and the distribution of digital products.

DM Television

Blockpit Review : Is it the Best Tax Solution?

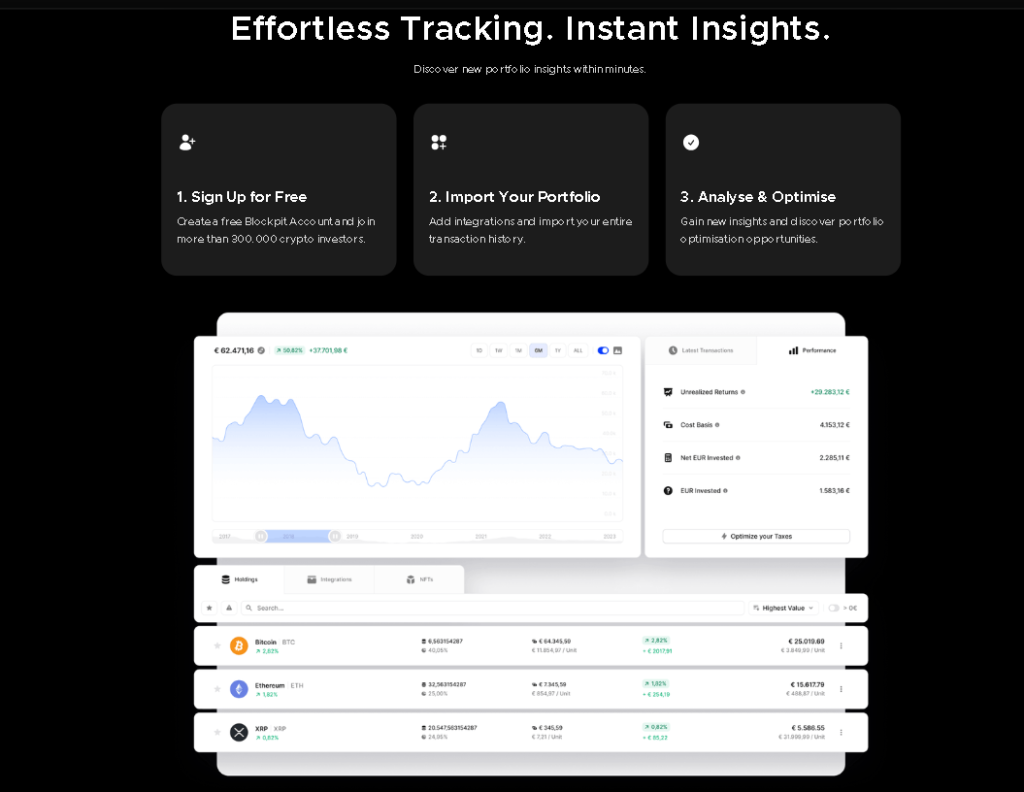

Blockpit is an automated solution for portfolio tracking and tax reports on cryptocurrency. It offers intelligent trade matching across exchanges and smooth integration with exchanges. We will discuss everything about Blockpit in this article.

What is Blockpit?Blockpit is an automated web- and mobile-based solution for crypto tax filing and portfolio management. It links its services to other exchanges’ APIs, like Kraken, Bitpanda, Coinbase, Binance, and many more. Blockpit wants to allow its customers to easily link their transactions, wallets, mining incentives, and other revenue streams like airdrops into a single dashboard.

The dashboard briefly overviews the gains that must be reported to the tax authorities. Users of Blockpit can also create tax reports, which one of its legal partners can examine and authorize.

Visit Blockpit Now Users can also create tax reports

Blockpit Features

Users can also create tax reports

Blockpit Features

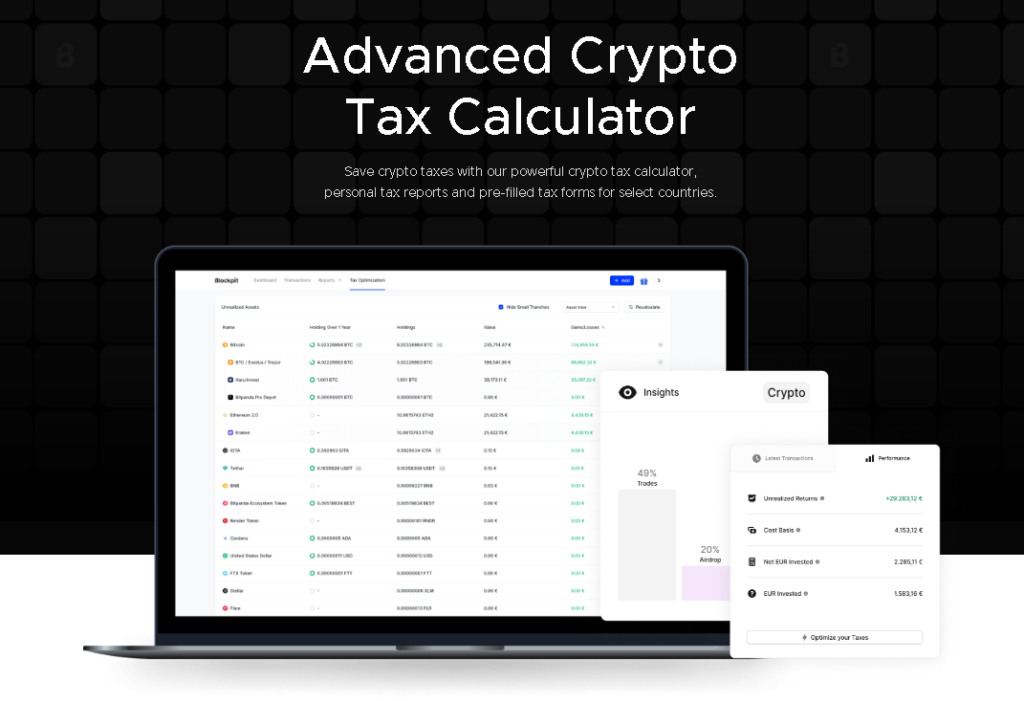

- Blockpit offers crypto tax calculator personal tax reports, actionable tax-saving opportunities, and pre-filled tax forms for select countries.

- Furthermore, it ensures accurate financial reporting and saves time by enabling the automatic import of transaction data into CRM systems, eCommerce stores, and accounting software.

- It is simple to import transactions using CSV files and APIs, enabling frequent imports to stay updated with monthly activity. Dates, times, or events can be used to schedule recurring imports.

- It is possible to measure essential parameters like net worth, cash flow, and ROI, which may be used to assess asset fit, spot dangers, and make wise decisions.

- The platform offers automated categorization of transactions, simplifying the process of organizing and classifying various crypto transactions for tax purposes.

- The tax calculator enables the automatic and manual merging of transactions, allowing users to consolidate and reconcile multiple transactions into a single entry.

- Users can track their cryptocurrency transactions and holdings in real-time, providing up-to-date insights into their financial activities and enabling proactive tax planning.

- The platform offers access to historical price feeds, allowing users to retrieve past cryptocurrency prices for accurate valuation and calculating profits and losses.

- This tax calculator provides robust tools for analyzing profits and losses associated with cryptocurrency transactions.

- In addition, it offers a comprehensive crypto dashboard that gives users a centralized view of their cryptocurrency portfolio, transactions, and tax-related data.

The platform offers access to historical price feeds

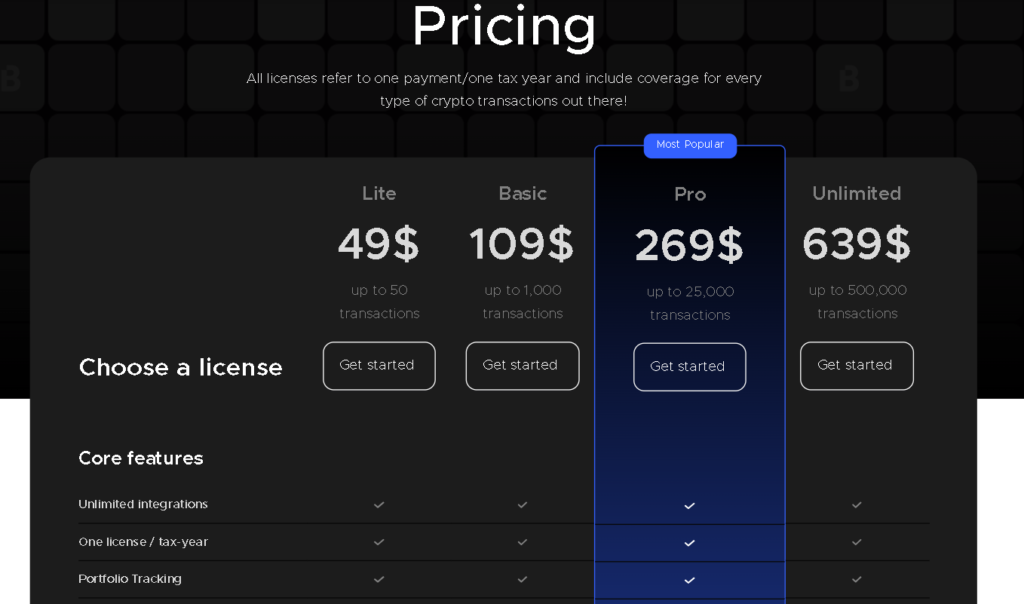

Blockpit Pricing

The platform offers access to historical price feeds

Blockpit Pricing

Pricing

Blockpit Supported exchanges

Pricing

Blockpit Supported exchanges

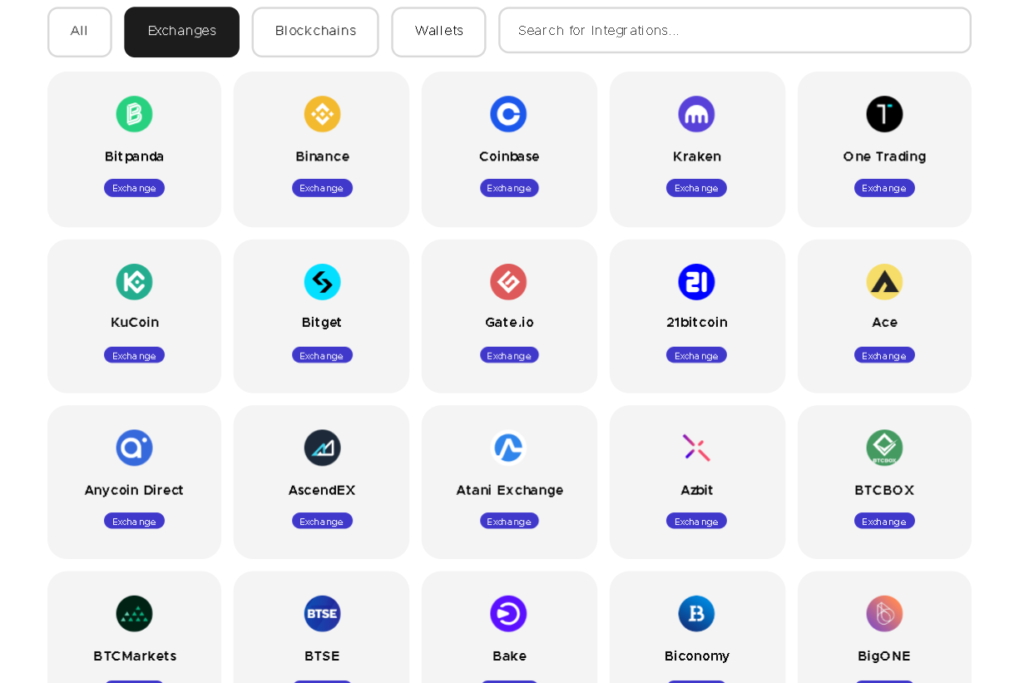

- Blockpit supports several cryptocurrency exchanges. It welcomes people to notify it of any exchanges they believe should be added and constantly strives to add them.

- Binance, BitFinex, BitFlyer, AscendEX, BitMart, BitMEX, Bitpanda, Bitpanda Pro, Bitstamp, Bittrex, Bitvavo, Blockchain.com, Indodax, Kraken, ByBit, Celsius, Coinbase, Coinbase Pro, CoinEx, Coinfinity, Crypto.com, Deribit, FTX, Gate.io, Gemini, HitBTC, Huobi, Kucoin, Latoken, MEXC Global, OKX, Paymium, Phemex, Poloniex, WhiteBIT and many more.

It supports several cryptocurrency exchanges

Blockpit Supported Wallets

It supports several cryptocurrency exchanges

Blockpit Supported Wallets

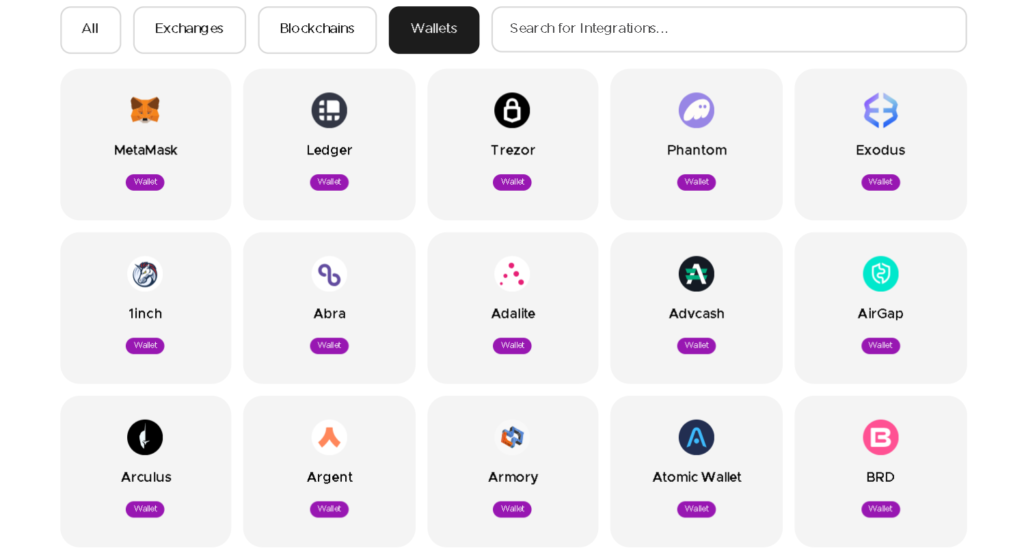

Blockpit supports several popular and secure cryptocurrency wallets. It is always working hard to expand support for new wallets like cryptocurrency exchanges. Trezor, MyEtherWallet, Electrum, Exodus, Ledger, Metamask, and Bitbox are currently supported, among many others.

It is always working hard to expand support for new wallets

Conclusion

It is always working hard to expand support for new wallets

Conclusion

In conclusion, Blockpit offers a robust and comprehensive cryptocurrency tax reporting and portfolio management solution. Overall, Blockpit’s crypto tax software is a valuable resource for businesses and individuals seeking to navigate the complexities of cryptocurrency taxation and portfolio analysis.

What kind of analysis and insights can I expect from Blockpit's tax software regarding my crypto profits and losses?It has a tax software that offers in-depth analysis and insights into your crypto profits and losses. It provides comprehensive reports on your cryptocurrency transactions, including capital gains and losses, additional income, and adjustments to income. You can expect detailed breakdowns of your investment performance, historical price feeds for accurate valuation, and tools to assess tax implications. This analysis empowers you to make informed financial decisions and ensures compliance with tax regulations.

What are the benefits of Crypto tax softwares?Crypto tax software can be advantageous to a wide range of people, including:

Traders: To accurately determine your tax obligation, you must find a method to record all of your transactions, profits, and losses if you are a frequent buyer, seller, or trader of cryptocurrencies.

Traders: Portfolio tracking capabilities let HODLers and long-term investors monitor the success of their holdings across exchanges and wallets.

Experts in taxes: Make sure your clients follow tax regulations using crypto tax software.

What features should you consider for crypto tax software?Verify that the crypto tax software you selected provides tax reporting tailored to the nation you reside in. Specific crypto tax solutions can offer specialized reports and analyses tailored to your nation’s tax structure, but others produce generic tax reports.

Similarly, to minimize the work involved in manually importing transactions, automatic imports of the transaction data from cryptocurrency exchanges, wallets, and blockchains are essential.

Additionally, attentive customer service is something to be wary of.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.