and the distribution of digital products.

DM Television

8 Best Apps to invest in Mutual funds in India

Investing in mutual funds has become increasingly prominent in India, thanks to the convenience and accessibility offered by various mobile apps. This article will explore the top 8 mutual funds apps available to invest in mutual funds in India, highlighting their features and providing information.

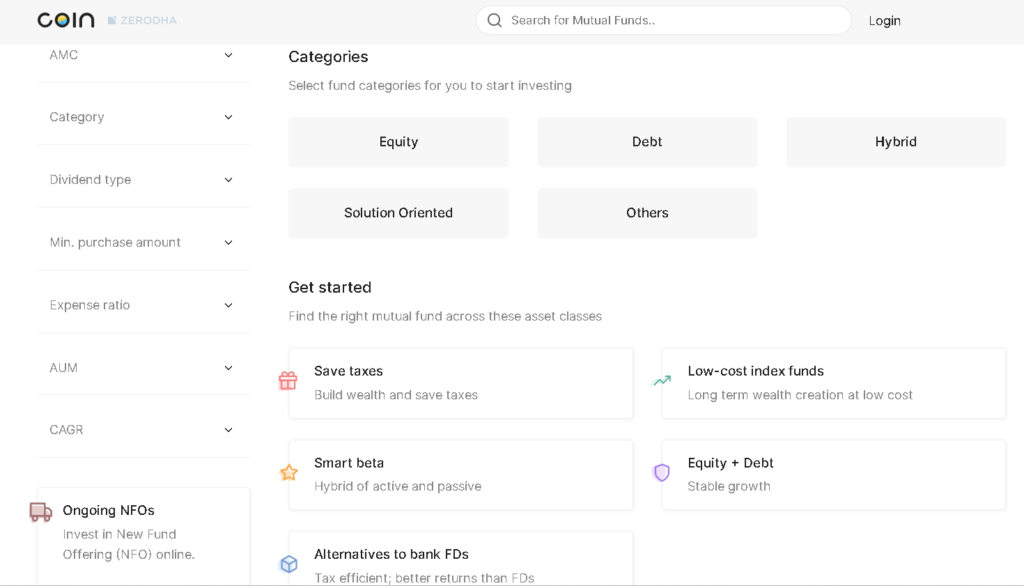

Summary- Coin by Zerodha is a popular mutual funds app offering zero commission fees for direct mutual fund investments.

- Paytm Money Mutual Funds provides a wide range of investment options and personalized investment recommendations based on an individual’s financial goals.

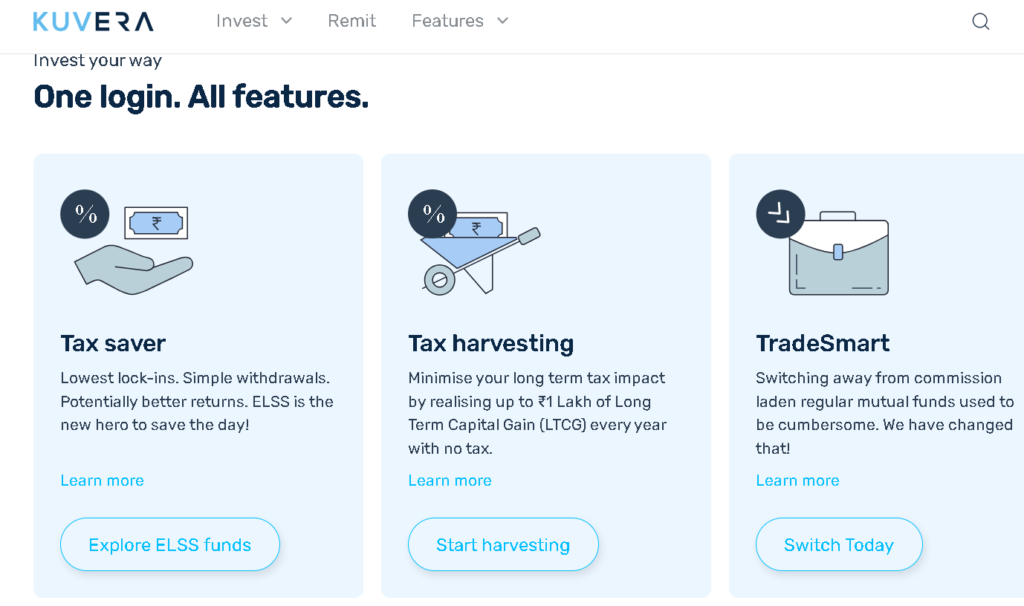

- Kuvera is a comprehensive mutual funds platform that offers direct mutual funds and tax-saving funds with a user-friendly interface.

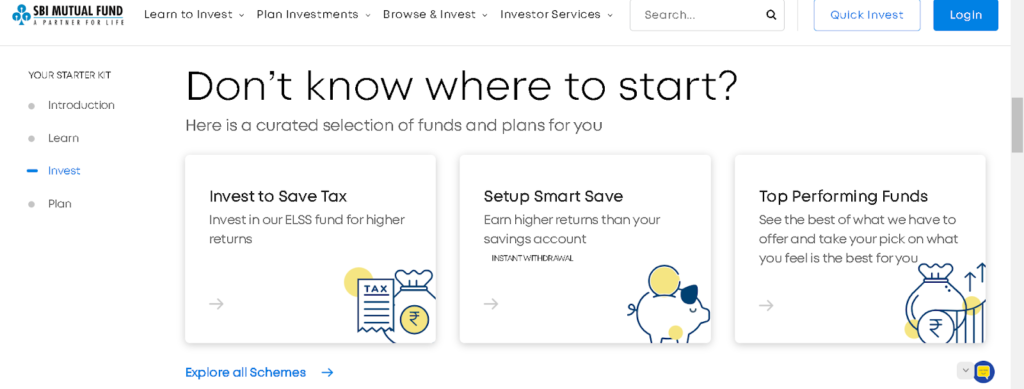

- SBI Mutual Funds offers diverse investment options, in-depth research, and real-time updates on portfolio performance.

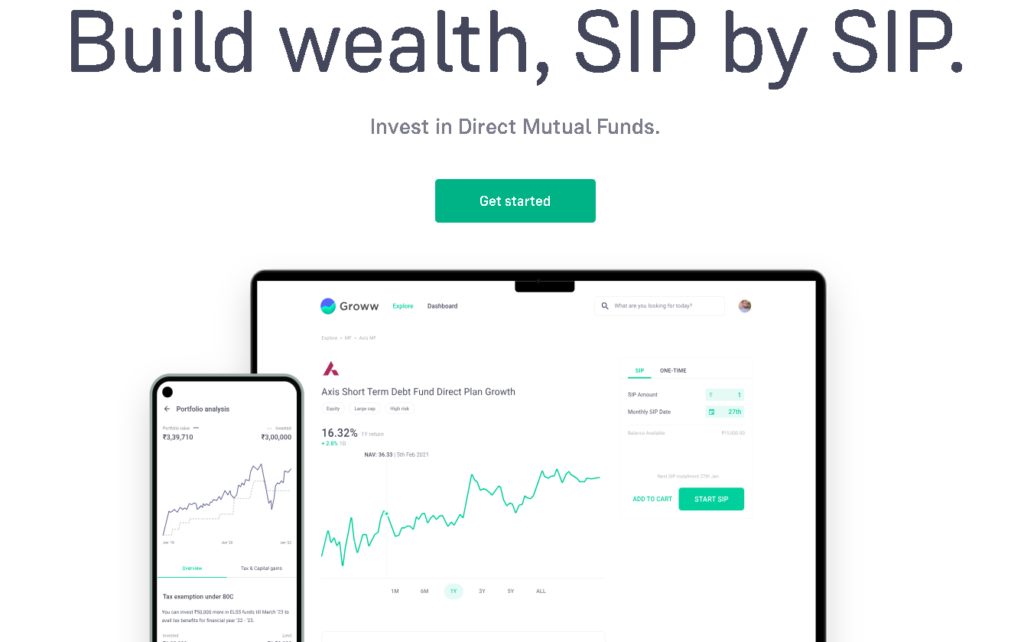

- Groww Mutual Funds allows investors to start investing with as little as Rs. 500 and offers goal-specific portfolios and auto-invest features.

- HDFC Mutual Fund is a trusted way to invest in mutual funds with a wide range of funds and investor-friendly features.

- ET Money offers many investment options, including tax-saving funds, and provides personalized investment recommendations.

- myCAMS Mutual Funds App allows users to track their investments in real-time, set up and manage SIPs, and switch between mutual funds.

- All the mentioned apps have mobile apps available for Android and iOS users, providing convenience, accessibility for investors and allow you to invest in mutual funds.

- Coin by Zerodha is a popular mutual funds app that offers direct mutual fund investments with zero commission fees.

- It has a user-friendly interface, making it easy for investors to navigate and invest in mutual funds.

- Coin by Zerodha offers a wide range of mutual fund options from several asset management companies, allowing investors to diversify their portfolios.

- The app provides detailed information about each mutual fund, including historical performance, expense ratios, and risk factors, helping investors make informed decisions.

- Coin by Zerodha allows investors to set up systematic investment plans (SIPs) and offers features like one-time investments and redemption options.

- The app provides real-time tracking of mutual fund investments, allowing investors to monitor their portfolio performance and make necessary adjustments.

- Coin by Zerodha seamlessly integrates with the Zerodha trading platform, allowing investors to manage their mutual funds and other investments in one place.

- Coin by Zerodha is a mobile app available for Android and iOS users and download them from the Apple app store and Google Playstore.

Invest in mutual funds : Coin by Zerodha is a popular mutual funds app

Paytm Money Mutual funds

Invest in mutual funds : Coin by Zerodha is a popular mutual funds app

Paytm Money Mutual funds

- Paytm Money Mutual Funds offers various mutual fund investment options, allowing investors to choose from categories such as equity funds, debt funds, and hybrid funds.

- The platform provides detailed information about each mutual fund, including historical performance, risk factors, expense ratios, and portfolio holdings, enabling investors to make informed investment decisions.

- The platform provides personalized investment recommendations based on an individual’s financial goals, risk appetite, and investment horizon, helping investors build a diversified portfolio.

- Paytm Money Mutual Funds allows investors to start investing with as little as Rs. 100, making it accessible to investors with varying budgets.

- The platform offers a systematic investment plan (SIP) feature, allowing investors to invest a fixed amount regularly in their chosen mutual funds, promoting disciplined investing.

- Paytm Money Mutual Funds provides a consolidated view of an investor’s portfolio, allowing them to track their investments, view portfolio performance, and monitor their overall investment strategy.

- Download the Paytm Money mutual funds app to invest in mutual funds from the Apple App store and Google Play Store.

Invest in mutual funds : Paytm Money Mutual Funds offers various mutual fund investment options

Kuvera

Invest in mutual funds : Paytm Money Mutual Funds offers various mutual fund investment options

Kuvera

- Kuvera is a comprehensive mutual funds platform offering various investment options, including direct mutual funds and tax-saving funds.

- It provides personalized investment recommendations based on an individual’s financial goals and risk appetite.

- Kuvera offers a user-friendly interface, making it easy for investors to navigate the platform and manage their investments.

- The platform provides detailed information about mutual funds, including historical performance, expense ratios, and risk factors.

- Kuvera allows investors to track their investments, view portfolio performance, and make transactions seamlessly.

- It offers a goal-based investment feature, helping investors plan and achieve their financial objectives.

- Kuvera’s mobile app is available for Android and iOS users, allowing investors to manage their investments on the go. Download the app from the Google Play and Apple App Store.

Invest in mutual funds : Kuvera is a comprehensive mutual funds platform among all apps to invest in mutual funds

SBI Mutual Funds

Invest in mutual funds : Kuvera is a comprehensive mutual funds platform among all apps to invest in mutual funds

SBI Mutual Funds

- SBI Mutual Funds offers diverse investment options, including equity funds, debt funds, hybrid funds, and more.

- It provides a seamless experience for tracking investments, viewing fund performance, and making transactions.

- SBI Mutual Funds offers in-depth research and analysis on mutual funds, helping investors make informed investment decisions. It offers detailed information on fund performance, historical data, risk factors, and expense ratios.

- Investors can easily track their mutual fund investments through the SBI Mutual Funds platform.

- It provides real-time updates on portfolio performance, allowing investors to monitor their investments and make necessary adjustments.

- SBI Mutual Funds offers Systematic Investment Plans (SIP) and Systematic Transfer Plan (STP), allowing investors to invest regularly and systematically and take advantage of rupee cost averaging.

- The platform enables investors to buy, sell, and switch mutual funds online, providing convenience and flexibility.

- SBI Mutual Funds has a dedicated mobile app available for Android and iOS users and can be downloaded from the Google Play Store and Apple App Store.

Invest in mutual funds : SBI Mutual Funds offers diverse investment options among all apps to invest in mutual funds

Groww

Invest in mutual funds : SBI Mutual Funds offers diverse investment options among all apps to invest in mutual funds

Groww

- Groww Mutual Funds allows investors to start investing with as little as Rs. 500 and offers the convenience of investing through systematic investment plans (SIPs)

- Groww Mutual Funds lets investors set financial goals (like buying a house, education, or retirement) and offers personalized investment advice, helping them build goal-specific portfolios.

- Groww offers an auto-invest feature that allows investors to set a fixed amount to be invested at regular intervals, ensuring disciplined investing and taking advantage of rupee-cost averaging.

- Investors can complete the entire investment process online, including KYC verification, without needing physical paperwork.

- The platform provides access to expert advice and insights on mutual funds.

- Investors can access articles, blogs, and educational resources to enhance their understanding of mutual funds and make informed investment decisions.

- Groww provides a comprehensive portfolio analysis tool that allows investors track the performance of their investments.

- Groww has a user-friendly mobile app available for Android and iOS users, allowing investors to manage their investments on the go.

Invest in mutual funds : start to invest in mutual funds with as little as Rs. 500

HDFC MF

Invest in mutual funds : start to invest in mutual funds with as little as Rs. 500

HDFC MF

- HDFC Mutual Fund is one of India’s leading and most trusted mutual fund houses, with a powerful track record of delivering consistent returns to investors.

- HDFC Mutual Fund offers a wide range of funds across various asset classes, including equity, debt, hybrid, and international funds.

- Furthermore, They conduct in-depth research and analysis to make informed investment decisions.

- HDFC Mutual Fund provides several investor-friendly features, such as systematic investment plans (SIPs), systematic withdrawal plan (SWPs), and systematic transfer plans (STPs).

- HDFC Mutual Fund has a robust risk management framework to mitigate investment risks.

- Moreover, They provide various resources, such as investor education programs, online tools, and customer support, to help investors make informed investment decisions.

- They have tie-ups with multiple banks, distributors, and online platforms, ensuring convenience and ease of investment for investors.

- Investor Services: HDFC Mutual Fund offers various investor services, including online access to account statements, transaction history, and portfolio details.

- HDFC MF has a mobile app available for both Android and iOS users. Get the app on your devices from the Google Play Store and Apple App Store.

Invest in mutual funds : HDFC Mutual Fund is one of India’s leading and most trusted mutual fund houses

ET Money

Invest in mutual funds : HDFC Mutual Fund is one of India’s leading and most trusted mutual fund houses

ET Money

- ET Money allows you to invest in mutual funds through many investment options, including tax-saving funds and SIPs.

- Buy mutual funds with zero commission, no transaction charges, and no hidden fees with ET Money.

- Invest in several types of mutual funds from one app, including equity, ELSS, small-cap, large-cap, balanced funds, gold, sector, and international funds

- Furthermore, Invest in top mutual fund schemes from AMCs like SBI Mutual Fund, Nippon India Mutual Fund, ICICI Prudential Mutual Fund, HDFC Mutual Fund, Kotak Mutual Fund, Mirae Asset Mutual Fund, Axis Mutual Fund, Motilal Oswal Mutual Fund, L&T Mutual Fund, IDFC Mutual Fund, Parag Parikh Mutual Fund, UTI Fund, and more

- Track your mutual fund portfolio and receive a health report. Additionally, Analyze and categorize your expenses to improve financial fitness.

- This platform promises tax savings of up to INR 78,000 through ELSS Mutual Funds, Life Insurance, NPS investment, and Health Insurance

- Plan your retirement with NPS by creating an account without paperwork, or start investing with an existing NPS PRAN.

- It provides personalized investment recommendations based on an individual’s financial goals and risk profile.

- ET Money has a mobile app available for both Android and iOS users. You can download the app from the Google Play Store and Apple App Store.

Invest in mutual funds : ET Money offers many investment options, including tax-saving funds and SIPs.

myCAMS Mutual Funds App

Invest in mutual funds : ET Money offers many investment options, including tax-saving funds and SIPs.

myCAMS Mutual Funds App

- Users can track their mutual fund investments in real time, allowing them to monitor the performance of their portfolio and make informed decisions using myCAMS mutual funds app.

- The app provides a range of investment options, including equity funds, debt funds, hybrid funds, and more, catering to different risk appetites and investment goals.

- Users can set up and manage Systematic Investment Plans (SIPs) through the app, enabling them to invest in mutual funds regularly and systematically.

- The app allows users to make one-time investments in mutual funds, providing flexibility for those who prefer to avoid committing to regular investments.

- Users can easily switch between mutual funds within their portfolio, helping them optimize their investments based on market conditions and changing investment objectives.

- It maintains a comprehensive transaction history, allowing users to view their past investments, redemptions, and other transactions for record-keeping and tax purposes.

- Users can generate consolidated account statements for their mutual fund investments, simplifying the process of tracking and managing multiple investments.

- The app offers goal-based investing features, enabling users to set financial goals and create customized investment plans to achieve them.

- You can download the app from Google playstore and apple app store.

Invest in mutual funds : The app offers goal-based investing features.

Conclusion

Invest in mutual funds : The app offers goal-based investing features.

Conclusion

Whether you are a beginner or an experienced investor, these platforms offer a range of features and personalized recommendations to help you make informed investment decisions. With their mobile apps, you can conveniently manage your investments. Choose the app that suits your investment goals and invest in mutual funds today.

What are mutual funds?Mutual funds are investment machines that pool money from several investors to invest in a varied portfolio of bonds, stocks, or other securities.

How do mutual funds work?Mutual funds work by collecting money from investors and using it to buy a varied portfolio of securities. Professional fund managers oversee the management of the fund and make investment choices on behalf of the investors. Investors get returns based on the performance of the underlying securities.

In what way are mutual funds similar to common stocks?Mutual funds and common stocks are similar in that both involve investing in securities. However, mutual funds offer diversification by investing in various stocks, while common stocks represent ownership in a single company. Mutual funds also provide professional management and are suitable for investors seeking diversification and convenience.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.