and the distribution of digital products.

BitMake Futures Trading: Crypto Futures Simplified

Futures are a sort of derivative contract used in the financial sector that let buyers and sellers buy and/or sell a certain underlying asset, like a cryptocurrency, at a defined future date and price.

At the end of the contract, the seller must deliver the item and get paid for it, while the buyer is required to receive and pay for the asset. Therefore, today we’ll talk about BitMake Futures Trading to make your trading experience easier!

What is BitMake?BitMake is a professional trading platform introduced in July 2022. It offers a wide range of cryptocurrency trading services, including spot trading, spot margin trading, perpetual futures contracts trading, and wealth management financing.

Besides, its distinguishing feature is a unified trading account, which allows traders to collateralize several currencies and use them as trading collateral, increasing capital utilization.

Real-time market information, price alerts, and portfolio tracking are just a few of the services and tools that BitMake provides users to assist them in managing their assets. Two-factor authentication and SSL encryption are among the platform’s security features.

SIGN UP ON BITMAKE! BitMake

BitMake

To learn more, read BitMake Review: Is it the Best Crypto Exchange?

What is Futures Trading?A binding agreement between two parties to acquire or sell an item at a fixed price and a fixed time in the future is known as a futures contract.

Without actually holding the underlying asset, futures trading enables investors to speculatively predict price changes for commodities, currencies, and financial instruments like stocks and bonds.

Anyone who wants to participate in this rewarding and dynamic financial market must understand the foundations of futures trading, including the workings of futures contracts, market dynamics that affect pricing, and risk management techniques.

To learn more, read Futures Trading – A Guide for Trading Futures in Crypto

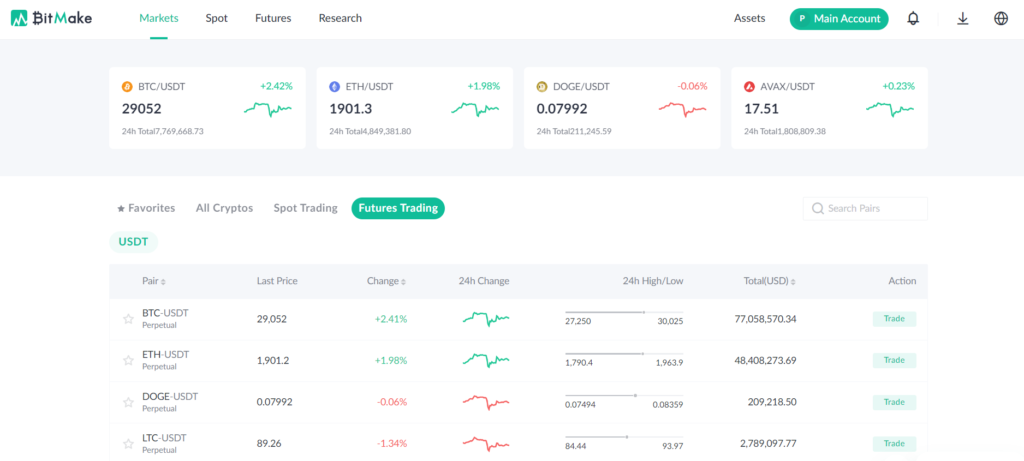

BitMake Futures TradingHere are some of the ways BitMake Futures Trading differs from other platforms in the crypto industry:

- Stablecoin settlement applies to all BitMake futures; you must deposit stablecoins as security for each future, and your PNL is settled in stablecoins. As a result, you receive USD-based price exposure and settlement without the requirement for a bank account.

- Further, you can easily switch between different contracts by using the same base currency as collateral.

- BitMake futures include cautious, calculated margin calls to prevent significant price reversals.

BitMake Futures Trading

How to Trade BitMake Futures?

BitMake Futures Trading

How to Trade BitMake Futures?

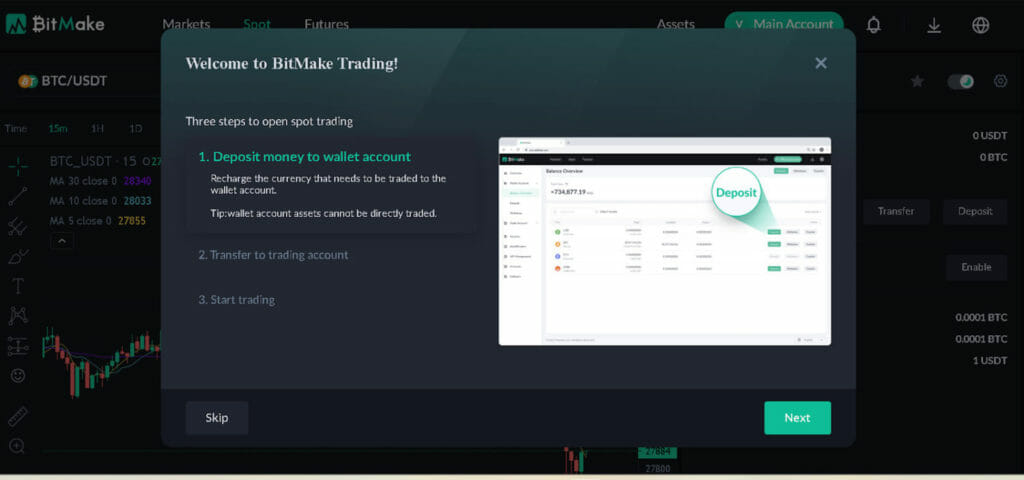

Following these easy steps will allow you to trade futures:

- Transfer USDC or other assets to your trading account. BitMake uses a joint margin model, so even if you have other assets, you can trade futures.

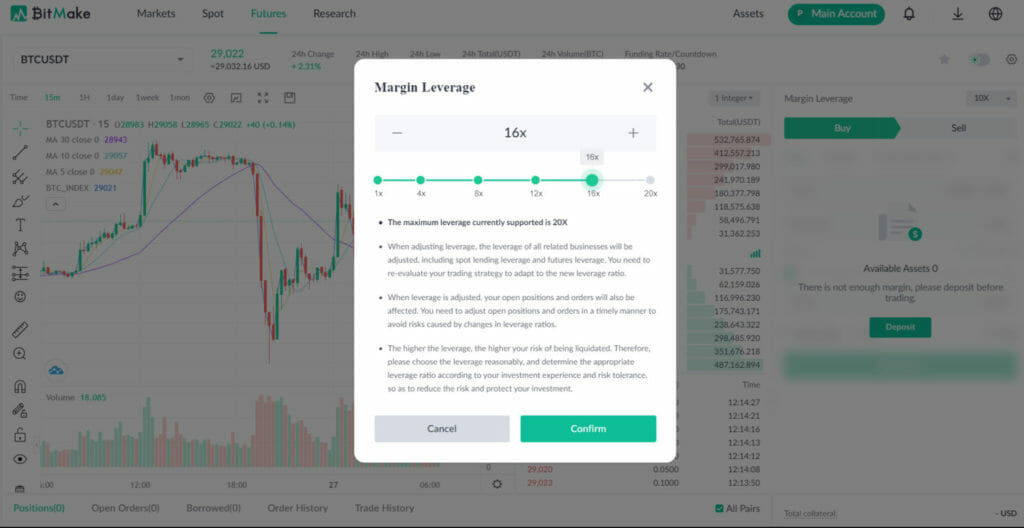

- Decide on your leverage multiplier.

- Choose the proper order direction (Sell or Buy).

- Enter the amount you wish to exchange.

BitMake Leverage Multiplier

How to Open a Position on BitMake Futures?

BitMake Leverage Multiplier

How to Open a Position on BitMake Futures?

- Bullish (Buy Long)

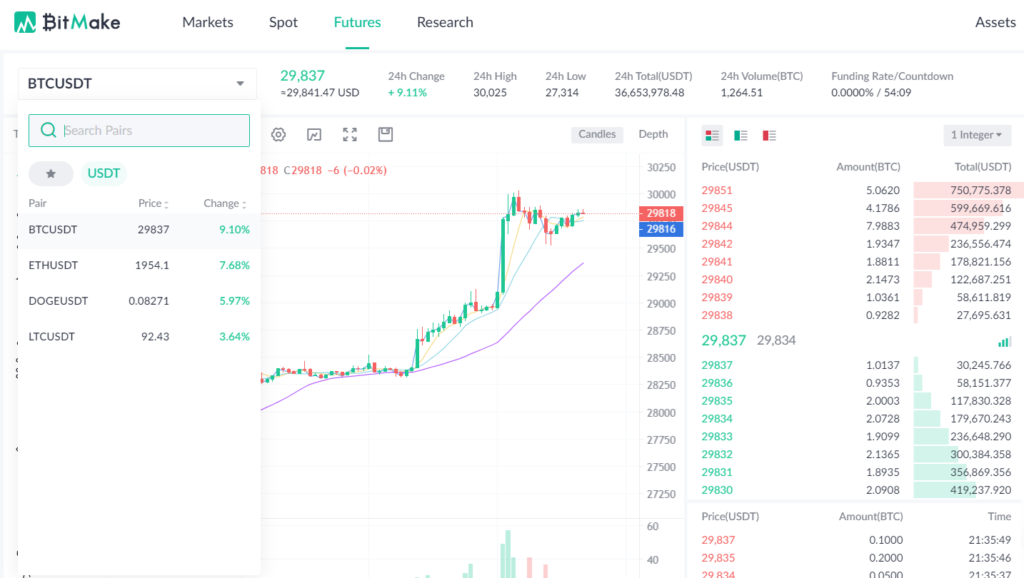

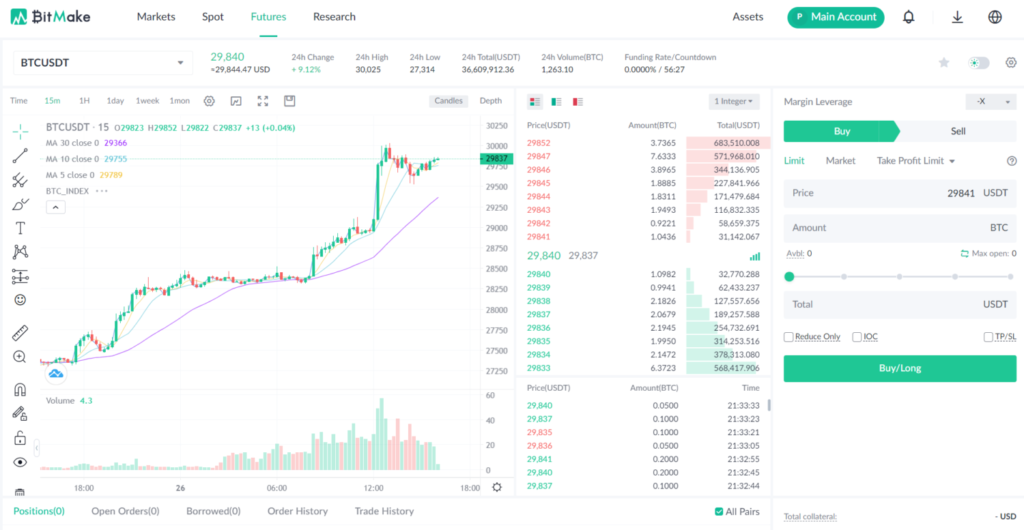

- Consider the BTC-PERP pair as an example: from the official home page, choose “Futures” to access the Futures quotes trading page.

- On this page, click the top left corner to switch currency pairings and choose “BTC-PERP.”

- Choose “Buy,” “Leverage,” “Limit” or “Market” as the order type, input “Price” and “Amount,” and then click “Buy / Long.”

- Enter a second order in the pop-up window and click “Confirm.”

- Bearish (Sell Short)

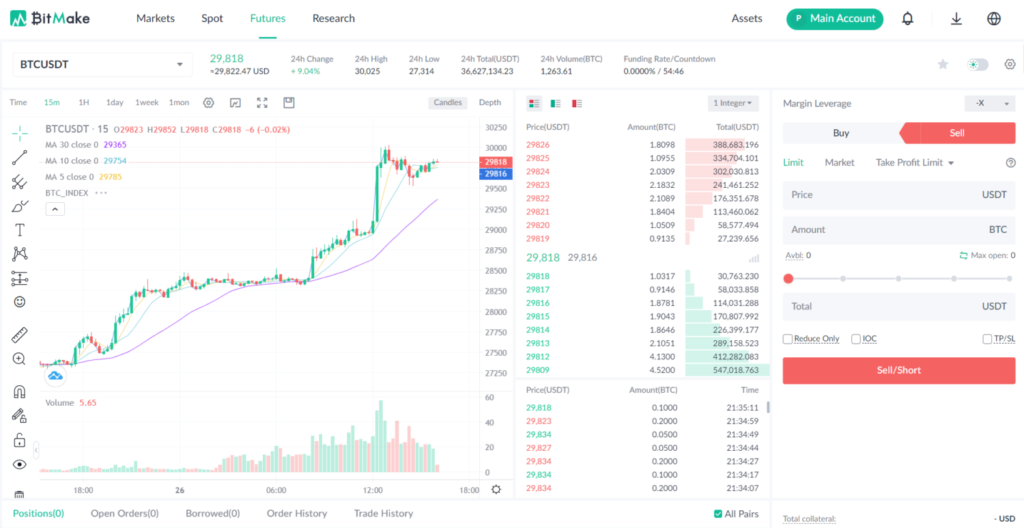

- Consider the BTC-PERP pair as an example: from the official home page, choose “Futures” to access the Futures quotes trading page. On this page, click the top left corner to switch currency pairings and choose “BTC-PERP.”

- Choose “Sell,” set “Leverage,” choose “Limit” or “Market” order type, input “Price” and “Amount,” and then click “Sell/Short.”

- Enter a second order in the pop-up window and click “Confirm.”

How to Close a Position on BitMake Futures?

How to Close a Position on BitMake Futures?

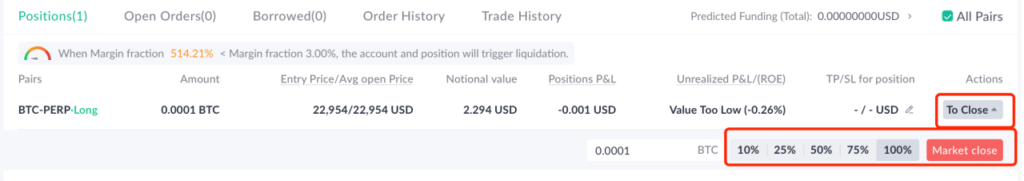

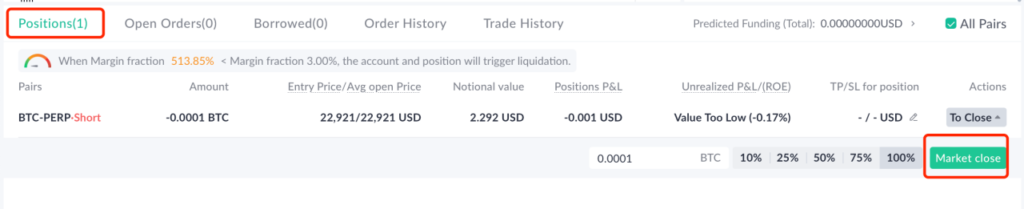

- Long orders (Sell to close Long positions)

- Select [Position] on the trading page for the futures market, choose the exact position to be closed, input an amount, and click “Close” to close the trade on the market price.

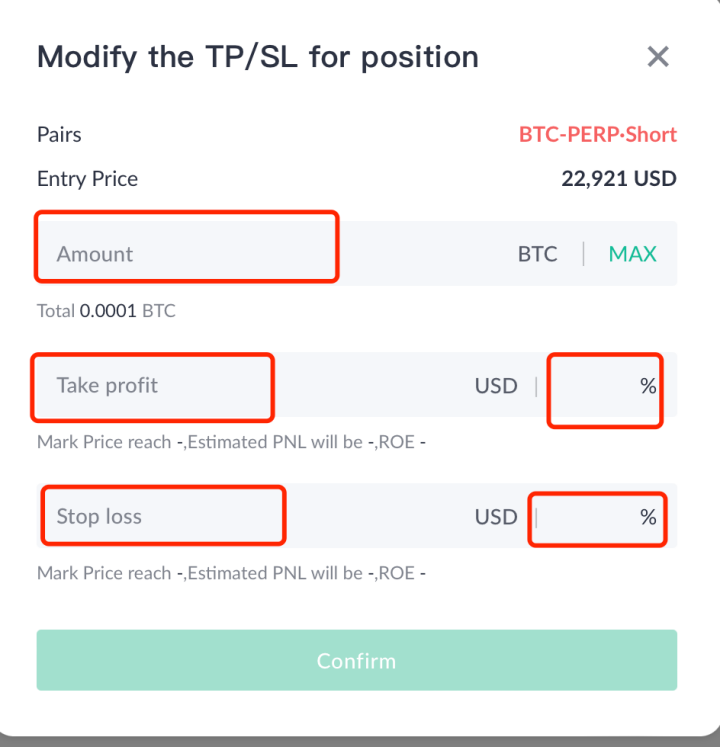

- Users have the option to end positions using the “Stop Loss and Take Profit” approach, which allows them to stop losses in order to minimize losses or profits in order to lock them in.

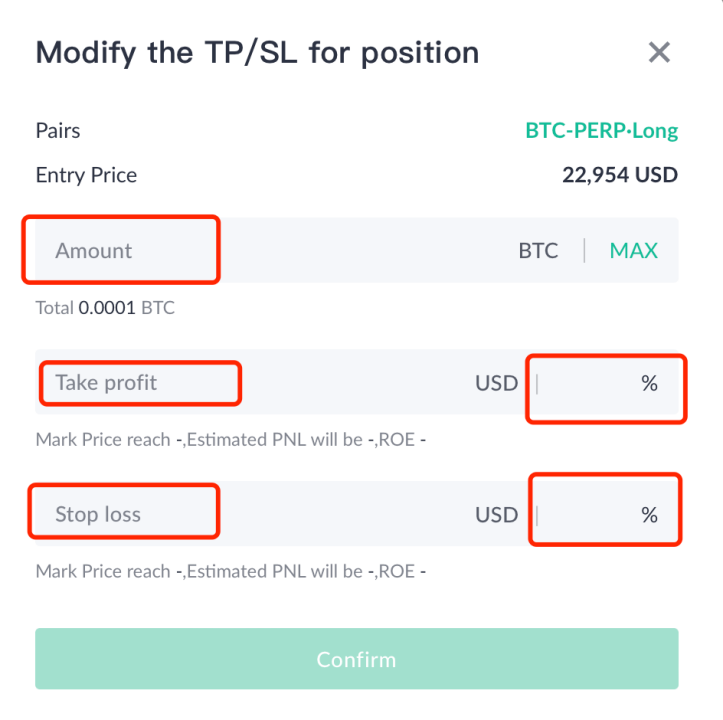

- Click “Stop Loss and Take Profit” after selecting the specific trade that has to be closed. Enter “Take Profit,” “Stop Loss,” and “Amount,” and then click “Confirm.”

- Alternately, enter the stop loss and take profit percentages and set them to the percentages you anticipate.

- It should be noted that there can be instances where the commission cannot be filled due to the market’s extreme fluctuations.

- Short order (Buy to close Short)

- Select [Position] on the trading page for the futures market, choose the exact position to be closed, input an amount, and click “Close” to close the position at the market price.

- Users have the option to end positions using the “Stop Loss and Take Profit” approach, which allows them to stop losses in order to minimize losses or profits in order to lock them in.

- Click “Stop Loss and Take Profit” after selecting the specific trade that has to be closed. Enter “Take Profit,” “Stop Loss,” and “Amount,” and then click “Confirm.”Or input the percentage for the stop loss and take profit.

- It should be noted that there can be instances where the commission cannot be filled due to the market’s extreme fluctuations.

Maximum Open = Trading Assets Available/ Entry Price

Available balance for orders = Trading assets * USD rate * Weights * Leverage + Unrealized P&L (ROE)

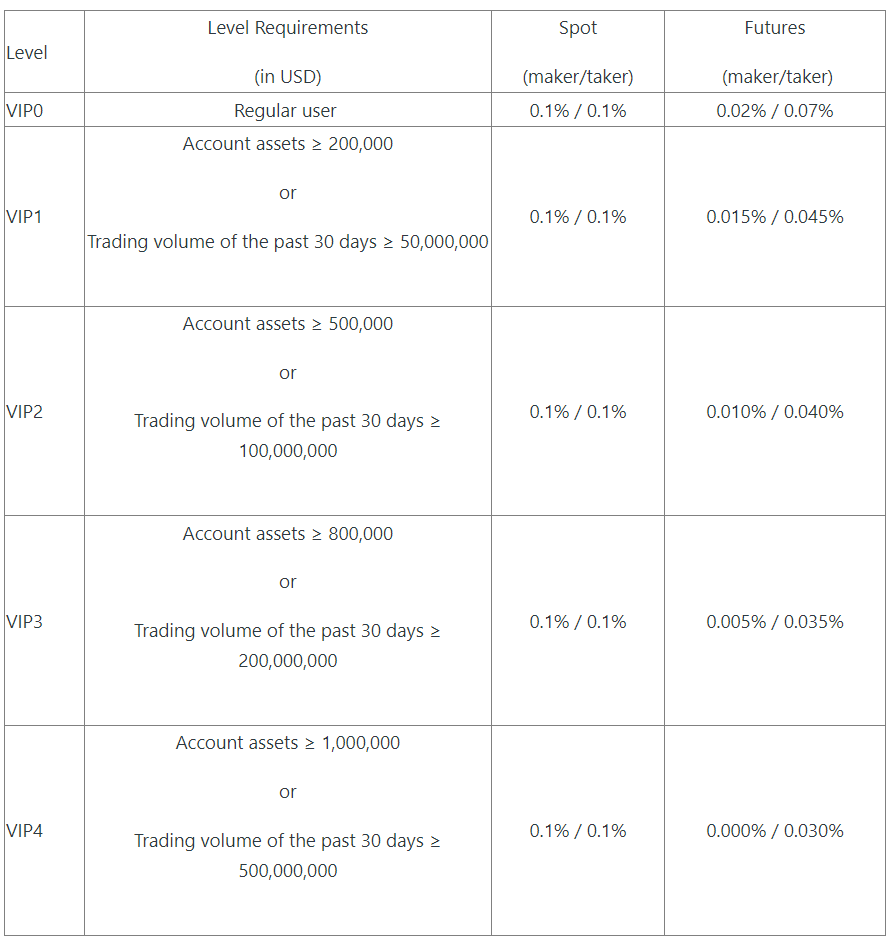

Amount x Entry Price x Rate = Handling Fee

- For instance, the maker’s fee is 0.030% and the taker’s fee is 0.050%.

- Buy 1 BTC-PERP for the current market price of $23000 USD.

- Taker’s handling fee: 1×23,000 times 0.05% equals 11.5 USD

- Sell 1 BTC-PERP utilizing the limit price of 23,500 USD following the price increase.

- Maker’s handling charge: 1 x 23,500 x 0.30% = 7.05 USD

Different VIP level fees at BitMake are as follows:

BitMake Futures Trading Fees: To learn more click here

Conclusion

BitMake Futures Trading Fees: To learn more click here

Conclusion

BitMake futures trading may be used by users to protect themselves against price changes while gaining returns through speculation. Futures trading is a complicated and risky activity, though, so it is vital to keep that in mind.

Not all investors should engage in it. Any platform or company you are considering investing in should first be thoroughly investigated.

SIGN UP ON BITMAKE!Also, read

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.