and the distribution of digital products.

DM Television

BitMEX Margin Trading | A Guide for Beginners

Estimated reading time: 17 minutes

Margin Trading has been a tedious concept for most of the folks out there. However, when done after proper analysis and through a reliable crypto exchange, it can deliver high returns. BitMEX is one of the early mover and the best margin trading exchanges in the world.

Table of contents- Summary (TL;DR)

- What is BitMEX?

- What is BitMEX leverage trading?

- How does BitMEX margin trading work?

- What are BitMEX perpetual contracts?

- What are BitMEX futures?

- BitMEX Leverage

- Features provided by BitMEX

- What is BitMEX daily insurance fund?

- BitMEX Fees

- How to use BitMEX?

- BitMEX Margin Trading: Pros and Cons

- BitMEX Margin Trading: Conclusion

- Frequently Asked Questions

- BitMEX allows you to open positions using leverage, through which you can increase your returns.

- It has advanced order options to make the order placing process more relevant.

- Trading in future and perpetual contracts is possible at BitMEX.

- BitMEX offers a leverage of up to 100x.

- Bitcoin is the only option to deposit funds on BitMEX.

- Various features like calculate, hidden, post only, etc., are available while trading.

- BitMEX charges a margin trading fee of 0.075%.

- You can verify your account in four simple steps on BitMEX.

BitMEX stands for Bitcoin Mercantile Exchange and hence provides trading services only through bitcoins. BitMEX deals with crypto and futures margin trading with a leverage of your choice.

BitMEX owns an outdated but complex user interface and hence offers BitMEX testnet to beginners. BitMEX testnet allows you to try all the features of the platform without actually investing any funds.

What is BitMEX leverage trading?So, first of all, let us understand margin trading in simple words. In BitMEX Margin trading, you can buy multiple assets at another asset’s cost with your capital as collateral.

The exchange provides you with various leverage options. For instance, if the margin is 10x, then you can buy ten assets at the cost of one.

Bitmex Margin Trading

How does BitMEX margin trading work?

Bitmex Margin Trading

How does BitMEX margin trading work?

Suppose bitcoin’s value is 50k USDT; now suppose you use a 10x margin on the BitMEX margin trading tab. By this, you can buy ten bitcoins for the cost of one, i.e., 50k USDT. Here, the exchange lends you the remaining amount using your 50k USDT as collateral.

So now, if the price of bitcoin increases by 10%, then you secure a profit of 10% on ten bitcoins. It sounds good, isn’t it? However, if the price of bitcoin slips down by 10%, you will lose all your collateral.

BitMEX Cross MarginSpread margin or Cross margin at BitMEX allows you to use all the funds in your margin trading account to prevent liquidations. The PNL from your one position can help save another position from liquidation.

In some instances, cross margin can lead to higher loss than your original capital. However, you can prevent this from happening by using hedging in cross margin trading. To know more about hedging, click here.

You can use isolated margin for opening short-term positions and take instant returns. The isolated margin opens a position with a liability of only your initial margin. The exchange won’t add more funds from your main account to that position to prevent liquidation.

Isolated won’t cause you to lose more than your initial margin for a particular position. However, you won’t be able to save your position in case of liquidations.

What are BitMEX perpetual contracts?A perpetual contract at BitMEX margin trading resembles future contracts in many ways. However, it has some fundamental differences that make it unique from future contracts. Let us understand perpetual contracts in simple terms:

- As the name suggests, there is no time constraint on perpetual contracts in your position.

- It is quoted in contracts and is available for bitcoin west dollar pair. That is 1 contract = 1 USD.

- Perpetual contracts on BitMEX act very similar to a margin-based spot market and hence trade close to Price’s underlying reference Index.

- Each Perpetual contract has its specifications of the reference index, funding rate, and maximum leverage.

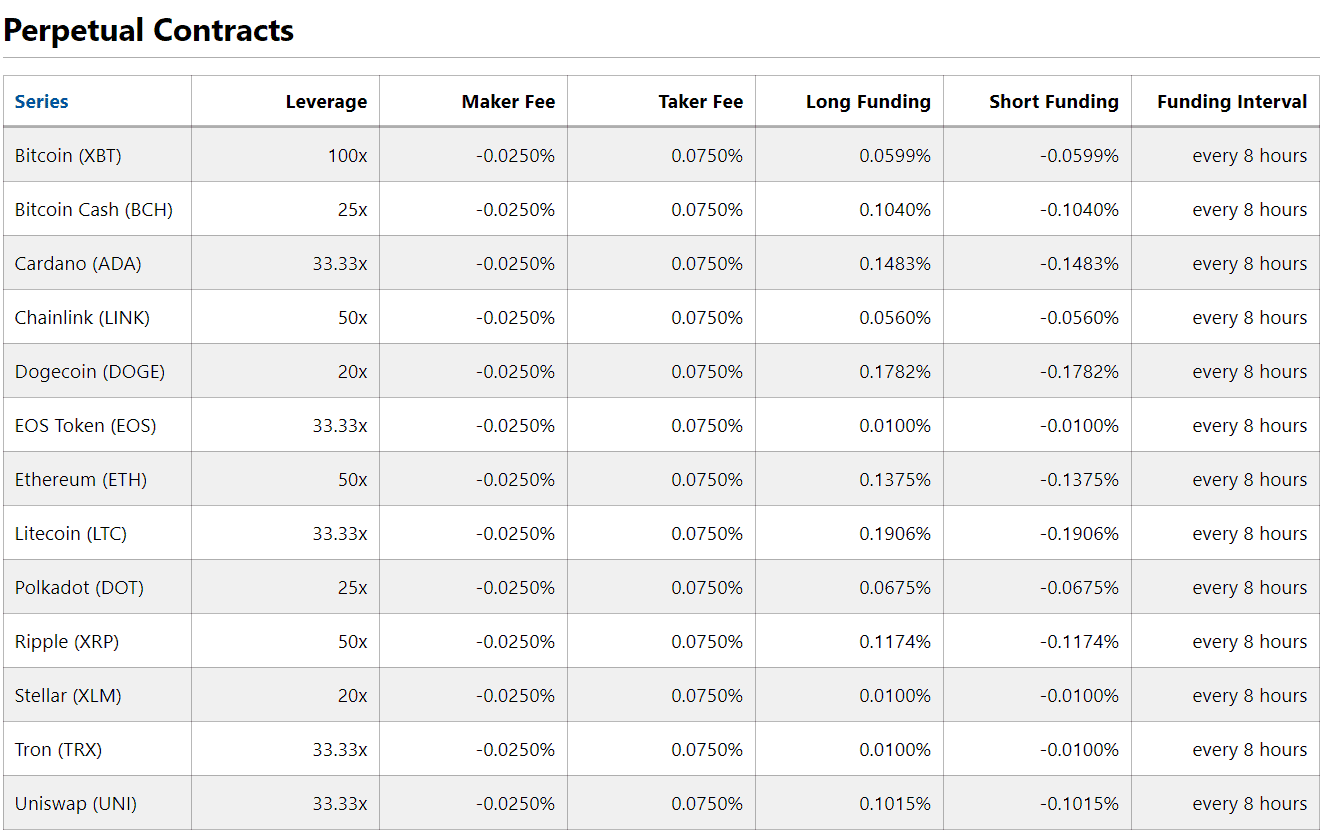

BitMEX perpetual contracts

What are BitMEX inverse perpetual contracts?

BitMEX perpetual contracts

What are BitMEX inverse perpetual contracts?

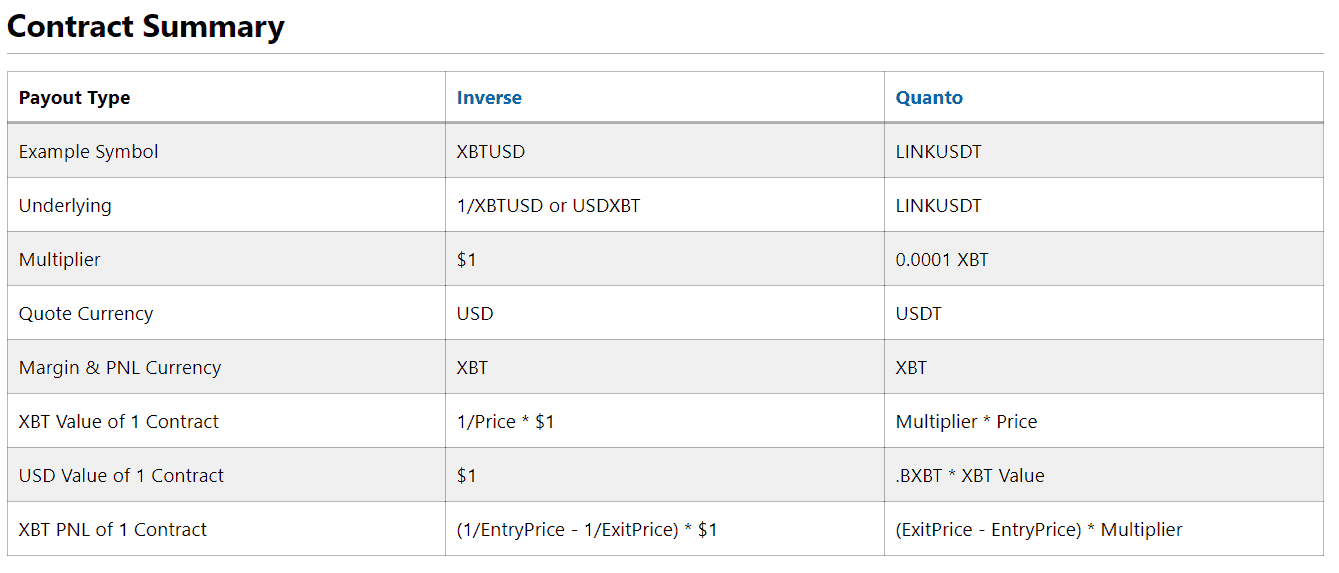

Every inverse contract has an already fixed value for the quote currency. This inverse contract is perfect for traders who wish to go for long or short US dollars against bitcoins.

For instance, in the XBT/ USDT perpetual contract, its value is quoted as XBT/ USDT, but the underlying is USDT/ XBT or 1 / (XBT/ USDT). So it is an inverse in which each contract is worth $1 of Bitcoin at any price.

What are BitMEX Quanto perpetual contracts?Quanto contracts exist for straightforward interpretation and trading. In this, the instrument itself settles in another currency at some fixed rate. The traders using Quanto contracts are subject to some risks even though the underlying assets are not bitcoin.

BitMEX Quanto perpetual contract Summary

What are BitMEX futures?

BitMEX Quanto perpetual contract Summary

What are BitMEX futures?

In the Futures contract, the trader does not deal with the current prices of the bitcoin. However, the traders have an agreement to buy/ sell a commodity at a predetermined price at some point in the coming future.

Future contracts at BitMEX allow leverage up to 100x in some assets. Let us now understand the three different types of future contracts in BitMEX:

- Quanto futures: It is the same as discussed in perpetual contracts.

- Linear futures: It is the simplest one and deals with many altcoins futures. The price of this contract is equal to the value of the underlying commodity in XBT (Bitcoin). Every contract holds the value of one unit against the underlying.

- Inverse futures: Like perpetual contracts, each inverse future holds a fixed amount of value of the quote currency.

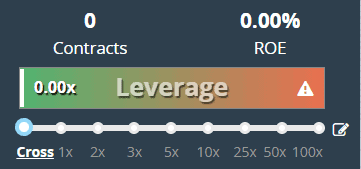

BitMEX offers leverage in the range of 1x to 100x. However, the leverage of 100x is available only for some specific assets.

BitMEX Leverage

Features provided by BitMEX

BitMEX Leverage

Features provided by BitMEX

BitMEX offers many features to its users and has a detailed explanation for those on the exchange itself. However, we will cover most of those below, mentioning how you can use them for your benefit.

Limit orderThese orders specify the maximum or minimum price at which the traders wish to open a position. It is perhaps the best possible way to trade at BitMEX. In simple words, the order is placed and executes when the price reaches your specified limit.

BitMEX Limit order

Market orders

BitMEX Limit order

Market orders

Market orders execute at the current market price of the asset. The traders who need to deploy urgent execution use these orders.

Stop-market orderA stop-market order executes when the market reaches the trigger price. The stop order becomes a limit order when the market price is achieved. You can use stop-market order to minimize losses of open positions.

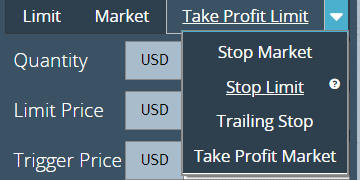

Stop-limit orderYou can use this option as an alternative to stop-orders, and it allows you to control your exits from a position.

Stop-limit order

Trailing stop order

Stop-limit order

Trailing stop order

A Market Order is triggered when the price reverts by an amount equal to the trailing Value. A negative trail value indicates trailing sell, and a positive trail value indicates trailing buy.

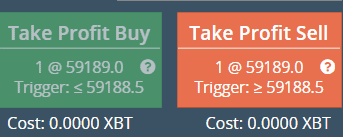

Take profit limit orderTake profit limit order behaves like a stop order, but the triggers work in opposite directions. In this, a limit order comes into existence when the market reaches the Trigger Price.

Take profit market orderIn this, the market order executes when the market strikes the specified Trigger price. You can use this to set an entry point for a new position or exit a position with profit.

How to long on BitMEX?By going long, you open a position predicting a rise in the value of the underlying asset. You buy the asset at a lower price and then sell it at a higher price to keep the difference as your profit. You can go long by clicking on the Buy Market/ green button on the trade tab.

How to long on BitMEX?

How to short on BitMEX?

How to long on BitMEX?

How to short on BitMEX?

By going short, you predict a fall in the price of an underlying asset. You sell the borrowed assets from the exchange at a higher price and then repurchase them at a lower price. You can go short by clicking on the Sell market/ red button on the trade tab.

BitMEX CalculatorYou can find it within the place order section to the upper left part of BitMEX‘s interface. You can access it by clicking on the calculator icon lying just beside the settings. This assists in calculating longs/shorts, margin, and profits/losses.

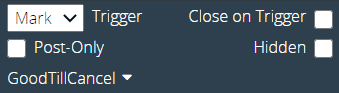

Close on triggerIf there is no adequate margin-left to execute, it attempts to cancel other open orders in the same symbol. You can use this order if there is a market reversal. Apart from this, it is considered a high-priority order.

BitMEX Close on trigger

Post only

BitMEX Close on trigger

Post only

This option is available in the place order section. Post only ensures that a limit order is only added to the order book if it does not match any pre-existing order. In this way, you also get a guaranteed maker rebate or refund for adding liquidity to the order book.

HiddenIt is a sort of limit order that does not appear on the public order book. You can access it while checking the hidden box via selecting the Limit Order, Stop Limit Order, or Take Profit Limit Order. So why even you should think of this hidden way out? It is simple; when you do not want the market to be aware of your trading intentions, you can hit on the hidden orders checkbox.

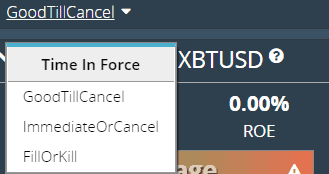

Good till cancelIt is one of the advanced trading options. You can use this to buy or sell a position until the order is filled or canceled.

BitMEX Good till cancel

Immediate or cancel

BitMEX Good till cancel

Immediate or cancel

This simply means that a position cancels if it remains unfilled.

Fill or killIt is the whole or nothing. If the volume is not adequate to extract the entire command, then do not execute it in any case.

Leverage sliderThis slider is the essence of margin trading on BitMEX. By using this, you can set the leverage/margin from the range of 1x to 100x.

BitMEX Leverage slider

What is BitMEX daily insurance fund?

BitMEX Leverage slider

What is BitMEX daily insurance fund?

This feature of the insurance fund is pretty much impressive on BitMEX as compare to other similar platforms. In simple words, the traders who make profit gain returns. In contrast, the exchange prevents the traders’ losses whose market predictions go sideways with an insurance fund’s help.

BitMEX Fees BitMEX Deposit and withdrawalsBitMEX does not charge any fee for deposits and withdrawals of Bitcoin. However, when you want to withdraw bitcoin, there can be minimum bitcoin withdrawal fees based purely on the blockchain congestion. You’ll get to have a look at the dynamic fee on the withdrawal page.

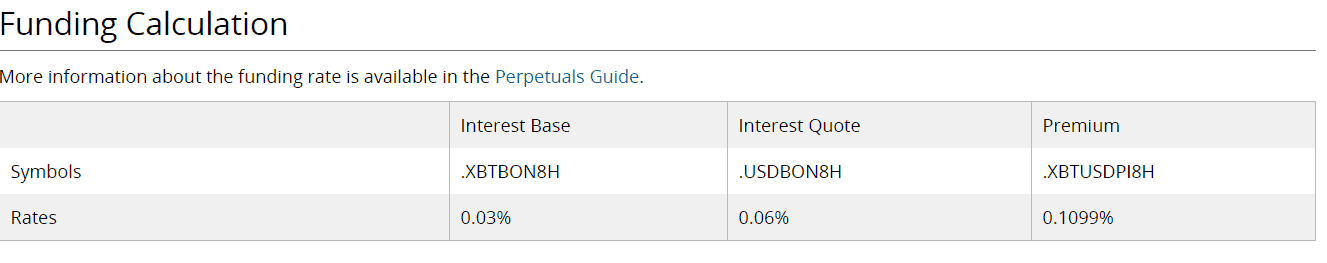

BitMEX Trading feesBitMEX charges a trading fee of 0.075% from its users, and you can know more about it by clicking here. Moreover, any open position in your order book will lead you to a settlement fee during settlements.

BitMEX Trading fees

BitMEX Funding fees

BitMEX Trading fees

BitMEX Funding fees

BitMEX charges a funding fee of 0.01% in an interval of 0.08% if you leave a position open for more than 8 hours.

BitMEX Funding fees

How to use BitMEX?

BitMEX Funding fees

How to use BitMEX?

After all, it is essential to understand the few steps to trade on BitMEX. So that without wasting time and distracting yourself, you can directly begin with your trade. Below are some simple steps to help you with the same.

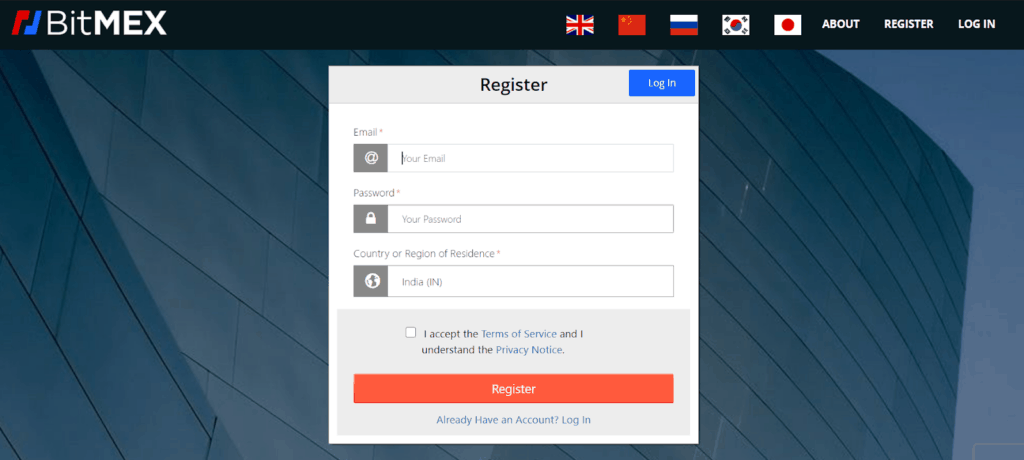

How to sign-up at BitMEX?It is super easy to sign up on BitMEX. Here are the steps:

- Go to the official website of BitMEX.

- Click on the register and enter your email and password.

- Select your country.

- Read all the terms and conditions and then click on the checkbox.

- Now click on register and then check for the verification email in your inbox.

- Open the verification email and click on the verification link.

BitMEX SignUP

How to verify your account at BitMEX?

BitMEX SignUP

How to verify your account at BitMEX?

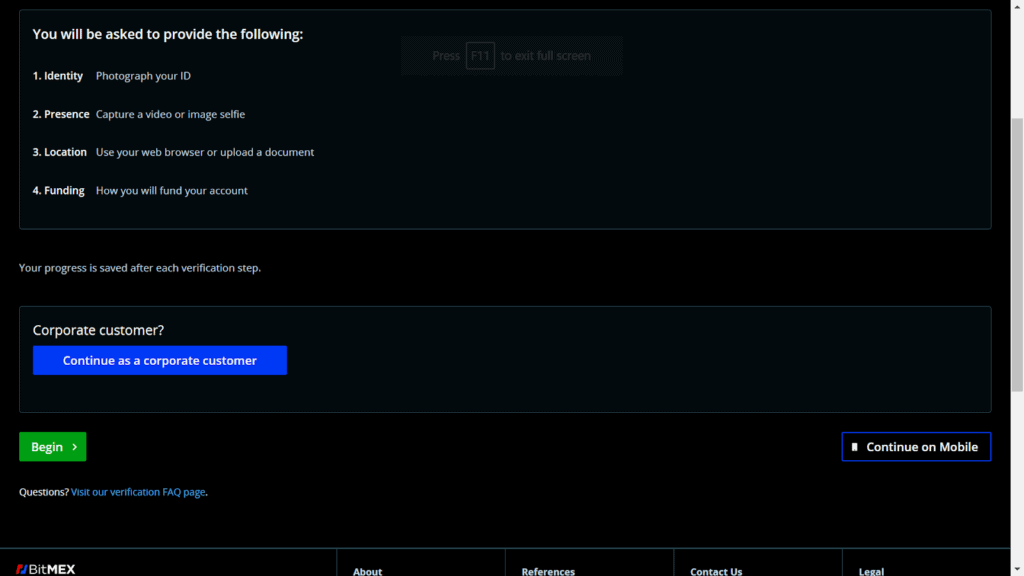

You can see a banner to verify your account once you sign in to your BitMEX account. Inside which you will find all these four options to complete your account verification. Here are the steps to do the same

- Identity: You can verify your identity by uploading your passport or driving license on the BitMEX. You can take a photo or upload a file of the same.

- Presence: To verify your presence, you can upload a photo or video of yourself under the presence option.

- Location: For verifying your location, either turn on your browser location or upload address proof of your location.

- Funding: In this, you have to answer a few questions about funding your account and your experience.

BitMEX Verification

How to deposit funds at BitMEX?

BitMEX Verification

How to deposit funds at BitMEX?

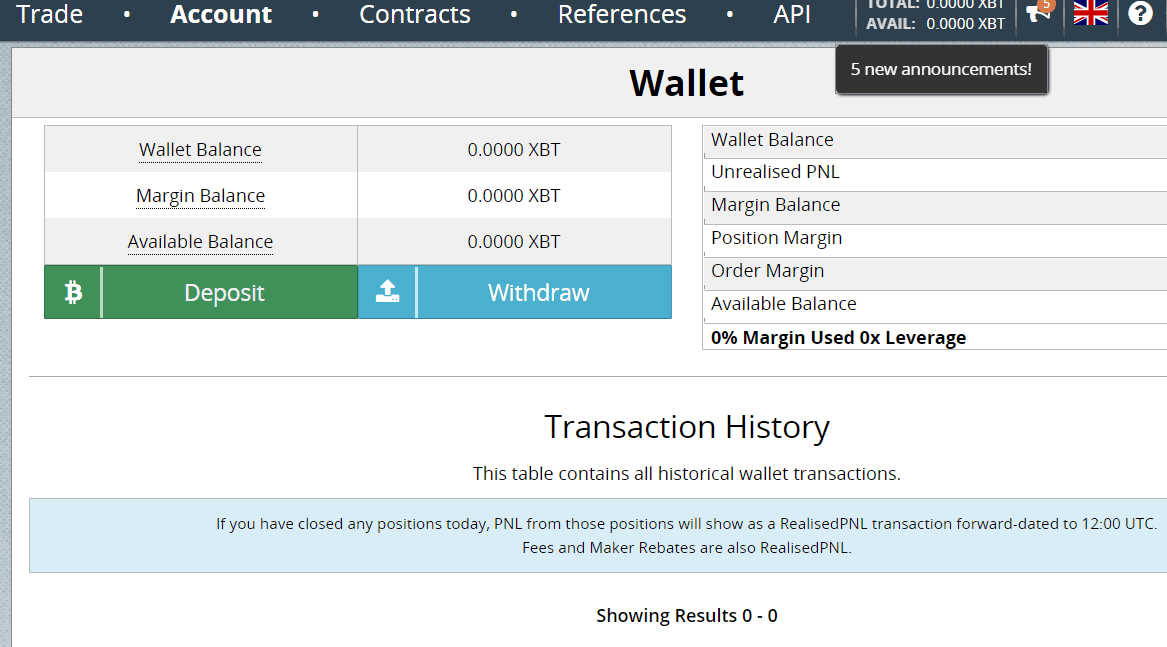

BitMEX allows only one way to deposit your funds and, i.e., using bitcoins. You can do it by clicking on the “accounts and security” option in the header. Here are the steps you need to follow to do the same.

- Click on the Account tab located in the navigation bar at the top of the screen.

- Here you will see the deposit option in the green background; click on that.

- Scan your QR address or copy your bitcoin wallet address.

- After this, you can use that address to deposit coins in your BitMEX margin trading wallet.

BitMEX deposit and Withdraw

How to trade on BitMEX?

BitMEX deposit and Withdraw

How to trade on BitMEX?

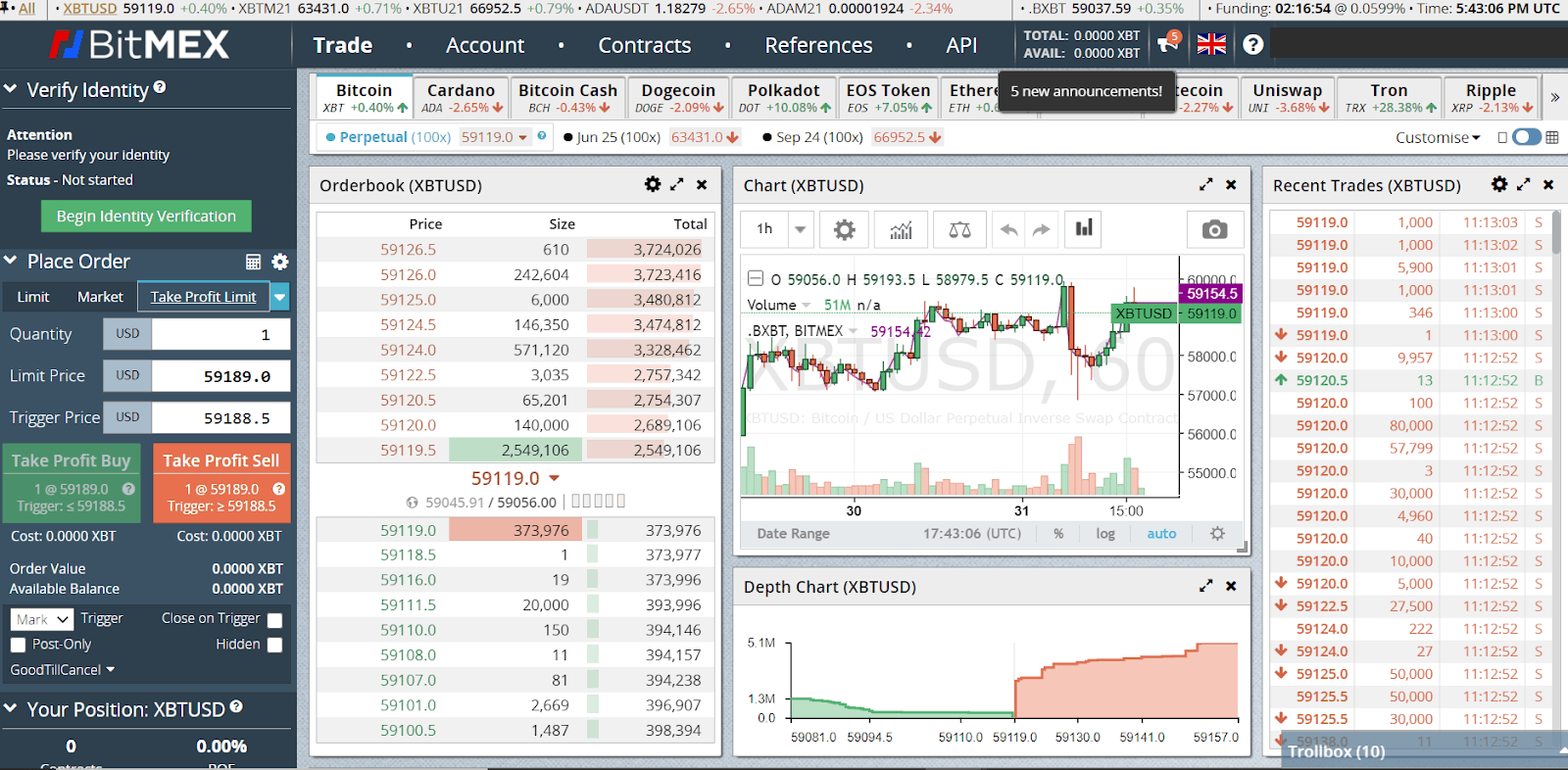

You can very quickly place buying or selling orders by clicking on the place order tab under the trading dashboard, or you can follow these steps:

- Visit the margin trading tab.

- Now enter all the required details on the right side of the screen,

- You can click on buy to go long and on-sell to go short.

- Your order will execute depending on your chosen options.

BitMEX Trading

How to withdraw funds at BitMEX?

BitMEX Trading

How to withdraw funds at BitMEX?

Withdrawing funds at BitMEX is very easy, and you can follow the below steps to do the same:

- Click on the Account tab in the navigation bar.

- On the next tab, click on withdraw.

- Provide your BTC wallet address there.

- Now enter the number of bitcoins you want to withdraw.

- Complete the transaction with two-factor authentication.

Suppose you are a beginner and wish to learn more about margin trading, risks involved in margin trading, and how margin trading works. In that case, you can check our article on margin trading.

BitMEX Margin Trading: Pros and Cons BitMEX Margin Trading: ConclusionBitMEX is a crypto margin trading exchange running particularly for professional traders; however, it suits a beginner equally if you know what you’re doing. BitMEX offers an outdated user interface and high fees; however, it also provides leverage of 100x, which opens your doors to higher returns. But, higher leverage also means higher risks, so it is better to begin only after researching and calculating your risks.

Frequently Asked Questions How to use BitMEX in the USA?BitMEX is illegal to use for USA customers as per the regulations adopted by the government of the USA. If you still wish to use BitMEX from the USA, then you can easily choose a free VPN and select a country where BitMEX offers its services. Some of the best VPNs are as follows:

– ExpressVPN

– Nord VPN

– Hola VPN

– Tunnelbear

BitMEX is a crypto trading platform based in Mahé, which is an island in Seychelles.

How does BitMEX work?BitMEX is a trading platform and provides its services in the perpetual contract. To trade on BitMEX, you need to deposit bitcoins as the exchange only excepts bitcoins. Then you can begin trading by going long or short from the trading tab.

What is BitMEX testnet?BitMEX is not a beginner-friendly platform due to its complex features. Hence the platform provides BitMEX testnet to its user. Here, you can get a hands-on experience of the platform and how things work there. However, you’ll need to create a se[erate account for the BitMEX test and then log in on https://testnet.bitmex.com/login.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.