and the distribution of digital products.

DM Television

Best crypto tax software for your money

Read our 2022 article on Crypto tax software.

Whether you’re new to crypto or if you have been in the space for a while, you’ll need to pay taxes.

If you are not sure, read our guide where we answer common cryptocurrency tax questions.

Normally a trader goes through 3 stages when trading cryptocurrencies.

Life of a Crypto Trader What’s the best crypto tax software for my money? Crypto tax software for beginners and tradersIf you’re new into the crypto space and you don’t want to be leveraging in 3-5 different software to manage your crypto portfolio, choose Accointing.

It focuses on the user. It provides educational content. And it has a crypto tracker app as well as a crypto tax software that delivers specific outputs per country for the US, UK, Germany, Austria, Switzerland, or any other country that uses FIFO or LIFO as a tax method.

It offers great customer support, and it’s one of the most affordable platforms out there.

Crypto tax software for CPAs and StartupsIf you’re looking for a more complex platform with more statistics of the general cryptocurrency landscape, I would recommend Cointracking.

It has a robust infrastructure in terms of data although it might not be for your novice trader. They also offer a directory of crypto CPAs around the world, but don’t have any official partnerships with any of them.

Crypto tax software with professional CPA supportIf you’re just looking for a platform to get your taxes done with the help of professionals, but with a considerably steeper price as the competitors, we recommend TokenTax.

It’s mainly focused on English speaking countries so you won’t have any trouble if you come from the US, Canada, or Australia. They handle several tax methods and you can acquire a tax package that includes a CPA…for a price.

Also, read CoinTracking vs Koinly: Simplify Your Crypto Taxes

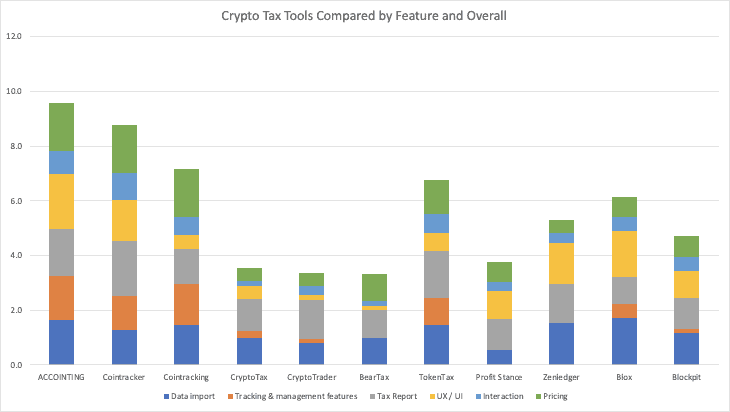

Comparing Different Crypto Tax SoftwareHere is a comparison of different crypto tax software evaluated based on different variables.

The variables are broken down into subcategories in order to provide a more unbiased approach. Each subcategory was individually tested on each platform using the best of our knowledge.

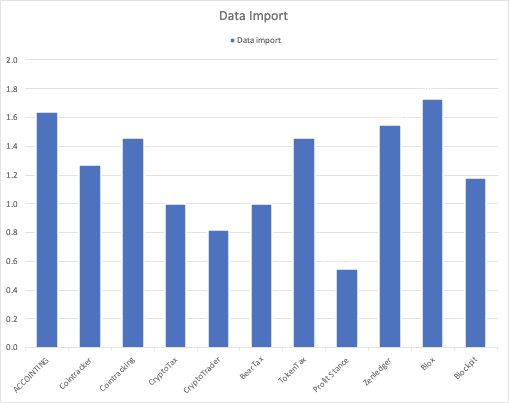

Data Import Features

Data Import Features

We have used multiple data import features as a variable. Following are these variables.

Historical Data ImportAll data from all different data sources consolidated into one single source of truth for transactions, properly aligned to provide a structured output

Automated Exchanges ImportFeature to automate that importing via API or Oauth, leveraging on Exchanges and Wallets connections to accelerate the connection between the exchange and a third party.

Automation Wallet ConnectionFeature to automate the wallet connection via Xpub or leveraging on an API connection to make the connection to a third party faster.

Data ExportFeature to export all transactions inside of the platform to manipulate them accordingly via CSV or Excel.

ICO/OTC ImportFeature to import ICO/OTC transactions properly into the crypto tax software.

Guided Data ExportStep by step guide on how to import your transactions including video tutorials and different importing format (API, CSV, Direct Connect, etc).

Multiple AccountsFeature to handle several accounts via one account (CPA approach).

Ease of Changing Imported DataAbility to easily edit, delete, rearrange data from wallets, exchanges or imported files in less than 2-3 clicks.

Manual ImportAbility to easily input manual transactions into the platform by providing the proper fields and flexibility to adapt to the different tokens conditions.

Option To Edit DataFeature to edit individual transactions.

ClassificationsA variety of classifications aligned to accounting principles in order to provide the best tax output possible.

How data import in crypto tax software is useful?

How data import in crypto tax software is useful?

Importing data into a platform is the first step for any crypto trader trying to understand their transactions any further.

Without the ease of use of importing data into a platform, any platform becomes useless, or cumbersome so instead of offering a solution, it causes a new pain point.

Why you need data import?If you’re extremely impatient or don’t have a lot of time if you have a few or thousands of transactions. A crypto tax software with a great onboarding experience will not only save you a lot of time.

However, if you’re working with a CPA for crypto tax purposes, it will save tons of money in terms of hourly fees by importing all your information faster and effortless with the proper tool.

Based on our analysis we find best data importing features in the following crypto tax software

Tracking & Management FeaturesWe have used tracking and management features mentioned below as a variable for our analysis.

Coin Analysis ChartA feature that translates data to information about your portfolio via an app or a dashboard, providing insights into your crypto portfolio’s performance.

Trade MetricsLinear graphs, bearish or bullish sentiment, candlestick charts or any other feature that helps crypto traders make better decisions based on trends and analytics.

Long/Short-Team CalculationCalculation of long term and short term holdings in order to understand tax repercussions, providing the allocation and amount of the cryptocurrency per term.

Cash Flow AnalysisPnL (Profit and Loss) of portfolio or per token, showcasing gains and losses in different time periods.

Full Data Set AnalysisA feature that allows the user to review the entire transaction history with its classifications, providing buy/sell date, amount, source, cost basis, and classification per each individual transaction in a compiled format.

Coat BasisProper cost basis to calculate tax returns according to each tax method.

Trading AnalysisSmart alerts and insights based on portfolio fluctuations (positive or negative) on customized and specific time periods.

Certified Tracking SystemSOC or any other certification of that sort based on the evaluation or auditing of the current way of handling transactions from an accounting perspective in order to provide the most accurate source of information.

A crypto tax software is not enough. If you’re not an accountant, understanding your entire portfolio transactions based on a glorified spreadsheet won’t be enough.

You need a platform that allows you to understand your entire portfolio, analyze and provide you with real insights in order to manage your portfolio. Taxes are seasonal so it becomes extremely relevant at specific periods of time. A platform that can do everything from anywhere is where the real value is.

Why you need tracking and management?With high volatility and with over 6,000 currencies and 300 exchanges, tracking your portfolio’s performance, it becomes extremely difficult, tedious, and time-consuming. Not only that. When looking for a crypto tax software, the majority only offer a solution during a specific point in time where you might have already made many wrong decisions without having full control of your portfolio and only reacting.

A tool that can provide you with both a tax software and a tracking platform combines the sexiness of trading analytics with the seriousness of taxes, giving you the perfect platform for any crypto trader.

Best tracking and management features is provided by the following crypto tax softwares

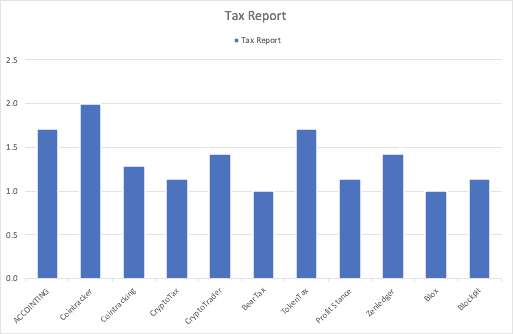

Tax ReportWe have used the following tax reporting features as a variable.

Revelant Tax DocumentsProvides the right information for taxpayers based on the requirements of their countries jurisdiction based on tax methodologies and laws.

Multiple CountriesAssistance in different languages for different countries with a crypto tax law expert on each country supported.

Clear and Guided Report CreationStep by step guide to import, review, classify, define and export a crypto tax report in the most organized way possible

Calculation of Crypto IncomeUsing the right cost basis and the proper methodologies, determining the proper way of evaluating the different transactions to identify income.

Export To Differnt ToolsFeature to add your crypto tax report to several tax platforms based on your countries jurisdiction. For example, TurboTax and Tax Act for the US or Smart Steuer for Germany and Austria.

Transaction Limit For Tax ReportsAllowable transaction limit per tax report package or cost per transaction to file a tax report.

How tax report features are useful?

How tax report features are useful?

If you’re looking to generate a tax report, it’s important that is properly handled by a tool that not only provides the right output based on the right information but also that connects to the relevant tax platforms in order to file all your tax returns in one place.

Having a tax expert within the platform is a nice bonus as long as it is a certified crypto tax lawyer with a good understanding of the crypto space.

Why you need Tax reports?Whether you have just started buying and trading crypto, and you’re realizing just now that cryptocurrencies generate taxable events.

If you have been a crypto trader for quite some time already and are frustrated with the existing crypto tools. it is important for you to know that the there are several software that can provide you with a solution to generate a crypto tax report.

Knowing your countries tax method and tracing every single transaction on an excel sheet is a thing on the past. Save thousands of dollars and time by using a tool that will help you do all of that way better than you (no offense).

Best crypto tax software with tax reports features are:

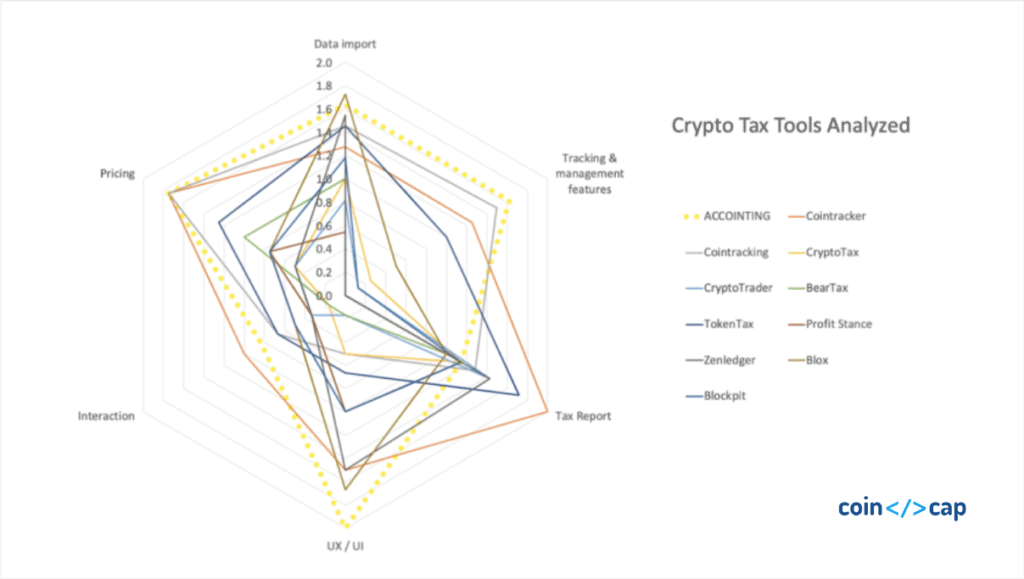

In this spider web diagram, you can visualize how each tool excels in the different categories. The closer the line is to the category (Data import, tracking, and management features, etc), the better it is in that field.

Best Bitcoin Accounting and Crypto Tax softwares

Read Review

Frequently Asked Questions

Is bitcoin tax free?

Best Bitcoin Accounting and Crypto Tax softwares

Read Review

Frequently Asked Questions

Is bitcoin tax free?

According to a U.S. Internal Revenue Service (IRS) internal memo, microtransactions worth less than $1 are taxable events. So no, Bitcoin and other cryptocurrency gains are not tax free.

How does crypto tax work?You need to report all your crypto gains and losses. Based on those your crypto tax will get calculated.

How much tax on crypto gains?This depends on the country you live in. Tax laws applies based on jurisdictions. Read this guide to help you understand how cryptocurrency taxes are calculated.

How to report crypto tax?You can do it manually by maintaining an excel sheet of all your crypto transactions or you can use any crypto tax softwares mentioned above to automate your tax reporting.

How to avoid bitcoin tax?Don’t try this at home.

Top Crypto Tax Softwares Accointing Accointing

Accointing

Accointing is a one in all solution. One of the easiest and fastest platforms to track and report taxes on Bitcoin and other cryptocurrencies.

Read Review Visit Website TokenTax TokenTax

TokenTax

TokenTax crypto tax software automates the entire tax filing process for individuals. Forms are automatically filed and available for download in all the formats an individual may need. And if you want, the TokenTax accounting team can file your tax return for you.

Read Review Visit Website CoinTrackingCoinTracking reduces this paperwork burden through the use of automation. The tax software automatically downloads traders’ transactions from their exchanges.

Read Review Visit Website- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.