and the distribution of digital products.

8 Best FinTech Apps in India

In recent years, India’s financial technology (FinTech) sector has experienced an unprecedented surge, reshaping how individuals manage and optimize their personal finances. These innovative mobile applications help users budget, save, and invest effortlessly, ushering in a new era of financial empowerment. In this article, we’ll delve into some of the best FinTech apps in India that are revolutionizing the financial landscape.

Summary- Goodbudget employs collaborative envelope budgeting and insightful reports.

- Digit is AI-driven and offers management of users’ savings, goal tracking, and security measures.

- Bajaj Finserv Experia enables loan management, insurance, investments, EMI calculators, and various financial products.

- INDMoney allows the user to do Personalized investing and portfolio monitoring and offers expert advice.

- Joy allows users to send Digital gifting, group contributions, and spending tracking.

- Money View enables Automated expenses, personalized budgets, and loans.

- Money Manager offers Expense categorization, bill reminders, and synchronizes data.

- Monefy simplifies expense tracking with a user-friendly interface, budgeting, and graphs.

Fintech apps are mobile applications that leverage technology to provide innovative and user-friendly financial services. They encompass a range of functions, such as digital payments, budgeting, investing, lending, and more. Fintech apps streamline financial processes, enhance accessibility, and often incorporate features like artificial intelligence and blockchain for secure and efficient transactions.

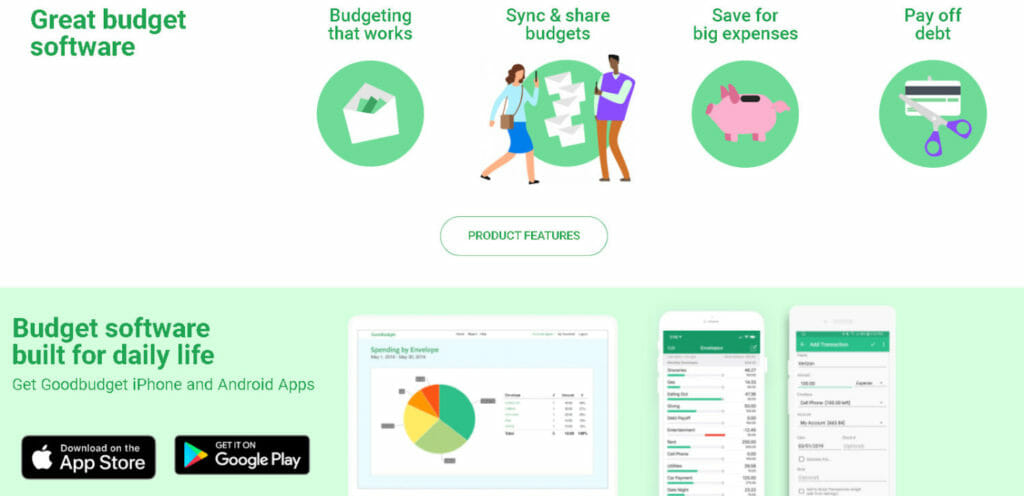

Best FinTech Apps in India Goodbudget- Goodbudget employs a unique envelope system, allowing users to allocate funds to different categories. This visual approach aids in efficient budgeting and expense tracking.

- The app facilitates collaborative shared budgeting among family members or partners, fostering transparent financial management.

- Goodbudget synchronizes data across devices, enabling seamless access and updates from smartphones, tablets, and desktops.

- Users can create strategies for debt reduction and track progress, helping them achieve financial freedom.

- The app generates insightful reports and analytics, empowering users to make informed financial decisions.

- Goodbudget offers free and premium versions, catering to users with varying budgeting needs.

- The Goodbudget app is available on both Android and iOS platforms.

Best Fintech apps: Goodbudget is unique envelope system

Oportun formerly Digit app

Best Fintech apps: Goodbudget is unique envelope system

Oportun formerly Digit app

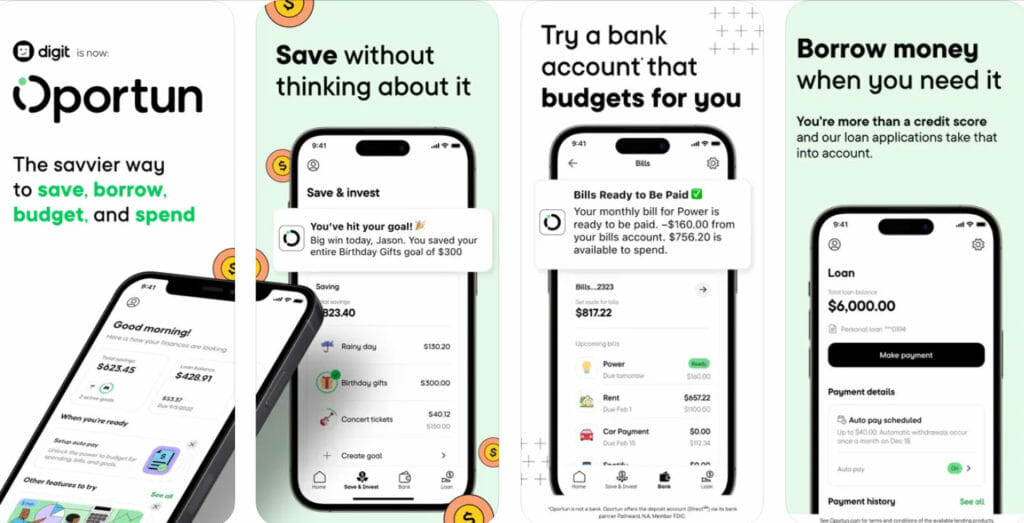

- Oportun employs AI-driven algorithms to analyze spending patterns and automatically transfer small amounts into a savings account.

- Users can set specific financial goals, such as a vacation or an emergency fund, and Oportun helps them save accordingly.

- The app ensures responsible savings by monitoring users’ checking accounts and avoiding overdrafts.

- Funds held with Oportun are accessible anytime, eliminating the barrier to accessing savings in emergencies.

- Users receive SMS notifications of their daily savings activity, enhancing financial awareness.

- Oportun offers a small interest rate on users’ savings, contributing to overall financial growth.

- The Oportun app employs robust security measures to safeguard users’ personal and financial information.

- You can download the Oportun app from Google play store and Apple app store.

Best FinTech Apps: Oportun employs AI-driven algorithms

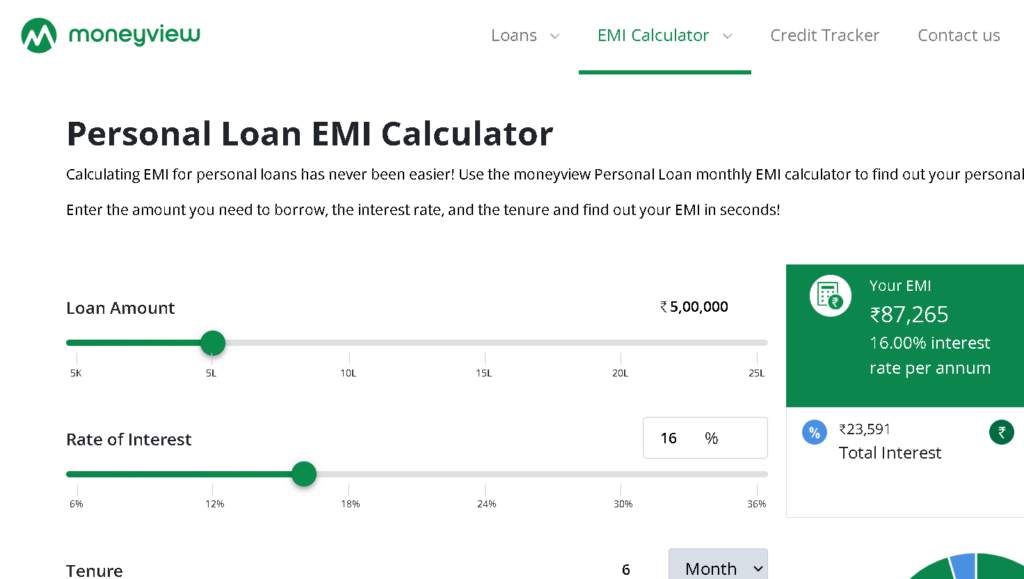

Bajaj Finserv Experia

Best FinTech Apps: Oportun employs AI-driven algorithms

Bajaj Finserv Experia

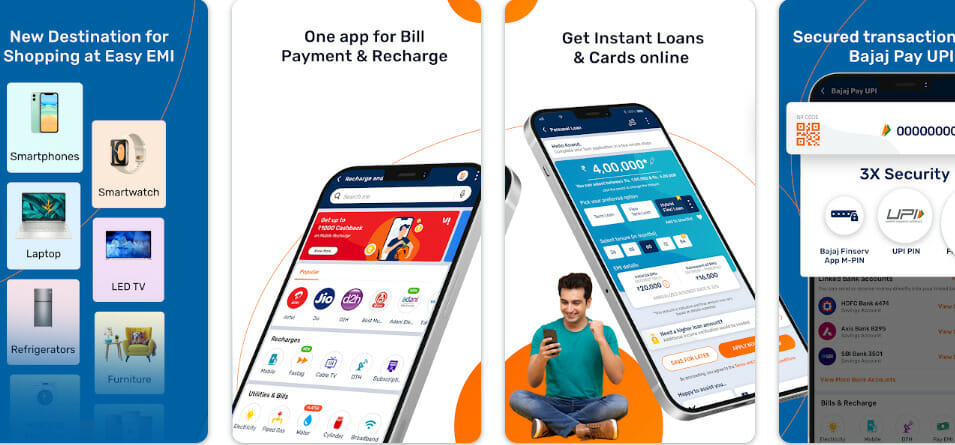

- Bajaj Finserv Experia provides a comprehensive platform for managing various financial products, including loans, insurance, and investments.

- Further, it can be used in real-time loan management by users to track their loan applications, repayments, and outstanding balances.

- This app allows users to conveniently manage their insurance policies, claims, and renewals.

- Bajaj Finserv Experia offers insights and information on investment options, aiding users in making informed decisions.

- Users receive personalized financial offers and recommendations based on their financial profile and needs.

- The app features an EMI calculator, helping users plan their loan repayments effectively.

- Bajaj Finserv Experia ensures secure access with multiple layers of authentication and encryption.

- Bajaj Finserv Experia app can be downloaded from Google Play store and Apple App Store.

Best FinTech Apps: Bajaj Finserv Experia provides a comprehensive platform

INDMoney

Best FinTech Apps: Bajaj Finserv Experia provides a comprehensive platform

INDMoney

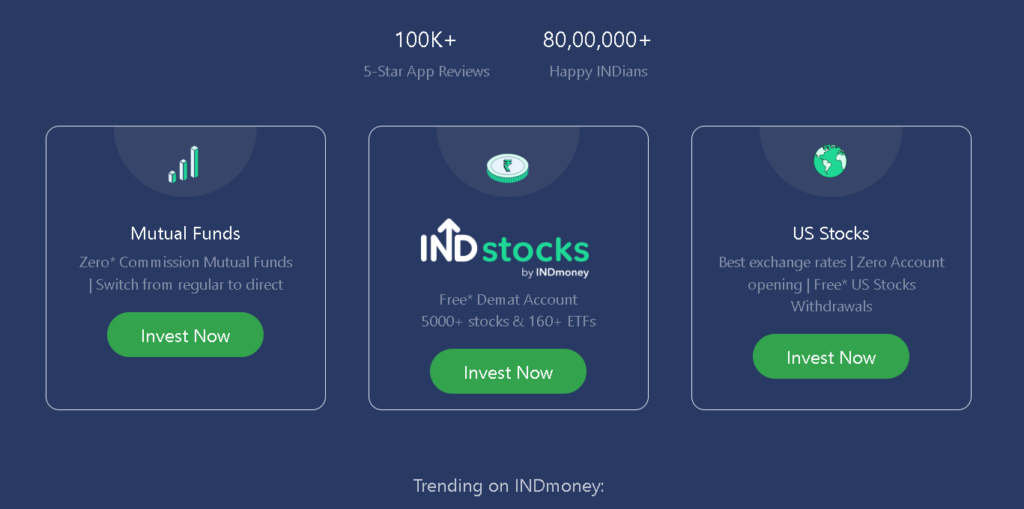

- INDMoney offers personalized investment plans based on users’ financial goals, risk tolerance, and investment horizon.

- The app enables users to open a paperless account and invest within minutes.

- Users can monitor their investment portfolios, track returns, and receive alerts for rebalancing.

- INDMoney facilitates seamless investments in mutual funds, eliminating the complexities of traditional investing.

- The app aligns your investments with specific financial objectives, such as retirement, education, or wealth creation.

- INDMoney provides expert investment recommendations to optimize users’ portfolios.

- The app also offers options for investing in gold and fixed deposits.

- You can use their app by downloading it from Google Play Store and Apple App store.

Best Fintech Apps : INDMoney offers personalized investment plans

Wallet

Best Fintech Apps : INDMoney offers personalized investment plans

Wallet

- Wallet by BudgetBakers is a robust app for tracking personal finances, allowing users to monitor expenses, incomes, and budgets.

- The app offers the ability to categorize expenses, providing insights into spending patterns and helping users make informed financial decisions.

- Wallet enables users to create customized budgets for various categories, assisting in controlling spending and achieving financial goals.

- The app includes bill reminder features that alert users about upcoming payments, helping them avoid late fees and maintain financial discipline.

- Wallet ensures seamless access and data consistency across multiple devices, including smartphones, tablets, and desktops.

- The app employs strong security measures to protect users’ financial information, ensuring data privacy and user confidence.

- You can access the wallet app from Google Play Store and Apple App Store.

Wallet by BudgetBakers is a robust app for tracking personal finances

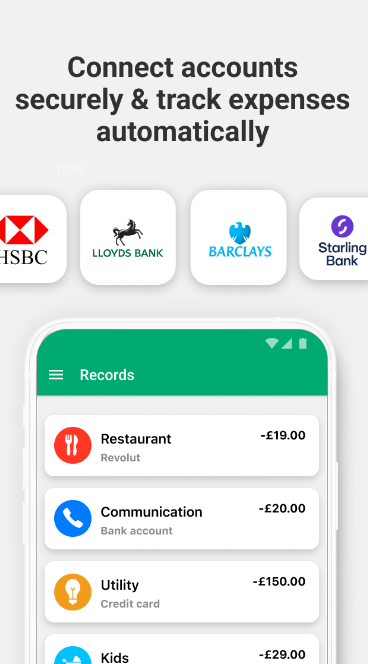

Money View

Wallet by BudgetBakers is a robust app for tracking personal finances

Money View

- Money View allows users to track their daily expenses automatically by analyzing linked bank accounts.

- The app suggests personalized budgets based on spending patterns and helps users stick to their financial goals.

- Users receive bill payment reminders to avoid late fees and maintain a good credit history.

- Money View offers insights into investment options and guides users toward building a diversified portfolio.

- The app provides eligible users instant personal loan options, streamlining access to credit.

- Money View allows users to monitor their credit scores and provides tips for improving them.

- The app employs advanced security measures to protect users’ financial data and can be downloaded from Google play store.

Best FinTech apps: Money View track their daily expenses

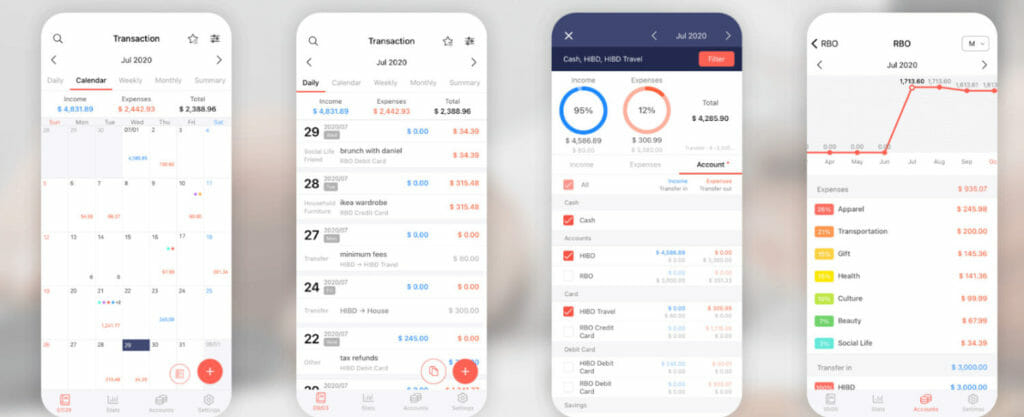

Money Manager

Best FinTech apps: Money View track their daily expenses

Money Manager

- Money Manager categorizes expenses, tracks income, and generates visual reports for better financial management.

- Users can set up customized budgets for various categories, ensuring controlled spending.

- The app sends notifications for upcoming bills and due dates, preventing late payments.

- Money Manager synchronizes data across devices, ensuring seamless access and updates.

- Further, it offers currency conversion. The app supports multiple currencies, making it suitable for users with international financial activities.

- Users can export financial data to spreadsheets for detailed analysis and record-keeping.

- Money Manager provides options for securing financial data with passwords or biometric authentication.

- The Money Manager app is available for download on both the Google Play Store and the Apple App Store.

Best Fintech apps: Money Manager synchronizes data across devices

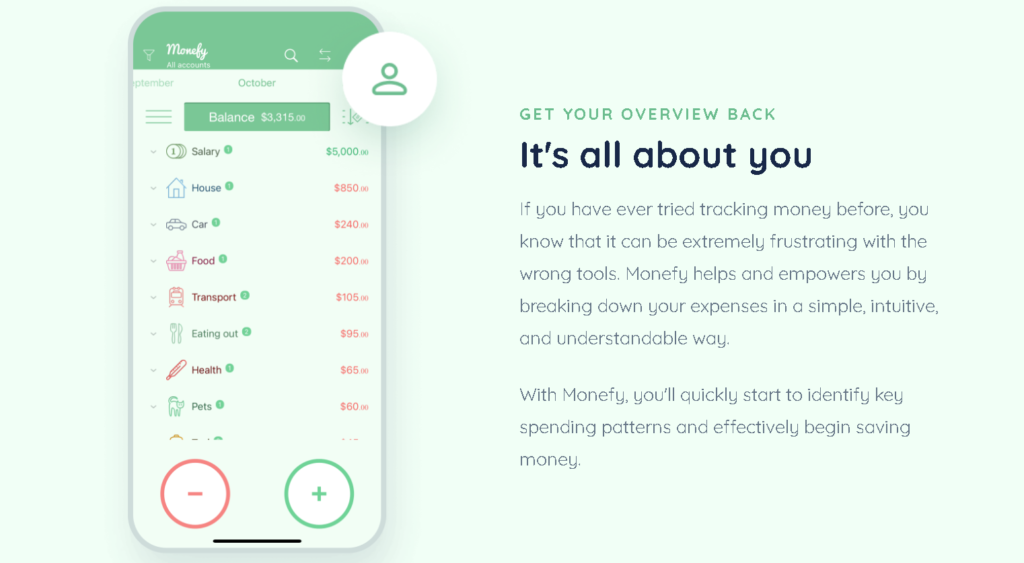

Monefy

Best Fintech apps: Money Manager synchronizes data across devices

Monefy

- Monefy simplifies expense tracking with a user-friendly interface for quick input.

- The app generates visual graphs and reports, aiding users in understanding their spending patterns.

- Users can manage expenses across multiple accounts or wallets within the app.

- Monefy synchronizes data across devices, ensuring consistent access and updates.

- The app helps users set and monitor budgets for different categories, promoting financial discipline.

- Users can export financial data in various formats for analysis and reporting.

- Monefy offers backup and restore functionalities to prevent data loss.

- You can access the monefy app from Apple App store and Google Play store.

Best Fintech apps: Monefy simplifies expense tracking

Conclusion

Best Fintech apps: Monefy simplifies expense tracking

Conclusion

Whether it’s automating savings, offering personalized investment plans, or simplifying group expenses, these apps are shaping a more financially conscious and secure future for individuals across the nation. Embracing the convenience and innovation of these FinTech solutions can pave the way for a brighter financial journey.

Are fintech apps safe to use?Yes, most reputable fintech apps prioritize user security. They implement encryption, secure authentication, and adhere to regulatory standards to protect your financial data. However, it’s wise to choose apps with strong reputations, read reviews, and be cautious about sharing sensitive information.

How Do Fintech Apps Make Money?Fintech apps generate revenue through various channels. They may charge transaction fees, offer premium subscriptions for advanced features, earn interest on users’ deposits, or partner with financial institutions for referral commissions. Some also explore data monetization while ensuring transparency in their revenue models.

What Differentiates one Fintech app from another?Fintech apps vary in features, user experience, and services offered. Points of differentiation include unique tools like AI-driven insights, specific focus areas (budgeting, investing), integration with banks, ease of use, customer support quality, and security measures. Choosing based on individual financial needs and app reputation is crucial.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.