and the distribution of digital products.

Critical Bitcoin Indicator Flips Bullish – On-Chain Data Confirms BTC Uptrend

Bitcoin has surged above $69,000, marking a significant milestone after two weeks of impressive gains. Since October 10, the price has increased by over 17%, positioning itself to test the previous all-time highs of around $73,000 set in March.

This resurgence comes at a pivotal moment. Key data from Glassnode indicates a shift in the BTC trend from negative to positive, with a crucial indicator suggesting a bullish surge on the horizon.

This week will be particularly critical as the crypto market gains momentum, especially with the upcoming US presidential election on November 5. The political landscape often influences market sentiment, and the current optimistic environment for crypto could pave the way for further price appreciation.

Investors closely monitor Bitcoin’s movement, as breaking through the $70,000 mark could trigger significant buying pressure and potentially lead to new highs.

With both technical and fundamental factors aligning, the stage is set for Bitcoin to capitalize on the bullish momentum. As excitement builds, market participants are eager to see whether BTC can maintain its upward trajectory and what impact the broader economic context will have on its performance in the coming days.

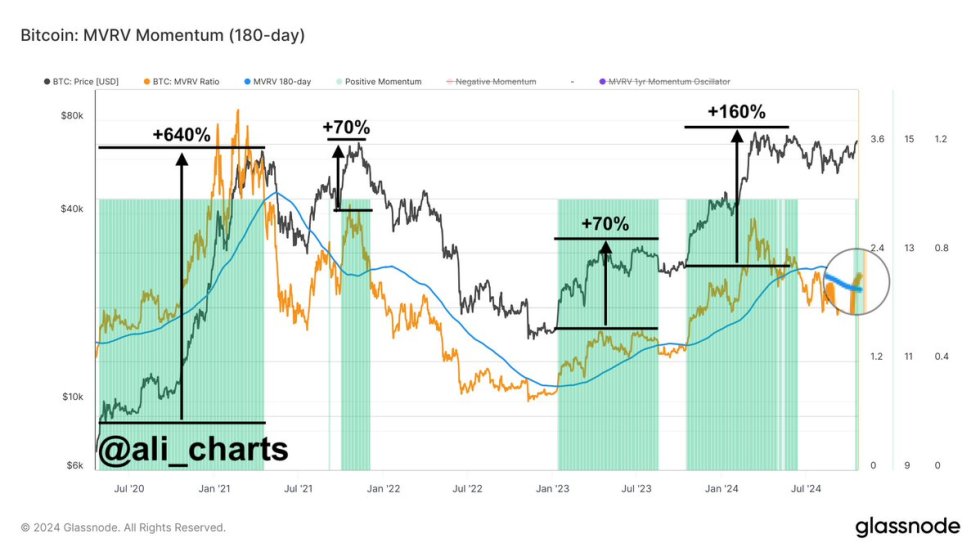

Bitcoin MVRV Momentum Signals An UptrendBitcoin is positioned for a further surge as key data from Glassnode reveals a significant shift in momentum, with the MVRV (Market Value to Realized Value) ratio flipping bullish. Top analyst and investor Ali Martinez shared a chart illustrating this positive development, showing that the MVRV ratio has surged past the MVRV 180-day threshold, indicating strong market dynamics.

The MVRV indicator provides insight into how overvalued or undervalued the current market is, and this recent uptick suggests that Bitcoin has transitioned from the accumulation phase that began in March into a new expansion phase.

This bullish momentum is critical as Bitcoin aims to break through key resistance levels and target new all-time highs. The psychological barrier of $70,000 looms large, and a sustained push above this level will be crucial to maintaining the current bullish trend.

As the price approaches this milestone, investors and analysts are closely watching market conditions and sentiment, anticipating significant volatility from increased trading activity.

The next few days will be pivotal for Bitcoin as it seeks to establish itself above these key levels. The recent shift in the MVRV ratio, coupled with positive market sentiment, paints an optimistic picture for BTC.

Suppose Bitcoin can continue to build on this momentum and attract new liquidity. In that case, it may soon pave the way for substantial price gains, reinforcing the bullish outlook for Bitcoin and the broader crypto market.

BTC Rising To ATHBitcoin (BTC) is trading at $68,300 after a remarkable surge from $62,000 last week. The price is approaching the last supply level that has held it back from price discovery, with the last weekly candle closing at $69,000— a critical level that marked the all-time high during the last cycle in 2021. Bulls are firmly in control, as the price is well above the daily 200-day moving average (MA), signaling potential further appreciation in the coming weeks.

However, there’s a chance that BTC may range below the all-time high before the upcoming election, as many investors are poised to either capitalize on a surge or take advantage of a dip to enter the market. This cautious sentiment is typical ahead of significant market events, leading to speculative trading behavior.

As we progress this week, the price action will be pivotal in determining the overall market direction for the coming months. Investors are keenly watching for signs of continued strength or potential retracements, making this a crucial period for Bitcoin as it navigates critical resistance levels.

Overall, the market sentiment remains optimistic, and how BTC reacts in the days ahead could set the tone for future gains.

Featured image from Dall-E, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.