and the distribution of digital products.

DM Television

Bitcoin Whales Buying As Stablecoins Flow To Exchanges Spikes: Are Bulls A Big Move?

Bitcoin is moving sideways in a consolidation, forming a bull flag that is clear in the daily chart. While prices are stable when writing, shaking off the weaknesses of yesterday, BTC is down 8% from last week’s highs and remains in a fragile position.

Technically, what’s needed for Bitcoin, at least in the short term, is for prices to shoot higher, breaching $63,000. When this happens, it may signal that buyers have sufficient momentum to confirm gains of August 8. The development could set the ball rolling for another leg up toward $70,000 in a buy trend continuation formation.

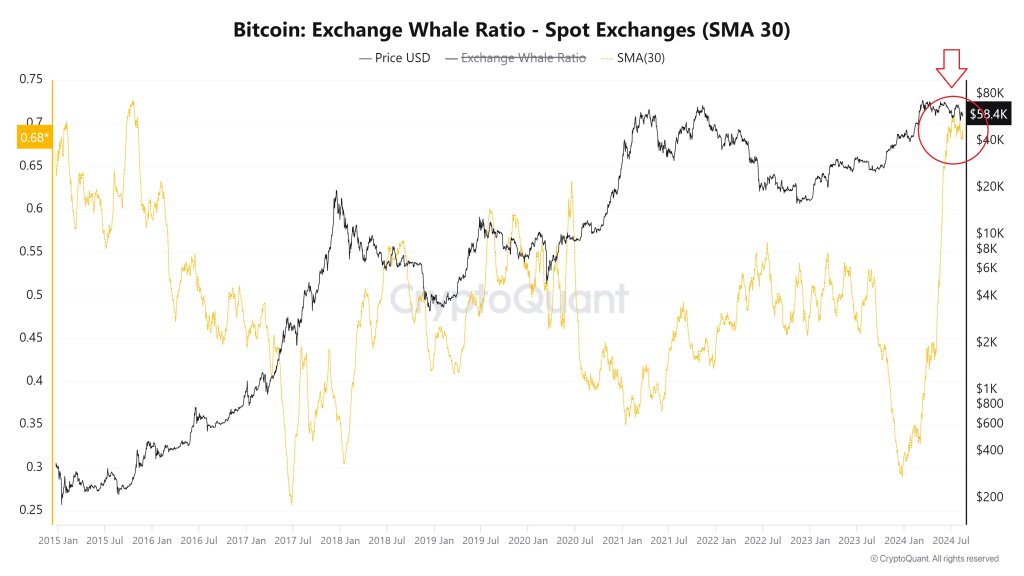

Bitcoin Whales Accumulating, Traders Must Be PatientBullish as market participants are, one analyst on X thinks they might have to wait longer. Citing on-chain data, the analyst said the Bitcoin whales ratio is at “extremely high” levels.

The metric, used by chartists to measure the number of large whale transactions relative to the general activity, helps gauge how involved whales, mostly institutions and deep-pocketed addresses, are at any price level.

The rising whale ratio means Bitcoin is likely in the accumulation phase. Here, these whales are keen on accumulating on dips, taking advantage of the low prices to increase their coin holdings.

Historically, the analyst said prices tend to spike higher whenever this happens, especially when the coin is weeks or months away after the Halving.

Bitcoin halved its miner rewards on April 20. The drop in emission, making the coin deflationary, coupled with rising demand from institutional players getting exposure via spot Bitcoin ETFs, is expected to impact prices positively in the coming days.

Stablecoins Pouring Into Exchanges, Breaking $72,000 Will Be Crucial For BullsLooking at the events in the daily chart, it is evident that sellers have the upper hand, at least from a top-down preview. There has been no comprehensive reversal of late July to early August losses.

A break above $63,000 will be positive. However, a clean close above July highs is needed to lift the coin above $70,000 and $72,000.

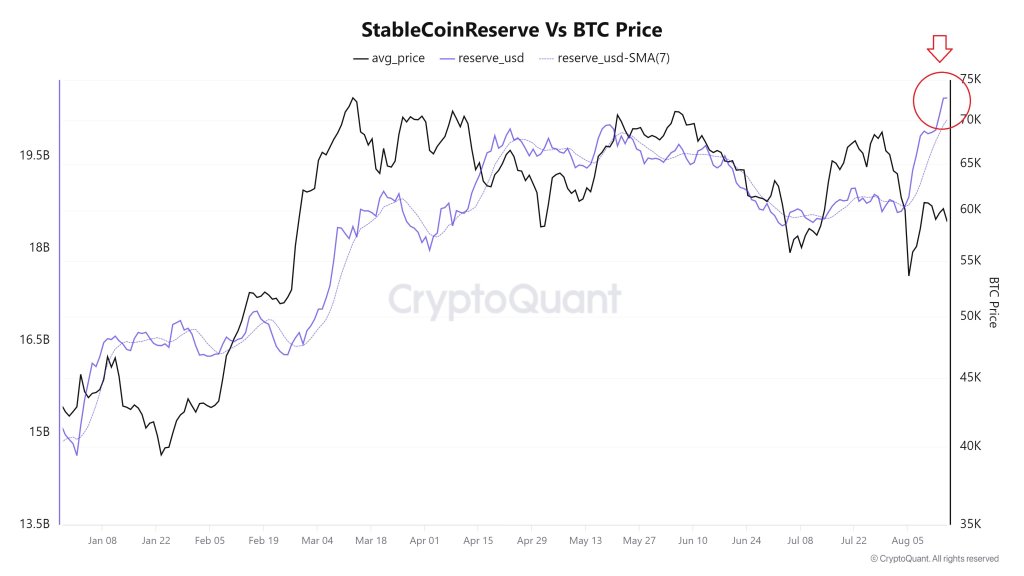

Nonetheless, there are positive developments that might spark and revive demand. The analyst, citing trading data, also said there has been an influx of stablecoins to leading exchanges like Binance and Coinbase.

If history guides, it means traders are increasing their crypto purchasing power and keen to double down. Overall, this is a net positive for Bitcoin and other digital assets.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.