and the distribution of digital products.

DM Television

21Shares Bets On Polkadot, Files For Spot ETF With SEC

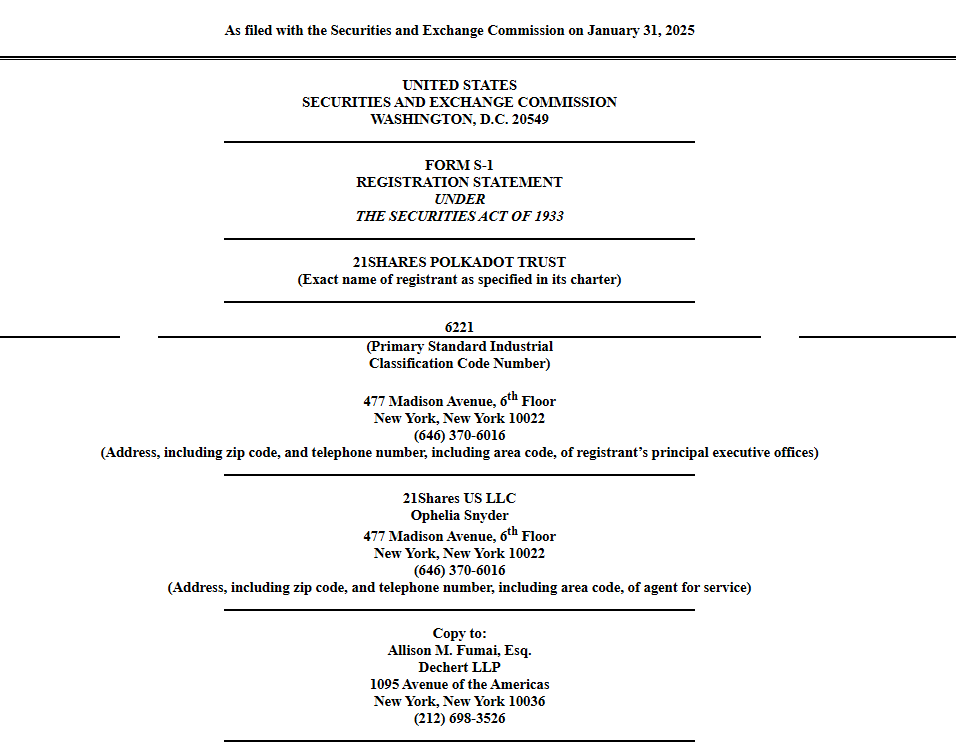

21Shares is taking a radical step in the crypto investment sector by submitting a spot Polkadot (DOT) exchange-traded fund (ETF) application to the US Securities and Exchange Commission (SEC).

If given the green light, this ETF would enable investors to acquire direct exposure to Polkadot without the need to purchase and maintain the cryptocurrency themselves.

The 21Shares Polkadot Trust, a proposed fund, is intended to be listed on the CBOE BZX Exchange. Coinbase will be the custodian for DOT tokens.

A Step Towards Increasing The Number Of Crypto Investment OptionsThis ETF aims to make it easier for both large buyers and everyday people to buy Polkadot. The blockchain is known for its interoperability, allowing different networks to communicate and share data.

21Shares is trying to bridge the gap between traditional finance and the crypto world by offering an exchange-traded fund (ETF). This will make DOT a more attractive choice for investors who like controlled investments instead of owning cryptocurrencies directly.

This follows rising demand for diversified crypto-based ETFs. Although Bitcoin and Ethereum spot ETFs have garnered attention, Polkadot’s participation shows popular interest in alternative currencies. However, the success of this filing depends on how the SEC views Polkadot’s regulatory standing, a factor that could impact the outcome of the approval process.

Polkadot has encountered market obstacles, despite the enthusiasm that fueled the filing. The price of DOT has decreased by approximately 5% in the past year, and it has declined by more than 10% in the past month alone. DOT is currently trading at approximately $6.42, a significant decline from its previous all-time highs.

The ETF filing acknowledges that the asset can be unstable and warns buyers about possible risks. Polkadot’s value could still be uncertain, even with an ETF setup, and there’s no guarantee that the token will rise or bounce back soon.

Regulatory Risks Might Affect The Chances Of ApprovalRegarding the security status of this ETF, there are significant concerns about Polkadot’s potential legal standing in the US. Polkadot’s backer, the Web3 Foundation, has attempted to portray DOT as a digital asset rather than a security concern. The SEC’s stance on digital assets is evolving, thus Polkadot’s security status may make it challenging for 21Shares to develop an ETF.

Featured image from DALL-E, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.