and the distribution of digital products.

DM Television

Bitcoin, Stocks, and Gold Rise over the Dollar after Inflation Report

The market’s bullish sentiments remained unaffected by the U.S. consumer price index (CPI) inflation numbers released by the Labor Department this morning. Gold, Bitcoin, and stocks showed slight upticks, while treasury yields remained flat.

Hot Inflation, Stronger BitcoinThe month-to-month (MOM) CPI reported rate is 0.1% higher than Dow Jones’ expected value of 0.5%, meaning the average price of consumer products is trading 0.6% higher than last month.

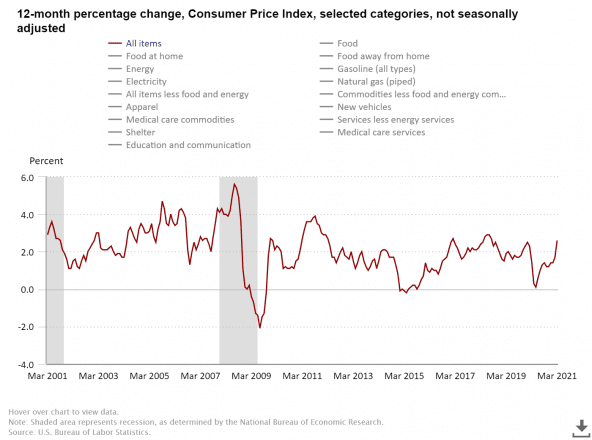

The year-to-year (YOY) value is 2.6%, the highest since August 2018. The figure was slightly above expectations of 2.5% and significantly higher than the 1.7% result seen last month.

March #CPI slightly stronger than expected at 2.6% y/y vs. 2.5% est. & 1.7% in prior month; core at 1.6% y/y vs. 1.5% est. & 1.3% in prior month pic.twitter.com/S2vi4KjAFz

— Liz Ann Sonders (@LizAnnSonders) April 13, 2021

The higher YOY value is attributed to the gut-wrenching crash in March last year. The YOY is expected to remain high until June due to the base effect.

US CPI Index YOY rate. Source: U.S. Department of Labor

US CPI Index YOY rate. Source: U.S. Department of LaborThe producer price index (PPI) data last week caused a strong rise in the stock market due to its stronger-than-expected value. The index, which measures inventory and production cost for various industries, increased 4.1% YOY, the highest rise in nine years.

The extreme rise is partially due to what’s known as the “base effect,” in which inflation figures appear higher or lower due to unusually low or high figures in the previous period. However, global supply constraints during the pandemic also played a role.

OOPS! US Consumer prices climbed more than forecast in March. #Inflation increased 0.6% MoM vs 0.5% expected after a 0.4% gain in Feb. CPI surged 2.6% YoY after pandemic & related shutdowns curbed activity in the same periods in 2020, a distortion known as base effect. (via BBG) pic.twitter.com/KfC614ue8O

— Holger Zschaepitz (@Schuldensuehner) April 13, 2021

The latest CPI data release confers to investors’ inflation concerns driving the price of stocks, gold, and Bitcoin.

Bottom LineThe market situation has been consistent since last month.

The Fed is not worried about the short-term effects of inflation. However, many economists argue that the recent stimulus will hurt the value of the USD as inflation runs hotter than the nation’s economic recovery rate.

The U.S. dollar index (DXY), which measures USD’s performance compared to a basket of global currencies, dropped 0.34% from today’s high after the announcement, trading below $92.

The announcement had no major impact on U.S. treasury bond yields.

In the beginning, S&P 500 dropped in tandem with DXY at the 9 am opening bell. The index made a quick recovery to $4130, close to the new all-time high of $4131, attained earlier today.

Gold’s value rose by $6 per ounce with a 0.35% rise on an hourly scale, trading at $1735 per ounce after the announcement.

Bitcoin’s bullish run from Monday continued unabated this morning as the leading cryptocurrency traded above $63,000, a new all-time high.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.