and the distribution of digital products.

DM Television

5 Best Bitcoin Margin Trading Exchange

Estimated reading time: 17 minutes

In this article, we will be talking about Bitcoin margin trading exchanges and their various features. Read our previous article to learn what is Margin trading?

Table of contents- Summary (TL;DR)

- What is bitcoin margin trading?

- How does bitcoin margin trading work?

- Bitcoin margin trading example

- Best bitcoin margin trading platform

- Bitcoin Margin Trading Risks

- Conclusion: Best Bitcoin Margin Trading Exchange

- Frequently Asked Questions

- Bitcoin Margin trading implies trading on borrowed funds from a third party.

- An exchange lends you funds based on your chosen leverage, and you use them for trading.

- Binance provides services in isolated as well as cross-margin trading with a leverage of up to 10x.

- BYDFI works with isolated margin trading and provides services like a demo, TP ratio, SL ratio, and customizable UI.

- Kraken is a US-based beginner-friendly margin trading exchange with competitive fees.

- BitMEX offers its services in bitcoin margin trading and handles liquidation with ADL mechanism.

- Poloniex is a Seychelles-based trading exchange providing high liquidity and a chatbox for their users to communicate.

Bitcoin margin trading means trading on borrowed bitcoins. You sign up for one of the above exchanges and activate your margin trading account. Then you can apply for the loan on the platform and trade using the coins you receive.

How does bitcoin margin trading work?After you activate your margin trading account and successfully log in. You need to deposit some funds, and then you can apply for a loan in BTC using your deposited funds as collateral.

The exchange charges you an interest every day, which updates frequently depending on the exchange.

Bitcoin margin trading exampleLet us assume you deposit 1 BTC in your margin trading account and choose a leverage of 10x. Then exchange will provide an additional 9 BTC in your account and charges you an interest every hour.

Now let’s say you have a 3% increase in BTC value, then you will have a total return of ( 3×10 = 30% ). However, you should keep in mind crypto market is highly volatile, and you can even suffer a 30% loss at the same time.

Best bitcoin margin trading platformThere are many options available in the market, and we have sorted the 5 best bitcoin margin exchanges based on their features as follows:

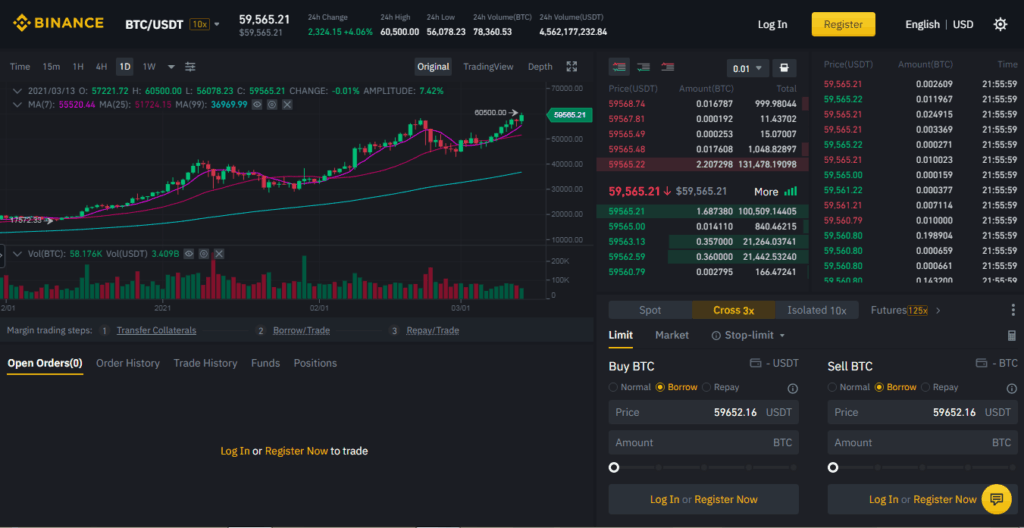

1. Binance margin tradingBitcoin margin trading at Binance is basically spot trading with borrowed funds and increased risks. Binance is the world’s biggest crypto exchange in terms of volume, and hence you get the industry’s best features.

Binance margin trading

Binance margin trading

Bitcoin margin trading at Binance comes with many features like isolated margin trading, cross margin trading, margin level, and maintenance margin.

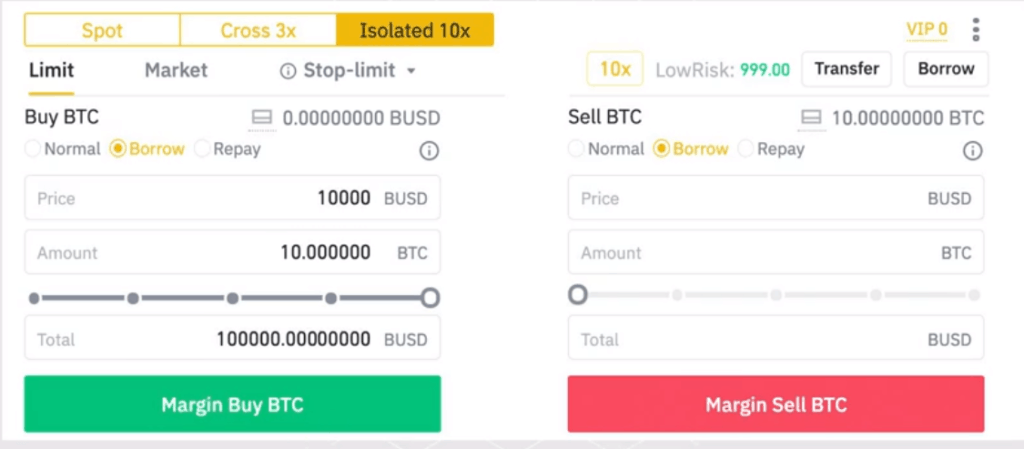

Isolated margin at BinanceAn isolated margin allows traders to limit the risk by restricting the amount of margin at each position. This way, if your funds liquidize, then you lose the funds of only that particular position.

In isolated margin trading, you get leverage of 10x, which is based on a tier system depending on your user level. Whereas cross margin offers maximum leverage of 5x in the master account and 3x in a regular account.

The function of tiered leverage in isolated marginTiered leverage automatically adjusts your leverage based on your borrowed funds. This implies that leverage for isolated margin trading is dynamic. You can have a look at the risk ratio for 10x isolated margin in the table below:

To know more about the function of tiered leverage in isolated margin trading, you can click here.

Binance Isolated margin

Cross margin trading at Binance

Binance Isolated margin

Cross margin trading at Binance

You share your entire asset balance across all the open positions in your margin account. It is so to prevent liquidations, as other positions can aid the position in loss. It is most popular among professional traders and investors who are hedging existing positions.

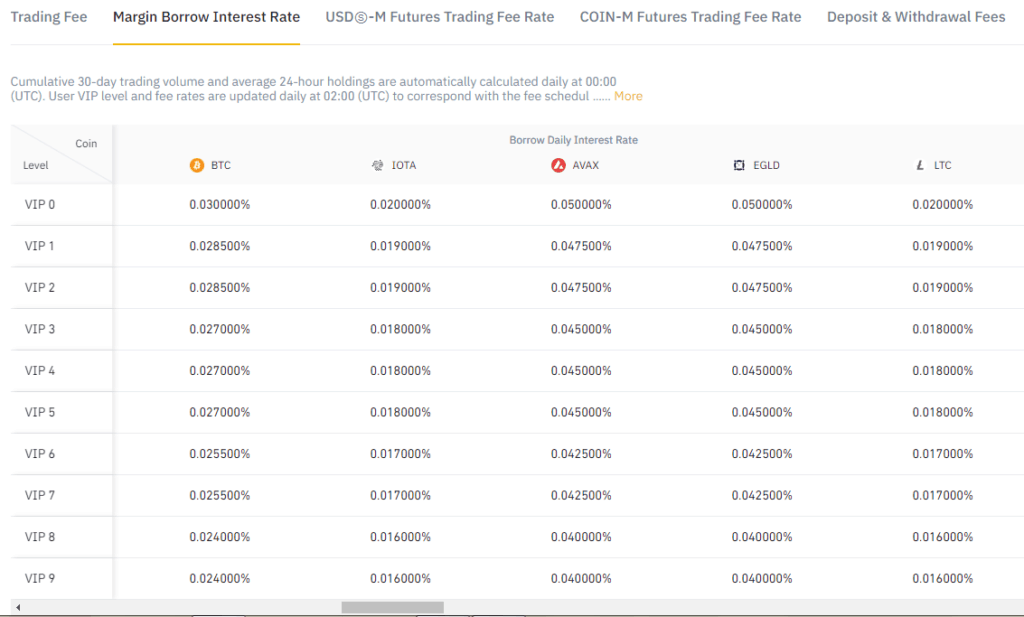

Binance FeesThere is no fee for depositing funds; however, all the users pay a fee at withdrawal. You can have a look at the margin interest rate for all the assets by clicking here or in the table below:

Binance Fees

Binance Fees

By using BNB, you can reduce your trading fee by 25%.

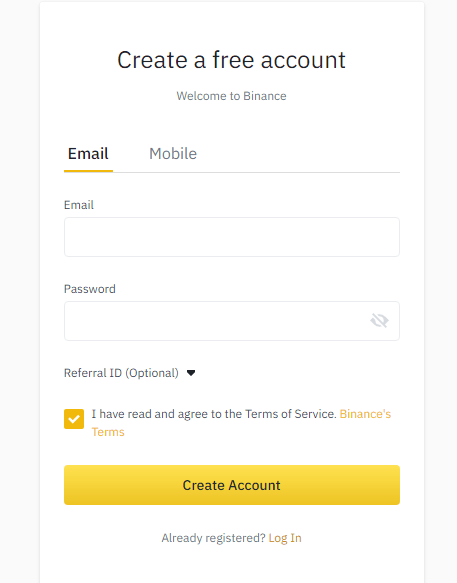

Getting started with Binance Marging TradingYou may follow these steps to begin bitcoin margin trading at Binance:

- First, you have to sign-up and complete your verification at Binance.

- Then deposit funds into your account.

- Now go to your account dashboard and click on margin.

- Then complete create your margin account.

- Transfer funds to your margin account.

- Now you can go long or short from the margin tab.

Binance Signup

Pros and cons

2. BYDFI margin trading

Binance Signup

Pros and cons

2. BYDFI margin trading

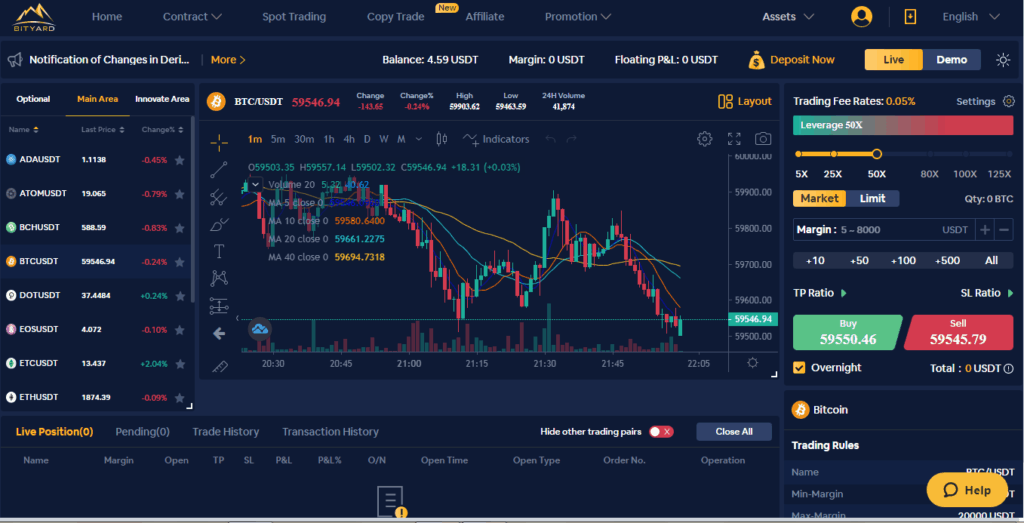

BYDFI is one of the best bitcoin margin trading platforms in the market. They operate with isolated margin trading, which helps you keep your entire fund safe during liquidation. BYDFI is a Singapore-based exchange and provides its services in over 150 countries.

BYDFI

What is isolated margin trading at BYDFI?

BYDFI

What is isolated margin trading at BYDFI?

BYDFI provides you its leverage services through isolated margin trading. Isolated margin trading allows you to use funds separately for each position. In the case of liquidation, you lose funds of only that particular position.

Leverage at BYDFIBYDFI provides you a leverage of up to 125x on crypto margin trading and 200x on derivatives margin trading. You can adjust leverage from the leverage slider.

BYDFI Fees

BYDFI Fees

BYDFI charges you a fixed price on margin trading at the time you open a position. The following formula calculates the margin trading fee:

(Opening/ Closing fee = Margin * Leverage * 0.05%)

Getting started with BYDFI Margin TradingTo begin with bitcoin margin trading at BYDFI, you can follow these steps:

- Create your account and complete your email verification.

- Transfer funds to your BYDFI wallet.

- Now visit the crypto margin trading from the contract tab in the header.

- You can now start margin trading.

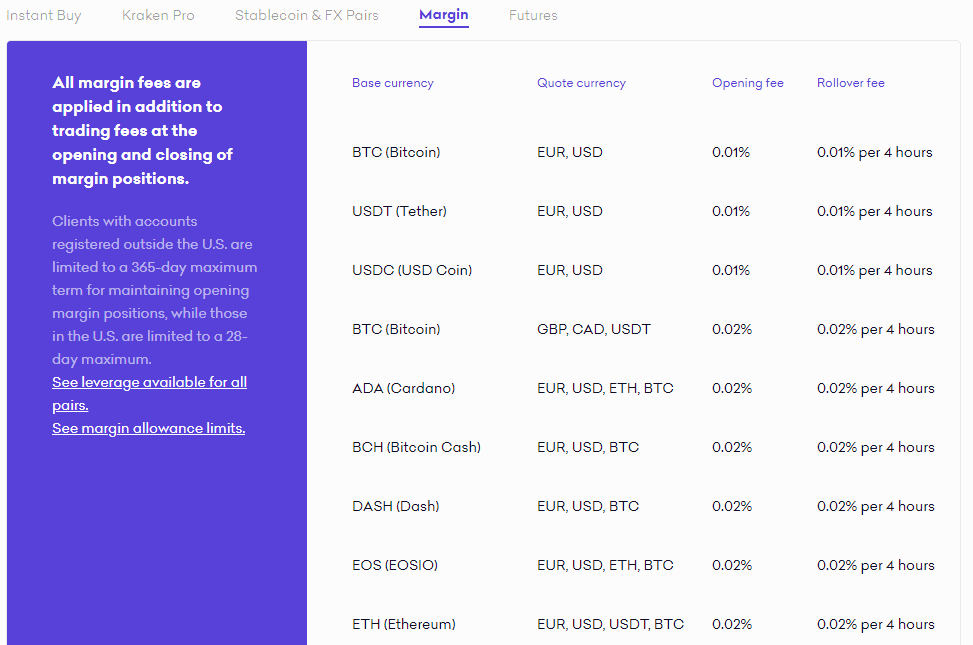

Kraken is a US-based cryptocurrency exchange providing its services in over 175 countries. Kraken margin trading lets you magnify your trades by letting you use more complex trading strategies.

Kraken margin trading

Leverage on Kraken

Kraken margin trading

Leverage on Kraken

Kraken provides minimum leverage of 2x and maximum leverage of 5x.

Going long or short at KrakenYou can open a position at a lower price and then close it at a higher price; else, you can open it at a higher price and close it at a lower price. The former is going ‘long’ and the latter going ‘short.’

Going long works with or without margin; however, going ‘short’ only works with margin trading.

Kraken

Kraken Fees

Kraken

Kraken Fees

Kraken charges an opening fee and a rollover on its margin orders. The opening fee is 0.02% for almost all the assets, and the rollover fee is 0.02% for all the assets. The opening fee is one time per order, whereas you pay a rollover fee every 4 hours.

Kraken Fees

Kraken Fees

You can click here to have a detailed insight into the fee charged.

Getting started with Kraken Margin TradingYou can follow these steps to get started:

- Sign-up and create your account at Kraken.

- Deposit funds in your Kraken margin trading account.

- Now click on margin from the header.

- Set the leverage, place an order and begin trading.

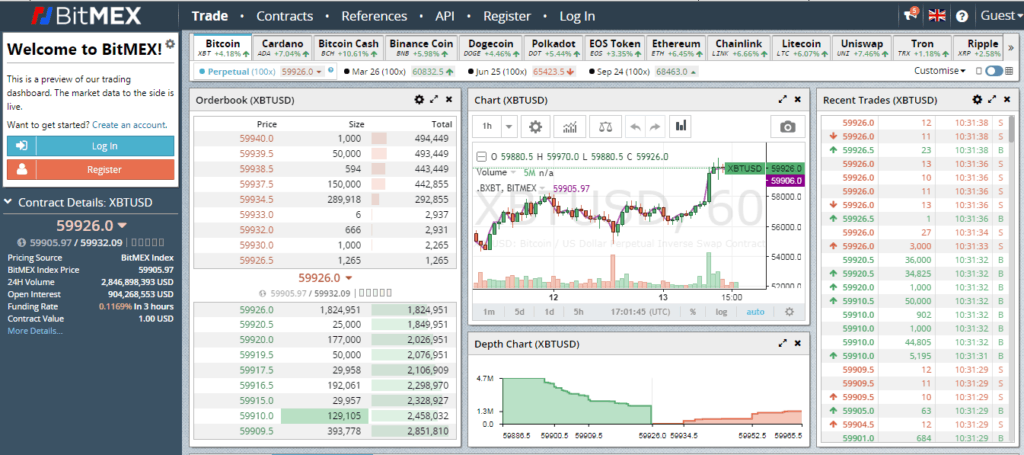

BitMEX is an exchange platform based in Seychelles which offers a fast and secure platform for crypto traders. The platform provides BitMEX futures and swaps on their platform.

Bitmex

Leverage on BitMEX

Bitmex

Leverage on BitMEX

You get a leverage of up to 100x on some of BitMEX’s contracts, and perpetual contracts do not need you to post 100% of your margin as collateral.

You can have a detailed look at the leverage provided by clicking here.

What is BitMEX isolated and cross-margin?Let’s assume you’re using an isolated margin and have 100 USDT in your account. Hypothetically, let the price of BTC be 10,000 USDT. Now you open a position worth 5 USDT, and the exchange has a liquidation price of 9,500 USDT.

Bitmex Margin Trading

Bitmex Margin Trading

The price falls to 9,000 USDT, and all of your 5 USDT undergo liquidation. However, there will be no deductions from your main balance. Now, if you would have been using cross margin, then you would’ve suffered a higher loss, but you wouldn’t have suffered liquidation.

BitMEX FeesBitMEX does not charge any fee on deposits or withdrawal, and in the case of bitcoins, the fee charged is based on blockchain load. You can have a look at the fee charged in contracts in the table below or by clicking here:

Getting started with BitMEX margin tradingYou can follow these steps to begin and place an order:

- Create an account on BitMEX.

- Now deposit some funds to your bitcoin margin trading app.

- Go to the ‘Trade’ tab, choose leverage and place an order.

- To close a position, click create the same price sell order or click on the red ‘Market” button.

Poloniex is based in Seychelles and offers lending, spot trading, margin trading, and staking. As of March 2021, Poloniex was ranked 13th by dollar value volume as per CoinMarketCap.

Poloniex

Leverage on Poloniex

Poloniex

Leverage on Poloniex

Poloniex offers a leverage of up to 100x. At Poloniex, your initial margin and maintenance margin levels determine your leverage.

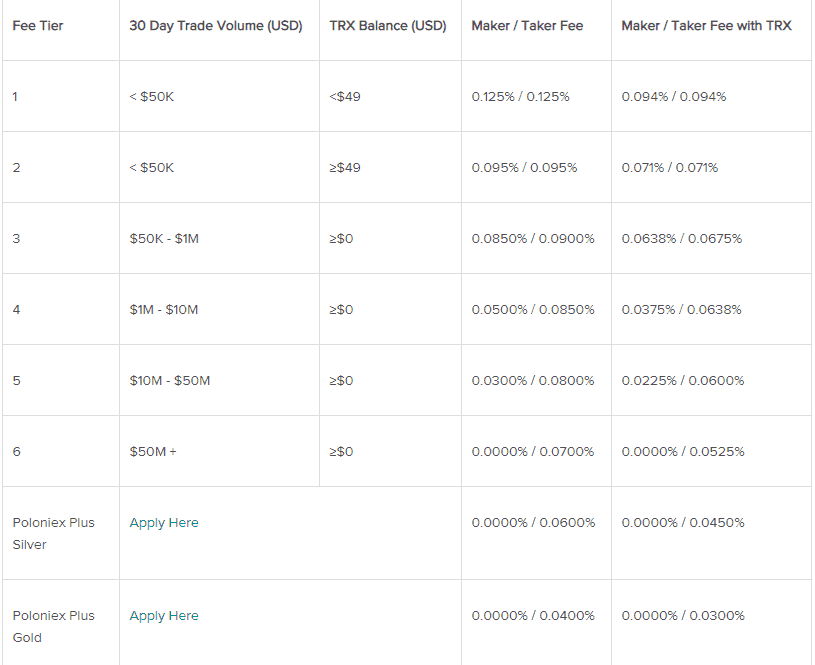

Poloniex FeePoloniex has a tier-based fee system, and you can also apply for the silver and gold tier. You can have a look at the detailed fee table wither by clicking here or in the below table:

Poloniex Fee

Getting started with Poloniex

Poloniex Fee

Getting started with Poloniex

You can get started by following these steps:

- Visit the exchange and create your account.

- Then log in and deposit some funds to begin trading.

- Visit the futures tab and set the leverage accordingly.

- Place an order and open a position.

Trading Bitcoin has its risks, and these risks increase with your leverage. For instance, the following are some of the things you should take care of:

- Open a position only if you can afford to lose the amount you are investing.

- Crypto markets are highly volatile, and margin trading not only increases your return but also increases your chances of bearing a loss.

- Always use the stop-loss option, as it prevents you from liquidation.

- Remember using higher leverage increases the percentage of your profit. But it also increases your chances of liquidation.

- Never leave the screen after you’ve placed an order, as things can go upside down in the blink of an eye or use crypto trading bots.

Bitcoin margin trading brings excellent opportunities to gain returns; however, just as everything has two sides, it also brings the case of liquidations. Binance and BYDFI are two of the best platforms in the market. Binance is the biggest in terms of volume, lags in terms of leverage. In contrast, BYDFI offers very high leverage for your trading.

Frequently Asked Questions What is long or short in margin trading?Going ‘Long’ means you buy an asset at a lower price and sell it at a higher price to gain profits. Whereas going ‘Short’ means buying an asset when its price is high and selling it at a lower cost to earn a profit.

How to go long or short in margin trading?To go long, you can select cross margin or isolated margin mode and then enter your desired amount and click on Margin buy BTC. And to go short, you need to click on Margin sell BTC. Additionally, read our guide on how to short Bitcoin using leveraged tokens.

What is ‘Demo’ in the margin trading?The ‘demo’ option allows you to try margin trading for free. You can practice as many trades as you want to without using any of your funds. You can go live when you feel you are ready to invest your funds.

What is the TP ratio?TP ratio tells you when you can close your position to make a profit. You can either enter the amount you seek to obtain after completing the trade or the percent of profit you desire. After doing so, you’ll be able to see the price at which you should close the position.

What is the SL ratio?SL ratio tells you the price you should close a position before liquidation. You can enter the maximum amount you are ready to lose. SL ratio lets you know the price you should close your position, so you don’t incur any more losses.

What is a trade balance?The trade balance is the total combined value of all the positions open and your trading account’s remaining balance.

What is equity?Equity shows your real-time total balance after adding or deducting a profit/ loss from your open position.

What is free margin?Free margin is the amount available in your wallet to place any new order. Suppose you do not have a free margin and you try to open a position. In that case, the exchange will automatically cancel your order.

What is auto de-leveraging or ADL?When you lose your position and reach the liquidation limit, the platform automatically sells your collateral to the first suitable offer to prevent any losses to the exchange. The insurance fund is in place to avoid ADL; however, if the insurance fund depletes entirely, ADL occurs.

What are long and short positions?When you buy to open a position in margin trading, then it is called long. While going long, you predict a rise in asset value and intent to profit from it.

Whereas, when you click on sell to open a position, it is called short. While going short, you predict a fall in the asset’s value and intent to profit from the fall.

A forced liquidation occurs when you’ve already lost all of your collateral. Your position is automatically closed to prevent any further losses to the loan amount. It happens when your maintenance margin goes higher than your current margin.

What is maintenance margin?The percentage of your borrowed value must be equal to your net worth to prevent a forced liquidation.

What is the initial margin?It is the minimum fund required in your account to open a position. We calculate the initial margin with the help of the risk limit and leverage of the order.

What is bitcoin margin trading?Bitcoin margin trading allows you to trade on borrowed funds by providing your capital as collateral. You complete a trade, try and successfully gain a return and then return the loan amount with interest.

What are the risks of crypto margin trading?Since crypto markets are highly volatile, on using leverage, the volatility increases. Hence, the most common risk would be significant losses and liquidations. At times, your losses can be way over your initial investment.

How long can you hold your margin trade?Every exchange has a different limit; however, all the positions close at a fixed time. For example, in BYDFI, the closing time is 05:55:00 SGT. Also, your trade automatically closes in case of liquidation.

What triggers margin call?When your equity falls below the maintenance margin, you get a margin call to adds more funds or suffer liquidation.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.