and the distribution of digital products.

DM Television

Crypto Liquidation Data Rigged By Exchanges? Researcher Unveils The Truth

Vetle Lunde, a senior analyst at K33 Research, has issued a stark warning regarding the practices of prominent crypto exchanges concerning the authenticity of liquidation data. In a post on X, Lunde outlines how exchanges such as Binance, Bybit, and OKX have systematically modified their data reporting processes in a way that he claims significantly distorts the true scale of market liquidations.

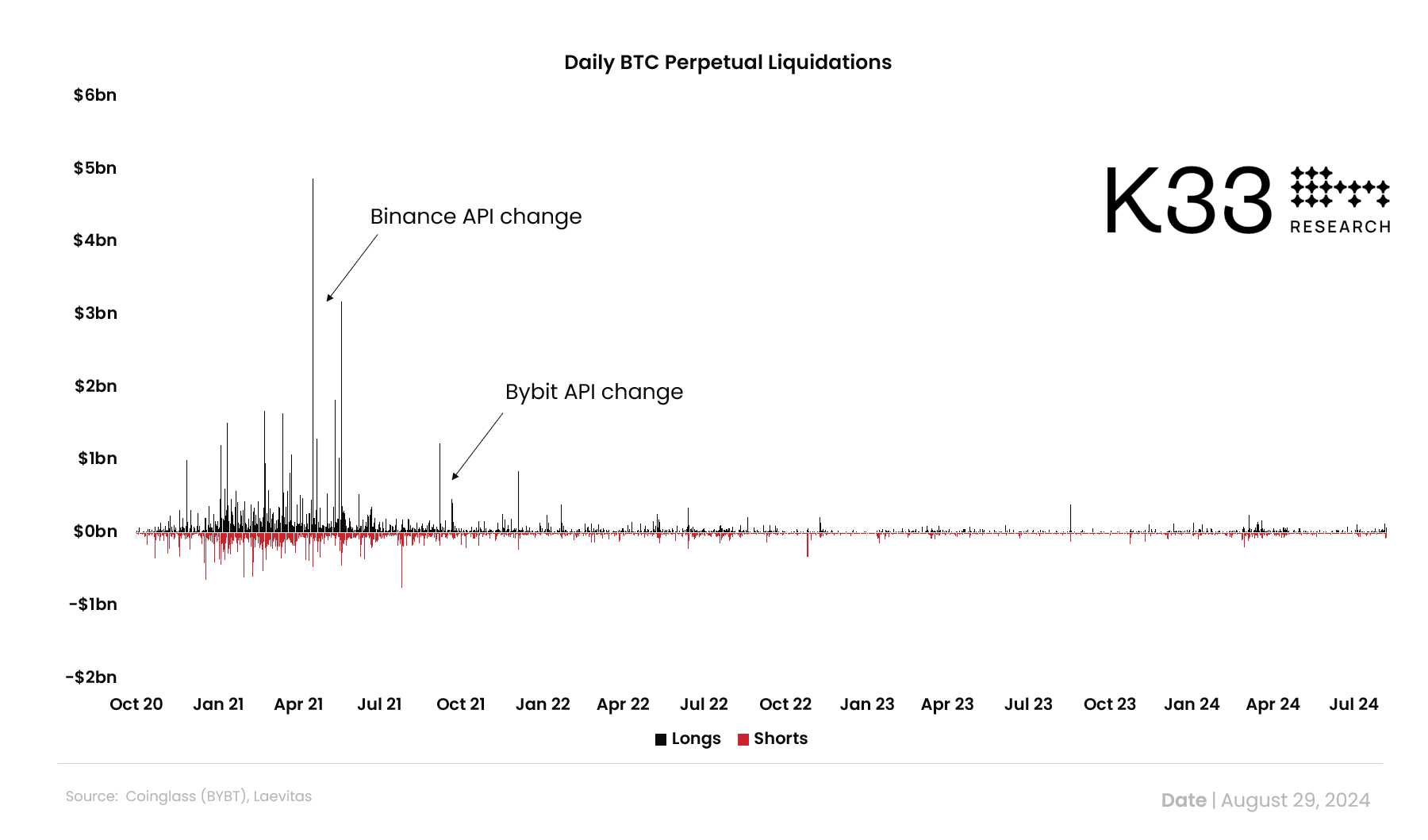

Why Crypto Liquidation Data Is BogusThe core of Lunde’s argument revolves around changes implemented by these exchanges around mid-2021. For example, both Binance and Bybit adjusted their liquidation WebSocket API to report only one liquidation per second, ostensibly to “provide a ‘fair trading environment’” and “optimize user data stream,” respectively. Similarly, OKX has implemented a cap, restricting the reporting to one order per second per contract.

Lunde explains that this modification in the data stream profoundly impacts the market’s transparency, leading to a scenario where liquidation data, a critical metric used to assess market health and trader behavior, is “wildly underreported.” According to Lunde, this has been the case for the past three years, which has implications not only for traders but also for the broader financial analysis of the crypto market.

Historically, liquidation data has served as a barometer for the market’s leverage levels and has been instrumental in understanding how traders react to sudden price movements and volatility. Accurate liquidation data helps in gauging the market’s risk appetite and in assessing whether a market downturn has effectively purged excessive speculative leverage positions. With this data now being underreported, Lunde suggests that traders and analysts are flying blind.

Lunde speculates on the motives behind these changes, suggesting that they may be driven by a desire to control the narrative around market stability and trader success. He points out that during the first half of 2021, high-profile liquidations were frequent fodder for media and social media discourse, often painting a picture of high risk and volatility in the crypto markets. By limiting the visibility of such events, exchanges might be trying to cultivate a more stable and trader-friendly image to attract and retain users.

“I am guessing it’s a PR choice. In H1 2021, liquidation gore was Twitter, media, and everyone’s bread and butter. Constantly figuring at the top of liquidation leaderboards is not aligning with a strategy of attracting as many as possible to trade as much volume as possible,” Lunde remarks.

Further complicating matters, Lunde hints at the possibility that exchanges might be withholding liquidation data to maintain a competitive edge. “Some exchanges even have interests in investment firms that may trade on information that the rest of the market does not have,” the researcher speculates.

Despite these significant challenges in accessing reliable data, Lunde discusses alternative methods to estimate current liquidation volumes, such as analyzing shifts in open interest or leveraging historical data to extrapolate current trends. However, he acknowledges that these methods have their shortcomings. They often fail to accurately reflect the changes in market participant behavior over the years or might overemphasize unusual market events that are not indicative of broader trends.

Concluding his post, Lunde expresses a deep skepticism about the utility of the currently available liquidation data. He calls for a return to the levels of transparency seen in the past, though he pessimistically notes that such a change is unlikely given current trends.

“For now, liquidation data is mostly erroneous entertainment and not actionable. I’d welcome a return to past transparency, but I guess we’ve already crossed the Rubicon,” Lunde concludes.

At press time, BTC traded at $59,540.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.