and the distribution of digital products.

Archway Q3 2024 Brief

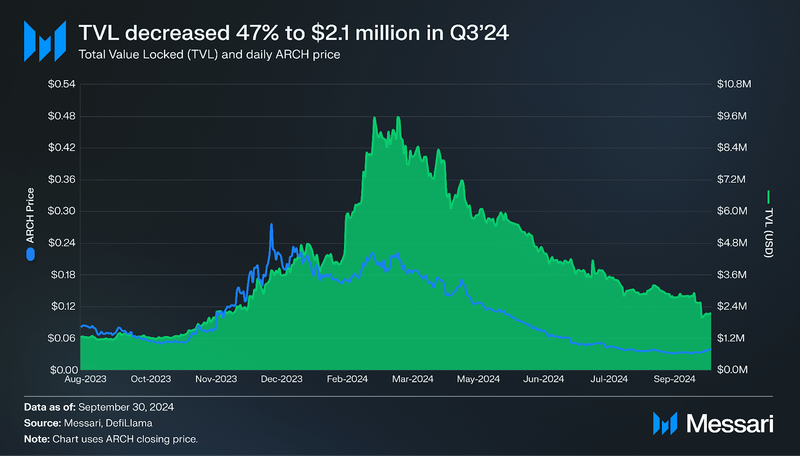

- Although TVL measured in USD dropped 47% in Q3, TVL in ARCH reached an all-time high in September, peaking at 89.7 million ARCH.

- Contract calls held steady with a total of 416,500 in Q3, while September recorded 163,800 calls, marking the second-highest monthly total in Archway’s history.

- To support the network’s long-term sustainability, the size of the active validator set was reduced to 40, and the inflation rate was lowered to 2% in Q3.

- Archway launched several key initiatives in Q3, including the Guzzlers Club free gas program, a partnership with Euclid Protocol for the Aurora Hackathon, and the “Arch Marks the Spot” scavenger hunt.

Archway (ARCH) is a Layer-1 blockchain in the Cosmos ecosystem that aims to revolutionize the economic model for decentralized applications (dApps). It provides a unique rewards system that compensates dApp developers through gas fee rebates, inflationary reward shares, and smart contract premiums. By giving developers a stake in the protocol's growth and governance, Archway seeks to foster a sustainable and thriving development environment.

Archway’s foundation is built on the Cosmos SDK, utilizing the Tendermint consensus algorithm for its speed, security, and efficiency. It leverages the Cosmos ecosystem's Inter-Blockchain Communication (IBC) protocol to ensure seamless cross-chain interoperability, enhancing dApp functionality. It also supports CosmWasm, allowing developers to build dApps in multiple programming languages.

Website / X (Twitter) / Telegram

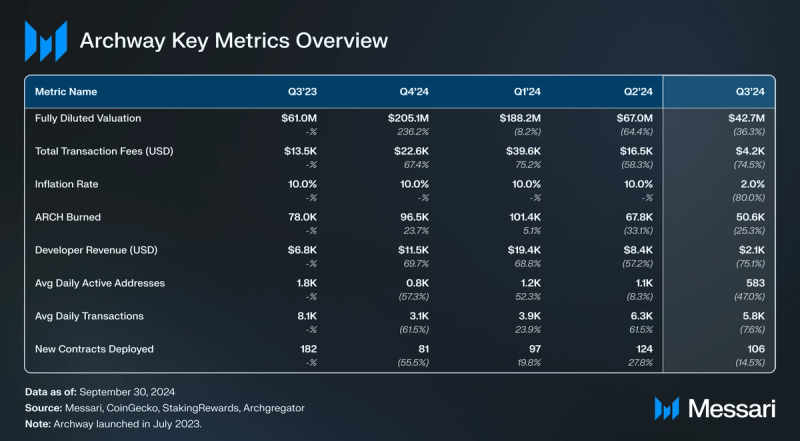

Key Metrics Financial Overview

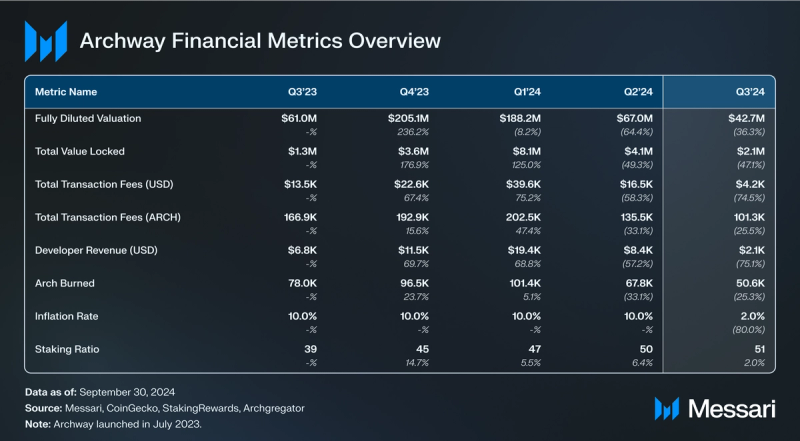

Financial Overview Network Overview

Network Overview

In Q3, Archway paid $2,100 to contract deployers, marking a 75% decrease from the previous quarter. The USD value of ARCH also dropped by 38% QoQ, mirroring a similar decline in ARCH burned. Total transaction fees for the quarter amounted to $4,200, resulting in 50,600 ARCH burned, as half of all transaction fees (paid in ARCH) are burned.

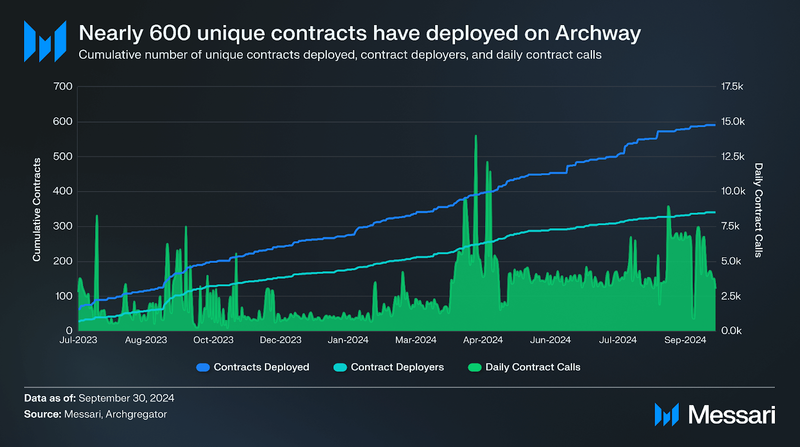

In Q3 2024, 42 unique addresses launched 106 new contracts on Archway. In turn, the number of unique deployed addresses increased to 590, up from 484 in Q2. Additionally, the number of contract deployers increased to 340, a 14% increase from 298 at the end of Q2.

Contract call activity, which tracks user interactions with smart contracts on Archway, held steady in Q3 at 416,500 — a slight increase from 413,400 in Q2. Daily activity peaked on August 28 with 8,900 unique contract calls. Following a record monthly high in April 2024, September posted Archway’s second-highest monthly total, with 163,800 contract calls.

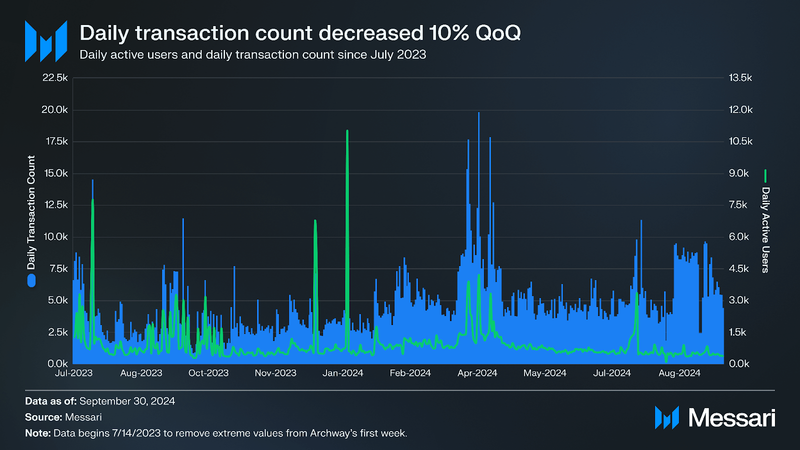

In Q3 2024, Archway averaged 583 unique active addresses daily, a 47% decrease from the previous quarter. Total transactions for the quarter fell by 7% to 534,400. Despite this recent dip, total transactions rose 65% year-over-year, making Q3 Archway's second-highest transaction quarter, following Q2 2024.

Transaction activity and daily active users reached quarterly highs in the first week of August. Daily transactions peaked at 11,300 on August 5, while daily active users — representing the number of unique transaction signers each day — hit a quarterly high of 3,400 on August 2. Following an all-time high in monthly transactions in April 2024, September recorded the second-highest monthly total, with 216,300 transactions.

TVL on Archway decreased to $2.1 million in Q3, down 47% from $4.1 million in June. This was driven by a 38% drop in the value of ARCH. However, when measured in ARCH, TVL hit all-time highs in Q3. It peaked at 89.7 million ARCH on September 3, 2024, before dropping to 56.7 million ARCH at the quarter end.

Astrovault, a native DEX built on Archway, held $2.0 million of Archway’s TVL at the end of the quarter. Many pairs on Astrovault are denominated in ARCH, with AXV (Astrovault’s native token), JKL (Jackal Protocol’s native token), ATOM, wBTC, and ARCH as the pools with the largest liquidity. As Astrovault continues to bootstrap liquidity and users, ARCH volume and transactions should increase as more projects are supported. Astrovault comprises over 95% of Archway’s TVL, followed by Liquid Finance and Balanced Exchange. The latter two protocols managed approximately $271,000 in combined TVL at the end of Q3.

Since its launch, Archway has consistently maintained a staking ratio above 40%, surpassing 50% for the last two quarters. In Q3, two governance proposals were enacted to bolster the network's long-term sustainability: the validator set was reduced to 40 to improve voting power distribution, and the network inflation rate was reduced to 2% from 10% to help stabilize token volatility. With half of the gas fees burned, Q3 saw a record-low burn of 50,600 ARCH.

Key DevelopmentsProtocol Upgrades and GovernanceUsers continued to benefit from the protocol upgrades introduced in Q2’s V7 upgrade, which added several key features. The new callback module allows smart contracts to receive callbacks at the end of each block, streamlining operations through task automation, eliminating transaction fees for scheduled tasks, and reducing reliance on intermediaries. In Q3, the callback module’s gas limit parameter was increased from 100,000 to 1,000,000, enabling smart contracts to execute more computationally intensive transactions. Additionally, the fee grants feature lets dApp developers cover user transaction fees, supporting subscription-based and freemium models that enhance the user experience. Improved multi-chain capabilities were also introduced through the CW ICA module, which expanded contract functionality for managing accounts and executing transactions across different chains within the Cosmos ecosystem.

Upon discovering a critical security vulnerability in Q3, the team implemented a consensus-breaking upgrade to V8 on the mainnet, ensuring immediate resolution of the issue and safeguarding network security. On September 5, 2024, a governance discussion began for the V9 upgrade. It proposed updates to CosmWasm, Cosmos IBC, and CometBFT, as well as some new features.

In Q3, Archway also announced support for Token Bound Accounts (TBA), allowing for the transformation of NFTs into onchain identities. This innovation enhances user control and security over assets and allows for NFT staking, airdrop reception, and bundled asset trading. TBAs can be managed using various credentials, including public keys, EVM addresses, or passkeys, offering users flexibility and improved asset management capabilities.

Partnerships and CollaborationIn July 2024, Archway announced a new feature allowing users to benefit from one-click cross-chain swaps on Osmosis through Nomos. On September 10, 2024, Leap Wallet revealed SwapFast support for Archway, enabling another avenue for one-click cross-chain swaps. These developments simplify the process of accessing liquidity across multiple networks.

Additionally, the Ambur Marketplace on Archway introduced new features to improve the overall user experience for trading NFTs on the platform. These include submitting offers, purchasing multiple NFTs in one transaction for minimum prices, customizing interface views, and transacting using USDC.

Other key developments in Archway’s ecosystem during Q3 include:

- Entity Finance allows builders on Archway to launch and manage cross-chain token projects seamlessly.

- Euclid Protocol enables developers to access cross-chain liquidity with reduced slippage across various networks, such as Cosmos, Solana, EVM-compatible chains, and others.

- Jackal Protocol was built on Archway to provide the ecosystem with decentralized storage.

- Fordefi integrated Archway into their MPC wallets.

- The Ghouls launched their first onchain game on Archway.

- Reclaim Protocol went live on Archway, enabling developers to leverage zero-knowledge proofs (ZKPs) to prove offchain data onchain.

- Monerium partnered with Noble to launch EURe, the first MiCA-compliant Euro-backed stablecoin in the Cosmos ecosystem. EURe provides Archway developers with new opportunities to create euro-denominated DeFi products and dApps.

Archway launched several key initiatives in Q3 2024 to encourage active participation in the ecosystem:

- Free Gas Initiative: Archway launched the Guzzlers Club, providing users with free gas fees for transactions on the Archway network. To join, participants must stake over 500 ARCH, hold an Archies NFT, and possess a Drop Camp Patch.

- Aurora Hackathon Collaboration: Archway builders participated in the Aurora Hackathon, focusing on developing dApps that integrate with Euclid Protocol’s Unified Liquidity Layer. This partnership aims to solve liquidity fragmentation across blockchain networks, enhancing capital efficiency and reducing slippage in cross-chain transactions.

- Friends with Benefits Campaign: Concluding in Q3, this campaign rewarded users with NFT badges and token incentives for completing Galxe quests. Rewards included 10,000 USDC for each successful ARCH token listing on a top 20 exchange, a monthly raffle of 1,000 USDC for badge holders, and meme competitions with a total of 450 USDC in weekly prizes.

- Arch Marks the Spot: On August 20, Archway launched the “Arch Marks the Spot” scavenger hunt, inviting participants to explore the Archway website in search of specific keywords to win USDC. With a total bounty of 500 USDC, the hunt awarded 20 winners with 25 USDC each.

Additionally, Archway’s dApp treasury stands at $1.1 million and is dedicated solely to contract deployers on mainnet. These initiatives show Archway’s commitment to its technical infrastructure and robust community, setting the stage for more growth and innovation.

Closing SummaryIn Q3 2024, payments to contract deployers fell 75%, and developer revenue declined YoY. Nevertheless, Archway demonstrated resilience with QoQ growth in contract call activity, with September marking the second-highest monthly activity in its history. Quarterly transactions fell by 7% to 534,400 but rose 65% year-over-year, making Q3 the second-highest quarter for transactions after Q2 2024. Additionally, while TVL in USD dropped 47% QoQ to $2.1 million, TVL measured in ARCH reached an all-time high, peaking at 89.7 million ARCH on September 3, 2024.

During the quarter, Archway reinforced its commitment to long-term sustainability by reducing the size of the active validator set to 40 and lowering the inflation rate to 2%. Archway also launched several initiatives, including the Guzzlers Club free gas program, a partnership with Euclid Protocol for the Aurora Hackathon, and the “Arch Marks the Spot” scavenger hunt. Additionally, Archway continued to improve its user experience by introducing one-click swaps, token bound accounts, and other new developments.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.