and the distribution of digital products.

DM Television

Challenges of Real-Time Data Processing in Financial Markets

\ As someone who's worked in the trenches of financial markets, I've seen firsthand the importance of real-time data processing. During my time at Two Sigma and Bloomberg, I witnessed how even minor delays can have significant consequences. In this article, I'll share my insights on the challenges of real-time data processing in distributed systems, using examples from the financial industry.

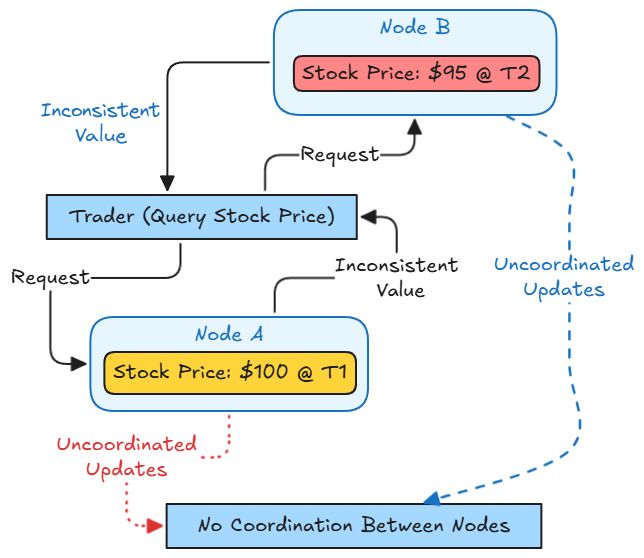

Data Consistency: The Achilles' Heel of Distributed Systems

\ Imagine you're a trader, relying on real-time market data to make split-second decisions. But what if the data you're receiving is inconsistent? Perhaps one server thinks the price of Apple is $240, while another sees it at $241. This discrepancy might seem minor, but in the world of high-frequency trading, it can be catastrophic.

\ To ensure data consistency, financial institutions employ various techniques, such as:

- Event sourcing: By storing all state changes as a sequence of events, systems can reconstruct the latest state, even in the event of a failure.

- Distributed consensus algorithms: Protocols like Paxos or Raft enable nodes to agree on a single source of truth, even in cases of network partitioning.

\ However, these solutions can introduce additional complexity, particularly in high-throughput environments.

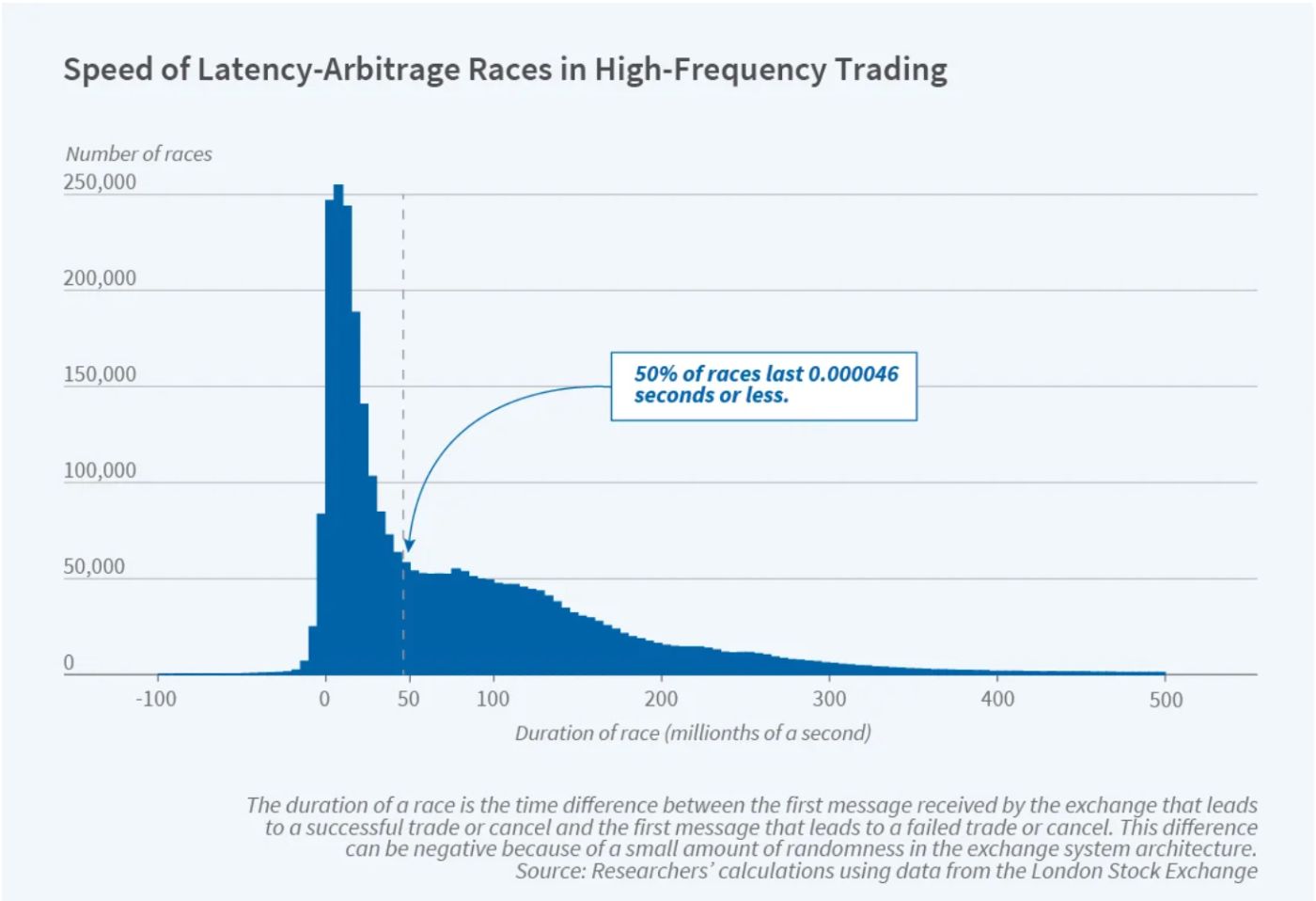

Latency: The Need for Speed

\ In financial markets, latency can make or break a trade. High-frequency trading firms invest heavily in infrastructure to minimize latency, and even the smallest inefficiency can have significant consequences. Real-time market data must be processed and delivered to consumers with extremely low latency.

\ To address latency, financial institutions employ strategies such as:

- Edge processing: By processing data closer to its source, systems can reduce latency and improve performance.

- Hardware acceleration: Utilizing specialized hardware, such as FPGA, can significantly reduce processing times for critical tasks.

- Optimized message brokers: Choosing the right message broker, such as Kafka or Pulsar, is crucial in ensuring that data is pushed to consumers as quickly as possible.

No system is immune to failure, but in financial markets, fault tolerance is paramount. If a single node or service goes down, consumers cannot afford to lose critical market data.

\ To ensure fault tolerance, financial institutions employ strategies such as:

- Replication: Market data is replicated across multiple servers or regions to ensure continuity in the event of a failure.

- Automatic failover: Systems are designed to detect failure and route traffic to healthy servers without human intervention.

- Distributed logging: Distributed logs, such as Kafka's log-based architecture, ensure that all actions are recorded and can be replayed in the event of a crash.

Financial markets are inherently unpredictable, and systems must be designed to handle sudden surges in traffic. Scalability is critical to ensure that systems can handle explosive growth without degrading performance.

\ To achieve scalability, financial institutions employ strategies such as:

- Sharding: Market data is divided into smaller chunks and distributed across different servers to improve performance.

- Load balancing: Incoming data is efficiently distributed across multiple nodes or servers to avoid bottlenecks.

- Elasticity: Systems are designed to scale up or down based on demand, ensuring that resources are allocated efficiently.

\ Finally, security is paramount in financial markets. Distributed systems, by their nature, involve multiple servers, databases, and services spread across various regions, making them vulnerable to attacks.

\ To ensure security, financial institutions employ strategies such as:

- Encryption: Data is encrypted both in transit and at rest to prevent eavesdropping or unauthorized access.

- Authentication and authorization: Only authorized parties can access sensitive market data feeds, using techniques like OAuth and API keys.

- DDoS mitigation: Systems are designed to detect and prevent Distributed Denial of Service (DDoS) attacks, ensuring availability and performance.

Real-time data processing in distributed systems is a complex challenge, particularly in high-stakes environments like financial markets. By understanding the challenges of data consistency, latency, fault tolerance, scalability, and security, financial institutions can design and implement more efficient, resilient, and scalable systems.

\ As the financial industry continues to evolve, the quest for near-zero latency, high availability, and real-time data processing will only become more critical. By sharing my insights and experiences, I hope to contribute to the ongoing conversation about the challenges and opportunities in real-time data processing.

\ Image Courtesy:

- https://www.nber.org/digest/202110/race-exploit-stock-price-differences-between-exchanges

- https://www.linkedin.com/pulse/distributed-systems-design-pattern-lease-based-stock-shanoj-kumar-v-0bawc/

- https://blog.e-boks.com/understanding-data-encryption-a-comprehensive-guide-for-regulated-industries

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.