and the distribution of digital products.

Best AI Tools for Stock Trading

Artificial intelligence (AI) integration has revolutionized investment strategies, offering efficiency and decision-making capabilities. As financial markets continue to evolve, traders and investors seek innovative tools to navigate the complexities of stock trading. Several AI-powered platforms have emerged, each claiming to provide a competitive edge in predicting market trends and analyzing vast datasets. In this article, we delve into the realm of AI for stock trading, its unique features, and its impact on shaping the future of financial markets.

How does AI stock trading work?AI stock trading uses artificial intelligence and machine learning to analyze large amounts of market data and make informed trading decisions. AI trading algorithms can identify patterns and trends in the market that human traders may miss. They can also process information much faster than humans, giving them an edge in volatile markets.

The benefits of using AI for stock tradingThere are several benefits to using AI for stock trading, including

- Improved accuracy: AI trading algorithms can be trained on historical data to identify patterns and trends that predict future price movements. This can lead to more accurate trading decisions and better returns.

- Speed: AI trading algorithms can process information and make decisions faster than human traders. This can be a significant advantage in volatile markets, where small price movements occur in seconds.

- Consistency: AI trading algorithms are not subject to human emotions, such as greed, fear, and overconfidence. This can help to reduce the risk of making impulsive decisions that lead to losses.

- Diversification: AI trading algorithms can be used to create diversified trading portfolios that are less risky than traditional portfolios.

Drawbacks of using AI for stock trading

Drawbacks of using AI for stock trading

There are also some drawbacks to using AI for stock trading, including:

- Complexity: AI trading algorithms can be complex and difficult to understand. This can make it difficult for investors to evaluate the risks and potential rewards of using them.

- Cost: AI trading platforms and algorithms can be expensive. This can make them inaccessible to some investors.

- Reliance on data: AI trading algorithms are only as good as the data they are trained on. The algorithm’s predictions may be inaccurate if the data is incomplete or inaccurate.

- Hard to trust: Some AI trading algorithms are considered “black boxes” because investors cannot see how they work or make trading decisions. This can make it difficult to trust the algorithm and understand its risks.

AI stock trading is best suited for experienced investors who understand the risks. Choosing a reputable AI trading platform with a proven track record is also important.

AI trading vs Algorithmic tradingAI trading is a subset of algorithmic trading. Algorithmic trading is a type of trading that uses computer programs to execute trades automatically. AI trading uses artificial intelligence and machine learning algorithms to make trading decisions.

Algorithmic trading has existed for decades, but AI trading is a newer development. AI trading is still in its early stages of development, but it has the potential to revolutionize how stocks are traded.

Best AI for stock trading 1. Hoops AI

Hoops AI is a powerful AI stock trading platform that uses machine learning to analyze market data and generate trading signals. Hoops AI offers a variety of features that can help traders of all experience levels make better trading decisions. Not only stocks but Hoops AI also gives insights into cryptocurrencies, commodities, etc.

Here are some key features of Hoops AI

- Advanced market analysis: Hoops AI uses machine learning to analyze market data, including historical prices, technical indicators, and news sentiment. This analysis helps Hoops AI identify patterns and trends that can predict future price movements.

- Real-time trading signals: Hoops AI generates real-time trading signals based on market analysis. These signals can help traders identify buy and sell opportunities and manage risk.

- Portfolio management: Hoops AI provides traders with various tools to help them manage their portfolios. These include stock screener and stock comparison, which helps traders to find the best stock.

- Educational resources: Hoops AI offers a variety of educational resources to help traders learn more about AI stock trading. These resources include blog posts, webinars, and video tutorials.

Also Read: The AI Buzz – An AI Newsletter for the Latest Updates in AI News

2. Black Hedge

BlackHedge is a comprehensive AI trading platform that provides users with the tools and resources they need to trade stocks intelligently. The platform uses a variety of AI techniques to analyze market data and generate trading signals. BlackHedge also offers a variety of features to help users manage their risk and optimize their trading performance.

Here are some key features of BlackHedge

- AI-powered trading algorithms: Black Hedge uses a variety of AI techniques to generate trading signals. These algorithms are trained on a massive dataset of historical market data and are constantly being updated to reflect changing market conditions.

- Comprehensive market analysis: Black Hedge provides users with a variety of tools to analyze the market, including a real-time scanner, backtesting tools, and technical analysis tools.

- Risk management tools: Black Hedge offers a variety of risk management tools, such as stop-loss orders and take-profit orders. These tools help users to protect their capital and manage their risk.

- Portfolio optimizer: Black Hedge’s portfolio optimizer helps users build and manage diversified trading portfolios. The optimizer considers the user’s risk tolerance and investment goals to create a portfolio optimized for their needs.

- Educational resources: Black Hedge offers a variety of educational resources to help users learn about AI trading and the stock market. These resources include articles, videos, and webinars.

Also Read: Best Crypto Trading Signals in India

3. Trade UI

TradeUI is a powerful AI-powered trading platform that provides traders with comprehensive tools to help them make informed trading decisions. With its real-time signals, options flow visualization, live news with AI sentiment, automated charts, and many more.

Here are some key features of TradeUI

- RealTime Signals: TradeUI’s RealTime Signals feature provides traders with buy and sell signals based on real-time market data. This can help traders to identify potential trading opportunities quickly and easily.

- TradeUI Options Flow: TradeUI’s Options Flow feature provides traders with detailed information on the flow of options trades. This information can be used to predict potential market moves and to identify trading opportunities.

- Live News with AI Sentiment: TradeUI’s Live News with AI Sentiment feature provides traders with real-time news updates with AI-generated sentiment analysis. This can help traders understand how the market reacts to news events and make informed trading decisions.

- Automated Charts: TradeUI’s Automated Charts feature generates precise and easy-to-understand charts that visualize market trends. This can help traders to spot potential investment opportunities quickly and to execute trades with precision and confidence.

- ABI Index: TradeUI’s ABI Index is a unique tool that provides traders with insights into market dynamics. The ABI Index can be used to identify trading opportunities and to manage risk.

Also Read: Best AI Affiliate Programs To Join

4. Capitalise AI

Capitalise.ai is an AI-powered stock trading platform that helps users make informed trading decisions by providing them with real-time market data, technical indicators, and AI-generated trading strategies. The platform is easy to use and requires no coding experience.

Here are some features of Capitalise AI

- Real-time market data: Capitalise.ai provides users with real-time market data, including stock prices, charts, and news.

- Technical indicators: Capitalise.ai provides users with a variety of technical indicators, which are mathematical calculations used to analyze market data and identify potential trading opportunities.

- AI-generated trading strategies: Capitalise.ai uses AI to generate trading strategies that are based on real-time market data and technical indicators. These strategies can be customized to fit the user’s risk tolerance and investment goals.

- Backtesting: Capitalise.ai allows users to backtest their trading strategies on historical data to see how they would have performed in the past.

- Paper trading: Capitalise.ai allows users to paper trade their strategies using real-time market data without risking any real money.

Also Read: The AI Buzz – An AI Newsletter for the Latest Updates in AI News

5. Trading Literacy

Trading Literacy is a cutting-edge platform redefining stock trading experiences by integrating conversational Artificial Intelligence . This innovative tool empowers users to interact, analyze, and optimize their investment activities.

Here are some key features of Trading Literacy:

- Chat with your Trade History files: Utilize conversational AI to gain deeper insights into your investment activity. Ask questions, receive reports, and uncover risk-adjusted values effortlessly.

- Analyzing Hundreds of Transactions: Move beyond generic aggregated reports to identify specific leaks and edges in your trading strategy through interactive chat.

- Upload Trade History Easily: Seamlessly upload PDF or CSV history files from any exchange or broker interface, ensuring a hassle-free experience.

- Instant Answers Powered by ChatGPT: Pose questions, extract information, and resume conversations later, all powered by the latest and most potent AI model on the market.

- Encrypted and Anonymized: Prioritize data security with encrypted and anonymized processes, ensuring the removal of personal information before interaction with the AI.

Also Read: Best AI Tools for Students

6. Option Alpha

Option Alpha is an AI-powered options trading platform that helps users generate high-quality trading ideas, research market data, backtest strategies, and find better trades. With its user-friendly interface and powerful AI capabilities, Option Alpha is a valuable tool for both experienced and beginner options traders.

Here are some key features of Option Alpha

- Generate trading ideas: Option Alpha’s AI models analyze market data and identify potential trading opportunities. Users can filter these ideas based on various criteria, such as risk tolerance, time horizon, and market conditions.

- Backtest strategies: Option Alpha’s backtesting tool allows users to test their trading strategies on historical data. This helps traders evaluate the potential performance of their strategies before risking real money.

- Research market data: Option Alpha provides users with access to a wide range of market data, including historical prices, options Greeks, and implied volatility. This data is essential for conducting thorough options research.

- Find better trades: Option Alpha’s AI models constantly scan the market for better trades. Users can receive alerts when the AI identifies potential trading opportunities.

Also Read: 10 AI Headshot Generators for Professional Portraits

7. BigShort

BigShort is a market maker trading indicator tool that provides real-time market insight by displaying equity, option, dark pool, and Smart Money positioning data within a single consolidated interface. It offers several key features that make it a valuable tool for traders.

Here are some key features of BigShort

- Real-time data: BigShort provides real-time data on equity, options, dark pool, and Smart Money positioning. This allows traders to make informed decisions based on the latest market information.

- Consolidated interface: BigShort displays all of its data in a single consolidated interface. This makes it easy for traders to see the big picture and to identify trading opportunities.

- Customizable charts: BigShort allows traders to customize their charts to view the most important data. This makes it easy for traders to personalize their trading experience.

- Alerts: BigShort can send alerts to traders when certain conditions are met. This helps traders to stay on top of the market and to avoid missing trading opportunities.

- Support for multiple markets: BigShort supports multiple markets, including the US, European, and Asian markets. This makes it a versatile tool for traders who trade in multiple markets.

Also Read: The AI Buzz – An AI Newsletter for the Latest Updates in AI News

8. Kavout

Kavout is a global InvesTech company that empowers institutions and investors to make smarter, faster, and better-informed decisions through the application of cutting-edge AI research.

Here are some key features of Kavout

- AI-powered stock recommendations: Kavout uses AI to analyze millions of data points and identify stocks that are likely to go up or down in the short and medium term.

- Pattern recognition technology: Kavout’s pattern recognition technology identifies patterns in stock prices that can help investors make better trading decisions.

- Price forecast engine: Kavout’s price forecast engine predicts future stock prices based on a variety of factors, including historical data, current market conditions, and news events.

- K Score equity rating: Kavout’s K Score equity rating is a proprietary metric that ranks stocks based on their likelihood of delivering positive returns.

- Broad coverage: Kavout covers over 7,000 US equities and 800 China A Share stocks.

Also Read: Best AI Tools for Sales

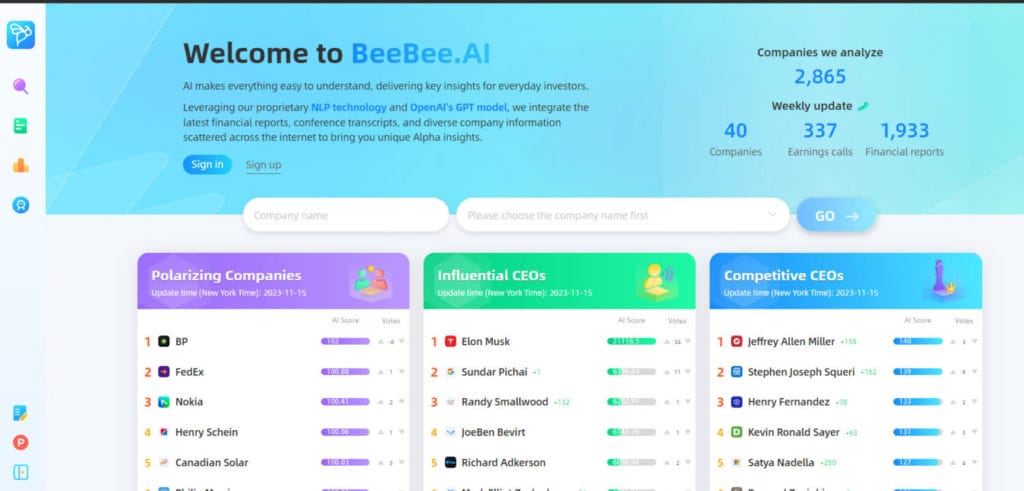

9. BeeBee.AI

BeeBee.AI is an AI-powered stock research platform that simplifies this process by providing comprehensive insights to retail investors.

Here are some key features of BeeBee.AI

- AI-Powered Earnings Call Interpretation: BeeBee.AI analyzes earnings call transcripts, identifying key takeaways and sentiment indicators, helping investors make informed decisions based on real-time insights.

- Company Ranking and Analysis: BeeBee.AI ranks companies based on various factors, including financial performance, market sentiment, and AI-driven insights, enabling investors to prioritize promising investment opportunities.

- Comprehensive Financial Data Integration: BeeBee.AI seamlessly integrates with various financial data sources, providing investors with a holistic view of a company’s financial health and performance.

- Tailored Investment Recommendations: BeeBee.AI tailors investment recommendations to individual investor profiles, considering risk tolerance, investment goals, and portfolio composition.

Also Read: 7 Best FREE AI Chatbots That Will Blow Your Mind

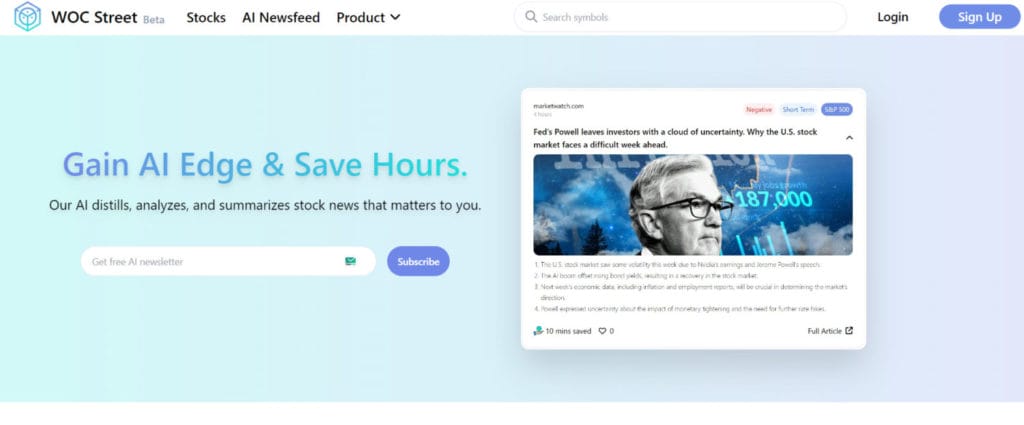

10. Wocstreet

Wocstreet, a cutting-edge stock market news and insights app stands as a beacon of innovation in the financial landscape, harnessing the power of artificial intelligence to redefine how users engage with stock-related information.

Here are some features of Wocstreet

- AI-Driven Stock Insights: Wocstreet harnesses the power of AI to provide users with intelligent and data-driven insights into the stock market.

- News Summarization: The app employs advanced algorithms to scan, analyze, and summarize relevant stock news, ensuring users receive concise and pertinent information.

- Efficient Decision-Making: With its AI capabilities, Wocstreet empowers users to make informed decisions in the stock market, saving time and enhancing their overall trading experience.

Also Read: Best AI Waifu Generators: Create Your Perfect Digital Companion

ConclusionAs financial markets grow more complex, AI is rising to the challenge, offering traders superior analytics and predictive capabilities. Platforms like Hoops AI, BlackHedge, and Option Alpha showcase how machine learning grants a competitive edge, from pattern recognition to portfolio optimization. While AI trading remains an emerging field requiring thoughtful implementation, its potential to minimize risks and identify opportunities through mountains of data points to continued success. For both new and experienced investors, integrating AI into trading strategies can enhance outcomes.

Frequently Asked Questions How does AI transform stock trading?AI analyzes vast amounts of market data to detect patterns and make informed trading decisions faster than humans can. This provides an edge in volatile markets.

What are the main benefits of AI stock trading?Key benefits are improved accuracy, speed, consistency, risk management, and the ability to process information human traders may miss.

What are some limitations of relying on AI for trading?Potential limitations include complexity, costs, data dependency, and lack of complete transparency into how some algorithms work.

What types of traders can benefit most from AI technology?AI trading is best suited for experienced investors who thoroughly understand risks and have clear trading strategies AI can complement.

What data does AI for trading analyze to generate insights?AI analyzes technical indicators, historical prices, news sentiment, options flow, and other datasets to identify profitable trades.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.