and the distribution of digital products.

Bitcoin Spot Is King – STH Selling Pressure Expected To Be Absorbed By ETFs

Bitcoin has experienced a whirlwind of volatility following its recent all-time high of $93,483 set on Wednesday. Over the past few days, the price has oscillated between this record level and a low of $85,100, indicating the potential onset of a consolidation phase before the next major move. Traders and investors are now closely monitoring whether BTC will stabilize or continue its upward trajectory.

Key data from CryptoQuant suggests that selling pressure may increase quickly, primarily driven by speculative traders looking to lock in quick profits. However, this doesn’t necessarily spell trouble for Bitcoin’s bullish momentum.

Analysts predict that much of the selling pressure will be absorbed by the growing demand for Bitcoin ETFs, which have gained significant traction among institutional investors.

This balance between short-term selling and institutional accumulation could set the stage for Bitcoin’s next move. With volatility expected to persist in the coming days, market participants are eagerly watching for signals that might indicate the direction of BTC’s price action. Whether this phase leads to a deeper correction or propels Bitcoin toward new highs, one thing is clear—Bitcoin continues to dominate the financial landscape with its dynamic performance.

Bitcoin Strong Demand Supports Bullish Price ActionBitcoin’s price action has been impressive, surging by 38% over the past ten days. This rapid rise has caught the attention of many investors, reaffirming the growing strength of Bitcoin’s demand.

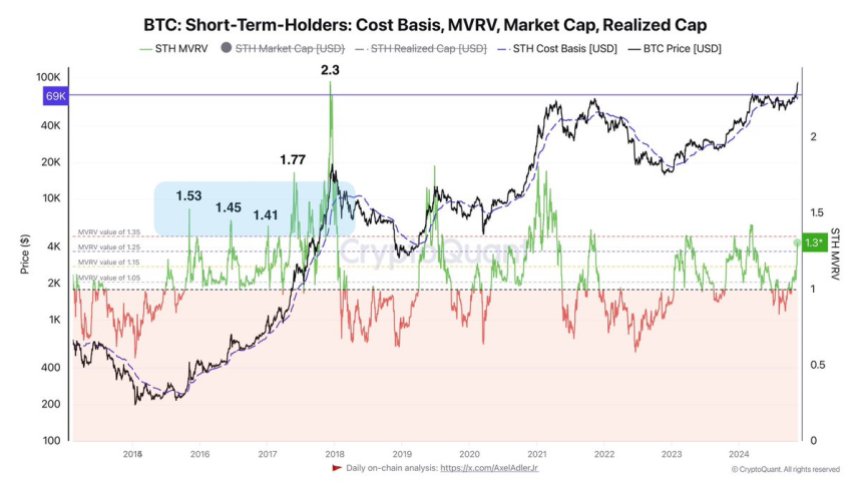

Key data from CryptoQuant analyst Axel Adler offers insight into the current market dynamics, highlighting that Bitcoin is trading above its short-term holder (STH) cost basis of $69,000. This level represents a crucial support threshold for those who acquired Bitcoin in the past few months, indicating solid demand above this price.

Additionally, the MVRV (Market Value to Realized Value) ratio stands at 1.3, suggesting that Bitcoin is still profitable. However, Adler notes that if this ratio crosses the 1.35 mark, it could trigger selling pressure from short-term speculators looking to lock in profits.

While this may prompt some market volatility, it’s important to note that most of these coins are expected to be absorbed by growing institutional demand, particularly through Bitcoin exchange-traded funds (ETFs).

This data points to a significant shift in Bitcoin’s rally—rather than being fueled by speculative futures trades, the recent surge appears to be driven by strong spot demand. Spot demand typically reflects a more sustainable, stable price move than the volatility often seen in futures-driven rallies.

As Bitcoin continues to trade above key support levels, the outlook remains bullish, driven by a healthy balance between speculative trading and long-term institutional interest.

BTC Technical View: Prices To WatchBitcoin is trading at $89,240, reflecting a 7% retrace from its recent all-time high of $93,483. The price has consolidated below this level following a period of aggressive upward momentum that propelled it into price discovery territory.

This pause in the rally allows the market to stabilize and test key support levels before determining its next move.

During this consolidation, the $85,000 mark has emerged as a crucial support level. If Bitcoin can hold above this level in the coming days, it may provide the foundation for another surge, potentially challenging the $90,000 resistance and retesting its all-time high. A successful reclaim of $90,000 would signal renewed bullish momentum, paving the way for further price expansion.

However, failure to maintain the $85,000 support could lead to a deeper correction. In this scenario, Bitcoin would likely seek lower-level demand, with $82,000 emerging as a significant area of interest for buyers.

As the market navigates this critical phase, traders and investors will closely watch price action for signals of either a breakout or a pullback, with both scenarios carrying implications for Bitcoin’s short-term trajectory.

Featured image from Dall-E, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.