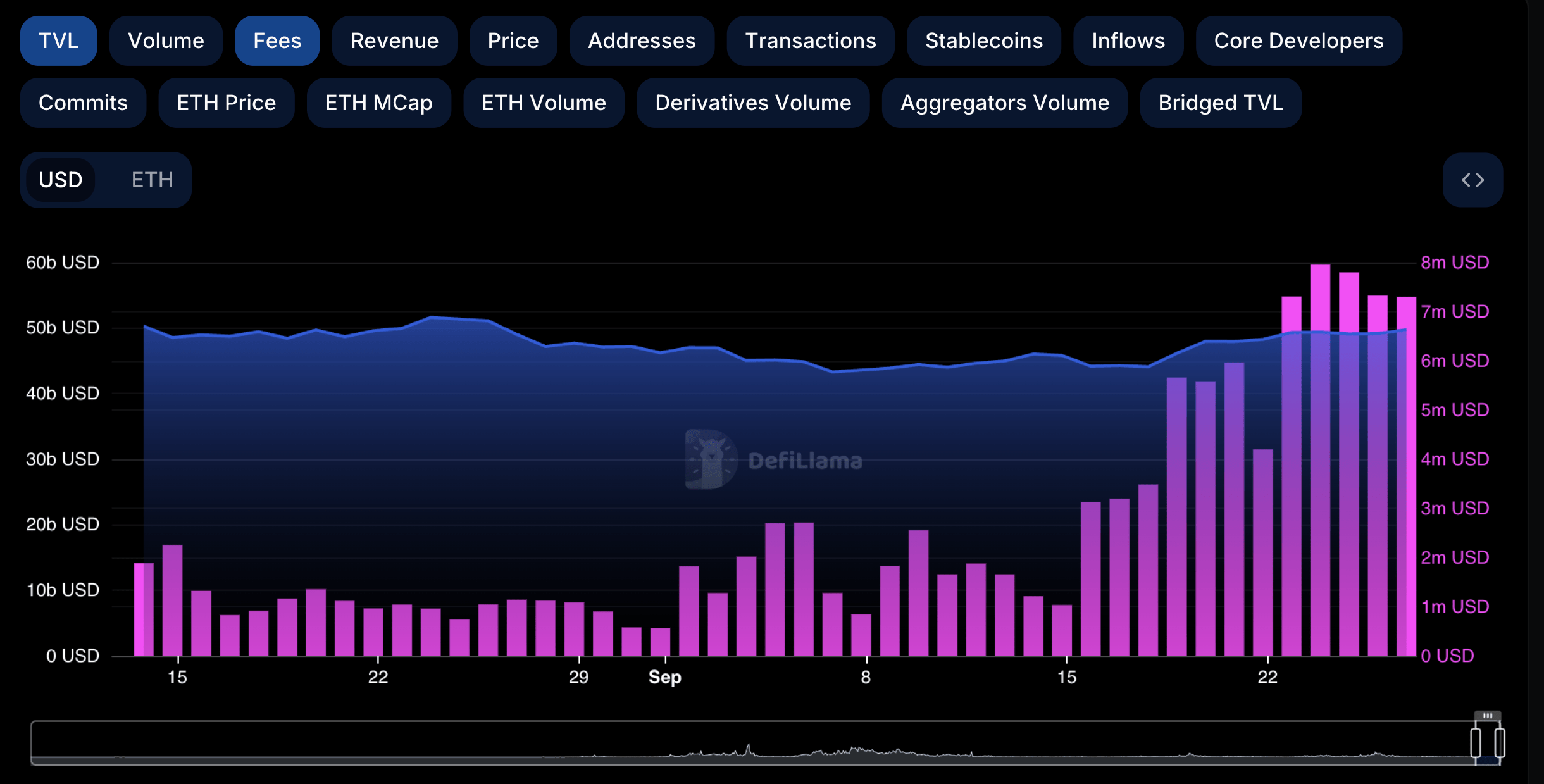

Another metric suggesting a potential altcoin rally later this year is the declining Bitcoin dominance (BTC.D) following the September FOMC meeting. BTC.D’s decline coincides with rising Ethereum (ETH) network gas fees, likely driven by increased altcoin activity on the smart contract blockchain.

The chart below shows the rise in Ethereum gas fees, surging from $1.89 million on August 13 to consistently hovering above $7 million since September 22.

The report adds that assuming the US Federal Reserve (Fed) continues to cut interest rates, high-beta altcoins could become increasingly attractive to crypto traders.

Encouraging Cryptocurrency Trends In South Korea, ChinaThe report highlights South Korea’s crypto trading activity as a factor strengthening the altcoin trend. Daily trading volume in the country now floats around $2 billion, with altcoins dominating trading activities ahead of BTC.

Notably, Shiba Inu (SHIB) has reclaimed the first position in trading volume in South Korea, indicating enhanced speculation and paving the way for a potential altcoin-dominated market in Q4.

Finally, Thielen highlights that Chinese over-the-counter (OTC) brokers have reported regular quarterly inflows of roughly $20 billion over the last six quarters, totaling $120 billion.

As reported recently, the Chinese central bank reduced its reserve requirement ratio (RRR) by 50 basis points to inject liquidity into the market, which could fuel a parabolic rally in digital asset prices later this year.

The report concludes by forecasting that Bitcoin’s next target will be $70,000 within two weeks, with a potential new ATH by late October. BTC trades at $66,298 at press time, up 1.4% in the past 24 hours.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.