and the distribution of digital products.

DM Television

Binance Card Review: Is This the Best Crypto Card?

Today, we will review the Binance card, a crypto card using which you can easily make online and offline purchases with a click of your fingers.

Table of contents- What is a Binance Card?

- Summary (TL;DR)

- Is Binance Card Good for You?

- Binance Card Review: Eligibility

- How to Order a Binance Card?

- How to activate the Binance Card?

- How to Set up the Binance Card?

- Binance Debit Card Review: Features

- Binance Debit Card Limit

- Binance Card Fees

- Binance Debit Card Review: Supported Currencies

- Binance Card Review: Supported Countries

- Binance Card Review: Customer Service

- Binance Card Review: Security

- Binance Mobile App

- Binance Card Review: Pros and Cons

- Is Binance Card Worth Using?

- Binance Card Review: Conclusion

- Frequently Asked Questions

Want to put your cryptos to use in the real world? The Binance card can be the go-to tool for you that will help you achieve the goal. Being a Visa card, you can use the Binance card to spend your cryptos at more than 60 million merchants worldwide.

It converts your cryptos to fiat in no time, and that too free of cost. Using your cryptos to buy groceries or even using them to pay at your favorite eateries might sound extremely tedious and time-taking.

But the Binance debit card does it for you in minutes. Converting crypto to fiat is a new way many exchange platforms adapt, and Binance is already one step further.

Binance released its debit card in selected European countries in September 2020. On 15 December 2020, Binance announced the shipping of the physical cards in the European Economic Area.

Binance Visa Card

Binance Visa Card

Binance aims to make use of the cryptos in real-time, and that too without any friction. While many rival companies have come up with debit cards of their own, one thing’s for sure, the Binance Card’s usage has made the blockchain more tangible and cryptos more useful in everyday life.

Summary (TL;DR)The company states, “Our vision is to increase the freedom of money globally. We believe that by spreading this freedom, we can significantly improve lives around the world.” And so it does exactly that by providing users with enormous facilities to enjoy seamless crypto transactions.

- Binance Card is a Visa debit card and can be used by over 60 million merchants worldwide.

- Binance offers you cash back rewards of up to 8% in BNB on all eligible purchases you make with your Binance Visa Card.

- Binance charges you no crypto conversion fee for converting your crypto to fiat in real-time.

- Supported cryptocurrencies are BTC (Bitcoin), ETH (Ethereum), SXP (Swipe), BNB (Binance Coin), and BUSD (Binance USD).

- As of now, Binance cards are available in European Economic Areas.

- Option for Freezing and terminating the account is available.

- Binance provides an extensive support system via numerous platforms.

- A mobile app is available on Android and ios.

Before getting to know its features, why don’t we discuss whether Binance Card is right choice for you?

Is Binance Card Good for You?You will be able to gain ample cashback rewards only if you own large amounts of BNB. Although it does make your cryptos way more usable by converting them to fiat, it doesn’t have many cashback rewards to offer unless you have made considerable investments in the Binance ecosystem.

However, since the limits are high and the fee is low, one would experience decent and seamless transactions using this card.

And we cannot ignore the fact that it is a product by the most reputed company in the crypto industry; hence you should consider applying for this card.

Binance Card Review: EligibilityIf you are thinking of applying for the Binance card, you must have at least a KYC level 1 verified Binance account, and you should also be living in an available country.

If you don’t already have an account with Binance.com, then you can easily create one. Just head on to their main website and click on ‘register.’ Fill in your active email id, referral ID if you have one (Or use our UARTH1S1), and choose a password for your account. To complete KYC level 1, you require your full name, date of birth, and residential address. Once you complete this, you will be eligible to apply for a debit card.

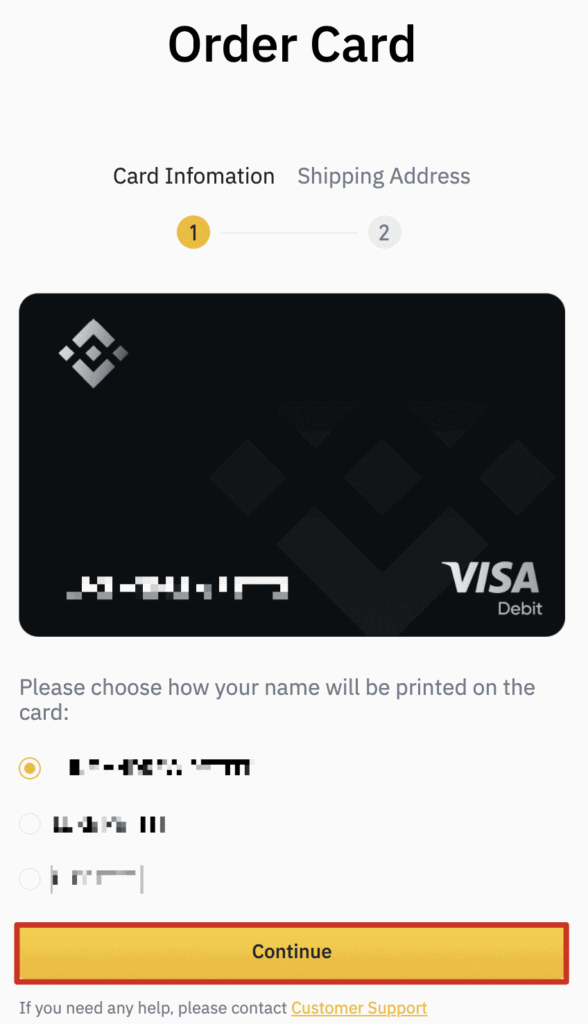

How to Order a Binance Card?You can click here, and it will direct you to their Binance Card page. You will have to click on ‘Order Card’ first. Next, you will find that the template is pre-filled with your details. Although some information may be missing, like your phone number or driver’s license/passport issue date that you will have to fill out. Once you complete this, you will have to decide whether to use Auto Top-up or not. You should then agree to the Terms of Use, Privacy Policy, and Cardholder Agreement.

Select the Order Your Binance Card button, and that’s it; you have completed the process.

Order a Binance Card

How to activate the Binance Card?

Order a Binance Card

How to activate the Binance Card?

Once you receive the card, go to the ‘Card Wallet’ section on Binance and click on the ‘Activate’ button. You will then have to enter the CVV number written on the back of your physical card. Binance will show you your four-digit pin. However, if you fail to activate your card within 45 days of order, it will automatically deactivate.

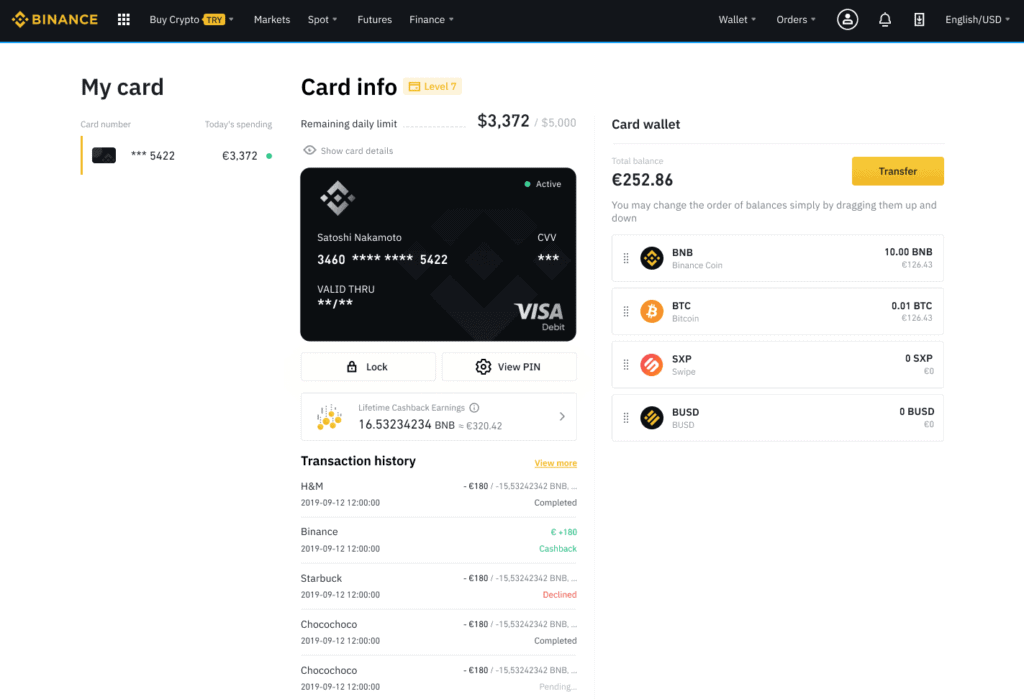

How to Set up the Binance Card?After receiving the card, you will have to set it up to be able to use it. We will familiarize you with how the setup works.

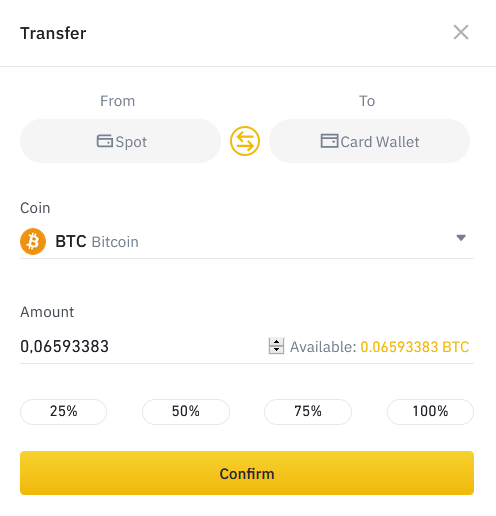

The card wallet won’t get filled by itself. Also, you will have to pay an initial top-up cost of $15 to get the card working. So, to use the card, you will have to transfer money from your Spot Wallet on Binance to your Card wallet. Spot Wallet is the default Binance wallet used for spot trading.

Transferring funds to your Card wallet

Transferring funds to your Card wallet

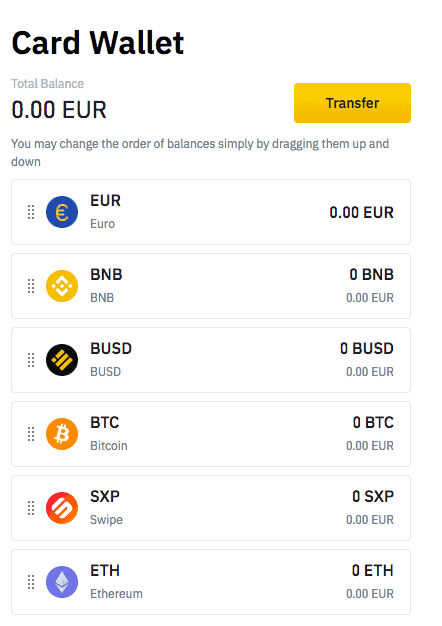

After transferring the funds, you will have to decide the order in which you would like the funds to get debited first. For instance, if you have chosen BNB and Euros as your top two funds, then the card will debit your BNB balance first and move on to Euros once you use the BNB.

You can anytime change your order of preference by dragging the options up and down.

You can now easily spend your cryptos using the card anywhere virtually or in person. You will have to make sure to keep your card funded and top it up regularly.

Binance Debit Card Review: FeaturesBinance continues to launch innovative and proficient products into the market. The debit card launch has brought opportunities for the company and excellent offers for the users. The card is as straightforward as it can be. The features are simplistic, convenient, yet alluring. The company has many things to offer with this card, and we have listed them below for you.

- Binance Card is a Visa debit card and can hence be used at over 60 million merchants worldwide.

- Your Binance card wallet’s funds are transferred from your Spot Wallet present within your Binance Account. You can hold your crypto in your card wallet and exchange only when needed.

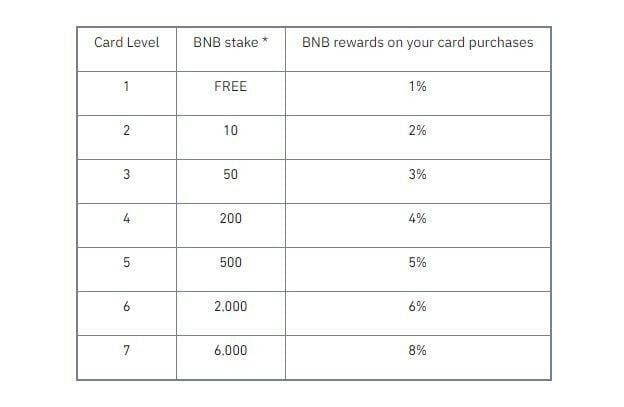

- Binance offers you Cashback rewards of up to 8% in BNB on all eligible purchases you make with your Binance Visa Card.

- To gain the highest amount of Cashback which is 8% in BNB, you must have an average of 6000BNB in your Binance account.

- You can view your cashback transactions in the cashback vault. They would indicate any of the three statuses; Paid, Completed and Declined.

- After you have made a successful transaction, the status changes to ‘Paid .’ It then changes to ‘Completed’ once received by the vendor.

- Your Cashback might get declined in the case of an ineligible transaction. It can also get rejected if you have reached your cashback limit of the month.

- The company states that transactions on digital wallets, crypto exchanges, digital banking services, money remittance services, stored value products, and specific other categories are considered ineligible for the BNB cashback program.

- Binance awards you Cash Back monthly, and the maximum monthly limit is equivalent to EUR 1,800.

- Your Cashback is calculated based on the average BNB holding in your Binance account in the concerned month and the corresponding card level.

Card level and Cashback

Card level and Cashback

- Binance might deduct the Cashback in case of a refund. The Cashback may have a different BNB value on the deduction day than on the settlement day because the exchange rates are subject to volatility.

- You will need a verified active Binance account to be able to apply for the Binance Visa Card.

- You will receive push notifications for every transaction that you will make.

- Binance offers yet another excellently convenient feature of setting up your Binance Card with Google Pay and Samsung Pay. This lets you make contactless NFC payments in a go.

- You get the option to set a minimum balance and let the Card auto top-up when your wallet runs out of funds.

- Binance charges you no crypto conversion fee for converting your crypto to fiat in real-time.

- The spending fee is 0.9%, which is quite reasonable considering the zero charge on the conversion process.

- Binance doesn’t charge any fees if you make the transaction in Euros, although third-party rates may apply.

- Using the app, you can easily view your daily spending and withdrawal and transfer your funds as per need.

- The card wallet also shows the per month average BNB holding your Binance account and your card level.

The Binance Card Wallet

The Binance Card Wallet

- The design of the debit card is slick and has an all-black and silver monochrome color shade with minimal texts on it.

- The UI layout is highly intuitive and easy to configure.

We have discussed the minimal fee and the highly generous limit services at length in the remaining article.

Binance Debit Card LimitThe sky’s the limit when it comes to spending your cryptos via the Binance Card. The daily maximum spending limit for the physical card is very generous at EUR 8,700. While for the virtual card, it is EUR 870. The daily ATM withdrawal limit is EUR 290. There are no minimum deposit limits. You can use the card as long as the Binance account connected to your card has a balance in it.

Considering limits capped by rival companies, Binance undoubtedly offers the most generous spending limits. This service provided by the company makes it even more convenient to use.

Binance Card FeesThe fees are quite generous as well. Binance charges zero monthly fees and issuance fees.

As you know, the Binance card converts your cryptos to fiat instantly, but you must be wondering how much it will cost you to do so. No worry, Binance does not charge you any crypto conversion fee whatsoever.

Every time you make a transaction using the cryptos from your Card wallet, you will have to pay a small spending fee of 0.90%.

For ATM withdrawal, too, fees are 0.90%. Binance doesn’t charge you any fees if you make the transaction in Euros. It would be best if you took note of the fact that here third third-party services and network fees may apply too.

The good part is that even after 12 months of inactivity, you won’t have to pay any fee. Moreover, if you decide to close your account, you can do that without paying an account closure fee.

But what if you lose your card or it gets stolen and how much will you have to pay then for the re-issuance of the Binance card?

Binance would reissuance the virtual card free of cost for you. But if you reorder a physical card, it would cost you EUR 25 to do so.

Binance Debit Card Review: Supported CurrenciesBeing relatively new, the Binance Card supports a decent amount of cryptocurrencies like BTC (Bitcoin), ETH (Ethereum), SXP (Swipe), BNB (Binance Coin), and BUSD (Binance USD). It also supports the EUR fiat currency.

Binance Card Review: Supported CountriesThe Binance Card is available in the following European Economic Areas-

Aruba, Austria, Belgium, Bulgaria, Croatia, Curaçao, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Guiana, Germany, Gibraltar, Greece, Guadeloupe, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Netherlands, Norway, Poland, Portugal, Reunion, Romania, Saint-Martin, Sint Maarten, Slovakia, Slovenia, Spain, Sweden.

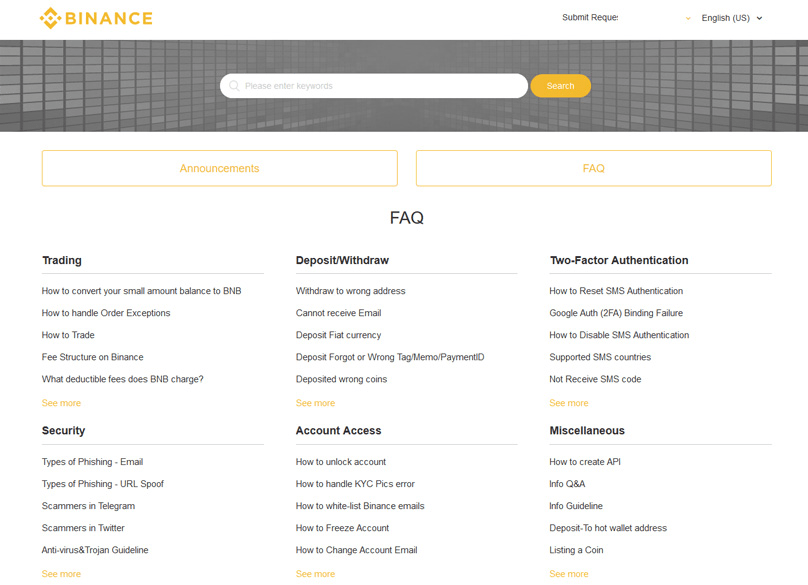

Binance Card Review: Customer ServiceBeing a globally established company, Binance sure does have an extensive support system. They offer help using various ways and on tons of platforms but at the same time are also known to be slow in responding to customer’s requests. This is a familiar scenario with other large exchanges as well. Due to a shortage of support staff and an increase in users, this problem may arise.

However, you can submit support tickets through their online form present on the website. You will receive the company’s response via email. A live chat system is also available, and you can contact them through [email protected] as well. They provide a customer service bot chat too, but some of the responses might be in Chinese.

Binance has one of the most active community members amid crypto exchange platforms. If you want to update yourself with the latest trends impacting trading and the crypto space, you should head over to their Facebook page and Twitter. If you feel like engaging in discussions with fellow Binance users and the Binance support staff, their Reddit forum might be the place for you. Binance is quite active on Reddit, for that matter.

Not much fond of Reddit? Are you more inclined toward using Telegram? Binance has channels there too. Discussions, announcements, and research are a few of the many dedicated topics of the media. The company has separate channels for Chinese and English-speaking users. Furthermore, they are regularly active on LinkedIn, Instagram, YouTube, VK, and Weibo.

If you are new to this business and want to gain more insight into crypto and its trading, Binance has a platform named Binance. Vision, which is the home of Binance Academy. It is dedicated solely to its users to learn everything about Bitcoin and altcoins, from trading to technology. It isn’t just any other knowledge-based platform. They provide well-formulated and easy-to-configure materials for everyone in the world.

While the response to tickets may be a little slow but the site and team are pretty responsive. They do have the capacity to offer empathetic support and professional guidance.

Binance FAQ

Binance Card Review: Security

Binance FAQ

Binance Card Review: Security

Security is taken very seriously at Binance. They have proved to be competent and trustworthy in the past in concern with safety measures.

It is a necessity to verify your account on Binance Exchange. They provide Two Factor Authentication to strengthen security. Also, Binance holds your received funds in a separate account to protect them against the creditors’ claim in an unlikely event where Contis Financial Services Ltd may become insolvent. The company also provides options to freeze, unfreeze, terminate, and report your card if stolen or lost.

The company further claims that your Binance Card funds are SAFU(Secure Asset Fund for Users). This means that your funds are in an emergency insurance fund and are well protected by the usage of top-notch security standards.

In May 2019, a group of hackers had stolen 7,000 bitcoins worth $40 million from the company. But the Binance was extremely quick to respond. They fully compensated the users and were transparent about the incident. This further instilled confidence in people regarding Binance’s security.

To learn more about Binance, read our comprehensive review of Binance.

Binance Mobile AppTo make things even more convenient, the company provides you with a Binance Card mobile app. It is available on IOS and Android. The UI is easy to use and is very interactive. The Binance Card App allows you to transfer and manage your funds, card security, and transactions with a few clicks. Once your new card arrives, you need to load it with funds. Just transfer Bitcoin or BNB from your Binance.com wallet to the Binance Card wallet, and you’re ready to go. You can also top-up your card wallet balance using the app.

Binance Card UI

Binance Card Review: Pros and Cons

Binance Card UI

Binance Card Review: Pros and Cons

Although the Binance Visa Card is one of the most convenient and affordable debit cards, it still has drawbacks. A quick read of the table below will give you an insight into the perks and shortcomings of the debit card.

Is Binance Card Worth Using?There are many crypto cards available out there but, what makes the Binance card worth it? For instance, Wirex, another crypto exchange platform, offers cash backs only up to 1.50% on its card. While Binance, on the other hand, offers up to 8% cashback on your purchases. Another notable feature is that Binance Card has an uncomplicated fee structure. You only have to pay 15 USD as a first-time compulsory top-up but, Coinbase, on the other hand, imposes high fees for many of its services.

The best of it all is that, unlike Coinbase, Binance does not charge a crypto conversion fee. You will have to pay a 2.49% crypto conversion fee while using a Coinbase card but none when using the Binance card.

Also, we cannot overlook the security and support of the company. Looking at all of its features, we reckon that the Binance card is worth using.

Binance Card Review: ConclusionBinance is currently the largest crypto exchange in the market. Even though it is relatively new, it has proven to be more proficient and trustworthy than its rivals. The recent launch of its Visa debit Card has paved the way for more innovative, well-timed services.

The cashback offers seem to work when you have heavily invested in the Binance ecosystem. But even if you are not a big fan of BNB, you can still enjoy the seamless, generous, simple features of the Binance Card. The company is undoubtedly secure, and having a vast global reach works in its favor.

We have reviewed the Binance card with an unbiased sense and have presented all its features to you. It depends solely on whether to use the Binance Card or to check out other similar debit cards. Nevertheless, the Binance Card can guarantee you a smooth, dependable, and advantageous application of your cryptos in the real world.

Frequently Asked Questions How do I freeze my Binance Card?Log in to your Binance.com account and hover the Card Dashboard.

Click on the ‘Freeze’ button on the Card dashboard, and your card will be locked.

Kindly note that until you unfreeze your card, it will automatically decline every transaction.

You must have passed at least KYC level 1 of verification and must be living in an available country.

Can I use the Binance card in an ATM?Being a Visa card, you can use it anywhere. The daily ATM withdrawal limit is EUR 290. Binance charges a 0.9% fee for every withdrawal.

Why did my Binance Card order fail?Your Binance card order can fail due to several reasons. When failed, the company will send you an email stating the exact reason for the incident. Also, if you suffer any loss during the Card order process, the company will return those fees to you.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.