and the distribution of digital products.

DM Television

Crypto’s $3.5 Trillion Market Cap is Impressive—But the Real Money’s Hiding in Plain Sight

We’re now far from Bitcoin's early days when it was the only cryptocurrency and its market capitalization was barely existent. Numerous alternative coins have followed, along with companies, organizations, and Distributed Ledger Technology (DLT) massive adoption. There’s a whole crypto industry right now, built by people from all around the world, and it’s likely bigger than you think.

\ Not all the figures are public and evident, like the now familiar cryptocurrency market capitalization available on free sites like CoinMarketCap or CoinGecko. There are also private profits and private investments that aren’t exactly in cryptocurrency but in fiat currency flowing through crypto companies. There’s the thing: the crypto industry also moves traditional money, and takes it as investment as well.

\ But first, let’s check the most transparent side of the industry.

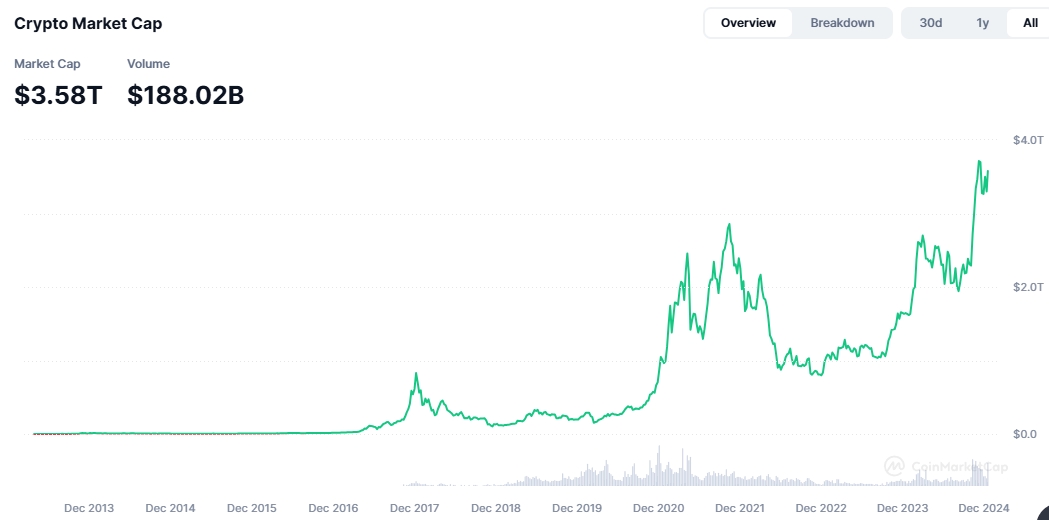

Coins and more coinsAs we mentioned above, there are free sites to consult not only the whole crypto market cap, but also every financial detail by coin, and also the markets by exchange. You can know pretty much everything about decentralized cryptocurrencies, including their market cap, trading volume, prices, supplies, documents, and even what people are saying about them on social media. As of January 2025, the total crypto market cap is at $3.5 trillion, counting at least 10,691 different coins [CMC].

\

\ It may sound big, but is still a modest figure when compared with other markets and industries. The gold market cap still surpasses it by far, with over $18 trillion. Not to mention that the global stock market is at over $113 trillion, with big companies like Apple and Microsoft surpassing $3 trillion each. However, the crypto market has also surpassed by far some of the biggest industries in the world, including auto manufacturers, credit services, and telecom services.

\ All of this is without counting the figures outside cryptocurrencies themselves. So, no stocks, values, or profits from crypto companies and other related ventures. Let alone the money that non-crypto companies are pouring into the crypto world, hiring services and platforms to improve their own firms. Let’s see a bit of that ahead.

Companies and more companiesIt’s not clear how many crypto and DLT-related companies exist globally at this point. If we decide that a crypto firm doesn’t even need to be registered anywhere, because it could be a simple kiosk to exchange your coins closer to your home, then it’s even harder to tell. But we can make some educated guesses. For instance, F6S, a platform that connects companies worldwide, is tracking around 1,512 crypto-related companies —all of them with their valuations outside the cryptocurrency market cap.

\ On LinkedIn, when searching for companies, the keyword 'cryptocurrency' gives 464 results, but 'blockchain' gives 5,000 results. Crunchbase, for its part, lists 4,357 blockchain and cryptocurrency companies and organizations, with a total funding amount of $64.9 billion and an estimated revenue range from $1 million to $10 million. This could be a very modest estimation, though. Other sources suggest a total of $100 billion in fundraising.

\

Annual revenues by top crypto exchanges have been reported in billions. The current #1 crypto exchange by volume, Binance, was founded in 2017, with a total funding of $21 million from several venture capital (VCs) firms. Now, its annual revenues have been reported in a range between $12 and $14 billion. Coinbase, a major competitor, reported a revenue of $3.1 billion in 2023. Bybit, another top exchange, has a revenue range of $100 million and $1 billion.

\ On the other hand, venture capital firms keep pouring money into the industry as well. In early 2024 alone, over $2.4 billion was invested by venture capital firms in crypto startups, and the investment interest in this type of firm is growing. A report by the research firm Absrbd indicated that over 70% of institutional investors were planning to put money in crypto in 2024.

DLT InvestmentsNow, beyond venture capital investments and new crypto companies, there are also numerous non-related crypto firms and governments using DLT somehow, or considering it. Among them, we have household names like BBVA, Barclays, Visa, Walmart, Ford, Pfizer, Siemens, Deloitte, Maersk, and British Airways; and governments from Dubai, Singapore, Seoul, Uganda, Massachusetts, and Buenos Aires. All of them, of course, have their own budgets and spending for this technology —but that’s a private affair.

\

According to some statistics from previous years, global investment in DLT solutions was expected to rise to nearly $19 billion by 2024. Additionally, these platforms are projected to contribute around $3.1 trillion in business value by 2030, potentially influencing 10-20% of the world’s economic infrastructure. This seems to be confirmed by a 2023 report by Casper Labs, in which they surveyed 603 global business decision-makers in the UK, China, and the US.

\ They found, among other things, that 87% of the surveyed parties were already planning to invest in DLT solutions. Besides, they also expect their technology budgets to rise over time —which would mean more money put into DLT efforts.

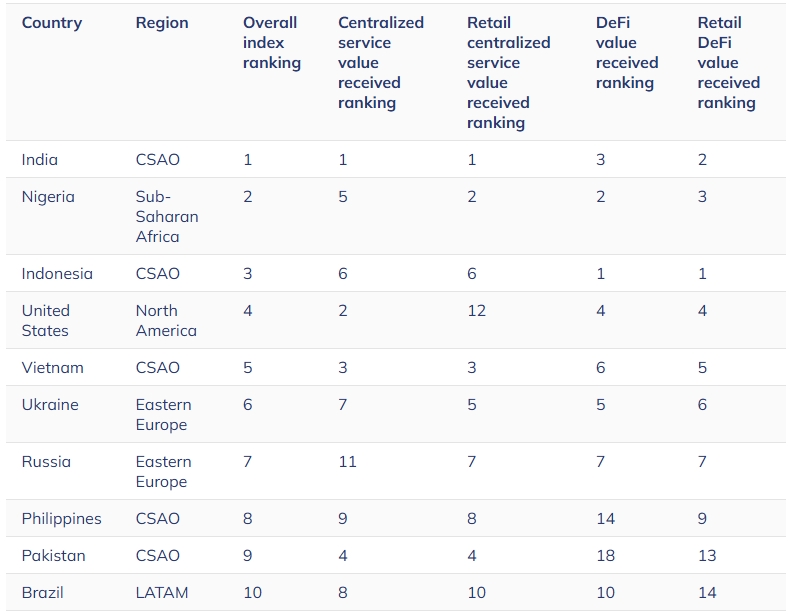

People and more people\ We can talk now about distribution and reach: the crypto industry is everywhere but on different levels. According to the last Global Adoption Crypto Index by Chainalysis, the region Central & Southern Asia and Oceania (CSAO) is leading the crypto adoption this year. Seven of the top 20 countries in crypto activity, such as India (#1), Indonesia (#3), and Vietnam (#5), are in this region, showcasing vibrant use across local exchanges, DeFi platforms, and merchant services.

\

Sub-Saharan Africa, represented by Nigeria (#2), also demonstrates strong adoption, especially for real-world uses like stablecoins. Meanwhile, North America and Western Europe see significant institutional activity, driven by events like the U.S. Bitcoin ETF launch. Conversely, retail and DeFi use is surging in regions like Latin America and Eastern Europe, supporting practical applications and altcoin activity.

\ We can say that crypto is very distributed and diverse for users, but that’s still a work in progress for founders and leaders. From the business side, the crypto industry is still dominated by white men from developed countries, while most average users are people who have been mostly excluded from traditional financial services, or whose countries have certain monetary issues or limitations.

An ecosystem for allAmong the sea of loosely similar crypto platforms, Obyte stands out as a complete, decentralized crypto ecosystem accessible to all, regardless of their background or applications. Its Directed Acyclic Graph (DAG) architecture eliminates intermediaries like miners, ensuring that every transaction is directly recorded without interference. This design makes Obyte censorship-resistant and empowers users by preventing centralized control, fostering true autonomy in digital financial activities.

\

\ Whether it's exchanging assets, participating in prediction markets, safely registering personal data, creating tokens, or managing funds with complex conditions, Obyte simplifies the experience for both beginners and experts. The wallet’s intuitive design and built-in chatbots lower barriers to entry, making powerful DLT tools accessible to everyone.

\ With its comprehensive features, Obyte evolves as a platform suitable for diverse applications, from simple peer-to-peer payments to IoT and business use cases. By continuously delivering innovative tools and updates, Obyte contributes meaningful value to the crypto industry as a whole.

\

Featured Vector Image by Freepik

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.