and the distribution of digital products.

Bitcoin To Hit $90,000 If Trump Wins: Bernstein Analysts

Analysts are meticulously observing the forthcoming US presidential election, especially about its possible influence on Bitcoin. Recent analyses from Bernstein underscore a significant divergence in Bitcoin’s prospects contingent upon the electoral victory of either Donald Trump or Kamala Harris.

Their estimate indicates that should Trump achieve victory, Bitcoin may escalate to a range of $80,000 to $90,000 by the conclusion of 2024. A victory for Harris could result in Bitcoin’s decline to the $40,000 range owing to expected regulatory obstacles.

Bernstein analysts said that short-term Bitcoin price fluctuations are closely related to the results of the US election. If Trump wins the US election next month, the price of Bitcoin is expected to reach a new high of $80,000 to $90,000. If Harris wins, Bitcoin may fall back to…

— Wu Blockchain (@WuBlockchain) October 9, 2024

Bernstein Analysts Weigh In On Trump VictoryAnalysts at Bernstein, including Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, assert that a Trump presidency would be “incrementally favorable” for the Bitcoin industry. Trump’s conversion in digital assets has made him a pro-crypto candidate who favors ending harsh laws and making a national Bitcoin reserve. This shift has made many investors think they would see less strict regulations if he were to be elected.

Conversely, Harris has adopted a more prudent stance about cryptocurrency. Although she has articulated support for innovation in the business, her policies may not offer the same degree of stimulus as those of Trump. Bernstein cautions that under Harris’s leadership, Bitcoin may see considerable downward pressure, possibly resulting in prices in the low $40,000s.

Broader Market ConsequencesSuch predictions have much broader implications beyond Bitcoin, though. Analysts at Standard Chartered believe that if Trump wins, then this time, Bitcoin could hit $125,000; if Harris took the top job, Bitcoin may settle at around $75,000.

Bernstein believes “win or lose,” Bitcoin will likely be on a pretty broad positive track considering the macro forces–low interest and high debt. Other cryptocurrencies, such as Ethereum and Solana, will also likely stay stable through post-election, according to Bernstein, who pointed out that these assets won’t take on definitive trajectories until there is clarity around appointees for regulatory offices in the new administration.

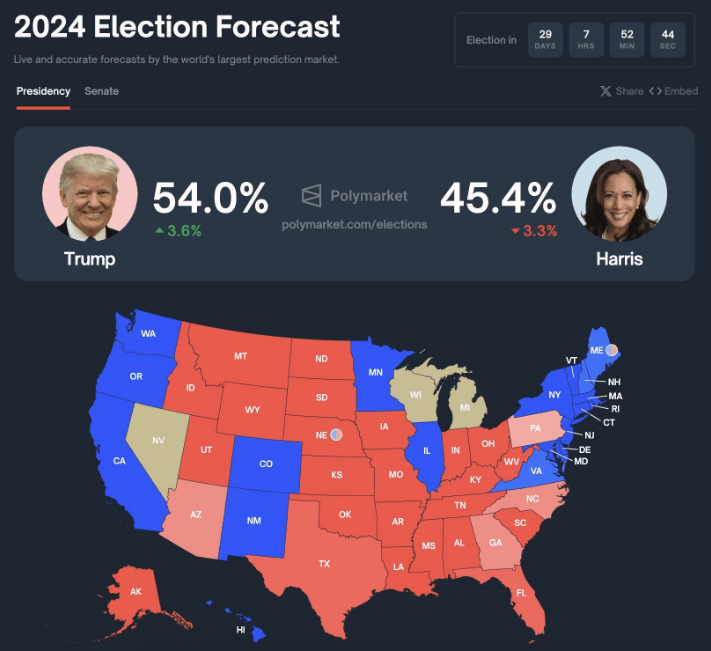

On Election Outcomes And Market SentimentAs the election date draws near, market sentiment seems to shift in favor of Trump. In prediction markets at present, Polymarket favors Trump with a nearly 9% lead against Harris. Based on analysts, that means so long as prospects improve for the victory of Trump, his chances would tend to influence the price of Bitcoin positively.

The forthcoming election represents a pivotal moment for Bitcoin and other cryptocurrencies. Bernstein’s analysis highlights the possible market volatility resulting from political outcomes.

As Trump promotes a more favorable regulatory framework and Harris adopts a prudent approach, investors are preparing for substantial fluctuations in bitcoin valuations as November nears. Irrespective of the victor, both analysts and investors concur that the political environment will significantly influence the future of digital assets in the United States.

Featured image from Fox Business, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.