and the distribution of digital products.

Algorand Q4 2024 Brief

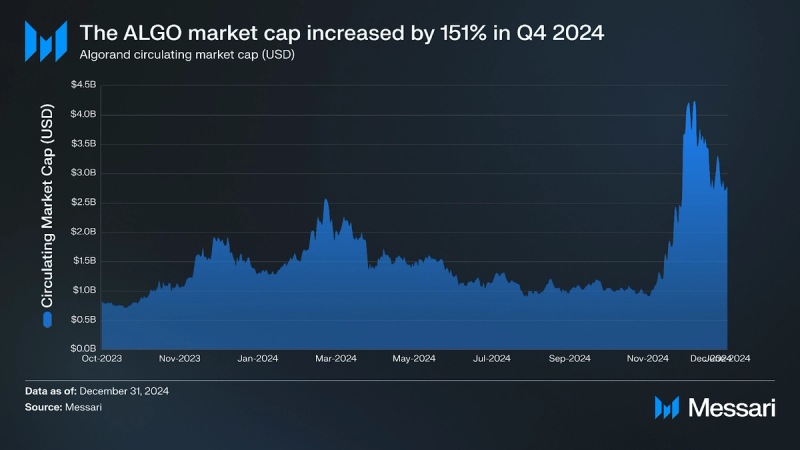

- Algorand’s market cap grew 151% QoQ, increasing from $1.1 billion to $2.8 billion.

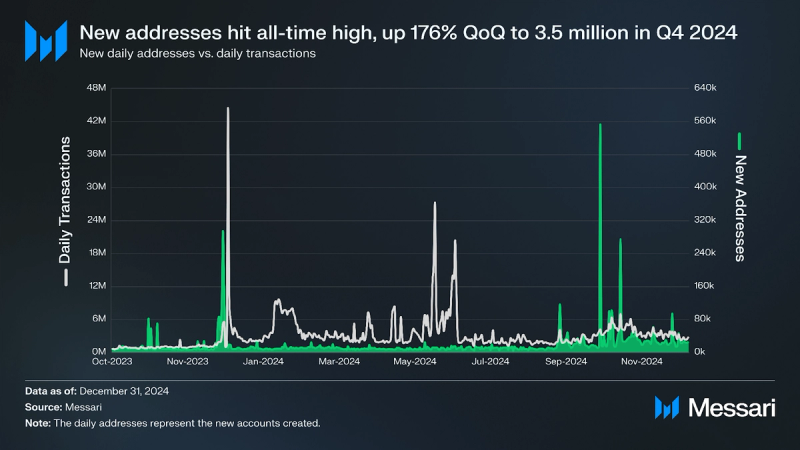

- New addresses in Algorand increased by 176% QoQ, from 1.3 million to 3.5 million.

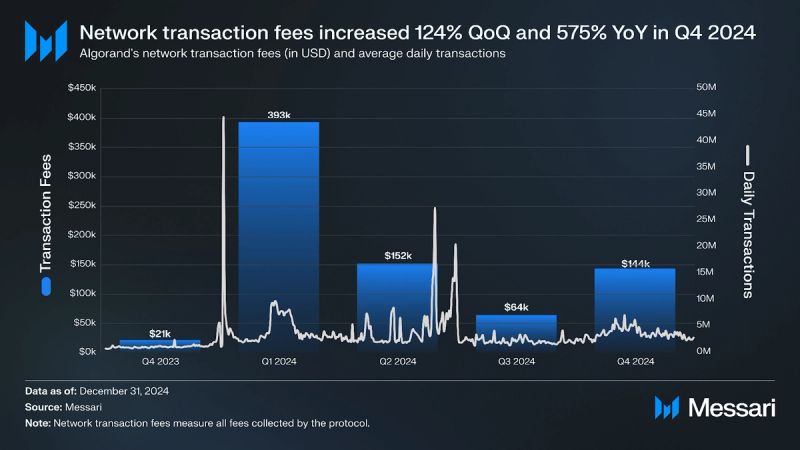

- Network transaction fees rose 124% QoQ to $144,000, reflecting higher engagement, while average daily transactions increased 66% QoQ to 3.5 million, driven by staking rewards and ecosystem growth.

- ZTLment, a European fintech company, migrated from Ethereum to Algorand in October 2024, leveraging Algorand’s Atomic Transactions and multisig approvals to enhance efficiency and compliance for regulated payments.

- GP13 allocated 17.2 million ALGO and introduced governance reforms, including the creation and eligibility of the xGov Council.

Algorand (ALGO) is a smart contract platform using a Pure Proof-of-Stake (PPoS) consensus mechanism. The protocol was founded by Turing award-winning computer scientist Silvio Micali, also known for co-inventing zero-knowledge proofs, Verifiable Random Functions (VRF), and probabilistic encryption. In Q1 2025, Algorand introduced staking rewards, allowing node operators to earn incentives for proposing blocks. Unlike other PoS networks, Algorand’s staking model features no slashing, no lockups, instant payouts, and low hardware requirements, making participation more accessible. These updates enhance network security and decentralization while maintaining flexibility for users. Like relying on stake weight in consensus, Algorand PPoS randomly selects consensus nodes based on their ALGO balances using a Verifiable Random Function (VRF), where having a larger balance increases the holder’s chance of selection. Algorand’s smart contract execution layer is powered by the Algorand Virtual Machine (AVM). Algorand supports smart contract development in Python and other community-developed languages. Algorand Technologies leads development, while the Algorand Foundation, a not-for-profit, supports governance, ecosystem funding, and community-driven development.

Website / X (Twitter) / Discord

Key Metrics Performance AnalysisNetwork Transactions

Performance AnalysisNetwork Transactions

Total protocol revenue on Algorand, which includes fees collected from network transactions, increased by 124% QoQ, rising from $64,000 in Q3 2024 to $144,000 in Q4 2024, and by 575% YoY, up from $21,000 in Q4 2023. Additionally, average daily transactions grew from 2.1 million to 3.5 million, while total transactions increased from 193 million to 321 million over the same period.

This growth can be attributed to several key developments in Q4 2024. The announcement of inclusive staking rewards in November likely encouraged greater validator participation, which increased onchain activity. Initiatives such as Coinbase Quests drove new user engagement, leading to a rise in wallet downloads and dApp interactions. Additionally, Kare Wallet’s deployment for disaster relief contributed to higher transaction volumes.

A significant increase in ALGO’s price also played a role. The token surged 149% QoQ, rising from $0.13 to $0.33. Since transaction fees are denominated in ALGO, this price increase amplified the dollar value of fees collected, boosting protocol revenue.

The number of new addresses on Algorand increased significantly in Q4 2024, rising 176% QoQ from 1.3 million in Q3 to 3.5 million and 91% YoY compared to Q4 2023. Similarly, the daily average of new addresses created rose from 14,000 in Q3 2024 to 38,000 in Q4, reflecting a 91% YoY rise. Two significant spikes contributed to this growth:

- October 22, 2024: A record high of 553,000 new addresses was created on this day. This increase is attributed to the ongoing impact of the Coinbase Quests program, which incentivized wallet creation and dApp engagement with rewards for interacting with platforms like Pera Wallet and Folks Finance. The migration of ZTLment to Algorand in early October, showcasing the network’s use in regulated payments, also likely contributed to new wallet creation around this period.

- November 7, 2024: Another spike of 270,000 new addresses coincided with the announcement of inclusive staking rewards, which attracted users by enabling staking without lockups or penalties, and the introduction of liquid staking, which increased activity on DeFi platforms. Additionally, updates to Pera Wallet and improved app discovery through Pera Discover may have encouraged further wallet activity.

Daily transactions also grew considerably, increasing 66% QoQ from 2.1 million in Q3 to 3.5 million in Q4 and 208% YoY from 1.1 million in Q4 2023. This growth reflects increased network activity driven by staking rewards, DeFi participation, and applications such as Kare Wallet for disaster relief, tokenized renewable energy credits, and broader ecosystem engagement efforts.

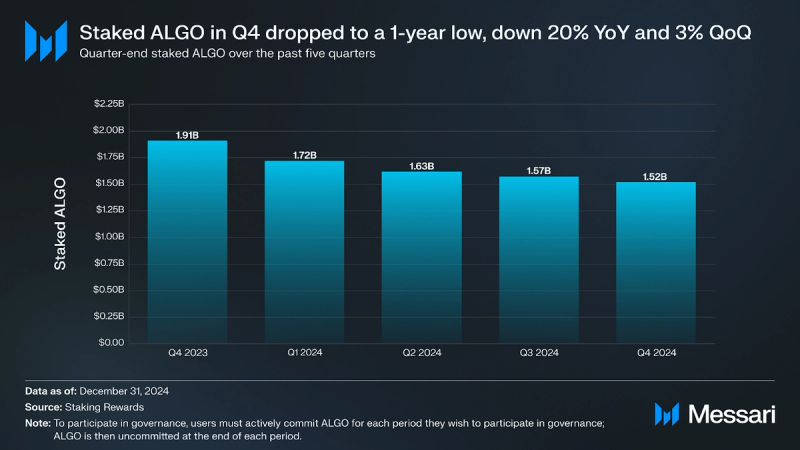

Staked ALGOGovernance on Algorand has followed a unique model compared to many other blockchains. Participants can earn rewards by committing ALGO to governance, but this process does not contribute to network security. If a user’s committed balance falls below the required threshold, they become ineligible for rewards.

Instead of using the Algorand Foundation’s governance interface, users can participate via Folks Finance’s Liquid Governance program, the largest DeFi protocol on Algorand. This program allows users to engage in governance by staking (rather than committing) ALGO in exchange for gALGO, a liquid governance token. However, this system is being phased out after Governance Period 14 (GP14), marking Algorand’s transition from governance rewards.

Starting in Q1 2025, Algorand will fully transition from governance-based rewards to a staking-based incentive model. Under the new system, staking ALGO will contribute directly to network security, with rewards distributed to block producers instead of governance participants. In this new structure, liquid staking tokens like xALGO will emerge as alternatives for users seeking to earn staking rewards while maintaining liquidity. Various DeFi platforms, including Folks Finance, Tinyman, Messina, CompX, and Réti Pools, will offer different methods for earning staking rewards.

In Q4 2024, the amount of staked ALGO on Algorand declined by 20% YoY and 3% QoQ, reaching 1.52 billion ALGO, the lowest level in a year. This decline can be attributed to the reduction in governance rewards, which decreased from 32 million ALGO in Q4 2023 to 17.2 million ALGO in Q4 2024, discouraging some participants.

The percentage of the eligible Algorand supply staked also fell by 2% QoQ, standing at 18%, while Algorand’s circulating supply increased by 0.7% to 8.3 billion ALGO. While the Algorand 4.0.1 protocol upgrade was introduced in late December 2024, bringing staking rewards and encouraging validator participation, its impact on staking behavior will likely materialize in early 2025 as the adoption of the upgrade progresses.

The declining governance rewards reflect Algorand’s strategic transition from a heavily incentivized governance model toward staking-based incentives. This shift aims to create a more sustainable and decentralized ecosystem, though the transition phase has led to temporary decreases in staked ALGO during Q4 2024.

Stablecoins

The market cap for stablecoins on Algorand experienced a decline in Q4 2024, dropping from $113 million in Q3 to $57 million. This reflects a 50% decrease in QoQ and a 26% decline YoY from $78 million. Most of this decline was driven by a significant reduction in USDC’s market cap, which fell from $110 million to $53 million, representing a 51% QoQ drop.

The decrease in USDC’s market cap may be attributed to a combination of factors. In the previous quarter, USDC saw strong growth due to Algorand’s integration with Coinbase and the Coinbase Learning Rewards program, which encouraged USDC transactions on the network.

Other stablecoins on Algorand displayed mixed performance during the same period. USDT’s market cap remained stable, while EURD saw a 16% QoQ decrease, falling from $1.1 million to $950,000. Smaller-cap stablecoins recorded an 8% QoQ increase, rising from $670,000 to $730,000. Despite the decline, USDC continued to hold the majority of the stablecoin market on Algorand, with a 94% market share. USDT and EURD slightly increased their shares, with USDT growing from 2% to 4% and EURD from 1% to 2% in Q4.

DeFi

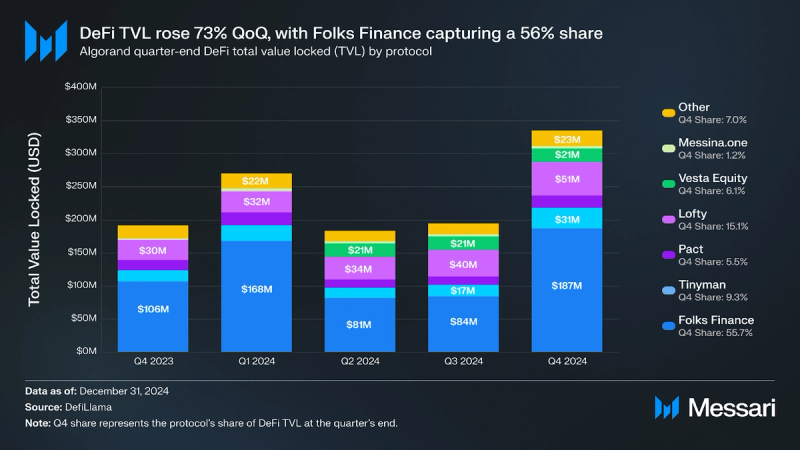

In Q4 2024, Algorand’s DeFi ecosystem experienced substantial growth, with Total Value Locked (TVL) increasing by 73% QoQ, rising from $194 million to $335 million. This expansion was driven by increased activity across major platforms, including Folks Finance, Tinyman, Pact, and Lofty. Among these, Folks Finance recorded the largest gain, growing 122% QoQ from $84 million to $187 million, while Tinyman and Pact saw increases of 82% and 42% QoQ, respectively. Lofty also experienced a 28% QoQ rise, reaching $51 million in TVL.

Several factors contributed to this trend. Algorand launched inclusive staking rewards in November 2024, attracting users to participate in staking without lockups or penalties. Additionally, the introduction of liquid staking on platforms like Folks Finance and Tinyman encouraged greater engagement in DeFi. Tokenized assets such as regulated euro-pegged tokens, tokenized farmland, and real estate also played a significant role in expanding use cases and driving user participation.

The network added 1.9 million new active addresses, reflecting a 176% QoQ increase in new addresses, which supported higher engagement and transaction volumes across DeFi protocols. Increased interest in Real-World Asset tokenization, particularly through Lofty, and broader ecosystem engagement efforts, such as developer initiatives and partnerships like ZTLment’s migration to Algorand, further fueled growth.

Market Cap

Algorand’s market cap grew by 151% QoQ, rising from $1.1 billion to $2.8 billion in Q4 2024. This growth closely aligned with a 149% increase in ALGO’s price, which rose from $0.13 in Q3 to $0.33 in Q4. Despite the sharp price increase, Algorand’s circulating supply saw only a modest rise of 0.7%, increasing from 8.2 billion to 8.3 billion tokens.

On a YoY basis, Algorand’s market cap expanded by 56%, up from $1.8 billion in Q4 2023, reflecting sustained long-term growth. This surge in valuation also improved Algorand’s overall market ranking, moving from 66th place in Q3 to 48th in Q4 2024. The sharp market cap and token price increase suggest stronger investor confidence, increased adoption, or favorable market conditions driving demand for ALGO

Qualitative Analysis GovernanceThe Algorand Foundation operates two governance programs: Community Governance and xGov. Community Governance runs quarterly, addressing key ecosystem decisions. The xGov pilot, which ran from Q3 2023 to Q2 2024, allowed participants to vote on fund allocations and strategic decisions. Unlike standard governance, xGov required participants to vote in each session or risk losing their staked ALGO, with forfeited stakes redistributed to those who completed the term. In Q3 2024, xGov transitioned to a public beta, updating eligibility criteria to link voting power to the number of blocks an address proposes, and aligning participation more directly with consensus activities.

Although the Governance Period 12 (GP12) took place in Q3 2024, the proposed measures had implications extending into subsequent periods. During this period, 11 key initiatives were implemented, with a total allocation of 22.5 million ALGO across various projects. Of this, 11.25 million ALGO (50%) was directed to General Governance Rewards, while the remaining 11.25 million ALGO was allocated to DeFi Rewards. Within the DeFi Rewards category, up to 50% (5.625 million ALGO) was designated for targeted DeFi projects, with the remaining funds supporting general DeFi rewards to foster decentralized decision-making across the Algorand ecosystem.

Targeted DeFi Rewards Allocation:

- Algomint: 206,491 ALGO to enhance liquidity in specific pools.

- AlgoRai: 165,795 ALGO for yield opportunities and educational programs.

- Cometa: 183,458 ALGO to drive cross-chain liquidity and users from Layer 2 chains.

- CompX Labs: 118,581 ALGO to increase TVL, transaction volume and attract new users.

- Folks Finance: 1,406,250 ALGO to attract users from other chains and raise TVL.

- Meld Gold: 131,925 ALGO for liquidity retention and brand awareness.

- Messina.one: 503,416 ALGO for cross-chain community engagement.

- Pact: 1,015,567 ALGO to increase liquidity and user numbers.

- Tinyman: 1,406,250 ALGO to enhance liquidity and trading volume.

- Wormhole: 120,124 ALGO to encourage asset bridging and liquidity growth.

Governance Period 13 (GP13) took place in Q4 2024, introducing three pivotal measures to refine and decentralize Algorand's governance framework. During this period, 1.5 billion ALGO was committed, and 17.2 million ALGO in rewards were distributed. Unlike previous periods, GP13 prioritized structural governance improvements over direct reward allocations, setting the foundation for a more community-driven governance model. This governance cycle also focused on transitioning to staking rewards and preparing for the phase-out of incentivized governance, further empowering community decision-making. Key Measures Approved:

- Establishing the xGov Council: A measure to create an elected xGov council was approved. This council will oversee the grant processes, reduce reliance on the Algorand Foundation, and enhance transparency and accountability. Council members will be elected by the community for fixed terms and tasked with managing proposals that meet eligibility criteria.

- xGov Council Member Eligibility: Eligibility criteria for xGov council candidates were expanded to include any community member with relevant experience. This change allows for broader participation and introduces diverse perspectives into Algorand’s governance.

- Eligibility to Vote for xGov Council Members: A measure to determine voter eligibility for xGov council elections was also approved. This ensures that the voting process remains inclusive and aligns with Algorand's decentralized ethos.

- Staking Rewards Launch: Algorand announced inclusive staking rewards in November, allowing validators to earn 10 ALGO per block without slashing penalties or token lockups. Validators earn 50% of the transaction fees from proposed blocks. The rewards decay by 1% every 1 million blocks, combining real-time incentives with non-inflationary mechanisms to support over 2 billion transactions.

- NodeKit and Node Operations: Algorand streamlined node creation with tools like NodeKit, making it easier for participants to join the network. To earn rewards as a solo validator, a node must stake a minimum of 30,000 ALGO.

- Liquid Staking on Algorand: Liquid staking was introduced, enabling users to stake ALGO and receive liquid tokens (e.g., xALGO) for DeFi activities. Platforms like Folks Finance, Tinyman, and CompX offer staking services with no lockup periods or penalties, enhancing ecosystem flexibility.

- Algorand 4.0.1: In December 2024, Algorand released version 4.0.1 of its protocol, introducing native consensus participation incentives. This update allows validators to opt into a rewards program based on specific balance requirements, enhancing network security and activity. It also features an automatic heartbeat function to help eligible nodes maintain consistent online performance, ensuring smoother network operations. Additionally, the update includes support for zero-knowledge proof applications through new MiMC hash function opcodes and addresses network handling issues.

- Kare Wallet for Disaster Relief: Kare Wallet leveraged Algorand’s blockchain to deliver rapid, fraud-free cash aid to disaster survivors in Tennessee, Florida, and Maui. Secure digital IDs and blockchain tracking reduced processing times to minutes, ensuring efficient and accountable distribution.

- Nasdaq TradeTalks – Climate Tech & Tokenization: Algorand’s Marc Vanlerberghe and Jasmine Energy’s Nathalie Capati discussed tokenization for renewable energy credits (RECs). They highlighted Algorand’s carbon-negative blockchain for tracking RECs, supply chain tracing, and tokenized carbon insets to reduce emissions.

- Regional Hackathons and Innovation: Developers from Vietnam, France, and Nigeria created localized blockchain applications during regional hackathons. Winning projects included "AlgoIDE" (Vietnam, developer tools), "Vibepass" (France, ticketing), and "Agroshop" (Nigeria, agricultural supply chains).

- ZTLment’s Move to Algorand: In Q4 2024, ZTLment, a European fintech company, migrated from Ethereum to Algorand to enhance its operational efficiency and scalability. The move enabled a sevenfold reduction in development time, largely due to Algorand’s built-in features such as Atomic Transactions and multisig approvals, which simplified processes and reduced the need for extensive custom development. These tools also supported compliance with Europe’s Payment Services Directive 2 (PSD2), a key regulatory framework for financial services. Atomic Transactions on Algorand allow for batching multiple operations into a single unit, ensuring that all transactions succeed or fail together. This functionality reduces the risks associated with delivery-versus-payment and simplifies fund management processes, which are critical for ZTLment’s escrow-based payment services. Additionally, Algorand’s multisig approvals provide added security by requiring multiple pre-authorized parties to approve specific actions. The transition to Algorand has allowed ZTLment to streamline its payment operations and develop solutions more efficiently, particularly for mid-sized platforms that lack in-house financial compliance capabilities.

- UNDP Blockchain Academy Expansion: Algorand partnered with the UNDP Blockchain Academy to train 24,000 UN personnel globally. The initiative focuses on applying blockchain to sustainable development goals, such as supply chain transparency and inclusive finance.

- AlgoCafe in Bangkok: Hosted during DevCon, this two-day event brought developers, blockchain enthusiasts, and media together for workshops, mini-MBA sessions, and networking events. Global participants explored topics like staking, node deployment, and community building.

- Pera Wallet Updates: Pera Wallet played a key role in the Coinbase Quest program and teased a debit card with Immersve, enabling USDC spending at fully onchain merchants. Additionally, Pera Discover updates enhanced app discovery and user verification.

- "Can a Blockchain Do That?" Marketing Campaign: Algorand launched a new campaign to showcase real-world use cases, targeting developers and enterprises. The campaign highlights Algorand’s unique features, such as carbon-negative infrastructure, instant transaction finalization, and modular components.

- Developer Efficiency and ROI: Algorand was recognized for offering a 600% faster development ROI than Ethereum. Developers benefited from Python-based tools and built-in protocol capabilities like multi-sig and atomic transactions, which reduced project completion times and costs.

- Completion of Algorand Incubator: The first cohort of the Algorand Incubator graduated, featuring 14 early-stage startups focused on tokenization, staking platforms, and decentralized applications. These projects now enter the Ecosystem Success program, receiving continued support for scaling and community-building.

Algorand’s DeFi TVL grew 216% QoQ to $417 million, driven by increased activity on Folks Finance, Tinyman, and Lofty, with key contributions from liquid staking and RWA tokenization. Meanwhile, the stablecoin market cap fell 50% QoQ, primarily due to declining USDC usage.

Network activity surged, with daily transactions up 66% QoQ to 3.5 million and new addresses rising 176% QoQ, fueled by Coinbase Quests and anticipation of staking rewards. Transaction fees increased 124% QoQ to $144,000, reflecting heightened activity.

Governance advanced with the launch of the xGov Council, while GP13 allocated 17.2 million ALGO in rewards and shifted focus toward staking incentives. Technical upgrades like NodeKit and partnerships in disaster relief and renewable energy tokenization further expanded Algorand’s real-world applications.

Algorand’s market cap rose 151% QoQ to $2.8 billion, driven by a 149% increase in ALGO’s price, reflecting stronger adoption and investor confidence.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.