and the distribution of digital products.

Bitcoin Barrels Close To $98,000—Is The $100K Barrier Next?

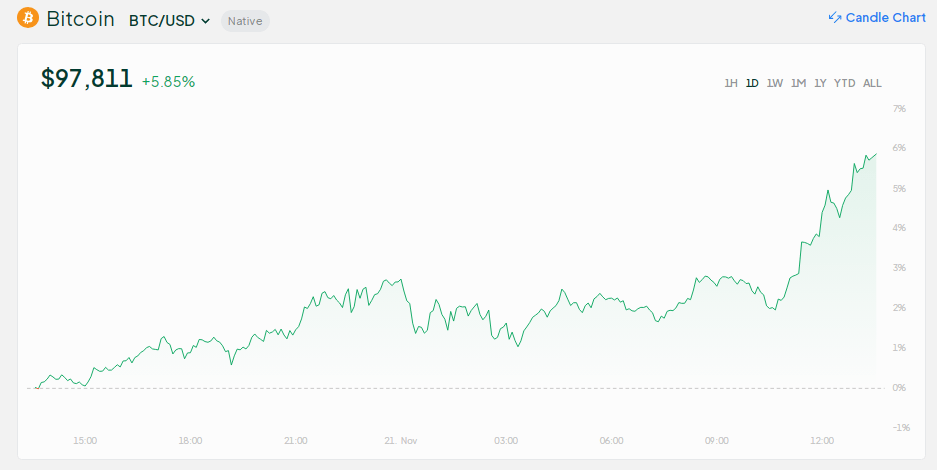

Bitcoin continues its price explosion this Thursday, hitting a new all-time high and breaking the $97,000 barrier during intra-day trading. The crypto asset’s price then spiked 5.7%, reaching $97,811 on Bitstamp, boosting its market cap to $1.93 trillion.

The recent surge in Bitcoin’s value is not just a market trend, but a reflection of the growing optimism surrounding incoming US President Donald Trump’s potential crypto-friendly policies and his pick for the Securities and Exchange Commission (SEC) chief.

This optimism has led to a 3% increase in the cumulative cryptocurrency market cap, now standing at $3.37 trillion. The 24-hour trading volume on Thursday saw a 5% increase, reaching $ 190 billion.

The obvious sign of the optimistic trend in the bitcoin market: its price has more than doubled this year. The whole industry has joined the upward surge, contributing an amazing $900 billion to the total crypto market capitalization. Given that Bitcoin is barely $3,000 short of the $100,000 milestone, the sector is bursting with hope about what the next few weeks can bring for the digital asset.

According to Edu Patel, CEO of Mudrex, Bitcoin’s price last year was $30,000. Today, the asset’s price surged to more than $97,000, reflecting a growth of over 300%.

Patel said several factors are pushing Bitcoin’s price, including Trump’s election and optimism over his pick as chairman of the SEC, and his friendly crypto policies. In addition, he also acknowledged the growing institutional participation in Bitcoin options and ETFs.

Is Trump Planning A Special Position To Oversee Crypto?The recent price surge of Bitcoin underscores the growing importance of the asset and cryptocurrency to the economy. The Trump administration has also signaled the possibility of creating a specific office to oversee the administration’s cryptocurrency policies.

According to some sources, the president’s team is currently considering this office, and many crypto execs are jockeying for an audience with the president.

1/ MicroStrategy just convinced investors to pay $520,234 per Bitcoin

That’s the biggest Bitcoin play I’ve ever seen: pic.twitter.com/yeZfGlcm6j

— ELI5 of TLDR (@explain_briefly) November 20, 2024

Institutional Adoption, MicroStrategy’s Bitcoin-First Policy Boost PriceSome experts also attribute Bitcoin’s recent run to MicroStrategy’s bold “Bitcoin-first” policy. Michael Saylor of MicroStrategy has doubled down on this approach and purchased additional BTC to boost its portfolio. Other companies have followed suit and are planning to add the asset to their inventories.

The growing popularity of Bitcoin ETFs also helps, and the market currently benefits from the introduction of options trading. According to multiple sources, more than $4 billion has flowed into Bitcoin ETFs since the November elections. Also, this week, Reuters reports that BlackRock is off to an exciting start with its BTC ETFs with call options.

Featured image from Pixabay, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.