and the distribution of digital products.

DM Television

Bitcoin Price Rallies Above $70K: Is a New High Within Reach?

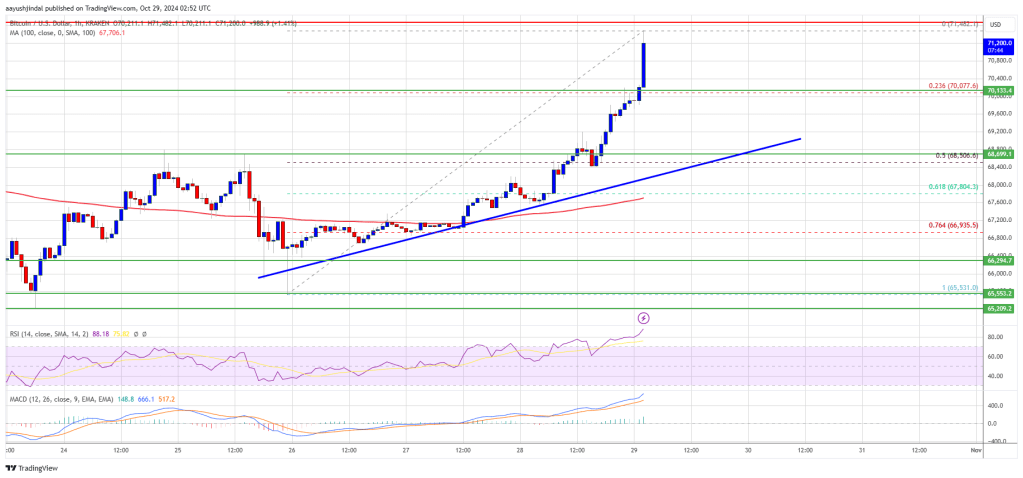

Bitcoin price is rallying above the $70,000 zone. BTC is up over 5% and it could soon aim for a move above the $72,000 resistance zone.

- Bitcoin started a fresh increase above the $68,000 zone.

- The price is trading above $70,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $68,700 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is surging and might rise above the $72,000 resistance zone or even to a new all-time high.

Bitcoin price found support near the $66,500 zone. BTC formed a base and started a fresh increase above the $68,000 resistance. The bulls were able to pump the price above the $70,000 resistance.

The price regained strength and cleared the $70,500 level. It is up over 5% and trading above the $71,000 level. A high was formed at $71,482 and the price is now showing signs of strength. It is well above the 23.6% Fib retracement level of the upward move from the $65,531 swing low to the $71,482 high.

Bitcoin price is now trading above $70,000 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $71,500 level.

The first key resistance is near the $72,000 level. A clear move above the $72,000 resistance might send the price higher. The next key resistance could be $72,200. A close above the $72,200 resistance might initiate more gains. In the stated case, the price could rise and test the $73,000 resistance level. Any more gains might send the price toward the $74,000 resistance level and a new all-time high. Any more gains might call for a test of $75,000.

Are Dips Supported In BTC?If Bitcoin fails to rise above the $72,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $70,500 level.

The first major support is near the $68,500 level or the 50% Fib retracement level of the upward move from the $65,531 swing low to the $71,482 high. The next support is now near the $67,800 zone. Any more losses might send the price toward the $66,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $70,500, followed by $68,500.

Major Resistance Levels – $71,500, and $72,000.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.