and the distribution of digital products.

DM Television

CoinLoan Review | Crypto Lending, Made Simpler

In this article, we will review CoinLoan, a crypto-lending platform founded in 2017 and currently licensed under the Estonia Financial Authority.

They offer instant loans and up to 12.3% interest on cryptocurrencies, stablecoins, and FIAT. You can also buy, sell, and swap assets. The platform is completely secure.

CoinLoan Review: Summary- CoinLoan is a P2P European Crypto-lending platform.

- They allow you to earn daily compound interest up to 12.3% on eighteen supported cryptocurrencies, stable coins, and FIAT.

- CoinLoan offers Crypto-to-Fiat Loans, Crypto-to-Crypto Loans, and Fiat-to-Crypto Loans with unique features such as no lock-ins, flexible repayment schedule, and no credit history checks.

- You can buy, sell and swap assets. They also support FIAT transfers through SWIFT, SEPA, Visa, MasterCard, Wire Transfers, and AdvCash.

- CoinLoan provides its native token CLT.

- They offer a user-friendly platform that supports Android and iOS.

- They use various techniques to secure their platform and are completely transparent about their security practices.

CoinLoan allows you to earn compound interest by depositing your fund in the Coinloan interest account.

Features- Your funds are never locked, and you can withdraw them whenever you want.

- The minimum deposit period is one day.

- The interest is paid in the same currency in which you deposit.

- Interest is deposited daily at 14:00 UTC. Compounded interest is credited to your account on the first day of the month at 15:00 UTC.

- The funds you deposit are used to fund collateralized loans, which helps CoinLoan pay you the interest.

The following table shows the interest rates of all the supported cryptocurrencies. The rates include a 2% CLT staking reward.

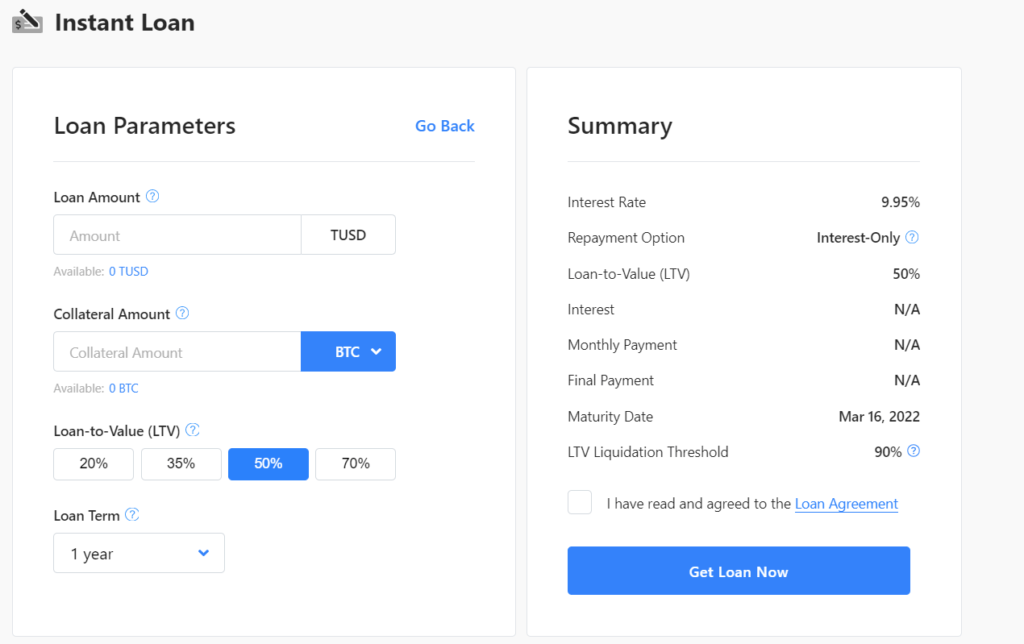

CoinLoan BorrowCoinLoan offers loans against cryptocurrencies, stablecoins, and fiat. The loans are approved instantly. No paperwork or credit history checks are required since the collateral assets is the only thing that matters. It is mandatory to complete KYC verification before applying for loans.

The LTV ratio can be 20% ,35%, 50% and 70%. The lower the LTV, the higher is the extent of collateral fluctuations. The collateral amount can also be increased during an active loan decreasing the LTV.

Your collateral is held safely at the custodian. The interest rates vary from 4.95% to 11.95%, according to the LTV ratio.

The minimum loan period is one month, and the maximum is three years. The minimum loan amount varies for all the assets. You can take an unlimited number of loans. All the information about your loans will be under the “My Loans” section.

You can repay your loan faster by paying interest only for the used time. It is not mandatory to repay the loan in the same cryptocurrency you had received the loan. There are no fines or lock-ins.

You will receive notifications and emails according to your payment schedule. CoinLoan will try to make an automatic repayment if you cannot pay the loan if you have funds in your CoinLoan wallet. If there are no funds, they will liquidate a part of your collateral to complete the repayment.

CoinLoan Borrow

CoinLoan Crypto Exchange

CoinLoan Borrow

CoinLoan Crypto Exchange

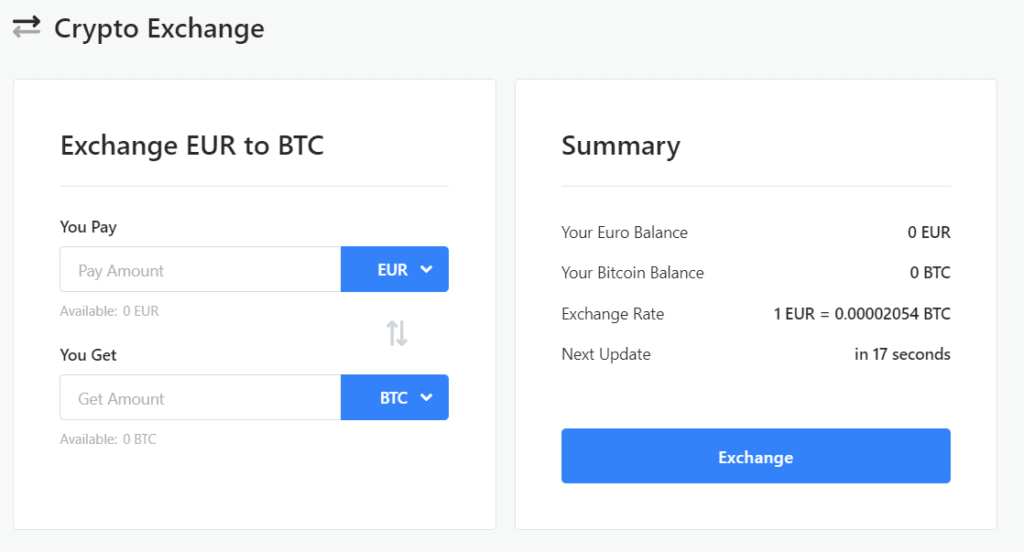

CoinLoan Crypto Exchange provides buying, selling, and swapping of assets. They offer competitive exchange rates.

FIAT transfers can be completed using any of the following four options –

- SWIFT (Available globally)

- SEPA (For Euro and Eurozone citizens)

- Visa and MasterCard (Available globally)

- AdvCash (Available globally except the USA)

CoinLoan also supports USD Wire Transfers in some of the countries.

CoinLoan Crypto Exchange

CoinLoan Token & User Experience

CoinLoan Crypto Exchange

CoinLoan Token & User Experience

CLT is the native token of CoinLoan and according to CoinMarketCap, its current rank is 3046. CoinLoan offers a user-friendly platform. They also have a mobile application to help you manage your funds on the go. They support both Android and iOS.

CoinLoan Review: SecurityCoinLoan stores the majority of the funds in cold multi-signature wallets. The private keys are not stored in network-connected devices. All the withdrawals are processed manually, and this may cause a minor delay but improves security.

All the transactions are signed offline on offline devices, which involves several people. All the operations performed by CoinLoan comply with Cryptocurrency Security Standard (CCSS).

All the assets are stored in BitGo, with insurance of $100 million from Lloyds.

The encrypted part of the keys is stored in geographically distributed banks’ safe deposit boxes. This safeguards the keys from any natural disasters such as floods, fires, earthquakes, and more.

To encrypt all the client traffic to the server, they use SSL with TLS 1.3, DNSSEC, HSTS.

They use Time-based One-time Password (TOTP) for two-factor authentication for each login attempt, fund withdrawal, password reset, and other essential actions.

The infrastructure is monitored 24/7 for identifying abnormal activity and system errors. Their servers are not connected directly to the internet. Additionally, the Bug Bounty Program helps them to analyze vulnerabilities or bugs.

CoinLoan Fees 1. DepositsCoinLoan deposits in cryptocurrencies are free. FIAT deposits are also free except using Visa/MasterCard 2 EUR + 4.2% (from deposit amount) is charged.

2. WithdrawalsCoinLoan Withdrawals in FIAT and cryptocurrencies are free.

3. LiquidationCoinLoan liquidation fee is 7% of the liquidated loan collateral.

4. Borrowing FeesCoinLoan borrowing fees is 1% of the principal amount. If you pay using CoinLoan Tokens (CLT), you will get a 50% discount on the borrowing fee. The remaining amount is converted into CLT according to the market value.

CoinLoan Review: Customer SupportYou can write to them at [email protected] and [email protected].They have an interactive Telegram community.

You can also connect with them on Twitter.

Additionally, they have two helpline numbers – +372 634 6411 and +1 (657) 220-1706

CoinLoan Review: Pros and Cons Pros- High-Interest rates

- High LTV ratio

- Flexible Repayment options

- Available worldwide

- Support FIAT transfers through SWIFT, SEPA, Visa, MasterCard, Wire Transfers, and AdvCash.

- Easy to use

- It is a relatively new platform.

CoinLoan is a regulated crypto lending platform. The instant loans with unique features attract users. They offer a high LTV ratio with flexible repayment options.

Additionally, they also provide high-interest rates on parking your funds with no lock-ins. CoinLoan uses various measures to ensure that the platform is completely safe.

Frequently Asked Questions (FAQ) Is CoinLoan legit?Yes, CoinLoan is legit . It is a crypto lending platform licensed under Estonia Financial Authority. They have insurance of $100 million from Lloyds, and assets are stored in BitGo. It is a secure platform and is safe to use.

What kind of loans does CoinLoan offer?CoinLoan offers Crypto-to-Fiat Loans, Crypto-to-Crypto Loans, and Fiat-to-Crypto Loans.

Is it mandatory to complete KYC verification for performing any transaction in CoinLoan?Yes, CoinLoan is a regulated platform, and it is necessary to complete KYC verification to perform any transaction. It takes only a couple of minutes to complete it.

Does CoinLoan support FIAT transfers?Yes, CoinLoan supports FIAT transfers through SWIFT, SEPA, Visa, MasterCard, Wire Transfers, and AdvCash.

Does CoinLoan perform any credit history checks for loan approval?No, CoinLoan approves loans instantly based on the collateral. No credit history checks or paperwork is required.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.